Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashiers check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

Dont Miss: Are Medical Insurance Premiums Tax Deductible

Recommended Reading: Pre Tax Or Roth 401k

Mailing Vs Electronic Filing

Under usual circumstances, taxpayers should receive their refunds or correspondence from the Internal Revenue Service within six weeks of mailing tax returns, forms and payments. Electronic filers generally receive direct deposits within three weeks of filing.

The IRS states that while it typically takes 21 days to issue refunds to business owners and individuals, the Covid-19 pandemic has led to extended processing times. Its important to plan accordingly when contacting the IRS via postal mail, as response times may be extended.

While its not a common occurrence, taxpayers who choose the mail-in method should also take into consideration the chance of a return getting lost or delayed in the mail. Its important to make copies of all forms, checks and other documents sent to the IRS via postal mail to avoid any additional delays if the submission must be re-sent.

For an extra layer of protection when mailing your forms to the IRS, consider sending them via certified mail. Sending certified mail ensures that the IRS will have proof of the date you mailed the return, and youll be notified when the return is received by the Internal Revenue Service.

Usc Financial Aid Has Asked Me To Supply An Irs Tax Return Transcript How Do I Do This

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

You May Like: State Of Oklahoma Tax Commission

What Happens If You Dont Update Your Address With The Irs

The IRS will continue to send any tax notices to the last address it has for you. This can include notices that youre being audited, that the IRS wants more information, or that you owe money.

When the IRS sends you a notice, you only have a certain number of days to respond. If you dont respond, the IRS will usually automatically adjust your tax return, and it probably wont be in your favor.

Any possible interest and penalties are also based on how long it takes you to respond.

The IRS sending a notice to the address it has for you counts as you being notified. You cant say that you didnt get a notice because you moved if you dont update your address.

You may also have a problem getting your tax refunds if you dont update your address. When government checks get returned to sender, you may have to call the IRS to verify your identity before theyll issue a new check.

How To Contact The Irs

Individual telephone assistance can be obtained by dialing 1-800-829-1040 Monday through Friday from 7 AM to 7 PM.

You can find a on the IRS website which allows you to select your home state and determine the appropriate mailing address for each filing.

The IRS offers the Interactive Tax Assistant to find and submit general tax questions. However, it’s best not to use it for more complex questions that require individualized information.

In-Person

Referred to as the Taxpayer Assistance Centers , in-person IRS offices are open from Monday through Friday from 7 AM to 7 PM.

Don’t Miss: What Are Bonuses Taxed At

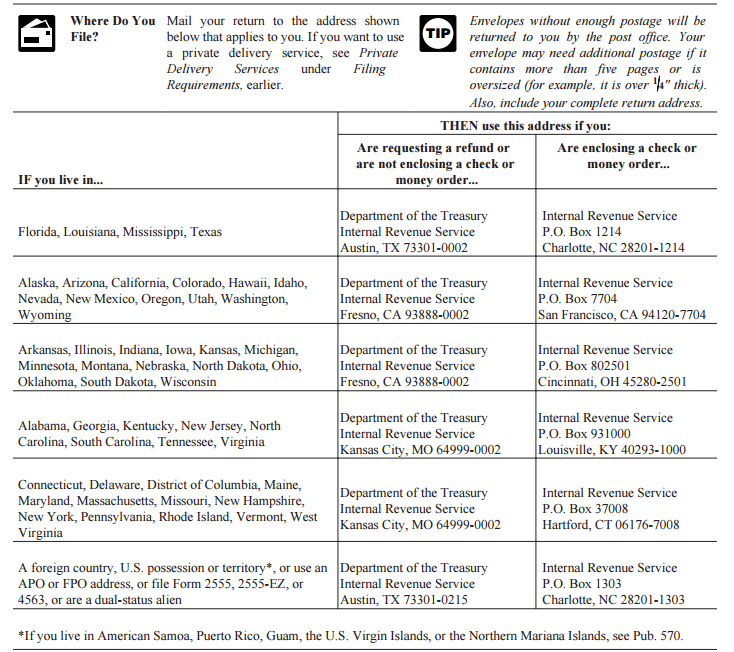

Where To Mail Federal Tax Returns

When you are filing your tax returns, you will feel like every single part of the process is complicated. Sadly, finding the where to post said tax return is also a complicated affair.

Today, we will endeavor to make it easier for you.

You will be able to tell where you need to post your tax return by looking in the top corner of the form. There, you should find a list of addresses find the address that applies to your state and to your payment plans.

If you are planning to mail back your return without paying then you will need to post to a different address than if you were sending a payment.

Contents

You May Like: Arizona Charitable Tax Credit List 2021

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

Also Check: File Income Tax Return India

What Is The Mailing Address For The Irs So I Can Mail My Taxes

look at the Turbotax filing instructions. there is no just one address. it depends on the state you live in and whether you are enclosing a payment or are getting a refund.

if you cant find it in the instructions

look on page 108 of this link

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Mailing Addresses For The Irs

During tax season, taxpayers have the option of submitting Federal tax returns and making payments electronically through the IRS website. However, many people prefer to correspond with the IRS via postal mail for various reasons, ranging from filing taxes via form 1040EZ to tax extension requests.

One challenge that individuals and business owners face when opting to mail in forms and payments is determining the appropriate IRS address, with the common question being where do I send my Federal tax return?

The IRS has offices in multiple locations throughout the U.S. where taxpayers can send tax returns and payments via postal mail. Some offices handle returns only, while others accept both payments and returns. Certain payment and correspondence offices are located in the same states in which taxpayers reside, while others may be several states away.

If youre planning to file your returns through the mail this tax season or youre dealing with a specific tax matter in which mail correspondence is your only option, you need to know which IRS address to send it to. Keep reading to find the appropriate IRS mailing address based on your state.

Also Check: Do You Have To Pay Taxes On Life Insurance

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Irs Locations For Forms With Enclosed Payments

- Residents of Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, and Virginia should mail forms and payments to: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Those who reside in Florida, Louisiana, Mississippi, or Texas can mail their forms and payments to: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, and Wyoming residents should mail forms and payments to: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- People who reside in Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, or Wisconsin can mail forms and payments to: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Residents of Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, and Vermont should send their forms and payments to: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Those who reside in Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, or West Virginia can mail forms and payments to: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

Recommended Reading: Long Term Capital Gain Tax Calculation

Where Do I Mail My Amended Tax Return

Use IRS Form 1040-X to file an amended tax return. You can e-file this return using tax filing software if you e-filed your original return.

If you are filing Form 1040-X because you received a notice from the IRS, use the address in the notice. Otherwise, use this article from the IRS on where to file Form 1040X. Find your state on the list to see where to mail your amended return.

Addresses For Forms Beginning With The Number 1

|

Form Name |

Address to Mail Form to IRS: |

|---|---|

|

Form 11-C, Occupational Tax and Registration Return for Wagering |

Department of the Treasury |

|

Form 1040-C, U.S. Departing Alien Income Tax Return |

Department of the Treasury |

|

Form 1040-NR, U.S. Nonresident Alien Income Tax Return Exception Estates and Trusts filing Form 1040-NR |

Department of the Treasury |

|

Form 1040-NR, U.S. Nonresident Alien Income Tax Return |

Internal Revenue ServiceCharlotte, NC 28201-1303USA |

|

Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Department of the TreasuryInternal Revenue ServiceAustin, Texas 73301-0215 |

|

Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Internal Revenue Service |

Don’t Miss: How Much Is Bonus Tax

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Non-Profit Entities Corporation Estimated Tax Payment Vouchers and Instructions

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Where Do I Mail My Colorado Tax Return

Mailing to Colorado Department of Revenue, PO Box 17087, Denver, CO 80217-0087.

- Where Do I Mail My Colorado State Tax Return? All tax returns in Colorado should be mailed to the Colorado Department of Revenue, 1375 Sherman Street, Denver, CO 80261. Adding a Plus 4 number to this address will guarantee that your details are routed in the right direction and the correct office deals with your returns and payments.

Also Check: Pay My Car Tax Online

Deadlines For Small Business Tax Returns

- Sole proprietors and single-member limited liability company owners filing Schedule C along with their personal returns

- Partners in partnerships and multiple-member LLC members filing a partnership Schedule K-1

- S corporation owners filing an S corporation Schedule K-1

Mailing addresses for business filing partnership returns on Form 1065. corporations filing Form 1120 returns, and S corporation returns filing Form 1120-S are provided on a .

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, youll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

Read Also: Tax Deduction For Charitable Donations

Read Also: Is Spousal Support Tax Deductible

Can I File My Tax Returns Via Mail

Yes, there are many different ways to file your federal tax return. If you want to post it to the IRS you can.

However, if you want to post your tax return you need to make sure you have the correct address and that you are posting it well in advance of the deadline.

We also recommend that you get proof of postage and pay to have the forms tracked so you know when they arrive.

We also recommend that you photocopy all your forms so that you dont have to start from scratch if they get lost in the mail.

Also Check: Tax Id Numbers For Businesses

Requiring A Tax Pro To Obtain And Interpret Tax Information

A copy of your tax return is required if you are applying for a mortgage, federal student aid, or other government benefits. You can get a copy of your tax return by completing Form 4506-T. You can also request a transcript of your tax return. This is a computer printout of your tax return, showing your adjusted gross income, a breakdown of your dependents, and more. The IRS allows you to request up to eight years worth of information on a single form.

If you have a question about your transcript, you can call the IRSs online hotline for tax professionals. These tax professionals can access IRS records and interpret the information on your transcript. They can help you determine whether or not you are eligible for a refund, if you are entitled to a refund, or if you have filed your taxes correctly. They can also help you determine whether you are eligible for a mortgage or student loan benefits.

Form 4506-TRequest for Transcript of Tax Return is an IRS tax form that is used by taxpayers towell, request their tax return transcripts. Use Form 4506-T or 4506T-EZ to request tax transcripts by mail. You also have the option to request tax transcripts online. If youre in need of tax transcripts as soon as possible, we suggest obtaining them online as its going to take significantly less time.

Filing Form 4506-T

Form 4506-T requires only basic information. On the Request for Transcript of Tax Return form, you will need to provide the following.

Don’t Miss: When Do We Get Tax Returns 2022