How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Don’t Mess With Taxes

We have a start date for the Internal Revenue Service’s 2023 tax filing season!

Stop cheering all you tax early birds who’ve already got your personal returns ready to go. This is not for you.

Thursday, Jan. 12, is the day that the IRS will begin accepting electronically filed business returns.

That’s a few days later than in 2022. Last year, business filers got the jump on the rest of us on Jan. 7.

But it’s still in the first half of this month. And it’s an official tax season beginning for some filers.

Individual returns, when? The start of the 2023 filing season for the rest of us, according to the agency’s Modernized e-File Status web page , is “To be announced.”

Last year, the annual individual tax season officially opened on Jan. 24. That was the day that the IRS started processing tax returns. From that date through the end of last October, the IRS received more than 163 million returns.

Ten days earlier, the IRS had flipped the on switch to Free File, its partnership with Free File Alliance tax software preparation manufacturers. That’s when eligible filers could start using the software provided by Free File participating companies.

Although there’s no official 2023 individual tax return acceptance dates yet, look for the IRS to implement a similar system this year. Business will go first , followed by Free File taxpayers , and then the rest of us .

The same goes for the IRS.

You also might find these items of interest:

What Does Payment Status Not Available Mean

According the stimulus check FAQ , you might see Payment Status Not Available if you are required to file a tax return but havent yet, the IRS hasnt finished processing it if you have, or youre not eligible.

Be patient and check back in with the Get My Payment app if youve recently filed your returns. If youve received your tax return payment and still see the Payment Status Not Available, message, call 800-919-9835 for the Economic Impact Payment information line.

Looking for more financial resources? Heres how to file for unemployment online.

- The best all-in-one printers to help keep your paperwork in order

Also Check: Irs Stimulus Check Sign Up

Don’t Miss: Travis County Tax Office – Main

How The Former Stimulus Check Portal Worked

The old âGet My Paymentâ tool that was taken down allowed you to:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

To access the tool, you were asked to provide a:

- Social Security Number or Individual Tax ID Number

- Street address and

- Five-digit ZIP or postal code.

If you filed a joint tax return, either spouse could access the portal by providing their own information for the security questions used to verify a taxpayerâs identity. Once verified, the same payment status was shown for both spouses.

If you submit information that didnât match the IRSâs records three times within a 24-hour period, you were locked out of the portal for 24 hours. You were also locked out if you previously accessed the system five times within a 24-hour period.

For third-round stimulus checks, the âGet My Paymentâ tool displayed one of the following:

1. Payment Status. If you got this message, a payment been issued. The status page showed a payment date, payment method , and account information if paid by direct deposit.

2. Need More Information. This message was displayed if your 2020 tax return was processed but the IRS didnât have bank account information for you and your payment had not been issued yet. It also may have meant that your payment was returned to the IRS by the Post Office as undeliverable.

The IRS sent additional or plus-up payments to people who:

Wait I Still Need Help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights. We can offer you help if your tax problem is causing a financial difficulty, youve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isnt working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

Read Also: How To Check Amended Tax Return Status

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Is filed on paper

- Needs further review in general

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q& A below.

- Includes a Form 8379, Injured Spouse AllocationPDF, which could take up to 14 weeks to process

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return. If were still processing your return or correcting an error, neither Wheres My Refund? or our phone representatives will be able to provide you with your specific refund date. Please check Wheres My Refund? for updated information on your refund.

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

The most convenient way to check on a tax refund is by using the Where’s My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Also Check: Free Tax Filing 2022 For Seniors

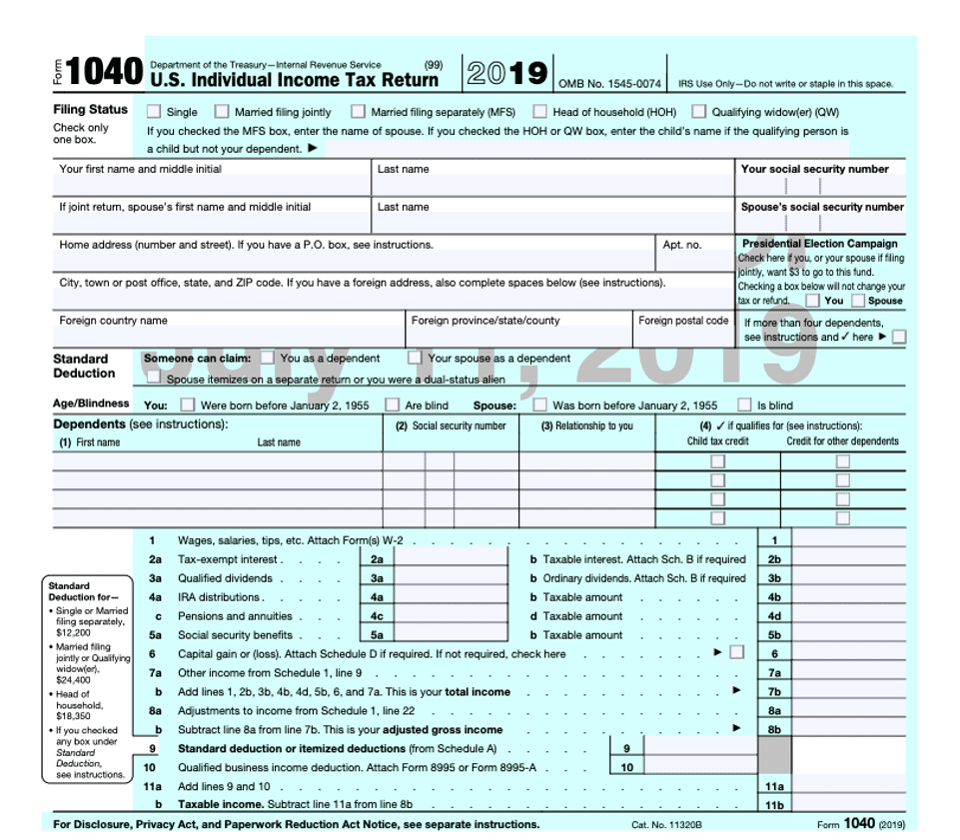

What Is The Standard Deduction

The standard deduction allows you to reduce your taxable income by a set dollar amount, depending on your tax filing status. If you file as a single person, you’ll get a smaller deduction than a person filing as head of household or a married couple filing jointly.

“There are special cases where the standard deduction can be higher for certain taxpayers,” says Armine Alajian, a certified public accountant and founder of the Alajian Group in Los Angeles. “If you are over 65 or blind, you can get an additional amount added to your standard deduction.”

Here’s a simple example of how the standard deduction looks in action: If you have gross income of $80,000 and file your return as a single person, are under 65, and are not blind, you would be eligible for a standard deduction of $12,950 on your 2022 tax return. This would mean you’d only be taxed on $67,050 of income, assuming there are no other above-the-line deductions.

Important: The standard deduction is just one of many tax deductions for which you may be eligible. For example, you may choose to itemize your deductions, which would allow you to write off expenses like mortgage interest, high medical expenses, charitable and property taxes.

About Where’s My Refund

Use Where’s My Refund to check the status of individual income tax returns and amended individual income tax returns you’ve filed within the last year.

Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount.

If you submitted your return electronically, please allow up to a week for your information to be entered into our system.

Also Check: Amended Tax Return Deadline 2020

How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Trumps Own 2017 Tax Law Appears To Have Reduced The Amount He Was Able To Deduct From Tax Bill

Trump claimed that the 2017 Republican tax plan he championed and signed would cost him and his family a fortune. Its not clear that it did, but it does appear to have limited the amount that he could claim in one part of his complex tax return.

The 2017 tax law capped the state and local tax deduction, known as SALT, at $10,000 a year. In previous years, tax filers were allowed to deduct more of their SALT payments. Although the law was passed in 2017, it didnt apply until the 2018 tax year.

In 2018, Trump listed $10.5 million in state and local taxes, but could deduct just $10,000 of that from his taxes. In 2019, Trump paid $8.4 million in SALT but was capped at $10,000. And in 2020, Trump said he paid $8.5 million in SALT but claimed the maximum allowable $10,000.

Some Democrats criticized the 2017 tax laws SALT cap for taking aim at residents in the Northeast and the West who have some of the highest property taxes in the country. The Tax Foundation found that property tax deductions capped in 2017 had previously accounted for about a third of all state and local tax deductions. But Trump defended the provision, saying the cap was necessary even if it would hurt his own finances.

Its not clear how much the SALT cap hurt Trump, however. Although that particular deduction was capped, Trump claimed many other deductions that limited the amount of federal income taxes he had to pay.

Recommended Reading: Amend Tax Return Online Free

Release Comes After Years

The returns were obtained by the Democratic-run Ways and Means Committee only a few weeks ago after a protracted legal battle that lasted nearly four years. The committee voted last week to release the tax returns, but their release was delayed to redact sensitive personal information like Social Security numbers.

The release of the tax returns follows a pursuit for the documents that had typically been made public voluntarily by past US presidents. Trump and his legal team continuously sought to keep his returns secret, arguing that Congress had never wielded its legislative powers to demand a presidents tax returns, which Trump said could have far-reaching implications.

The Democrats should have never done it, the Supreme Court should have never approved it, and its going to lead to horrible things for so many people, Trump said in a statement following the release.

The Trump tax returns once again show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.

During the committees closed-door meeting last week, Republicans warned that the release of Trumps tax returns by Democrats could prompt retribution once Republicans control the House next year like going after the taxes of President Joe Bidens son, Hunter Biden.

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

Also Check: How Do I File Back Taxes

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: 2021 Capital Gains Tax Calculator

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

When Should You File An Amended Return

If you receive information after filing your original tax returnlike a pesky Form 1099-NEC that you forgot aboutyou may want to file an amended return. Thats especially true if it significantly affects your taxable incomeforgetting $10 may not be a big deal, but not including $10,000 could be. Keep in mind that changes to your taxable income can also affect your deductions and credits.

Other reasons to file an amended return include changes to your filing status or dependents .

Of course, its not all gloom and doom sometimes an amended return goes your way. Youll want to file, for example, if you forget to claim certain deductions and credits to which you were entitled.

Don’t Miss: How Much Taxes Deducted From Paycheck Pa