Understanding Disaster Relief Tax Law And Contribution Deductibility

The IRS offers online training for charitable organizations that assist with disaster relief. Disaster Relief Parts 1 and II discuss how charities may provide disaster relief, deductibility of contributions and tax treatment of relief recipients. Organizational leadership and volunteers should complete the Tax-Exempt Organization Workshop for important information on the benefits, limitations and expectations of tax-exempt organizations.

Who May File Form 990

In general, exempt organizations have an annual reporting requirement although there are exceptions.

Most small tax-exempt organizations that have an annual reporting requirement can satisfy the requirements by submitting Form 990-N, Electronic Notice for Tax-Exempt Organizations Not Required to File Form 990 or Form 990-EZ. Form 990-N is submitted electronically, there are no paper forms.

An organization eligible to submit Form 990-N can instead choose to file Form 990 or Form 990-EZ to satisfy its annual reporting requirement.

Small tax-exempt organizations generally are eligible to file Form 990-N to satisfy their annual reporting requirement if their annual gross receipts are normally $50,000 or less.

- Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses.

- Gross receipts are considered to be normally $50,000 or less if the organization:

- Has been in existence for 1 year or less and received, or donors have pledged to give, $75,000 or less during its first tax year

- Has been in existence between 1 and 3 years and averaged $60,000 or less in gross receipts during each of its first two tax years and

- Is at least 3 years old and averaged $50,000 or less in gross receipts for the immediately preceding 3 tax years .

Tax Exempt Organization Search Becomes Sole Source Point For Exempt Organizations Data

Beginning December 31, 2021, the publicly available data provided by the IRS on electronically filed Forms 990 will be available solely on the TEOS webpage on IRS.gov. The IRS will no longer update the Form 990 series data on Amazon Web Services. This change is to provide access to public data for organizations with tax-exempt status in one location.

See IRS News Release 2021-250 for further details.

Don’t Miss: New Mexico State Tax Refund

Ep And Eo Participating In 2016 Irs Nationwide Tax Forums

Employee Plans and Exempt Organizations will participate in the 2016 IRS Nationwide Tax Forums in five cities starting in July. The forums offer three days of seminars and workshops featuring speakers from both the IRS and tax practitioner organizations. In addition to getting the latest tax information, tax professionals can earn continuing education credits for their attendance.

Taxpayers Can Find Legitimate Charities Using The Tax Exempt Organization Search Tool

IRS Tax Tip 2021-158, October 26, 2021

When taxpayers decide to support a cause they care about, they want their donation to do as much good as possible. Doing some research can help ensure donations go to legitimate and qualified charities and help donors avoid scams. The IRS’s Tax Exempt Organization Search tool, is a great place to start.

Recommended Reading: What Is The Maximum Tax Refund You Can Get

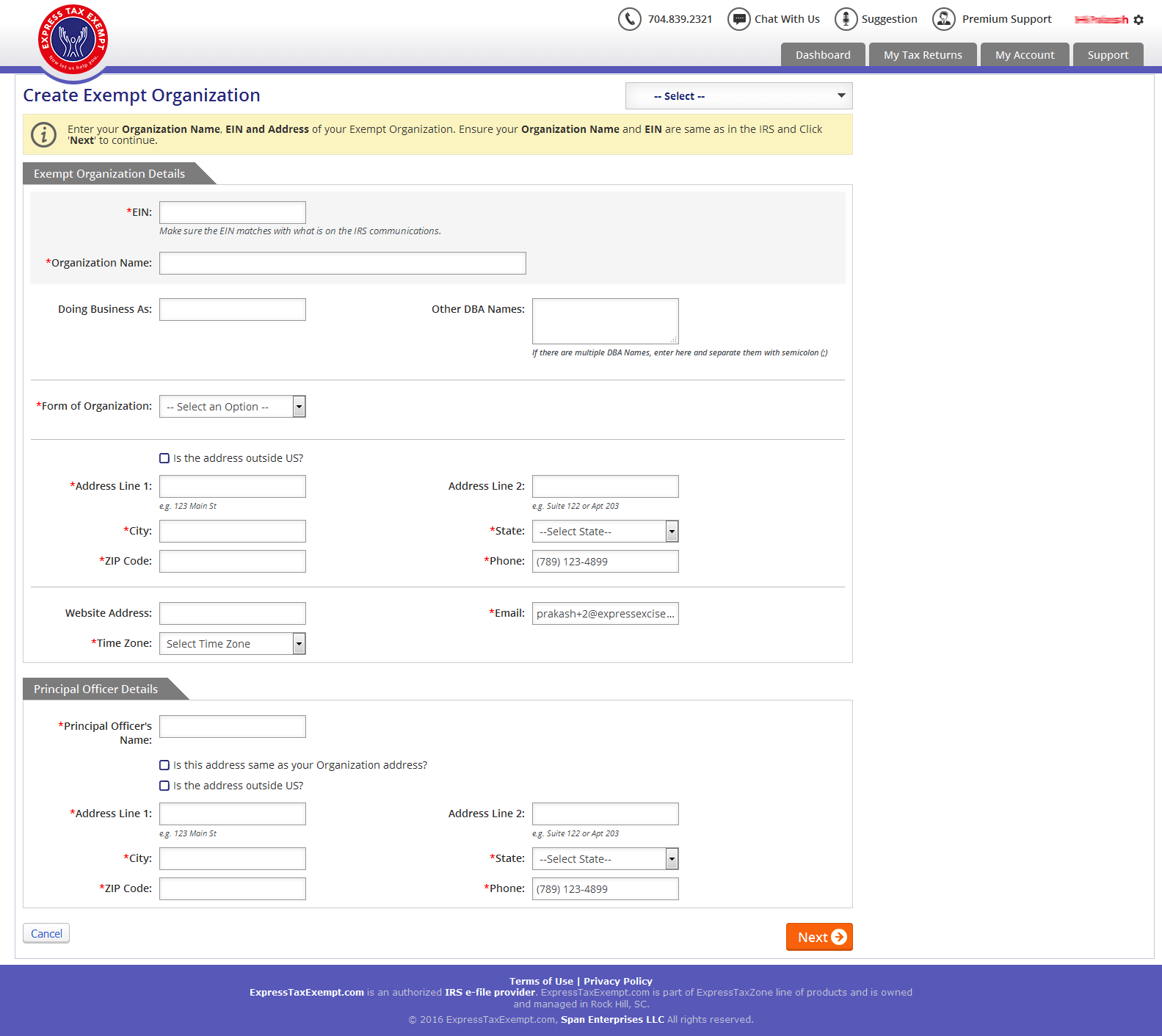

Electronic Filing Mandate For Forms 990 And 990

Effective for tax years beginning after July 1, 2019, the Taxpayer First Act requires organizations exempt from taxation under section 501 to file their annual Form 990 and Form 990-PF returns electronically, unless covered by one of the exceptions listed in the form instructions. Form 990-EZ filers are required to file electronically for tax years ending July 31, 2021, and later. This IRS News Release contains a summary of e-filing requirements.

IRS will be sending an educational letter to organizations that filed paper Forms 990 or 990-PF prior to 2019. There is no need to reply to the letter.

Irs To Terminate/inactivate Enrolled Agents Who Haven’t Renewed

The Internal Revenue Service has begun sending letters to Enrolled Agents whose enrollment status was terminated or inactivated because of failure to renew.

EAs with SSNs ending in 7, 8, 9 or no SSN who have not renewed for the 2018 and 2021 cycles will have their enrollment placed in terminated status. Anyone in terminated status must re-take the Special Enrollment Examination to apply for re-enrollment.

EAs with SSNs ending in 7, 8, 9 or no SSN who did not renew for the 2021 cycle will have their enrollment placed in inactive status. Anyone in inactive status can still submit a late renewal for approval with proof of continuing education.

For additional information, go to Enrolled Agent News.

Recommended Reading: Do I Pay Taxes On Social Security

New Technical Guides Published

Exempt Organizations and Government Entities has published eight new Technical Guides . These guides are comprehensive, issue-specific documents. TGs combine and update the Audit Technique Guides available on IRS.gov with other technical content and will replace corresponding ATGs as they are completed. The newest TGs are:

You May Also Download Bulk Data From Tax Exempt Organization Search This Includes:

- Organizations eligible to receive tax-deductible charitable contributions

- Organizations whose federal tax exemption was automatically revoked for not filing a Form 990-series annual return or notice for three consecutive tax years

- Organizations filing Form 990-N

- Form 990-series returns filed 2017 through 2021

- Forms 990/990-EZ for section 527 organizations,

- Form 8871, Political Organization Report of Contributions and Expenditures, and

- Form 8872, Political Organization Notice of Section 527 Status.

Also Check: How To Report Tax Fraud To The Irs

Filing Deadline Extensions For Hurricane Impact Areas

The IRS extended certain filing deadlines for taxpayers, including exempt organizations, in certain counties in North Carolina, South Carolina, Virginia, Florida and Georgia. Organizations in affected counties that had an original or extended due date on or after September 7, 2018 and before January 31, 2019 , October 7, 2018 , or October 9, 2018 , now have until February 28, 2019 to file affected returns, including Form 990-series annual information returns and Form 990-T, Exempt Organization Business Income Tax Return.

Form 8976 Electronic Notice Registration System Updated

Recently, we added the following functionality to the Form 8976 Electronic Notice Registration System:

- The registration system now links to Pay.gov to prompt organizations to pay the required Form 8976 fee immediately.

- A non-payment notice will be generated if the required fee isn’t paid within five days of submitting Form 8976. If not paid within 14 days, the registration will be rejected.

- The registration system won’t allow uploads of subsequent documents for the same organization.

Use the link above to visit the Tax Information for Charities & Other Non-Profits page, then click on the “Learn More button.” Your participation will help us improve our navigation menus and labeling.If you have a specific question about exempt organizations, call EO Customer Account Services at 877-829-5500.

Read Also: Haven T Received Tax Return

Irs Makes Tax Exempt Organization Search Primary Source To Get Exempt Organization Data

IR-2021-250, December 16, 2021

WASHINGTON The Internal Revenue Service announced today that the publicly available data it provides on electronically filed Forms 990 in a machine-readable format will be available solely on the Tax Exempt Organization Search webpage.

Beginning December 31, 2021, the IRS will no longer update the Form 990 Series data on Amazon Web Services. This change is to provide access to public data for organizations with tax-exempt status in one location on IRS.gov on the Charities and Nonprofits webpage.

The webpage has multiple data sets of information about organizations’ tax-exempt status and filings with instruction on how to download.

The Form 990 series data set includes XML and individual PDF files of Form 990, Return of Organization Exempt from Income Tax Form 990-EZ, Short Form Return of Organization Exempt from Income Tax and Form 990-PF, Return of Private Foundation and related schedules. The IRS redacts personally identifiable tax-identification numbers to prevent the data’s misuse.

A tax-exempt organization must file an annual information return or notice with the IRS unless an exception applies. Annual information returns include Form 990, Form 990-EZ and Form 990-PF. Form 990-N is an annual notice.

For updates on TEOS and other issues related to charities and nonprofits, please subscribe to the Exempt Organization Update newsletter.

Why Choose Compliancely Real

Improve your existing due diligence process for identifying tax-exempt organizations with Compliancely. Search the entity or individuals details against the IRS database and get the federal tax classification details within seconds. This gives you insights into the tax regimes that the organization has been following through the years.

This information further allows you to validate if the contributions that you have made to a non-profitable entity or charitable organization are tax-deductible. Businesses that believe in environmental and social causes regularly make huge contributions to new charitable organizations. Imagine if your donations were actually sent to a for-profit entity in the garb of a nonprofit.

The complexity of dealing with such fraudulent organizations is not new or remote. It happens very commonly and it is your responsibility to protect your business and verify the tax-exempt entities before processing the donations.

Compliancelys real-time Tax-Exempt Org. check enables the following for you.

- Screen tens and hundreds of tax-exempt organizations at once

- Validate the real-time tax-exempt status of entities per the official IRS records

- Manage your KYB and tax compliance operations effectively with authorized checks

- Get Compliancely For Your Business

Compliancely Changes The Way You Approach Compliance

Tax-Exempt Checks For Emerging Markets

Compliancely enables the following for your business.

Tax-exempt Checks For Corporate Social Responsibility

You May Like: How Long To Get Tax Refund 2022

International Charity Fraud Awareness Week October 18

Please join the IRS and other international organizations and regulators by participating in the annual International Charity Fraud Awareness Week , October 18-22, 2021. This is a free event and open to all. The international event is held to raise awareness and share best practices to detect, avoid and respond to fraud and financial crime. The ICFAW Resources webpage also has a list of useful links.

Registration Now Open For The Irs Nationwide Tax Forum

The 2022 Virtual IRS Nationwide Tax Forum will consist of a 5-week program of live webinars, beginning on July 19, 2022. Webinars will be offered every Tuesday, Wednesday, and Thursday for the 5-week duration.

Like the in-person Tax Forum, participants will pay a single price to register and have access to all live webinars. The full schedule and list of topics will be released in early April. Register for the Tax Forums at www.irstaxforum.com.

Recommended Reading: Long-term Hotel Stay Tax Exempt

Group Ruling Holders Will No Longer Receive Lists Of Parent And Subsidiary Accounts From Irs

As of January 1, 2019, the IRS stopped mailing lists of parent and subsidiary accounts to central organizations for verification and return. Central organizations with accounting periods ending June 30, 2019, must submit updates by April 1, 2019. See Group Exemption Rulings and Group Returns for details.

Newly Published Technical Guide

Exempt Organizations and Government Entities recently published a new Technical Guide . TGs combine and update the Audit Technique Guides available on irs.gov with other technical content. Once completed, the TGs replace corresponding ATGs. TG 6 IRC 501 Business LeaguesPDF is the latest in a series of these comprehensive, issue-specific documents.

Recommended Reading: 2021 Dependent Care Tax Credit

How To Maintain Your Organizations Tax

Leadership and volunteers of charitable organizations should be familiar with their responsibilities and the various actions that can jeopardize their organization’s tax-exempt status. The Maintaining 501 Tax-Exempt Status course discusses what charitable volunteers and employees must do to maintain this valuable exemption and which actions can result in revocation of exempt status. The Small to Mid-Size 501 Organization Workshop provides additional information on the benefits, limitations and expectations of tax-exempt organizations.

New Irs Online Tool Offers Expanded Access To Information On Tax

The IRS introduced a new online tool designed to provide faster, easier access to publicly available information about exempt organizations.The new Tax Exempt Organization Search replaces EO Select Check, a more limited tool available since 2012 that focused primarily on providing information on an organization’s tax-exempt status. Among the enhancements, the new TEOS tool includes images of newly-filed 990 forms and it’s mobile friendly so you can access it using smartphones or tablets.”This new tool provides taxpayers an easy way to get information about charitable organizations,” said Acting IRS Commissioner David Kautter. “Tax-exempt organizations play a critical role in our nation, and this will provide greater insight for people considering donations.”

You May Like: How Do I Get My Tax Transcripts

Irs Nationwide Tax Forums Online Launches 18 New Seminars

The Internal Revenue Service has 18 self-study seminars available for continuing education credit through the IRS Nationwide Tax Forums Online. The new seminars were recorded in July and August at the 2021 IRS Nationwide Tax Forum and can be reviewed for free. Tax professionals CPAs, enrolled agents, Annual Filing Season Program participants and others can earn continuing education credit for $29 per seminar.

Read Irs Te/ge Issue Snapshots

The IRS Tax Exempt and Government Entities Knowledge Management team periodically issues research summaries called “Issue Snapshots” on tax- related issues for practitioners. They are posted on IRS.gov’s electronic reading room page under “Training and Reference Materials.” Bookmark and check the page often for helpful new materials.

Read Also: Penalty For Not Paying Taxes Quarterly

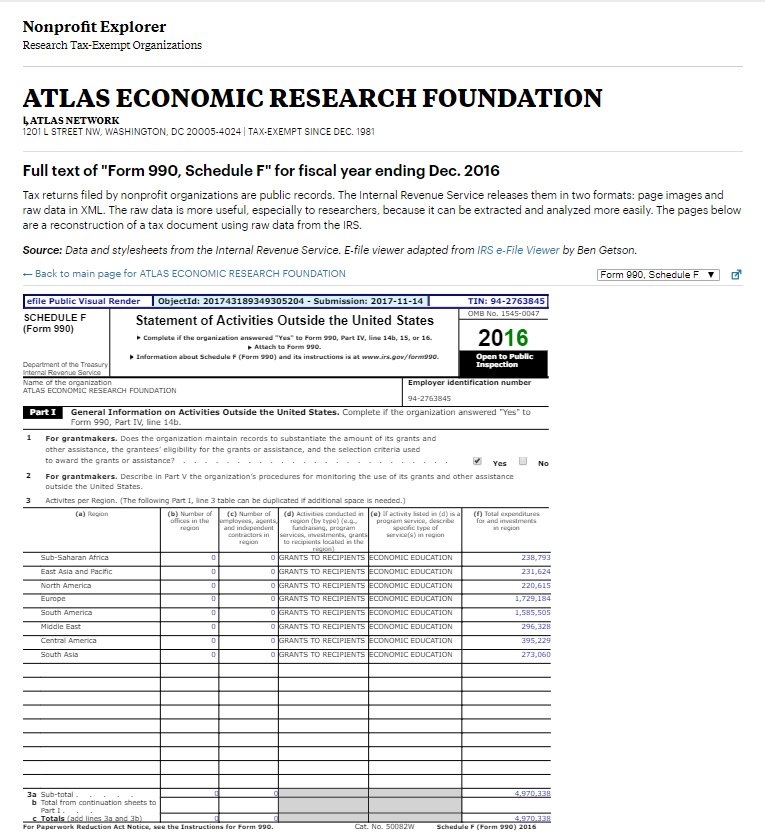

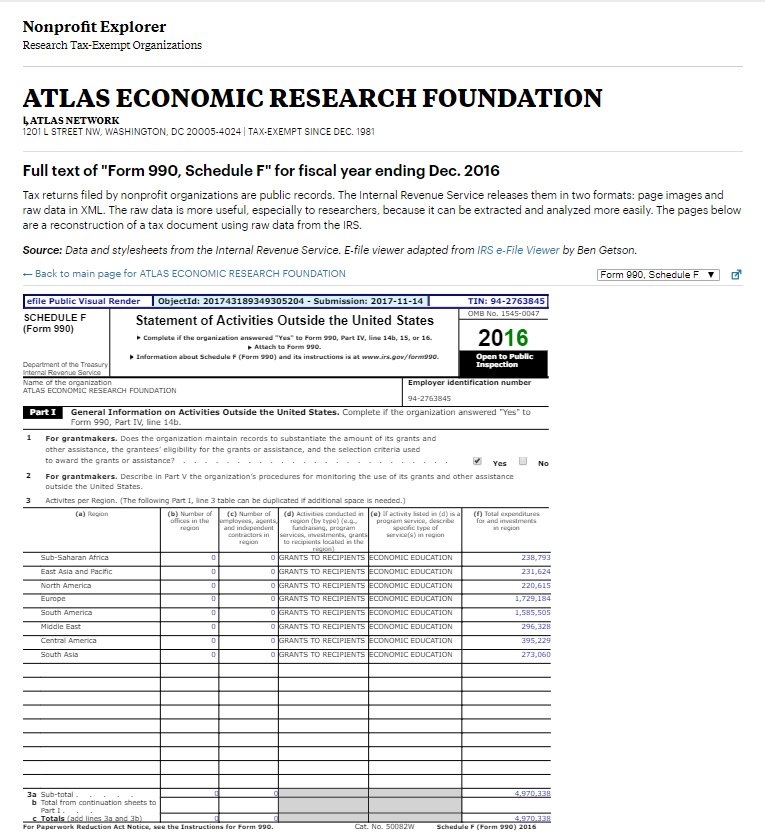

Viewing Forms On Irsgov For Returns Filed In Years 2017 Through 2021

You are able to view exempt organization forms free of charge on the IRS website.

You can search for individual Form 990-series returns filed since January 2018 on Tax Exempt Organization Search. This includes Forms 990, 990-EZ, 990-PF and 990-N . Forms 990-T filed by 501 organizations are also available.

Here Are Some Key Features And Functions Of This Tool:

- It provides information about an organization’s federal tax status and filings.

- Donors can use it to confirm that an organization is tax-exempt and eligible to receive tax-deductible charitable contributions.

- Users can find out if an organization had its tax-exempt status revoked.

- Organizations are searchable by legal name or a doing business as name on file with the IRS or Employer Identification Number

- The search results are sortable by name, EIN, state and country.

Users may also download complete lists of organizations eligible to receive deductible contributions, auto-revoked organizations and e-Postcard filers using links on the Tax Exempt Organization Search page of IRS.gov.

Also Check: What Is The Sales Tax

Llcs Applying For Tax

Notice 2021-56PDF sets forth current standards that a limited liability company must satisfy to receive a determination letter recognizing it as tax-exempt under Internal Revenue Code Section 501. Accordingly, an LLC applying for recognition of exemption on Form 1023, Application for Recognition of Exemption under Section 501 of the Internal Revenue Code, must submit the following information as part of its completed application. Otherwise, LLCs continue to complete Form 1023 as described in the instructions for Form 1023PDF.

1. Submit both the LLC’s state-approved articles of organization and its adopted operating agreement. Both your articles of organization and your operating agreement must contain the following:

- Provisions requiring that each member of the LLC be either an organization described in Section 501 and exempt from taxation under Section 501 or a governmental unit described in Section 170 .

- An acceptable contingency plan status) in the event that one or more members cease to be Section 501 organizations or governmental units .

- The charitable purposes and charitable dissolution clauses described in Part III, lines 1 and 2 of Form 1023.

- The express Chapter 42 compliance provisions described in Section 508 if the LLC is a private foundation. See Part VII, line 1a of the Instructions for Form 1023 for more information on these provisions.

2. Submit the following representation, signed and dated by an officer, director, trustee or other governing body member :

You Can Search The Following Data Sets

You can review the list of organizations that have filed forms in the Form 990 Series:

- Form 990PF Private Foundations)

- Form 990T organizations only)

Note: JAWS users will need to request these files.

Latest data posting:

Form 990-N is an annual electronic notice most small tax-exempt organizations are eligible to file instead of Form 990 or Form 990-EZ.

Latest data posting:

Lists of organizations that can receive tax-deductible contributions.

- Users may rely on this list in determining deductibility of their contributions.

- If an organization uses a doing business as name, that name will not be listed in the Pub. 78 Data. Only the organizations official name submitted to the IRS is included in the data set.

- Some donees eligible to receive tax-deductible charitable contributions may not be listed in Pub. 78 Data. For more information see, Other Eligible Donees.

Latest data posting:

Auto-Revocation List

An organization may have applied for reinstatement of its tax-exempt status after the automatic revocation date had posted. IRS will recognize the reinstatement of the organization’s tax-exempt status if the application is approved. You can find out if the exemption status has been reinstated by reviewing the Pub. 78 Data organizations) or reviewing its determination letter, which would show an effective date on or after the automatic revocation date, with the online tool or the . You may also review the EO BMF Extract to check the organizations current exempt status.

Recommended Reading: How To Check If Taxes Were Filed

Tax Exempt Organization Search: Deductibility Status Codes

In general, an individual who itemizes deductions may deduct contributions to most charitable organizations up to 50 percent of his or her adjusted gross income computed without regard to net operating loss carrybacks. Individuals generally may deduct charitable contributions to other organizations up to 30 percent of their adjusted gross income . These limitations are indicated as follows: