So What About The Ein

An EIN, more specifically, is a type of TIN assigned to business entities only, not to individuals. Also known as a federal tax identification number, it is used to identify your business as a single entity in the eyes of the federal government in all tax-related matters. It is also the proper TIN for all trusts and estates that derive income from their financial holdings. These earnings are required to be reported on Form 104, U.S. Income Tax Return for Estates and Trusts.

The IRS EIN Filing Service is here to help the small business owner by simplifying the EIN filing process. We are a Third Party Designee of the IRS, so we can process EIN applications on behalf of individuals and entities applying for the EIN. The application for the EIN is open 24/7/365. Whether you are looking to apply for a Federal Tax ID number in Texas , Wisconsin Tax ID, or any other state, the application and support team are available online any time, and we offer telephone support if necessary.

Member of NSTP

What Is The Difference Between A Tin And An Ein

When youre filling out a document that asks for your tax identification number , you may be confused. What should you write down? In fact, there are various possible types of tax ID numbers that may be required for personal or business purposes. Personal TINs can be your Social Security Number or ITIN for non US Citizens. The most common type of TIN for businesses is an EIN.

What Is a TIN?

Many people use the catch-all term of a TIN, which refers to a Taxpayer Identification Number. There are three different types of numbers the IRS uses for tax purposes: Social Security Number , individual taxpayer identification number , and an employer identification number . If youre wondering about the differences between a TIN and an EIN, SSNs and ITINs are tax IDs for individuals, while EINs are used for businesses.

Who Needs an ITIN?

If you dont meet the requirements to obtain an SSN, you may have a TIN assigned to you. This is simply a personal tax ID number with nine digits. You may have a TIN if you are:

- A non-resident alien.

- A spouse or dependent of a non-resident visa holder.

- A spouse or dependent of a resident alien or U.S. citizen.

If you need to put a personal tax ID on a form and you dont have an SSN, youll use this number. Do you still have questions about a TIN? Read our What Is a TIN page.

What Is the Difference Between a TIN and EIN?

Entity Selector

Start Your Filing

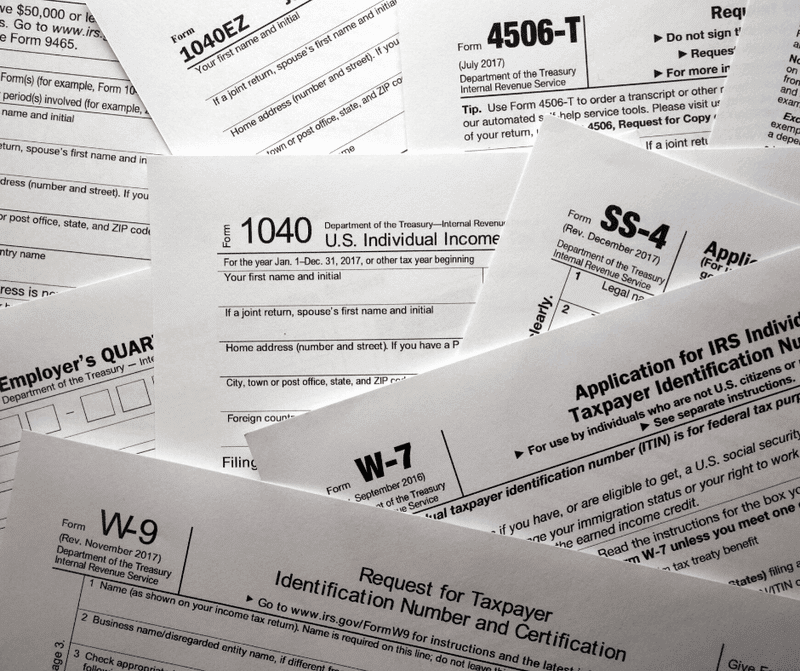

How To Get One

You can easily get an EIN online through the Internal Revenue Service . Make sure you apply for the number in time to include it on your return. You can either apply online or complete and fax IRS Form SS-4 to your states IRS service center. In about seven business days, the service center will fax you your businesss EIN.

Should you choose to apply by snail mail, send your completed Form SS-4 at least five weeks before you have to file your tax return.

Recommended Reading: How To Calculate The Sales Tax

Is 501c3 The Same As Tax

Does nonprofit, 501, and tax-exempt all mean the same thing? Actually, no! These terms are often used interchangeably, but they all mean different things. 501 means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

What form is tax-exempt?

Is Ein and tax ID same thing?

A federal employer identification number and an employer identification number are the same thing. An EIN is also referred to as a federal tax identification number. An EIN is a nine-digit number that the Internal Revenue Service assigns to a business.

Is tax ID same as Ein number?

The tax ID number and the employee ID number are similar, but their differences include: An EIN is one of several types of tax ID numbers. An EIN is assigned to businesses only, not individuals.

Make Sure Your Business Qualifies

To qualify for an EIN, your business must operate within the United States. As the business owner applying for the EIN, you must have a valid taxpayer identification number, such as a Social Security number or individual taxpayer identification number. Check the list of questions above to see if your business qualifies for a federal tax ID number. You can also find helpful information in the IRS online FAQ.

Also Check: Do You Have To Pay Taxes On Inheritance

What Is Payers Tin

When a legal form request to fill out a Payers TIN it can get a bit confusing.

As mentioned above, a TIN is one of a few potential IDs. With that understood, it really depends what form you are filing for the government authorities.

A Payers TIN is a specific taxpayers identification card which can be an EIN if you have a Domestic LLC or a foreign LLC, an ITIN if you are a non US citizen with a business in the United States or it can simply be your SSN.

You will need a specific ID based on the document that you are filing.

Quick tip: If you are stuck with a form and are unsure with Tax ID to use, simply head over to the IRS website and look for the instructions on filing the specific form on hand. Everything will be written in the instructions there.

How To Find Your Ein If Youve Forgotten It

Your business EIN is the equivalent of an individual’s social security number. In the same way that you guard your social security number, you should take care to safeguard your EIN to reduce your risk of business identity theft. In fact, in its effort to reduce the risk of a taxpayer’s identifying number getting stolen, there is no automated look-up for EINs. However, the IRS has provided guidance on how to find your number if you’ve forgotten it. The IRS’s suggests that take these steps:

- Find the confirmation that the IRS sent when you applied for your EIN

- Contact your bank, state agency, or local agency if you supplied your number to open a bank account or obtain a business license

- Locate a previously filed tax return, which should have your EIN on it.

If these measures are not successful, you will need to contact the IRS directly to ask the IRS to search for your EIN number. You will need to provide identifying information. In addition, you must be a person that is authorized to receive the number on behalf of the business. For example, you must be a corporate officer of a corporation or a manager of an LLC. If you provide the requisite identification and proper proof of authorization, the IRS employee will give you your EIN number over the phone.

Also Check: How Much In Taxes Do I Owe

Employer Identification Number Faq

Created by FindLaw’s team of legal writers and editors| Last updated September 26, 2022

An Employer Identification Number is a federal tax identification number similar to a social security number. Generally, all businesses must have an EIN in order for the Internal Revenue Service to identify taxpayers who are required to file various business tax returns. Here are some answers to commonly asked questions regarding EINs.

We make business formation EASY. Learn about our DIY business formation services here.

Other Types Of Tins : Itin Atin Ptin

A TIN is a broad umbrella term that refers to a nine-digit number assigned by the federal government to individuals and businesses to identify them for tax purposes. There are actually five types of TINs. They include EINs, as well as Social Security Numbers , Individual Taxpayer Identification Numbers , Taxpayer Identification Numbers for Pending U.S. Adoptions and Preparer Taxpayer Identification Numbers . There are also State level Tax ID Numbers, which vary from state to state, and require a separate filing with your individual state you are located in or the state you form your business in. Each of these can be obtained by filling out the proper form for each corresponding TIN. IRS EIN Filing Service only processes applications for a general TIN, or EIN.

Don’t Miss: Bexar County Tax Assessor Collector San Antonio Tx

What Is An Fein And An Ein

You might have a question about what is the difference between a FEIN and an EIN. You can relax knowing that there is not too much of a difference between these two numbers. In fact, a FEIN and an EIN are pretty much the same thing.

A FEIN is the Federal Employee Identification Number, while an EIN is the Employee Identification Number. These two numbers can be used to identify a business. There is no such thing as a FEIN in the eyes of the federal government, and it is not used for federal filing purposes.

What Is A Tin

When noting the difference between TIN and EIN, a TIN, or taxpayer identification number, includes all numbers used for reporting taxes. Each TIN has specific purposes when used on a tax form. These include:

- EIN: Employer identification number

- ITIN: Individual taxpayer identification number

- ATIN: Adoption taxpayer identification number

- PTIN: Preparer taxpayer identification number

When comparing an EIN vs TIN, keep the above information in mind. While an EIN is a type of TIN, a TIN is a generic term for several types of taxpayer numbers.

Read Also: Federal Tax Return By Mail

Employee Identification Number Vs Taxpayer Identification Number

A Tax Identification Number is a broad term used to describe any type of identification number. An EIN is a specific type of TIN. A TIN is a generic descriptor for an assortment of numbers that can be used on a tax form including but not limited to:

Depending on the nature of the particular taxpayer, the EIN may or may not be the TIN used by the IRS. For sole proprietors, the TIN is often their Social Security number. For corporations, partnerships, trusts, and estates, their TIN is often an EIN.

Difference Between Tax Id And Ein

Categorized under Business,Legal | Difference Between Tax ID and EIN

Tax is one of the most common things we encounter in our lifetime and so, it is almost inevitable for us to get the tax identification number . Well, there are actually a lot of acronyms used by the IRS to identify the different types of taxpayers. There are many numbers that can be used for tax identification purposes, so understanding each one of them and the differences between them is important.

Recommended Reading: How To File Taxes Without W2 Or Paystub

Adoption Taxpayer Identification Number

An adoption taxpayer identification number , according to the IRS, represents a temporary taxpayer ID number, designed for an adopted child who currently does not have a Social Security number .

This number is required if:

- You adopt a child in the U.S. for domestic adoption or the adoption is foreign and the child has a certificate of citizenship or permanent resident alien card.

- The adoption is not final and you cannot get an SSN for that reason.

- You could not get an SSN for the adopted child or obtain it from the biological parent or the adoption agency.

- You claim the adopted child on your personal tax return.

When Do You Need To Change Your Tax Id

Generally, a tax ID is meant for the whole lifetime of your business. However, you must obtain a new ID under certain circumstances like:

- Change in business name or location

- Bankruptcy of LLCs and corporations

- S-corporation election

- Change in the type of business entity

- When a corporation receives a new charter from the secretary of state

Read Also: When Does Tax Season End 2022

Understanding Employer Identification Numbers

Employer identification numbers are issued to identify business entities in the United States the same way Social Security Numbers are used to identify individual residents of the country. The EIN is also known as a Federal Tax Identification Number.

As noted above, EINs are unique nine-digit numbers that are formatted as XX-XXXXXXX. EINs are issued by the IRS and include information about the state in which the corporation is registered. The agency uses EINs to identify taxpayers that are required to file various business tax returns.

You need an EIN if you have employees, operate as corporations or partnerships, file certain tax returns, or withhold taxes from income other than wages. Business entities must apply for an EIN by phone, online, fax, or mail before they can begin operations. All forms of businesses can apply for and be issued EINs, including:

- have a Keogh plan.

- are involved with a number of types of organizations including but not limited to trusts, estates, or non-profits.

Preparer Tax Identification Number

A preparer tax identification number is for a paid tax preparer or accountant to use when preparing federal tax returns. You can quickly apply for or renew a PTIN online, but can also fill out IRS Form W-12 and mail or fax it. Applying for the PTIN online takes about 15 minutes, compared to filling out a W-12, which has a 4- to 6-week processing time.

You May Like: Are Municipal Bonds Tax Free

Q: Under What Circumstances Am I Required To Change My Employer Identification Number

A: If you already have an EIN, and the organization or ownership of your business changes, you may need to apply for a new number. Some of the circumstances under which a new number is required are as follows:

How Do I Get A Tax Id Number For My Business

Once you have a legal business structure, you have a few options to get a tax ID number:

Where is tax ID located?

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration.

What is sales tax ID Shopify?

A sales tax ID is a number provided to you by your state tax authority after you register with them to collect taxes. This number is issued by states to allow you to charge taxes there.

How do I find my sales tax ID on Shopify?

Steps:

Don’t Miss: Local County Tax Assessor Collector Office

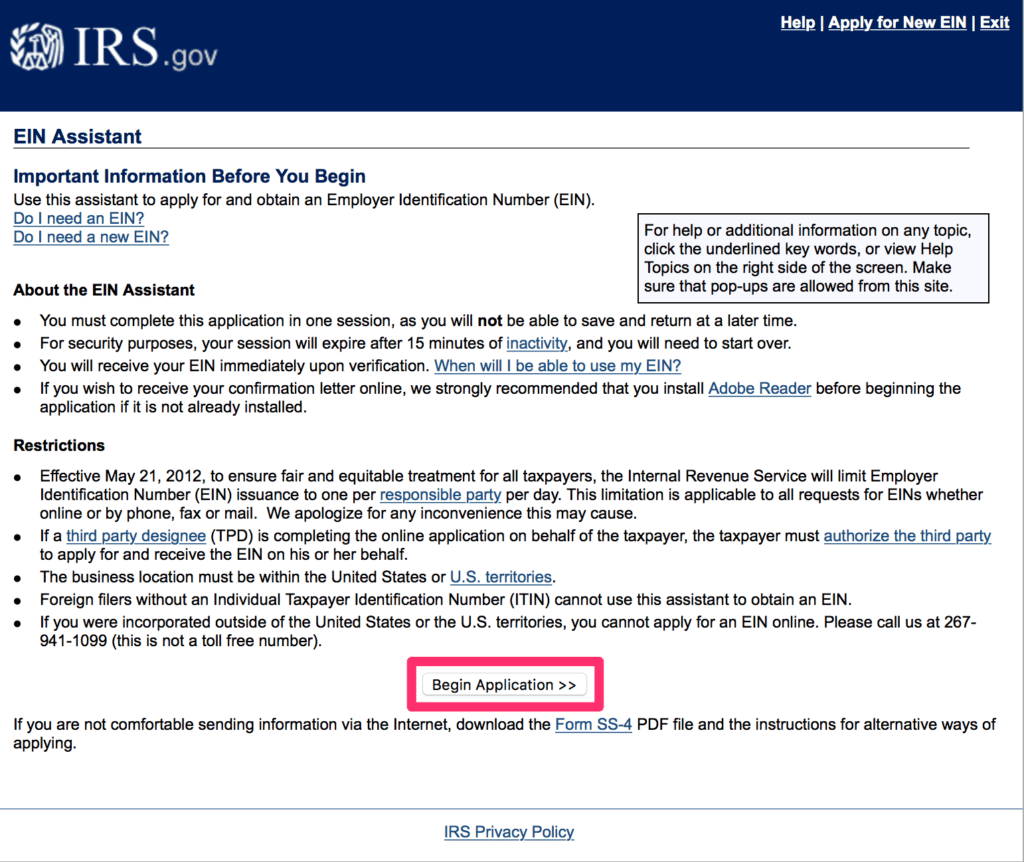

Employer Identification Number Online Application

To apply for an EIN online, you first need to visit the IRS website. Once you’re on the site, locate and click the âApply Online Nowâ link. Click âBegin Application,â choose âLimited Liability Company,â and then click âContinue.â After clicking âContinueâ again, you should enter how many members there are in your LLC. Then, you will choose the state where your LLC will be formed.

Choose âStarted a New Business,â which should be the first option, and click âContinue.â Now, you will need to choose âIndividualâ and click âContinue.â At this point, you will need to enter important information such as your Social Security number and name. With this information entered, select the option for LLC owners , and click âContinue.â

On the following page, you will need to provide the principal address of your LLC, which will also usually be the physical location of your company. When you provide the address of your company and click âContinue,â the address will be verified by the IRS. You should click âAccept Database Versionâ to proceed.

Next, you will provide the name of your LLC, as well as the state and county where it is organized. For example, if you want to name your business âRhonda’s Bakery, LLC,â you would enter that âRhonda’s Bakery LLCâ and the start date of the company. This start date must match what you used on the LLC operating agreement and application to form your LLC in the state of Michigan.

What Is An Employer Id Number

An employer ID number is needed for most businesses to file federal income taxes. The IRS uses the EIN to identify those businesses with certain tax obligations, such as limited liability companies , partnerships and corporations.

All businesses with employees must get an EIN through the IRS. There are several other factors that determine whether a business needs an EIN, including:

- Open an account requiring an EIN for banking or a line of credit

- Purchase or inheritance of a business by a new owner who will be running it as sole proprietor

- Change in the ownership of a business, such as sole proprietorship, partnership, or corporation

- Form or create a trust, pension plan, corporation, partnership, or LLC

- Represent an estate that takes over a business following the death of a sole proprietor

Businesses without employees, such as sole-owner LLCs who do not file pension or excise tax returns, are not required to obtain an EIN. These single-member businesses can simply use the owner’s Social Security Number to file a tax return.

Depending where the business is located, a state-based EIN might be needed to file state income taxes. This number is different from the one used for federal income tax. For a person discussing state and federal EINs, a federal employer ID number is simply another way of describing the EIN used for filing federal income tax returns as described in this article.

Read Also: When Are Tax Payments Due 2022