What Is A Tfra

A Tax-Free Retirement Account or TFRA is a retirement savings account that works similar to a Roth IRA. Taxes must be paid on contributions going into the account. Growth on these funds are not taxed. Unlike a Roth IRA, a tax-free retirement account doesn’t have IRS-regulated restrictions for withdrawals.

Is Gross Salary Before Or After Taxes

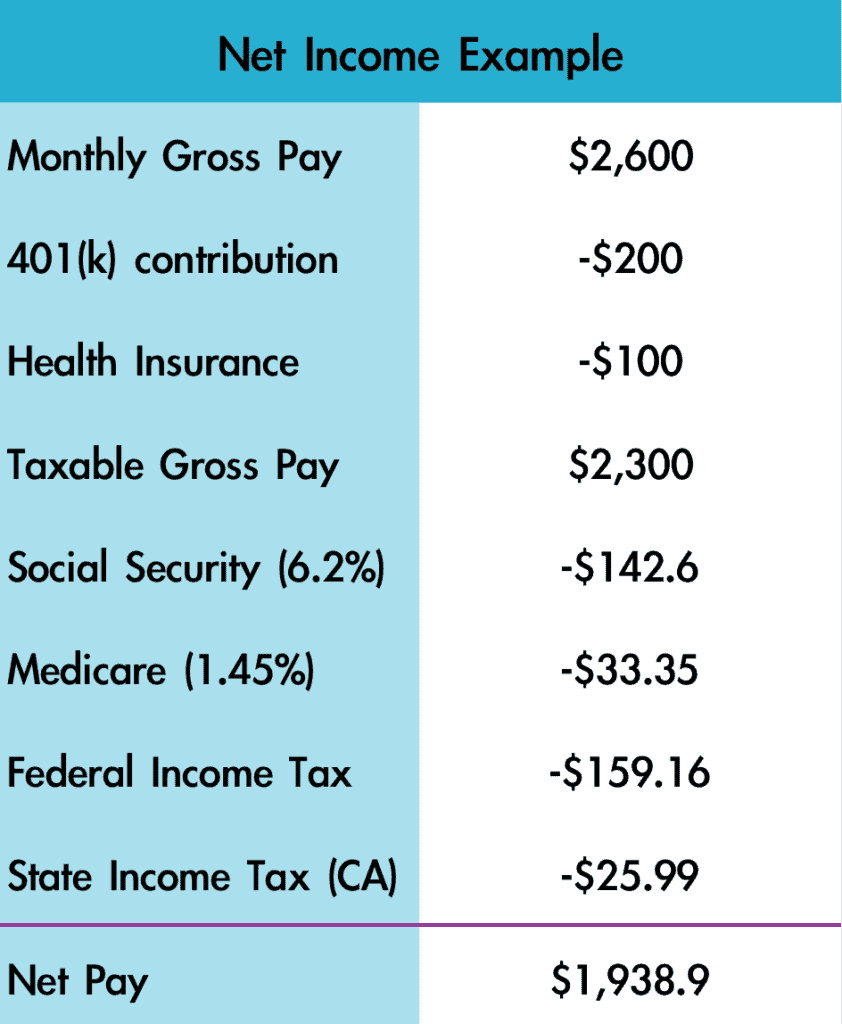

Your gross salary is the total of your taxable income but, unfortunately, all that money is not going to show up in your paycheck. Your employer will take numerous payroll deductions from that gross amount, and you get whats left. Those deductions include the inevitable taxes you must pay, but other things can be subtracted from your gross pay as well. The result is your net salary, sometimes referred to as take-home pay.

You shouldnt be left in the dark as to how your employer arrived at your net pay. Your pay stub should show exactly what was deducted from your gross salary and how much, according to the Social Security Administration.

What Are The Benefits Of Pre Tax

With pre-tax benefits, the value of the benefit is deducted from an employee’s paycheck before federal income and employment taxes are applied. By withholding deductions before you withhold taxes, the employee’s total taxable income amount is lowered, reducing the amount of ordinary income tax the employee has to pay.

Read Also: Free Amended Tax Return 2020

How Annual Income Is Calculated

Add all your monthly income You multiply by 12 because there are twelve months in a year. For example, if you earn 2,000 per month from a part-time job and receive 10,000 as house rent, add these two figures and multiply by 12.

Is total gross annual income before or after taxes?

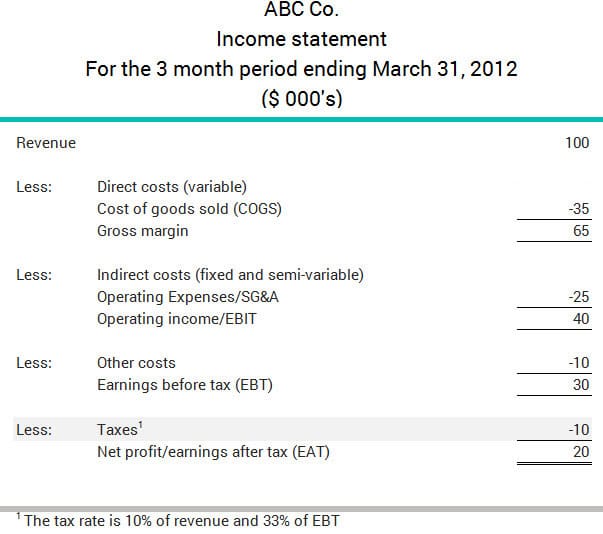

For an individual, annual gross income equals the amount of money that you earned in a year before taxes. If youre a business, your annual gross income would be your companys revenue, less any business expenses.

What means annual income?

Annual income is the amount of income you earn in one fiscal year. Your annual income includes everything from your yearly salary to bonuses, commissions, overtime, and tips earned. Gross annual income is your earnings before tax, while net annual income is the amount youre left with after deductions.

Calculating Gross Income For Salaried Employees

The salary included on the contract you and your employer signed when you started will be your official gross pay. You may also be able to calculate gross income based on your regular pay statements. For example, if you receive $5,000 per month in gross pay from your employer, you can do a simple calculation to get your gross income of $60,000.

However, there’s a chance you could earn other income from your employer, such as through bonuses. If you’ve received bonuses in addition to your salary, you will need to include the full amount you received before taxes in bonuses when you calculate your gross salary amount.

It’s important to add the gross bonus amount to your gross salary because bonuses are often taxed at a different rate than regular income.

For example, if your employer agrees to pay you $60,000 per year without bonuses, that will be your gross income. However, if you receive a $5,000 bonus this year, it will be taxed at a different rate depending on if this is your first bonus in a given year. Your regular salary will have either a lower or higher tax rate, depending on how you file your taxes. So your gross pay will be $65,000 including bonuses, but your net pay might be a bit more complicated to calculate. When it comes to understanding how bonuses impact your gross pay, consider contacting an accredited accountant to see how this will impact your yearly taxes.

Related: Hourly vs. Salary Pay: Differences, Benefits and Drawbacks

Also Check: Where’s My Tax Refund Pa

How To Calculate Gross Annual Income

Your adjusted gross income is equal to your gross income minus any eligible adjustments that you may qualify for. These adjustments to your gross income are specific expenses the IRS allows you to take that reduce your gross income to arrive at your AGI. Some of these adjustments to income include contributions to your traditional IRA, student loan interest and alimony payments.2

If you’re doing your own taxes, you can calculate your AGI with an online calculator from a source you trust, or there are DIY tax programs that can also help you to determine this figure and guide you through preparing and filing both your federal and state tax returns.

You can approximate your gross annual income using the following calculations.

- To convert your hourly income to annual income, multiply your hourly rate by 2,000

- To convert your weekly income to annual income, multiply by 50

To see how this works, let’s consider an example.

If Tom earns $30 an hour at his job, what would his annual gross income be? Using the chart above as a guide, multiply $30/hour by 2,000 to get to $60,000 as an approximation.

To calculate specifically, at $30/hour, assuming Tom is full time , he will earn $1,200 week. Assuming he works 51 of the 52 weeks per year, that equals $61,200.

Budgeting Tips For Taxpayers

- Understanding what your gross and net income is, as well as how much youll pay in taxes, can be difficult. You can try working with a financial advisor to make things easier, and finding one doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you need help creating a budget, try SmartAssets budget calculator. Use it to compare your spending habits with similar individuals in your area. Just input your gross income and how much you spend every month to determine how you can budget better.

- If youre an employee of a company that withholds taxes from your paycheck, youll fill out a W-4 form. Its important to understand how this form affects your take-home pay.

Recommended Reading: Income Tax By State Ranked

How To Calculate Gross Income If Youre A Salaried Employee

When youre paid an annual salary, youll often see a recurring figure on every payslip, showing your gross pay for that month. Multiply your gross monthly income amount by 12 to find out your annual gross salary. Make sure you take into account any short or long-term bonuses you might receive to land at your total gross number.

What Is Adjusted Gross Income

Adjusted gross income is your total income after you account for deductions like student loan interest, certain retirement account contributions, and more. Your adjusted gross income is what your tax bill is based on every year during tax season. The lower your adjusted gross income, the less income tax you’ll pay.

Don’t Miss: How Property Taxes Are Calculated

Is Your Gross Income Adjusted Before Or After Standard Deductions

When you fill out your tax return, you pay the most attention to your total taxable income. However, there is an equally important indicator. It is adjusted gross income . It directly affects the number of deductions and credits that apply to you. It reduces the amount of taxable income you report on your return.

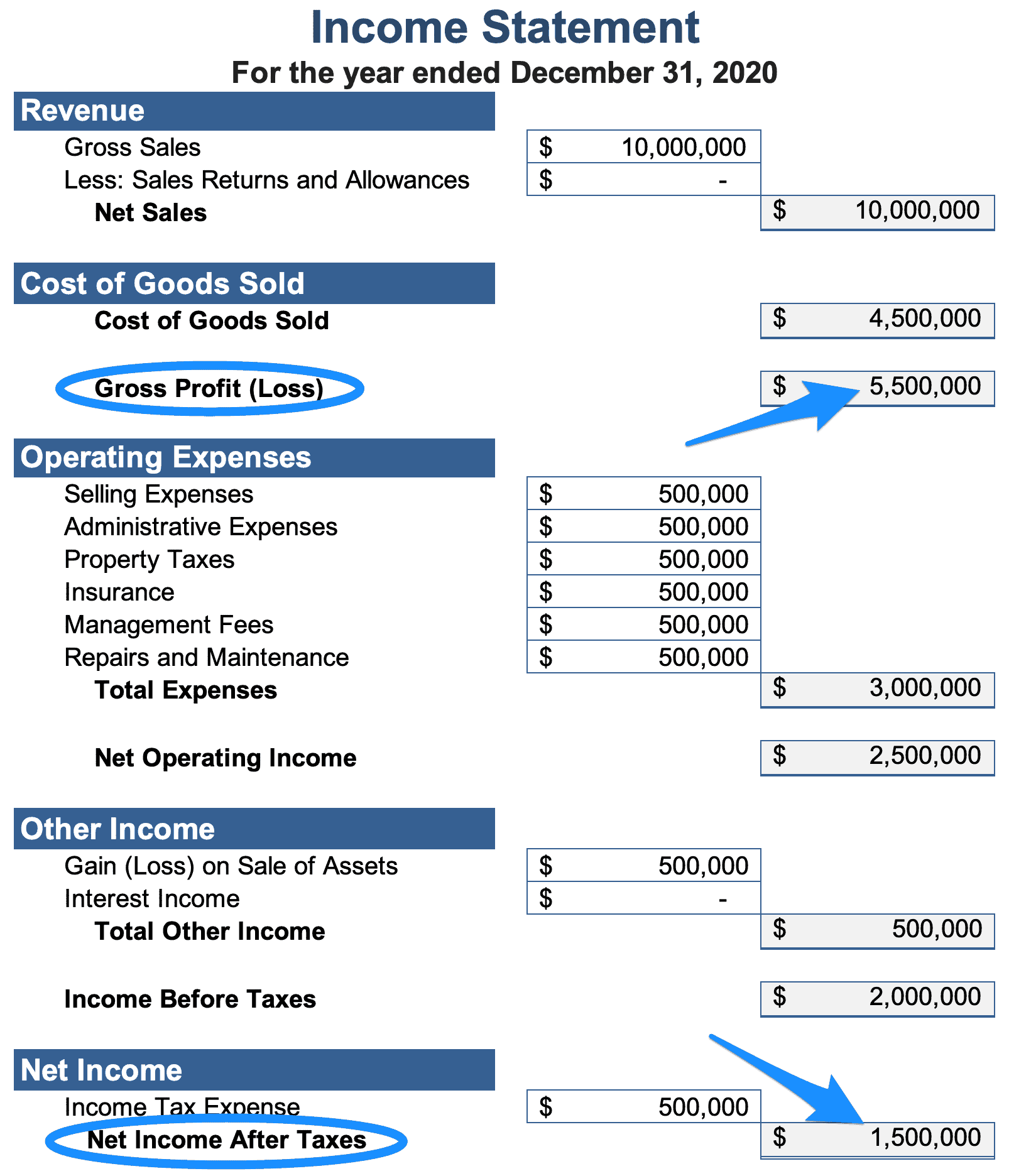

How Is Calculating Your Gross Income And Net Income Useful

Calculating your gross income and net income helps determine your financial health, and could help you determine as to what changes in your budget you should make in the following year.

If youre an employer, you may want to see if you qualify for additional tax deductions, so your net income is higher next year. As a business owner, you might find that another manufacturer is less expensive, thus providing you with a higher net income.

Whatever your financial goals may be, understanding the difference between gross income and net income is the first step towards predicting your growth for next year.

Also Check: Do 16 Year Olds Have To File Taxes

Is Salary Before Or After Tax

Gross salary is the term used to describe all of the money youve made while working at your job, figured before any deductions are taken for taxes, Social Security and health insurance. If you work more than one job, youll have a gross salary amount for each one.

What salary is 5000 a month?

Annual / Monthly / Weekly / Hourly Converter If you make $5,000 per month, your Yearly salary would be $60,003. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 40 hours a week.

Is 80 000 a good salary in Australia?

The typical Australian worker earns just $57,918. Most Australians earn less than the average hourly wage, and many employees only work part-time. So a taxpayer with an income of $80,000 a year is therefore in the top 20 per cent of Australians.

Is Net Before Or After Taxes

If you are not a numbers person, it can be tricky to understand your accounts, especially when you take into account all the different jargon that comes with it.

From assets to gross and net income, there are lots of new words that you need to learn, and this is part of what makes your accounts so confusing.

Two terms that often confuse people are gross income and net income. A lot of people often get these two mixed up, and find it tricky to know which means what.

In particular, a lot of people struggle to remember if your net income is your income before or after taxes.

In this guide, well be taking a look at whether your net income is your income before, or after, taxes, and lots more.

So, if you want to find out more about this terminology, keep on reading!

Contents

Also Check: When Can You File Your Taxes

What Payroll Deductions Affect Net Pay

The largest impact on net pay comes from three types of taxes that nearly all employees must pay:

- Federal income tax withholding: The government determines the proper amount of tax to withhold with a bracket system that increases based on income. Taxation is progressive, and it usually depends on the employees pay, W-4 filing information and their filing status .

- State income tax withholding: Most states use progressive tax brackets, but others like Washington and Texas have no personal income taxes. In addition, some cities choose to impose income taxes on people who live and/or work within the city limits. Employers should check with the state and city government to ensure proper withholding.

- Social Security and Medicare taxes: Also known as Federal Insurance Contribution Act or payroll taxes, these taxes amount to a total of 7.65% of income. Employees must pay a 6.2% tax for Social Security and 1.45% for Medicare. Employers must match these contributions.

Employees typically fill out a W-4 form to provide information about their tax filing status, dependents and other forms of income. These details impact just how much federal income tax the government deducts each pay period. In addition to the W-4, employers use the tax withholding tables in IRS Publication 15 to determine the proper amount to withhold from each check.

In addition to the required taxes, other voluntary and involuntary payroll deductions impact net pay. They can include:

Is Your Gross Income Before Taxes Or After Taxes

When filing federal and state income taxes, gross income is the starting point before subtracting deductions to determine the amount of tax owed.

What is your gross income?

Gross income refers to the total earnings a person receives before paying for taxes and other deductions. The amount that remains after taxes are deducted is called net income.

Also Check: California Capital Gains Tax Rate 2022

How To Calculate Net Pay

Calculating net pay involves deducting the elective amounts for health insurance, retirement savings and any other pre-tax contributions. Once completed, the employer will withhold all taxes including federal, state, FICA and local taxes.

What does this look like in practice? We will walk through the process of calculating net pay from start to finish.

Imagine an employee, Dave, who is a single filer who lives in Kentucky.

Dave makes $35 per hour and works 40 hours per week without an opportunity for overtime. He has bi-weekly pay, which means he receives 24 paychecks per year. Because of this, Dave receives a total gross pay of $2,800 per pay period.

Dave does not have health insurance, but his gross pay is subject to federal income, FICA and state taxes. His county in Kentucky does not charge a local tax.

To determine his net pay from his gross pay, we need to calculate deductions and subtract them from his gross wages.

Obtaining An Alcohol Permit

- Print and complete the Texas Alcoholic Beverage Commission On-Premises Prequalification Packet.

- You will need a Texas Sales and Use Tax Permit to pay sales or use tax on taxable items that you purchased tax free and then used in a taxable manner. Take the packet to a Comptrollers field office to be certified for sales and use tax.

- EXAMPLE: A permittee owes sales or use tax on the cost of taxable ingredients in a complimentary beverage, and on any napkins and straws served with the complimentary beverage. You will owe use tax on items purchased from a vendor that did not charge Texas tax.

Don’t Miss: Short-term Rental Tax Loophole

Calculating Gross Pay For Hourly Workers

The amount of an hourly workers gross compensation is determined by multiplying the total number of hours worked by their hourly wage. For illustration purposes, a part-time worker who puts in 25 hours a week at an hourly rate of $12 would receive a gross weekly salary of $300 .

At the same hourly rate, a full-time hourly employee working 40 hours per week would earn $480 per week .

You have an additional obligation to include as part of the employees weekly gross salaries any overtime pay that they have received during the week.

In the majority of Australian cities, overtime compensation is calculated at time and a half hence, if one of our full-time employees worked five overtime hours, their overtime pay would amount to $90 ). Their complete weekly gross pay would come to 570 dollars .

On the other hand, the computations for overtime in certain other states are more specialised. Make sure you have a good understanding of how overtime is calculated in each state for your hourly workers.

Why Is My Gross Pay More Than My Salary

Basically, gross pay refers to all the money your employer pays you before any deductions are taken out. It includes all overtime, bonuses, and reimbursements from your employer, and it does not account for such deductions as taxes, insurance, and retirement contributions.

Read Also: Are Funeral Expenses Tax Deductable

How To Calculate Your Gross Income

This will depend on how youre paid and whether you receive an annual salary or hourly pay. A salaried employee will be paid a fixed amount, usually divided over 12 months. If youre being paid by the houralso sometimes known as a wage employeeyour payment will vary depending on the number of hours you work. So, lets look at the different calculations for gross income.

Who Is Tax Exempt In The Uk

Individuals may apply for tax exemption if they face the following conditions:

- If someone is a tax resident for at least one year out of the previous three years

- They have spent less than 16 days in the UK during the previous tax year

- They are not a UK resident

The same applies in case:

- Someone is not a tax resident for the previous three years

- They have spent less than 46 days in the UK

Recommended Reading: Will Property Taxes Go Up In 2022

How Do I Calculate My Salary

Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year . For example, if an employee makes $25 per hour and works 40 hours per week, the annual salary is 25 x 40 x 52 = $52,000.

What kind of taxes do I pay on my paycheck?

The federal government determines the percentages employees will pay for payroll taxes. The payroll taxes taken from your paycheck include Social Security and Medicare taxes, also called FICA taxes. The Social Security tax provides retirement and disability benefits for employees and their dependents.

What does it mean to have before tax income?

Before-tax income is quite simply the income a business or private individual makes prior to taxes being deducted. This may also be called pre-tax income or gross income.