Qualifying For The Home Office Deduction

The home office deduction is a lot less restrictive than many freelancers and small business owners realize. A lot of people who actually qualify end up missing out, leaving potentially thousands of dollars on the table at tax time.

To find out if you qualify, you can take our home office deduction quiz. Otherwise, you should definitely be aware that, to claim the deduction, your home office:

- Doesnât have to be a separate room â just a dedicated area in your house that you only use for work

- Doesnât have to be used more than weekly

- Doesnât have to be used year-round

Letâs put this into perspective with an example.

Say youâre an online seller who works at a desk in your bedroom three days a week.

Even though you donât use your workstation every day, youâre still eligible to claim a home office â which means you can write off a portion of your homeowners insurance.

Now, say you go on hiatus in the summer to work a seasonal W-2 job, abandoning your at-home workstation till September. On your tax return, you can still claim home office expenses for the months you spent regularly working at your desk.

Is Hazard Insurance Tax Deductible

Hazard insurance, when bought for your main property, is not tax deductible. However, if you bought this extra protection for your rental property, youll be able to deduct it as a business expense.

Taxes, like home insurance, can be complicated. But luckily, you can make things easier on yourself by working with companies who get it. Here at Hippo, we have a team of insurance experts on call to help you understand all the ins and outs of insurance with ease. Because after all, your dream home deserves the best protection possible.

For more information on homeowners insurance, and to ensure you have the coverage you need, give us a call.

Save up to 25%*

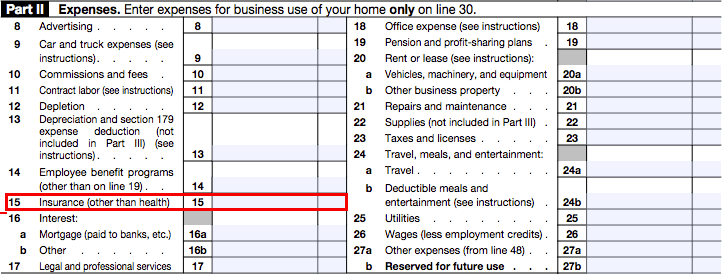

Tax Deductions If You Work From Home

Working from home has a ton of benefits, you get to avoid traffic, you can’t be late, and you get to set your own schedule.

But did you know that you can deduct expenses from your home office.

The amount you deduct is calculated by figuring out what percentage of your home is used for business. If 25% of your houses square footage is used for work, then 25% of the amount you paid in premiums for the year would be deducted from your taxable income.

However, keep in mind that your home office needs to actually be designated for that and only work happens in there.

Examples of deductible casualty losses are:

- Floods

You May Like: Where Is My California Tax Refund

What Does This Mean For You

Basically, if you raise your deductible, youll likely cut insurance costs and therefore have less to pay up front. But youll be left having to pay more when you file a claim.

According to William Davis of the Insurance Information Institute, limiting your out-of-pocket expenses is virtually the solereason for choosing a lower deductible policy. Otherwise, its up to the policyholder and their circumstances.

“There really aren’t any other benefits other than having to pay less out of pocket in the event of a loss,” Davis says.

“But policyholders should discuss their individual situation and insurance needs with their company representative or agent to ensure they understand their coverages, the deductibles that are available, and how those things will affect them in the event of a loss.”

Home Accessibility Tax Credit

Renovations or expenses incurred which make homes safer or more accessible for Canadians 65-years of age or older, or for the disabled people of any age may qualify for the HATC provided they are being claimed by the eligible individual or by someone who looks after the individual and meets all of the CRAs requirements. Up to $10,000 in expenses can be claimed under the HATC. Since this is a non-refundable tax credit, you are eligible to receive 15% of the renovation costs as a reduction on your taxes.

Read Also: When Are Tax Payments Due 2022

Tax Deductions For Denied Home Insurance Claims

-

What counts: Denied or partially covered home insurance claims that occurred during a federally declared disaster

-

What tax form to file: Schedule A Itemized Deduction

If your home or property is damaged and your homeowners insurance claim is denied, you may be able to deduct the loss from your taxes if it occurred during a federally declared disaster.

Known as a casualty and theft loss deduction, you can deduct a portion of the value of the property or home that was damaged or lost during a declared disaster on your taxes.

However, the damage or theft needs to have occurred during asudden or unexpected event meaning the loss was swift, unanticipated, and unintended, rather than gradual or progressive.

|

Deductible casualty losses |

|---|

|

Volcanic eruptions |

What if my home insurance company only partially covered my claim?

If your home insurance company only partially covered the damage or theft, you might still be able to deduct the difference on your taxes if it meets the above criteria.

For example, if that antique urn that was stolen from your mantelpiece was worth $6,000 and the insurer only paid out $5,000 to cover your losses, you can claim a $1,000 loss on your taxes.

What Are The Deductions Available To Me That Is Related To My

Keep in mind, you can deduct any qualifying real estate taxes that you paid to deduction related to your home is Qualified Mortgage Insurance Premiums.Qualified insurance premiums include homeowners, flood, and wind and hail insurance. Applies to state income taxes only. Any unused credit can be The deductibility of PMI premiums has been an on-again, off-again affair for years, but homeowners are again in luck for tax year 2021, as it is on again. The

Don’t Miss: How To File An Extension Taxes

Is Hazard Insurance Different From Home Insurance

Hazard insurance is not a different type of insurance from home insurance. It is the component within a standard comprehensive homeowners insurance policy that covers just the structure of your home. It will pay for repairs if your home is damaged or to rebuild it if the home is a total loss. You cannot purchase hazard insurance as a separate or standalone policy.

Home Businesses May Need Additional Insurance

We should also point out that a home business might need additional insurance or small business insurance. If youre storing inventory, keeping a lot of cash on hand, offering child care services, or building a laboratory in your garage, you should let your insurance agent know.

In the case of a fire, for instance, your standard homeowners insurance policy would likely cover your computer, desk, and home office needs up to a few thousand dollars. It wouldnt cover inventory or expensive equipment.

Don’t Miss: Penalty For Filing Taxes Late If I Owe Nothing

Can You Write Off Your Property Insurance

You cannot write off your property insurance premiums or the actual expenses related to it unless the premiums are for a rental home. In this case, you have to show that youve been getting income from your rentaloften as a part of your adjusted gross income. If you have proof, the property insurance packages you get will be considered business expenses.

Deducting Home Insurance As A Self

If youâre self-employed and work from home, you can write off part of your homeowners insurance costs by taking the home office deduction.

This valuable tax break lets you claim more than just your monitor and your desk chair. Because your home insurance premiums help protect your home office, it counts as a related cost that you can write off.

Recommended Reading: Amended Tax Return Deadline 2020

Tax Deductions For Investing

If you are a real estate investor and have home that you rent out, you can deduct the homeowners insurance for that house as an expense on your taxes.

This is because it is the equivalent of running a business when you start making rental income and homeowners insurance is an expense for that business.

You would need to file a Schedule E form and provide how much rent you collected that year and whether or not you lived at the property yourself during the year.

Individuals Who Are Not Required To File A Louisiana Income Tax Return

Individuals who are not required to file a Louisiana individual income tax return must file their claim for refund on the “Request for Refund of Louisiana Citizens Property Insurance Corporation Assessment, Form R-540INS A copy of your homeowners or propertys insurance declaration page and any supplemental page that shows the charges for the LA Citizens assessment must be attached to the Form R-540INS.

Read Also: How To Report Tax Fraud To The Irs

Information You Must Provide To Claim Your Home Insurance As A Tax Deduction

Depending on which circumstance applies to you, you may need to provide proof of the amount paid for your home insurance policy. If this is the case, be sure to keep a record of your home insurance policy.

If you cannot find a copy of your home insurance policy, contact your insurance provider or broker to help you obtain one. Even if you are not required to include proof of home insurance costs with your tax return, you should keep a record of all expenses in the event of an audit by the Canada Revenue Agency .

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

You May Like: What Do You Need To Do Your Taxes

When Homeowners Insurance Premiums Can Be Deducted From Taxes

Homeowners insurance premiums usually cannot be deducted on an income tax return because most people only use their home for personal purposes .

For that reason, the Internal Revenue Service considers homeowners insurance premiums nondeductible payments, much like the cost of utilities.

This also applies to all types of personal home insurance, including hazard coverage, liability coverage and more specific forms such as earthquake insurance or flood insurance. If the coverage applies to personal home usage, none of those premiums can be written off.

However, there are some cases in which someone can deduct their homeowners insurance and other related insurance premiums. Considering the cost of homeowners insurance, the write-off is definitely something a policyholder should take advantage of if they can.

Have You Submitted A Theft Or Loss Claim

You may be able to deduct the difference between your insurance settlement and the cost of a loss, if you submit a claim for theft, damage or other type of loss. If the associated costs supersede your policy limit and you end up paying out of pocket for loss or damage, you may be able to deduct it on your taxes the following year. Your accountant or financial professional will be able to help you determine if your theft or loss claim qualifies for this deduction.

If any of these situations applies to you, speak to your accountant or financial professional. They can help guide you in the right direction. To learn more about Nationwides homeowners insurance offerings and what type of coverage is right for you, visit our home insurance page and start a quote today.

-

Homeowners

You May Like: How Old Do You Have To Be To File Taxes

Homeowners Insurance Coverage For Small Business Owners

It is worth noting if you run a very small business on your propertylike lawn care or gardening business, your homeowners insurance might cover up to a couple of thousand dollars for it. If you do run a business on your property it is recommended you ask your homeowners insurance company upfront if it is covered or not.

If you run a larger business out of your home, it likely will not be covered, and you would need to take out an insurance policy specifically for the business.

For example, if you run something like a daycare in your house, for instance, your homeowners insurance policy would most likely require you to take out a commercial policy for your business.

Is Homeowners Insurance Tax Deductible In 2021

Fact-checked with HomeInsurance.com

Finding ways to save on taxes is essentially a universal practice. If youve ever wondered whether your homeowners insurance is tax deductible, the answer is generally no. However, there are instances where your taxes and homeowners insurance can have an impact on each other. Lets take a look at how it works.

Recommended Reading: Do You Have To Pay Taxes On Inheritance

Homeowners Working From Home Can Deduct Some Insurance Costs

More Americans are working from home than ever before. The Work From Home movement was changing the employment landscape, even before COVID-19. If youre a homeowner now telecommuting for the first time and looking to learn how your homeowners insurance might relate to income taxes, youre in the right place.

Lets start with a better understanding of income tax deductions.

What Is Home Insurance

First things first, what is home insurance? To understand whether home insurance is tax deductible, you must first understand what home insurance is.

We can all agree that a home is a major purchase, it may even be the biggest purchase you make in your lifetime. For this reason, its important to protect it, and thats where home insurance comes in. As with any type of insurance, home insurance protects your home from risk.

The specific risks it protects against depending on the policy you choose but may include coverage in the event of fires, theft, vandalism, floods, power outages, and more. As with any insurance policy, its up to the policyholder to decide which coverage and how much of each coverage they want to include with their policies.

The home insurance coverage you choose will ultimately depend on your budget, the part of the country you live in , and your unique needs. The insurance policy you choose might also be determined by the way in which you use your home.

For example, if your home also functions as a rental property or home office, specialty coverage might be wise. Home insurance is available on all types of homes in Canada, from townhouses and detached homes to condominiums and semi-detached homes.

The cost of home insurance policies varies by provider and depends on a wide variety of factors, such as the age and location of your home.

Read Also: When Are Llc Taxes Due

Contact Brokerlink To Learn More About Home Insurance

Still have questions about tax deductions as they relate to home insurance? At BrokerLink, we are experts in all things home insurance and would be happy to answer your questions. We can also help you find a home insurance policy that meets your needs.

Whether you own a rental property, operate a home business, or simply use your home as a residence, we can find a policy that protects your home.

Contact BrokerLink to learn more about home insurance in Canada or to request a free quote. Our quotes are accurate, competitive, and 100% obligation-free, meaning you have nothing to lose and everything to gain by contacting us.

You can reach us by phone, email, or in person at one of our many locations across Canada. You can also use our online quote tool to receive a complimentary home insurance quote in as little as five minutes. Get started with BrokerLink today!

Best Companies Offering Hazard Insurance

Many insurance companies offer hazard insurance as part of their homeowners insurance policies. To determine the best companies providing hazard insurance, MoneyGeek based its ranking of the best home insurance companies on such factors as the overall affordability, J.D. Power customer satisfaction scores and AM Bests financial stability rating. Using a homeowners insurance policy with $250,000 in dwelling coverage and $50,000 of personal property, the scores are on a scale of 0-100 on the national level.

Recommended Reading: How Is Property Tax Paid

Hazard Insurance Deductibles And Limits

The cost of hazard insurance can quickly build up if you dont plan. Unfortunately, these insurance premiums are not tax-deductible, and however, it may be possible to explore a few exceptions.

According to Clever Real Estate , several individuals may qualify for a tax deduction for this expense, depending on whether they own a rental property, work from home, or have experienced a natural disaster. However, homeowners dont need to worry there are other options to reduce their tax liability. Tax professionals can provide more information you may need.

For example, if your insurance policy has a $600 deductible, and your insurer determines that you are entitled to a claim check for $9,400, you would receive $9,400.

Generally, percentage deductibles are only applicable to homeowners policies. They are based on a percentage of the hazard insured value. For example, considering $100k in hazard insurance coverage and a 2% deductible, a claim payment of $2,000 would be deducted. The remaining $8,000 would be paid out in case of a $10,000 insurance loss.