I Am Having Issues Downloading The Income Tax Forms Online What Is The Issue

The most compatible browsers for this form are Internet Explorer or Mozilla Firefox. If you are using Google Chrome or Safari and see a blank/warning/error message, please view the form within your computer’s Download folder instead of online.

Please ensure you download and open the form from your computer folder using Acrobat, as you will encounter issues when viewing and filling it out within your internet browser.

Fillable forms are in PDF format and contain JavaScript coding, which does not operate properly in internet browsers.

For more forms technical help, see .

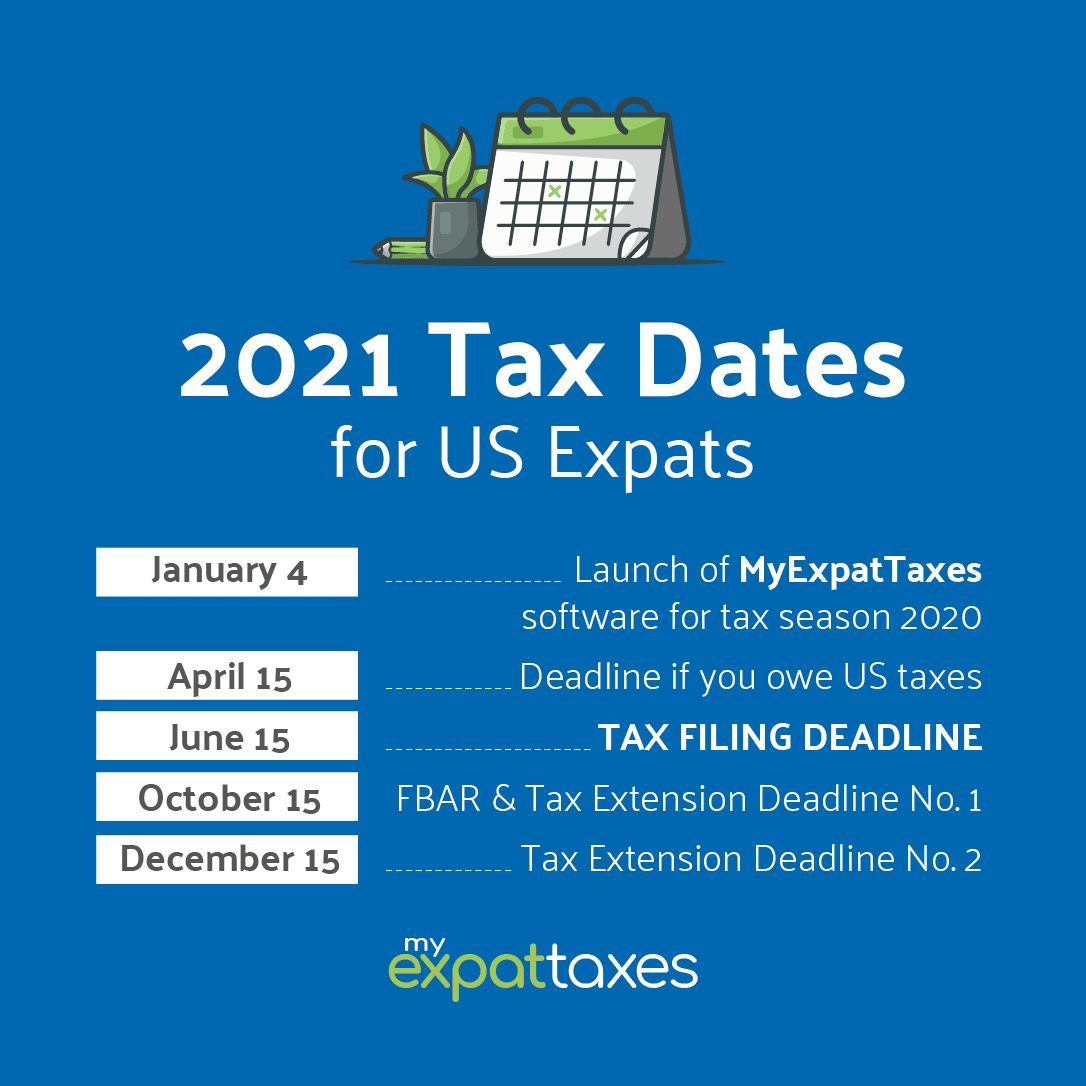

File For An Extension By Tax Day

If you can’t finish your return by the April 18 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 17 to file their tax returns. See more about how extensions work.

Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

» MORE: See how to set up an installment plan with the IRS by yourself

Quarterly Vs Annual Payments

Wondering if your business should pay taxes quarterly or annually? If your business has employees, youll need to file Form 941 every three months. You will also need to pay a quarterly tax if your business sells specified goods, like gasoline or alcohol, that require an excise sales tax.

If your business doesnt fall under those categories, figure on paying at the usual tax time. But if youre worried about having a large sum of cash on hand to make a lump-sum annual payment, consider paying quarterly instead. Additionally, freelancers are required to pay estimated quarterly taxes and to file an end-of year tax return.

All quarterly estimated tax payments for individuals, S corporations, and C corporations, should be made on the following schedule:

C Corporations will make their final estimated quarterly tax payment on December 15, 2022. Individuals and other types of corporations can wait until January 2023 to file their fourth quarterly payment for the 2022 tax year.

Recommended Reading: Tax Preparation Services Springfield Il

Claim These 2021 Tax Breaks Now Before Theyre Gone

The tax code saw some major overhauls in 2021 amid the pandemic. With many families and businesses struggling to stay afloat, lawmakers put in place a dizzying array of changes, including tax breaks, to provide extra help.

Some of those tax breaks, however, may not return in 2022, which means that taxpayers should be aware of what to claim and when, before time runs out. In some cases, that means taking steps before December 31 which means the clock is ticking.

The tax code was the primary method tapped by lawmakers to deliver financial aid to families via stimulus checks and the enhanced Child Tax Credit. Both provided advanced payments on tax credits for the 2021 calendar year. That means some families could have a chance to claim additional money in early 2022 when they file their tax return but, in some cases, only if they take steps now.

All the stimulus efforts had income thresholds. Families earning above those cutoffs received either reduced payments or none at all. But because the IRS based eligibility for those payments on families 2020 tax returns, some taxpayers could have a chance to claim extra money based on their 2021 filing.

For instance, take two parents with a child whose joint income in 2020 was $165,000. In that case, they wouldnt have qualified for the third stimulus checks because their 2020 income was above the $160,000 threshold to qualify.

Investment Proofs For Tax Saving

For individuals who are could not submit their actual tax-saving investment proofs to their HR/Accounts department during the given time period in the previous financial year, they have to declare and submit the same directly to the I-T Department for claiming tax deductions.

These include receipt of life insurance premium paid, receipt of medical insurance, receipt for investment in Public Provident Fund , 5-year FD receipts, mutual funds investment , ULIPs, NSC, home loan repayment certificate/statement, donation paid receipt, tuition fee paid receipt etc.

The maximum amount that can be claimed under Section 80C is Rs 1.5 lakhs while an individual can claim a deduction of Rs 25,000 under section 80D on insurance for self, spouse and dependent children. An additional deduction for insurance of parents is available up to Rs 25,000, if they are less than 60 years of age. If the parents are aged above 60, the deduction amount is Rs 50,000.

Recommended Reading: How To Calculate Taxes For Payroll

More Time To File And Pay

If you wont be able to file by the original May 1 deadline, dont worry. Everyone has an automatic 6-month filing extension in Virginia, which moves the filing deadline from May 1 to November 1 for most taxpayers .

In addition, as part of the state’s COVID-19 tax relief actions, if you owe taxes, you have until June 1, 2020 to pay without any penalties or interest.

This also applies to individual extension payments for Taxable Year 2019 as well as the first estimated income tax payments for Taxable Year 2020.

C Corporation Tax Returns Due

Today is the deadline to file C corporation tax returns . C corporations in Texas, Oklahoma, and Louisiana have until June 15 to submit their tax returns.

April 15 is also the deadline to file for an extension to file your corporate tax return.

Forms:

Last day to file taxes with the IRS. Individuals are required to pay their taxes before a certain date. There are many deadlines, however, there is one that applies to everyone: the deadline for filing federal income tax returns. Form 1040 is the form most taxpayers use to file federal tax returns. In order to ensure your form is completed in time.

Also Check: Do I Have To Charge Sales Tax On Handmade Items

What Happens If I Didn’t File Taxes In 2021

If an individual taxpayer is owed a refund, there’s no penalty for filing late. On the other hand, tax owed and not paid by May 17, 2021 is subject to penalties and interest . Anyone who didn’t file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest.

Can I Call The Irs To Get Answers

While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited.

The IRS is directing taxpayers to the Let Us Help You page on its website and to get in-person help at Taxpayer Assistance Centers around the country. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to. You can call 800-829-1040 or 800-829-8374 during regular business hours. If you have not received a refund yet, you shouldnt file a second tax return.

You May Like: Where Can I File My Taxes

Also Check: New York State Tax Login

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

Which Address Do I Mail Payments To

If you are sending your payment separate from the return, you should complete Arizona Form AZ-140V and send it with the payment to the address shown on Form AZ-140V. To avoid delays when sending a paper check, include your ID# , the tax type, and return period on the check with the appropriate voucher. Without the voucher and information on the check, ADOR must research to process your payment accurately. Find vouchers at .

Read Also: Aarp Foundation Tax-aide Site Locator

Other Income Tax Debts Including:

- Tax in respect of Over-contributions to Deferred Income Plans .

- Tax in respect of Registered Investments

- Tax in respect of overpayments to Registered Education Savings Plan .

- Payments under Registered Education Savings Plan

|

Part X.1 Within 90 days after the end of its taxation year . Part X.2 Within 90 days from the end of its taxation year. Part X.4 Within 90 days after the end of the year . Part X.5 Persons regular filing due date . |

| Payment dates |

|---|

What If You Cant Pay Your Taxes This Year

Does your heart sink when you receive a piece of mail from the IRS?

Thats reason enough to dread tax season. I have a friend whose family always filed extensions on their taxes. This, of course, added to the stress of tax season. After April, 15th no one in her family would go to the mailbox.

My friend decided at age 18 she was fed up and wanted to start filing her own taxes. With a little help, she was able to prepare as soon as she received her tax documents. She never stressed again, because she had plenty of time to make adjustments.

If youre finding yourself asking What if I cant pay the taxes I owe by this years filing deadline? I can help! Here are a few guidelines for avoiding and reducing IRS interest, filing penalties, and underpayment penalties.

- If you cant pay your taxes, file your tax return and pay as much as you can by the tax filing deadline.

- Then, set up a payment plan with the IRS. Youll still have to pay interest and penalties, but this will significantly reduce the total amount youll owe.

- Then make adjustments to your W-4 or quarterly tax payments so you can avoid owing taxes in the future.

Read Also: Are Medical Insurance Premiums Tax Deductible

You Should Follow These Steps To File Taxes

First, send your tax return by UPS or FedEx to the address on the cover page. Do not wait until the last minute to send it because your deadline may be further away. Next, print out your tax extension.

It is important to have proof of your mailing address , so make sure you take a copy with you the next time you go to the post office. Remember to use the same post office box for all your mail, so do not leave one out. Mail your extension to the IRS as soon as you can.

Some other deadlines are due, including the filing of federal income tax returns for April, May, June, July, August, and September. These deadlines vary and will depend on the type of tax returns you are filing.

If you want to maximize your savings, make sure you are aware of these deadlines. By having an estimated tax due date when you begin your taxes, you will know what to save for, what penalties you might be eligible for, and how much you will have left in your savings account by the end of the year.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How Fast Can You Get Your Tax Refund

Also Check: California Sales Tax By Zip Code

When Can I File My 2021 Taxes Turbotax

The IRS starts accepting tax returns on January 24th, and they anticipate that most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. However, TurboTax launched Refund Advance on December 1, 2021.

When Are 2022 Taxes Due

Each year, the IRS sets the due date for filing your federal tax return for April 15 if youre a calendar year filer. Generally, most individuals are, though if you have a business that uses a fiscal year that differs from a calendar year, your return is due on or before the 15th day of the fourth month after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

The last day of tax filing for 2021 taxes was April 18, 2022, unless you lived in Maine or Massachusetts, where your last day of tax filing was April 19, 2022, because of holidays. Likewise, you could have submitted Form 4868 to request an extension to file later this year.

The last day to do taxes isnt the only important tax deadline to know, however. There are several other important tax deadlines for the 2022 tax year you should know, or for the taxes youll file in 2023. If you’re wondering, “When are taxes due, anyway?” Here are the important dates at a glance.

Don’t Miss: Department Of Tax Debt And Financial Settlement Services

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2021 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 26,450 |

| $ 26,450 |

Your income tax return is due July 15, 2022.

Tax Deadline Extension: What Is Extended For 2021

The IRS gave residents and businesses of Texas, Oklahoma and Louisiana extra time because a severe mid-February winter storm left millions without power and water.

On March 17, 2021, the IRS officially extended the federal income tax filing deadline from April 15 to May 17. That means taxpayers who owe money dont need to file a tax return until this date, and if they owe money they dont need to make payments until then.

This extension applies to all filers, including individuals, businesses, trusts, estates and more. It applies regardless of the amount you might owe, and payments will not incur additional penalties or interest up until May 17. This extension is automatic, meaning taxpayers do not need to file any additional forms to take advantage of it.

The May 17 extension could provide some significant benefits for taxpayers looking to save for retirement through an IRA. Thats because the normal April 15 income tax deadline is also the IRA contribution deadline. In turn, the new May 17 due date would simultaneously push back the 2019 IRA contribution deadline.

For reference, the 2020 standard IRA contribution limit is still $6,000, or $7,000 if you are 50 or older. If youve already maxed out your contribution for the 2020 tax year, you can contribute toward the 2021 tax year, for which the limit is also $6,000.

This extension does not apply to 401 retirement savings accounts.

You May Like: Calculate Capital Gains Tax On Real Estate

Court Bars Monroe Man From Working As A Tax Preparer In Louisianacontinue Reading

BATON ROUGE A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.

Courtney C. Blockson was arrested in Dec. 2019 for a tax fraud scheme involving state child care tax credits. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. None of the taxpayers involved were aware of Blocksons scheme. The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.

Blockson pleaded guilty to Filing False Public Records. As a condition of the plea, the court issued an injunction prohibiting him permanently from participating directly or indirectly in the preparation or filing of any Louisiana tax return except his own.