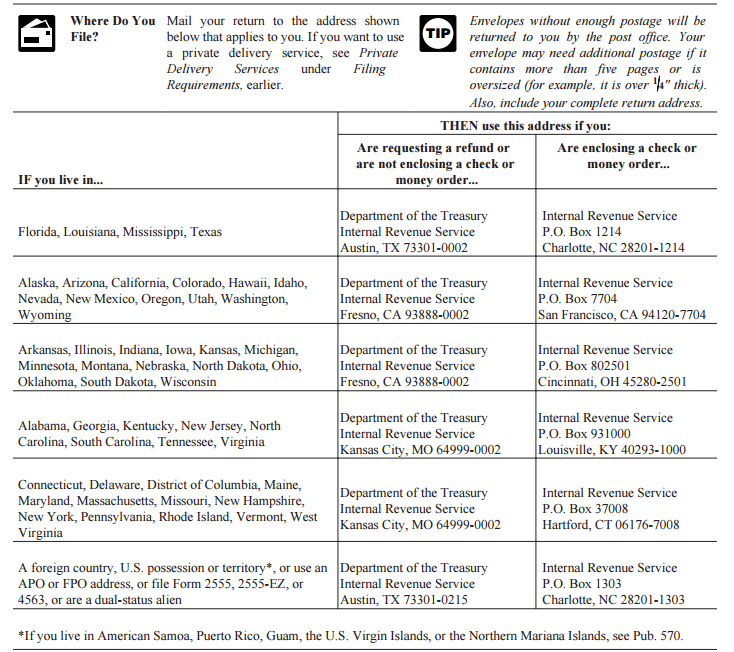

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Notice To Taxpayers Presenting Checks:

When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction. When we use information from your check to make an electronic fund transfer, funds may be withdrawn from your account as soon as the same day we receive your payment, and you will not receive your check back from your financial institution.

Where To Get Help With Filing Your Taxes

All sorts of tax preparers can help you file your federal and state returns, and most charge a fee. These include certified public accountants, enrolled agents and preparers who havent earned those designations.

One study by the National Society of Accountants pegged the average cost for a federal 1040 and corresponding state return, without itemizing, at around $220. With itemizing and preparation of the federal Schedule A, the average cost rose to more than $320. Tax-preparation costs rise with more complex returns.

The IRS partners with various tax firms that provide free online return-preparation help. This is the Free File Alliance, and its available to people with low or moderate incomes. The IRS hasnt yet announced which companies will participate, but the trend in recent years is toward fewer companies just eight last year, down from 11 the prior year.

Some companies will help you file your federal return for free but might charge for state returns, so read the fine print. The IRS will unveil the program for the 2022 tax year in coming days. For tax year 2021, people with adjusted gross incomes of $73,000 or less are eligible.

For subscribers:Inflation will cause some tax breaks to rise, but not all. Make sure you know these key exceptions

Also Check: Where Do I Mail My State Tax Return

Where Do I Mail My Federal Tax Return If I Live In Alabama

Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000.

Do I need to send a copy of my federal return with my Alabama state return?

State Only Return Requirements Alabama state returns must be transmitted as a linked return with the Federal Return. Amended Returns Alabama does not support electronic filing for Amended Returns. Taxpayers must file a paper return, and mail it to the appropriate address.

What do I need to include if I mail my tax return?

n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: Haven T Received Tax Return

Benefits Of Filing Tax Returns Via Postal Mail

In todays world of rapidly expanding technology, many taxpayers prefer the faster results offered by e-filing and other electronic modes of correspondence with the IRS. While electronic filing definitely has its benefits, there are also several benefits to filing your taxes the old-fashioned way.

Paper filing of tax returns allows both taxpayers and tax preparers to carefully review each document for errors and unintentional omissions. Electronic filing software comes with error-checking features, but it can be easy to overlook minor issues when clicking through screens and submitting online, as opposed to going over each line in a physical document.

Taxpayers who file paper returns dont have to worry about potential security issues that may arise when utilizing software or sending personal, identifying information over the internet. While the IRS portal itself is extremely secure, the electronic steps taxpayers take prior to e-filing may leave their data more vulnerable. With paper returns, the submission process is simple and transparent.

Mailing Vs Electronic Filing

Under usual circumstances, taxpayers should receive their refunds or correspondence from the Internal Revenue Service within six weeks of mailing tax returns, forms and payments. Electronic filers generally receive direct deposits within three weeks of filing.

The IRS states that while it typically takes 21 days to issue refunds to business owners and individuals, the Covid-19 pandemic has led to extended processing times. Its important to plan accordingly when contacting the IRS via postal mail, as response times may be extended.

While its not a common occurrence, taxpayers who choose the mail-in method should also take into consideration the chance of a return getting lost or delayed in the mail. Its important to make copies of all forms, checks and other documents sent to the IRS via postal mail to avoid any additional delays if the submission must be re-sent.

For an extra layer of protection when mailing your forms to the IRS, consider sending them via certified mail. Sending certified mail ensures that the IRS will have proof of the date you mailed the return, and youll be notified when the return is received by the Internal Revenue Service.

Also Check: What States Do Not Have Sales Taxes

Usc Financial Aid Has Asked Me To Supply An Irs Tax Return Transcript How Do I Do This

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Amend Your Tax Return Now Turn If You’re Still Waiting For 2020 Unemployment Tax Refund

For others still waiting on their 2020 unemployment tax returns, things got a little confusing with an update from the IRS on its Frequently Asked Questions page in early December.

After telling people for two years NOT to amend their taxes, the IRS said that it had now completed all automated processing for 2020 unemployment taxes. Anyone who had not received a refund via the automated process should amend their taxes.

I spoke to an IRS spokesman who confirmed anyone including those who had letters from the IRS within the last 60 days who still hasnt received their unemployment refund should go ahead and amend the 2020 tax return.

You May Like: What Is Social Security Tax

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Cutting It Close The Mailbox Rule

Can you mail your tax return on the same day that its due?

Yes, a document delivered by U.S. mail is considered timely if the envelope is properly addressed to the recipient with sufficient postage, the postmark date falls on or before the deadline, and the document is mailed on or before that date.

If sending via private delivery services, only the following services are designated by the IRS to meet the timely mailing as timely/filing/paying rule:

DHL Express:

Also Check: States That Don T Have Income Tax

Did You Receive A 1099

Extra Unemployment Benefits Were Exempt From Taxes

Although unemployment benefits are usually taxable, the American Rescue Plan Act provided an exclusion of up to $10,200 in unemployment income for individual filers. For married couples filing jointly, the amount is doubled to up to $10,000 per person. To receive this exclusion, your modified adjusted gross income must have been under $150,000.

The IRS has reviewed Forms 1040 and 1040-SR that were filed before the passage of the American Rescue Plan Act. This was done to identify taxpayers that had already reported their unemployment compensation as income, making them eligible for a correction. The IRS said it took care of these tasks “to ease the burden on taxpayers.”

You May Like: How Much Taxes Taken Out Of Check

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

How To Contact Irs Customer Service

You’re welcome to call the main IRS number . The agency’s average telephone service waiting time is 13 minutes during filing season and 19 minutes off-season . Call volume may be higher on Mondays and Tuesdays as well as around the tax deadline.

If you’ve got a question about any of the topics below, one of these lesser-known IRS phone numbers might get you to help faster.

|

TOPIC |

Don’t Miss: How Much Do I Have To Make To File Taxes

Additional Irs Office Mailing Addresses For Non

In certain cases, individuals and business owners must submit non-return forms to the Internal Revenue Service via postal mail. Below, youll find the addresses for certain types of applications and other forms:

- Individual Taxpayer Identification Number Applications: Internal Revenue Service, Austin Service Center ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342

- Innocent Spouse Relief Application: Internal Revenue Service, P.O. Box 120053 Covington, KY 41012

- Tax Lien Inquiries: Centralized Lien Operation, P.O. Box 145595, Stop 8420G Cincinnati, OH 45250-5595

Reach Out Online Or By Phone

The IRS has online tools for many of the more common taxpayer requests. There are tools for setting up a tax payment plan, requesting your tax transcript, making a payment, checking on your refund, and viewing your individual tax account.

If those tools don’t address your request, you can then reach out to the agency by phone. The main number for individuals is 1-800-829-1040. If you have questions about business taxes, you’ll call 1-800-829-4933.

For more specific requests, use the below numbers:

|

Contact reason |

|

|

Stimulus check not received or is wrong amount |

1-800-919-9835 |

Quick tip: Before reaching out by phone, make sure you have your Social Security or other taxpayer identification number, birth date, filing status, last tax return, and any IRS correspondence on hand. You may need these during your call.

Recommended Reading: Which States Are Tax Free

Submission Processing Center Street Addresses For Private Delivery Service

Private Delivery Services should not deliver returns to IRS offices other than those designated below.

Private Delivery Services should deliver returns, extensions and payments to the following Submission Processing Center street addresses only:

Austin – Internal Revenue Submission Processing Center3651 S IH35,

Kansas City – Internal Revenue Submission Processing Center333 W. Pershing,

Ogden – Internal Revenue Submission Processing Center1973 Rulon White Blvd.Ogden, UT 84201

If using a private delivery service, send your returns to the street address above for the submission processing center designated for your type of return: Where to File Tax Returns – Addresses Listed by Return Type.

Note when you mail a return from the post office to the IRS, the address to send the return is often different depending on whether you are sending the return with a payment or without a payment. However, when using a private delivery service to send a return to the IRS, all returns go to one of the street addresses above.

Mailing Address For Individual Tax Payment

For people who owe money on their tax balance, one way of making the payment is by mailing a money order or check to the IRS. The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. The following table summarizes the mailing addresses of any Form 1040-V payments according to people who live in the areas.

Tip You can find the mailing address on Page 2 of Form 1040-V. The mailing address of Form 1040-V can change every day.

Please visit IRS About 1040 Form to get the latest filling address.

| The State You Live in | Mailing Address |

|---|---|

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service |

| P.O. Box 802501Cincinnati, OH 45280-2501 |

The following group of people should mail their forms to the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201- 1303.

- People who live in a foreign country

- People who live in American Samoa

- People who live in Puerto Rico

- People who are excluding income under internal revenue code 933

- People who use an FPO or APO address

- People who file form 2555, 2555 EZ, 4563

- People who are dual-status aliens, or non-permanent residents of Guam, or the U.S. Virgin Islands.

You May Like: Capital Gains Tax Calculator New York

What Happens If You Dont Update Your Address With The Irs

The IRS will continue to send any tax notices to the last address it has for you. This can include notices that youre being audited, that the IRS wants more information, or that you owe money.

When the IRS sends you a notice, you only have a certain number of days to respond. If you dont respond, the IRS will usually automatically adjust your tax return, and it probably wont be in your favor.

Any possible interest and penalties are also based on how long it takes you to respond.

The IRS sending a notice to the address it has for you counts as you being notified. You cant say that you didnt get a notice because you moved if you dont update your address.

You may also have a problem getting your tax refunds if you dont update your address. When government checks get returned to sender, you may have to call the IRS to verify your identity before theyll issue a new check.

How Much Did The Irs Refund Taxpayers

According to the IRS, this recently completed round of corrections for 2020 resulted in corrections of about 14 million returns. About 12 million refunds have been issued totaling $14.8 billion. The average tax refund given was $1,232.

Not all of these new refunds resulted from unemployment compensation issues, but from other tax credits as well, including:

- Advance Premium Tax Credit

Read Also: New Jersey Sales Tax Filing