Montgomery County Assessor’s Office Services

There are three major roles involved in administering property taxes – Tax Assessor, Property Appraiser, and Tax Collector. Note that in some counties, one or more of these roles may be held by the same individual or office. For example, the Montgomery County Tax Assessor may also serve as the Montgomery County Tax Appraiser.

When contacting Montgomery County about your property taxes, make sure that you are contacting the correct office. You can call the Montgomery County Tax Assessor’s Office for assistance at 936-539-7897. Remember to have your property’s Tax ID Number or Parcel Number available when you call!

Please before you send documents or if you need to schedule a meeting.If you have general questions, you can call the Montgomery County Courthouse at 936-539-7812.

When Are Montgomery County Property Taxes Due

Once you receive your tax bill for your Montgomery County property taxes, you will need to pay it off by January 31st of the following year. This is the official deadline for when Texas property taxes are due, regardless of whether you live in Travis, Mitchell or Montgomery County. Delinquent property taxes will be issued to your account if you miss this deadline and will stay active until paid in full.

What Happens When You Get Montgomery County Delinquent Property Taxes

As a resident of Montgomery County, delinquent property taxes can impact your annual statement if you fail to pay your tax bill by the deadline. At first, these tax penalty fees will begin at 7% of your total tax bill for the month of February and increase as the months go on. Whether you own a commercial or residential property, these percentages can go up 15% by June 30th. If you still havent paid by July 1st, you will also be required to pay an additional 15 to 20% collection fee.

Don’t Miss: How To Find 2020 Tax Return

Notices Are Now Available Online Due To State Code Exemptions Are Not Shown On The Appraisal Notice

Due to the massive number of exemption applications received please allow at least 90 days for processing. No further action is required. A late application for residence homestead exemption may be filed up to two years after the deadline for filing has passed. We sincerely appreciate your patience and apologize for any inconvenience.

To offer the most efficient and prompt response, please only email the department that best corresponds to your immediate need. If you are uncertain which email to utilize, please use the email address.

The Tax Administrators Office

The Administrators Office is responsible for maintaining records of real and personal property ownership for use as a basis for ad valorem taxation. This information is collected and used on a yearly basis and begins in January of each year during the listing period. Real property is permanently listed and does not require the owner to re-list every year. Personal property such as unregistered vehicles, multi-year or permanently tagged vehicles, boats, boat motors, jet skis, wave runners, farm machinery, campers, mobile homes, airplanes and business personal property must be listed every year in January. Tax bills are usually printed in July-August each year after the tax rate is set.

The Administrators Office is responsible for collecting all county real estate taxes as well as real estate taxes for 4 of the 5 towns, they are Biscoe, Star, Candor, and Mount Gilead. The town of Troy collects their own taxes. There are 3 fire districts that are also collected they are Lake Tillery, Badin Lake and Wadeville. In accordance with North Carolina General Statutes, the collector is given authority to use all remedies to collect delinquent taxes including: garnishment of wages, attachment of funds such as bank accounts or money owed to the taxpayer, levy on personal property, Debt Setoff and foreclosure of real estate.

You May Like: Corporate Tax Rate In India

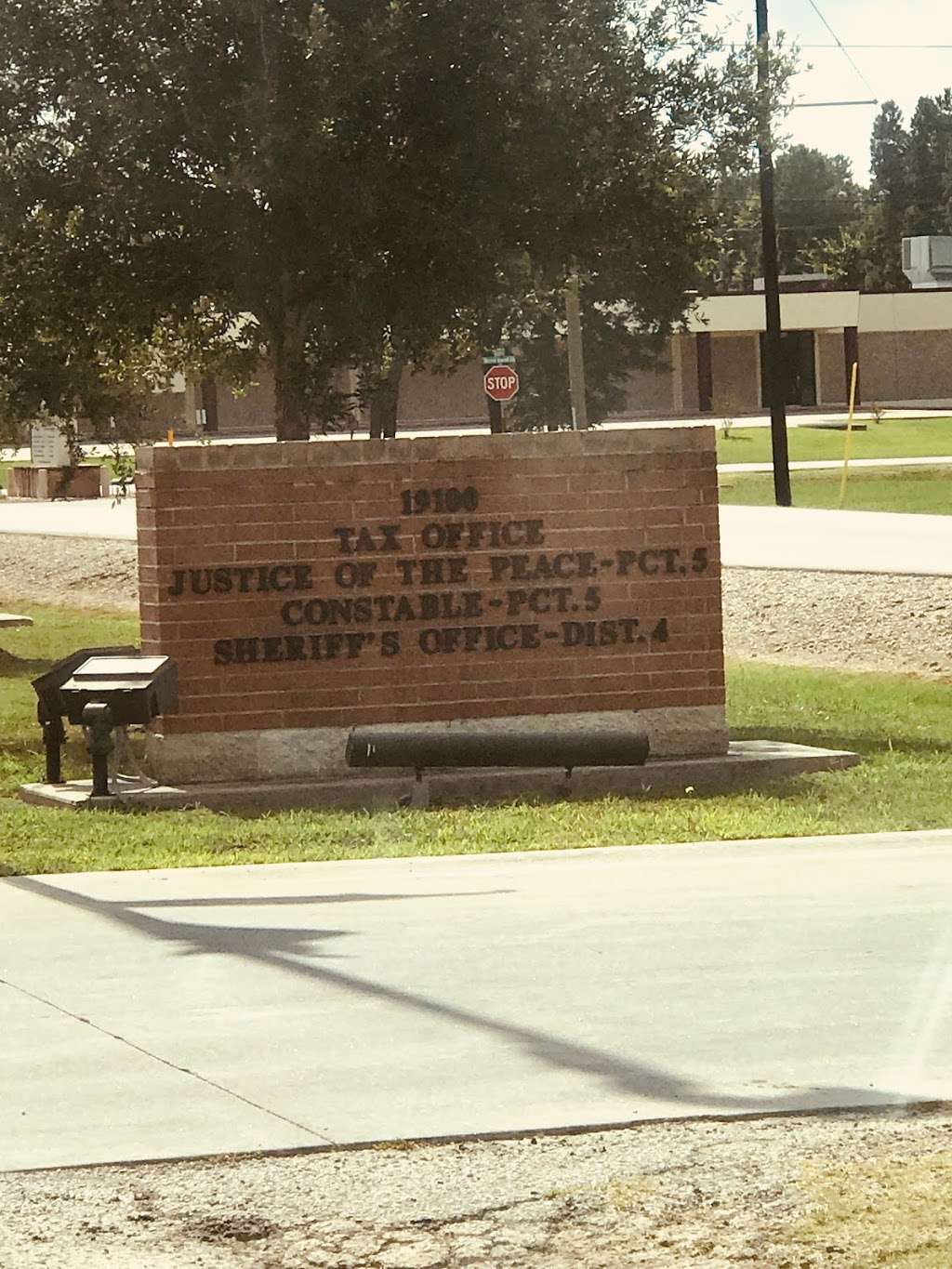

Montgomery County Tax Office

County tax assessor-collector offices provide most vehicle title and registration services, including:

- Registration Renewals

- Vehicle Title Transfers

- Change of Address on Motor Vehicle Records

- Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates

- Disabled Parking Placards

- Copies of Registration Receipts

- Temporary Registration

Many counties allow you to renew your vehicle registration and change your address online. Some counties allow renewals at substations or subcontractors, such as participating grocery stores. Acceptable forms of payment vary by county.

Other locations may be available. Please contact your county tax office, or visit their Web site, to find the office closest to you.

This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Please CHECK COUNTY OFFICE availability prior to planning travel.

Find Montgomery County Tax Records

Montgomery County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Montgomery County, Texas. These records can include Montgomery County property tax assessments and assessment challenges, appraisals, and income taxes. Certain types of Tax Records are available to the general public, while some Tax Records are only available by making a Freedom of Information Act request to access public records.

Learn about Tax Records, including:

- Where to get free Tax Records online

- How to search for Montgomery County property Tax Records

- How to challenge property tax assessments

- What Tax Records are public information

- How long to keep tax records for

You May Like: Sales Tax And Use Texas

How To Save Money On Homeowners And Car Insurance In Texas

DallasJerrycar and home insurancelicensed insurance broker#1 rated insurance app45 seconds

âI usually hate all the phone calls that come with getting car insurance quotes, but with Jerry I was able to do everything over text. I went from $224 with my previous provider to $193 with Nationwide. Such a relief!â âGabby P.

Thousands of customers saved on average $887/year on their car insurance with Jerry

About The Montgomery County Tax Collector

The Montgomery County Tax Collector, located in Conroe, Texas is responsible for financial transactions, including issuing Montgomery County tax bills, collecting personal and real property tax payments. The Montgomery County Treasurer and Tax Collector’s Office is part of the Montgomery County Finance Department that encompasses all financial functions of the local government.

You may contact the Montgomery County Tax Collector for questions about:

- Property records requests for Montgomery County, TX

- Looking up property owners by name and address

- Montgomery County property tax bills and payments

- Property tax rates

Recommended Reading: Amended Tax Return Deadline 2020

What Happens If You Dont Pay Your Montgomery County Tx Property Tax

Not only will you receive a steep collection fee on top of the accrued interest from your Montgomery County delinquent property taxes, but you may receive a tax lien which allows the bank to foreclose on your property. You can prevent the foreclosure by taking care of this debt immediately, but the bank can auction off your tax deed if you ultimately default on your payment.

Why Over 65 Exemption Not Indicated On Properties Via The Website

Notice: House Bill 394 H.B. 394 amends the Tax Code to include information that indicates the age of a property owner, including information indicating that a property owner is 65 years of age or older, among the information in property tax appraisal records that is prohibited from being posted on the Internet. The bill requires the chief appraiser for each appraisal district to ensure that any information indicating the age of a property owner that is posted on a website controlled by the appraisal district is removed from the website not later than the bills effective date. EFFECTIVE DATE September 1, 2015.

DISCLAIMER

Pursuant to Sec. 11.1825 of the Texas Property Tax Code, The Montgomery County Appraisal District gives public notice of the capitalization rate to be used for the 2022 Tax Year to value properties receiving exemptions under this section. Rent restricted properties vary widely. These variations can have an effect on the valuation of the property. A basic capitalization rate of 7.5% will be used to value these properties although adjustments may be made on the individual property characteristics and the information provided to the chief appraiser as required under Sections 11.182 and of the Property Tax Code.

Chief Appraiser

Contact Information

Also Check: Free Irs Approved Tax Preparation Courses

Welcome To The Montgomery County Assessors Office Web Site

Montgomery County Tax Assessors Office303 South Richardson St.

Notice to Montgomery County Property Owners and Occupants.

In accordance with O.C.G.A 48-5-264.1 please be advised that the Montgomery County Appraisal Staff may be visiting your property. The purpose of the visit could be related to any of the following reasons:

The appraiser may need to take photos while visiting your property. The appraiser or data collector will have photo identification and will be driving a marked county vehicle. If you should have any questions regarding the appraisal staff visiting your property please feel free to contact the assessor’s office at 912-583-4131.

Office hours are Monday through Friday 8:30 to 4:30.

The regular meeting of the Board of Assessors will be changed to the 3rd Thursday of each month at 4:00 p.m.

The goal of the Montgomery County Assessors Office is to provide the people of Montgomery County with a web site that is easy to use. You can search our site for a wealth of information on any property in Montgomery County.

Take Control Of Your Property Tax Bill And Payment

Are you worried about lost mail or post office delays?

Dont wait for the bill to be mailed

You May Like: How Is Property Tax Paid