Retirement Income Exclusions Based On Per

The 16 states in the table below offer retirement income exemptions on a per-spouse basis, not as a combined exemption for the household. Which means that, in order to access up to double the per-person exclusion, each spouse needs to have their own retirement income.

Example 3a: Jimmy and Rosalynn are married and are both 95 years old. They live in Georgia, where taxpayers age 62 and older can each exclude up to $65,000 of their own retirement income for a combined maximum of $130,000.

Jimmy and Rosalynn have a combined income of $145,000, which is roughly split between them. Since they each receive income in excess of the per-person maximum exclusion permitted in Georgia, they are entitled to take the full combined exclusion of $130,000, with a taxable state income of $15,000.

Example 3b: Amy, Jimmy and Rosalynns daughter, is married to James. Amy and James are both 65 years old and also live in Georgia, so they, too, can also exclude up to $65,000 of their own retirement income.

Amy and James also have a combined income of $145,000, but since Amy earns the lions share of the familys income and James earns only $5,000, which is less than the maximum retirement income exclusion amount allowed by their state, they cannot take the full combined exclusion. They are only entitled to exclude $70,000 of their income, with a taxable state income of $80,000.

Pros And Cons Of Relocating For Tax Benefits

Lower taxes alone may not be enough to motivate someone to pick up and move house. Other factors should also support the decision.

Pros of Relocating for Tax Benefits

Potentially lower cost of living

Discovering a community of like-minded retirees

Possibly ticking off other boxes on your list

Cons of Relocating for Tax Benefits

Other living costs may cancel out the tax benefits

Moving costs are high, and the stress can be tough

Need to find another home in a sellers market

How To Estimate Your Retirement Taxes

Filing your taxes for one year can feel overwhelming and unpleasant. Just thinking about tax planning for all of your retirement might seem an impossible feat.

However, the NewRetirement Retirement Planner makes it easy to forecast taxes and optimize your retirement income, no matter where you live.

For users of the free Retirement Planner, income taxes are modeled using a blended state and federal rate.

For PlannerPlus subscribers, the income tax model is more accurate, detailed and transparent. You can:

- See annual estimates for federal, state and capital gains taxes

- Review annual taxable income and realized capital gains

- Specify itemized deductions and property taxes.

Create an account or log in today for a detailed and reliable view of your retirement finances now and well into the future.

Read Also: Personal Tax Return Due Date 2022

Finding The Right State & Living The Goodlife In Retirement

Choosing the right state to settle down in based on taxes can be a helpful tool to make the most of your retirement finances, but its important to remember that there are plenty of other factors to consider. Be sure to review each of these items before committing to relocating to a new state for retirement.

Living in one of the most tax friendly states for retirees isnt the only way to ensure that your retirement finances remain secure and sufficient to have the quality of life you deserve. Even for those who have not saved up the ideal amount, there are options.

GoodLife reverse mortgages allow retirees to age in place, living in their home and receiving a steady stream of cash flow. Reverse mortgages allow you to access the equity in your home, converting into monthly payments, a lump sum, or a line of credit that you can use to cover a variety of retirement expenses.

Even if the cost of living and taxes in your state are difficult to handle, a reverse mortgage can help staying in your home state make more sense. By supplementing other retirement income sources, a reverse mortgage loan allows retirees a higher degree of financial freedom while also making it easier to stay right where they are.

What Makes A State Tax

You might hear people call a state tax-friendly if it doesnt impose many taxes or doesnt impose high tax rates on the people who live there. States can be tax-friendly to individuals by imposing few taxes that apply to average citizens, and they can be tax-friendly to businesses by having low corporate, payroll, or other taxes. Having low taxes can be a great way to prioritize saving money in retirement.

- Note: Tax-friendliness comes with certain tradeoffs. States with lower taxes may have fewer funds to pay for essential services like schools, roads, nutrition assistance, healthcare, transit, public housing, and other public goods. If you find that you frequently need services such as these, tax-friendly states might not be ideal.

There are a few different kinds of tax friendly states for retirees. The best way to understand this is by looking at the different taxes that states impose.

Read Also: How Do Deductions Work On Taxes

Income Taxes By State

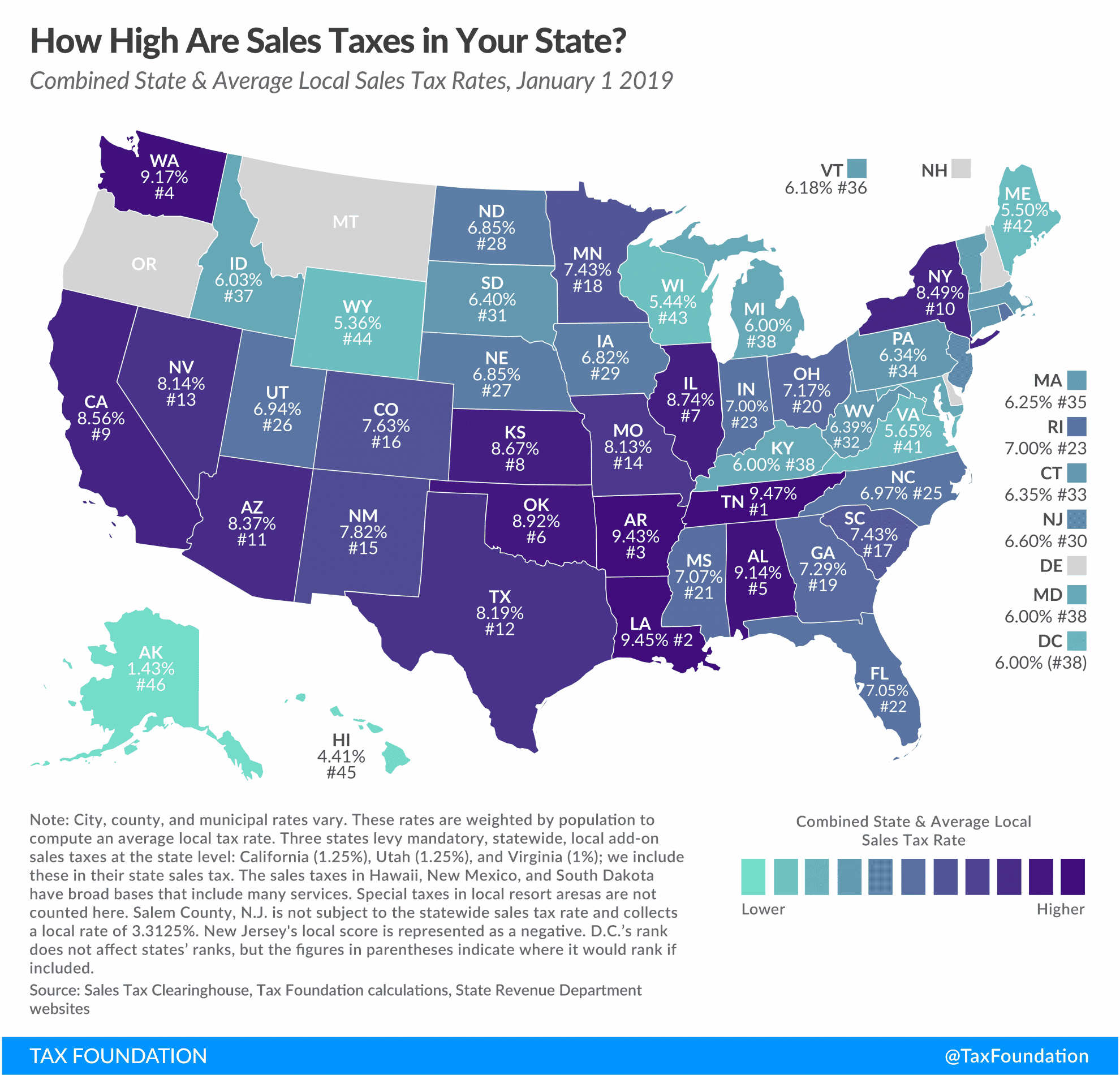

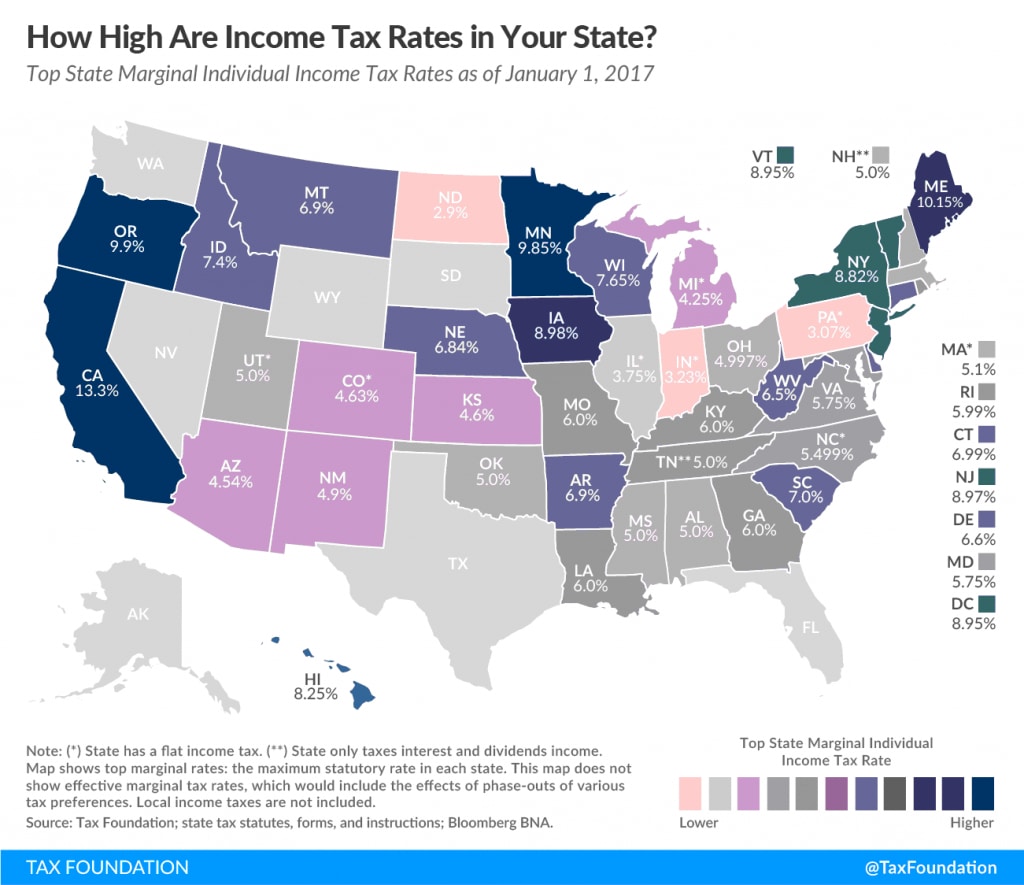

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two statesNew Hampshire and Tennesseeexclusively tax dividend and interest income. Seven states levy no income tax at all.

There are some notable 2020 individual income tax changes in Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia and Wisconsin. Learn more about the changes.

Find the income tax rate by state on the map below:

Surprising Data Reveals The Top 25 Tax

If you want to stretch your retirement savings as far as possible, don’t focus solely on the cheapest places to retire. Pay attention to taxes in the places you’re considering, too, because they can take a big bite out of your retirement income.

GOBankingRates looked at income, sales and property tax rates across America to find out whether Social Security is taxed, all to help you pinpoint the most tax-friendly states for retirees.

-

State sales and average local tax: 6%

-

State tax on Social Security: None

-

Effective property tax: 1.44%

-

Income tax rate : 4.25

Retirees can benefit from Michigan’s low income tax rate and no taxes on Social Security benefits. However, residents will pay 6% in sales tax.

-

State sales and average local tax: 7.46%

-

State tax on Social Security: None

-

Effective property tax: 0.56%

-

Income tax rate : 7%

South Carolina has the fourth-lowest property tax rate, and Social Security benefits escape taxes. But the state’s income tax rate is the second highest in our rankings.

-

State sales and average local tax: 6.25%

-

State tax on Social Security: None

-

Effective property tax: 1.44%

-

Income tax rate : 4.25%

Despite its nickname “Taxachusetts,” Massachusetts isn’t even close to being the worst state for retirees when it comes to taxes. In fact, it beats out 22 of them. For starters, MA doesn’t tax Social Security benefits — and its 6.25% sales tax rate is lower than in the majority of states. However, its property tax rates are among the highest.

Don’t Miss: What’s The Deadline For Filing Taxes

Low Tax State #: Mississippi

Mississippi is an especially good state for retirees. Many of the tax benefits are aimed at helping you keep more of your retirement income, and prescription drugs and health care are tax exempt.

In Mississippi, Social Security is also exempt from state tax, and so are your pension, annuities, IRA, and 401 distributions. And while your home is taxed at 10 percent of its assessed value, retirees can qualify for the Homestead Exemption, which means the first $75,000 of its value is tax exempt.

- State Income Tax: 3 5 percent

- State Sales Tax: 7 percent

- Inheritance Tax: No

Examining State Taxes When Choosing Where To Retire Means Focusing On More Than Just The Top Marginal Tax Rate

The state where an individual retires can have a big impact on their net retirement income and, therefore, their standard of living in retirement. Higher taxes can equate to larger withdrawals from retirement savings, presenting a higher risk that the individual will run out of savings before they retire . Thus, many individuals seek to relocate where they can expect lower state tax rates in retirement, allowing them to spend their savings in more enjoyable ways.

States are commonly classified as high- or low-tax based on their overall marginal income tax rates and on their top marginal tax brackets in particular. By this measure, states such as California , Hawaii , New York , and New Jersey have garnered reputations as high-tax states.

For financial advisors who use financial planning software applications that model state taxes in retirement projections, the challenge can be that many programs might not be able to factor in the nuances of all 50 different state tax codes, let alone keep up with every change and detail.

But advisors can still help clients navigate the tax implications of where to live in retirement, even without being experts on every single states tax policy. By understanding a few general rules and knowing where to find the right information when its necessary to go deeper advisors can help correct potential misperceptions that their clients may have and even expand the list of possible states where they would consider retiring .

Nerd Note:

You May Like: How Do I File For Extension On My Taxes

Illinois Ranks Least Tax

Tax friendliness reports ranked Illinois as the most expensive for middle-class families and second most expensive for retirees. Analysts cited high property taxes, sales taxes and income taxes as cinching the bottom spots.

New financial reports rank Illinois as the least tax-friendly state for middle-class families and second-least tax-friendly for retirees in 2022.

Kiplingers annual state tax analyses found Illinois second-highest property taxes, eighth-highest combined sales tax and above-average income taxes are costing middle-class families more than anywhere else in the country.

The reports also determined Illinois retirees pay the second highest rates combined in the U.S. for property, sales, income and estate taxes. Only retirees in New Jersey paid more thanks to the states inheritance tax.

Corroborating reports show Illinoisans paid the nations highest taxes in 2022, costing each family 16.8% of their annual income. The same family would pay less than 10% of their income to taxes in 30 other states.

This nation-leading tax burden is driven primarily by Illinois second-highest property taxes, which are double the national average.

The Kiplinger report estimates property taxes cost Illinoisans $2,241 yearly per $100,000 of assessed home values. That means the median state homeowner is predicted to pay about $5,688 in 2022.

Chicago Office| Illinois Policy300 S. Riverside Plaza | 1650 |Chicago, IL 60606

States With No Income Tax

Just as it is easy to focus on the top marginal tax rate for high-tax states, it is also easy to assume the list of low-tax states begins and ends with the 8 states that have zero income tax at the state level , as listed below:

- No state income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming

- Only interest and dividend income is taxed: New Hampshire

Clearly, all else being equal, these 9 states are the most income-tax-friendly to all taxpayers, retirees included. But, for retirees, in particular, the list of states that offer the chance of 0% state-income-tax rates may be much longer. Depending on a households complete retirement income picture, individuals might owe little or no state income tax even if they dont live in one of the 9 income-tax-free states listed above.

Read Also: How Does The Electric Car Tax Credit Work

States With Tax Exemptions For Social Security Income

Social Security is a core source of income for many retirees. And luckily , Social Security income receives favorable tax treatment from the Federal government as well as from many states. At the Federal level, a maximum of 85% of Social Security benefits are included in taxable income . Furthermore, even the amounts that are Federally taxable are themselves often completely or partially exempt from state income tax.

There are 32 states and the District of Columbia that completely exclude Social Security income from their normal income taxation. Which means that, including the 9 states with no state income tax noted earlier, Social Security income is not taxed in 42 U.S. jurisdictions!

Notably, the list includes some of the states with the highest top marginal rates , meaning that despite their high-state-tax reputation, retirees in these states would pay 0% state income tax on their Social Security benefits . And the benefits go beyond just paying zero tax on Social Security income: Because Social Security is subtracted from the taxpayers taxable income, that means in states with progressively higher tax brackets as income increases that more of the taxpayers other, non-Social Security income will be taxed at lower rates, further reducing the overall tax burden!

Nerd Note:

Though not included on the list above, Nebraska has passed a law that will phase out state taxation of Social Security benefits entirely by 2025.

States That Exclude Income From Pensions And Retirement Plans

Many retirees particularly those who are clients of financial advisors rely not just on Social Security for retirement income but also on coordinated withdrawals from their retirement savings . And while this income is almost always taxable at the Federal level , many states exclude some or even all pension and retirement plan income if certain conditions are met.

There are 3 states Mississippi, Illinois, and Pennsylvania that exclude all pension and qualified retirement plan income from taxation . Notably, these 3 states are also on the above list of states that do not tax Social Security. Which means that, for retirees whose income consists solely of Social Security benefits and withdrawals from retirement accounts, these 3 states, plus the 9 states with 0% income tax, would not tax their income at all!

But for retirees who dont plan on retiring in any one of these 12 states, there are many other states offering additional exclusions of retirement income from pensions and other qualified plans, which could significantly reduce their taxable income. Specifically, 21 states offer limited exclusions of certain types of retirement income, some of which are subject to limitations such as income-based phaseouts, age-based restrictions, or reductions based on the amount of Social Security that is also excluded from income. The particulars of these rules can be complex and are specific to each state, but they are summarized at a high level in the map and table below.

Read Also: Tax Software For Tax Preparer

The Benefits Of Working With A Trusted Tax Advisor For Retirement Taxes

Retirement is a big step personally, professionally, and financially. You want to make sure you get the process right! Working with a trusted tax advisor can help ensure that youre making the most of your retirement funds and taking all the right factors into consideration as you make your plans. That expert can help set you up for success in your retirement years, plus ensure you understand state, federal, and local taxes and how they can impact your available funds with the lowest tax.

Finding a tax-friendly state for retirees can make a big difference in your retirement destination, including the funds you have available. Contact Silver Tax Group today to discuss your questions about tax-friendly states for retirement, or to speak with an expert about other tax-related questions you might have about a tax bill.

Learn More About Your Taxes

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

Understanding Retirement Income And Taxes

Retirement is a time for relaxation, reflection, and enjoyment of the simple things in life. Having healthy retirement savings and reliable sources of retirement funding makes that much easier. While there are a number of ways that you can prioritize your own retirement finances, one thing that many retirees consider is moving to a state in the US that has a lower tax burden.

In many cases, retirement income is counted as taxable. For instance, if you have a traditional IRA , your withdrawals may qualify as taxable income. That makes moving to a tax-friendly state desirable for many retirees who wish to avoid losing retirement funding to taxes. In fact, as many as 60% of Americans report they want to retire somewhere else.

You May Like: How To Check Amended Tax Return Status

Does The State Tax Social Security

Generally Social Security income is subject to federal tax. But some states also tax Social Security above a certain income threshold, while other states offer tax exemptions for individuals in lower tax brackets.

The states that tax Social Security benefits are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2020 to 2021, as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2021.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average.

Of the states with an E grade, two out of three had population declines in 2021. Of the nine states with a D grade, only two New Hampshire and Vermont had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Read Also: Free Hr Block Tax Filing