Nc Department Of Revenue Opens 2022 Tax Season

Staff report

The North Carolina Department of Revenue officially opened Tuesday the 2022 tax season and began accepting and downloading 2021 individual income tax returns.

Taxpayers who file state returns electronically will receive acknowledgments.

The delay in opening the tax season is because of the late approval of the state budget, which included multiple tax law changes. The later start date provided the time necessary to complete the testing of system updates and approve updates in commercial tax preparation software.

Tax returns are due this year on April 15. However, because of the Emancipation Day holiday, returns filed on or before April 18 will be considered filed on time and will not be subject to penalties or interest.

NCDOR will begin issuing refunds in April. Taxpayers can check the ncdor.gov website on the status of refund processing and updates.

Taxpayers are encouraged to file their taxes electronically it is safer, more convenient, and more accurate than traditional paper filing. Free online filing options for qualified taxpayers are available through the NCDOR.gov website using NCfreefile. Eligibility requirements for NCfreefile are available at: . Taxpayers must start at the agency website atwww.ncdor.gov, to file their taxes for free.

The NCDOR funds public services benefiting the people of North Carolina. The Department administers the tax laws and collects taxes due.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their returns after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

How Can I Check The Status Of My Refund

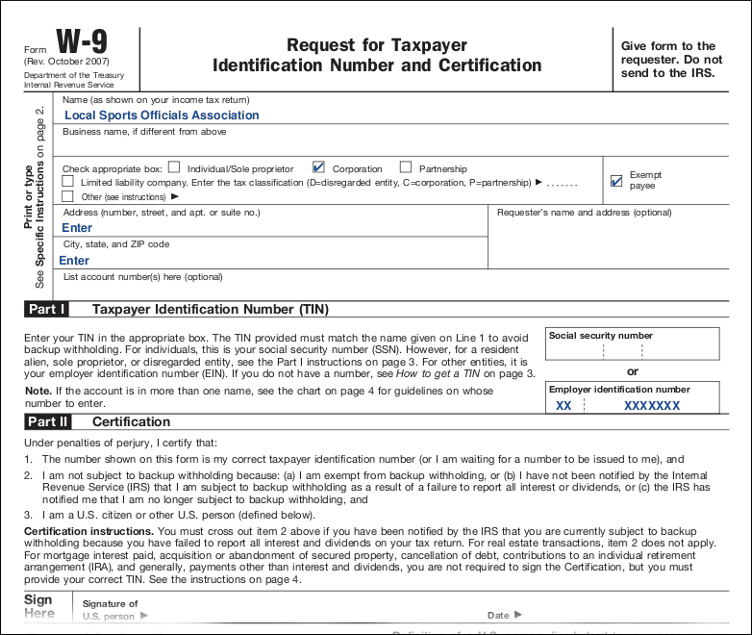

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Don’t Miss: Rv Sales Tax By State

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Love A Good Mystery Heres One You Probably Want To Solve Right Away The Whereabouts Of Your North Carolina Tax Refund

Getting a refund from the Tarheel State could take up to 12 weeks, depending on whether you e-filed or mailed your individual income tax return. But you can track your refund for the most recent tax year and, if your refunds been approved, get an estimated payment date.

The easiest way to check your refund status is through the North Carolina Department of Revenue website, but you can also pick up the phone. Here are some things to know about how to track your North Carolina tax refund.

Read Also: Pa Local Earned Income Tax Instructions

Indiana: $325 Rebate Payments

Indiana found itself with a healthy budget surplus at the end of 2021, and it authorized two rebates to its residents.

In December 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by January 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to the state.

Taxpayers who filed jointly could receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit and the second payments started rolling out in late August. If you changed banks or didnt have direct deposit information on file, you should have received a paper check.

Individuals who are only eligible for the $200 payment will not receive them at this time. They will have to file a 2022 tax return before January 1, 2024 to claim the credit.

For more information, visit the state Department of Revenue website.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page, you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Recommended Reading: How Do Property Taxes Work

Irs Identifies Jan 23 As Start To 2023 Tax Filing Season

WASHINGTON The Internal Revenue Service has announced Monday, Jan. 23, 2023, as the beginning of the nation’s 2023 tax season when the agency will begin accepting and processing 2022 tax year returns.

More than 168 million individual tax returns are expected to be filed, with the vast majority of those coming before the April 18 tax deadline. People have three extra days to file this year due to the calendar.

With the three previous tax seasons dramatically impacted by the pandemic, the IRS has taken additional steps for 2023 to improve service for taxpayers. As part of the August passage of the Inflation Reduction Act, the IRS has hired more than 5,000 new telephone assistors and added more in-person staff to help support taxpayers.

This filing season is the first to benefit the IRS and our nations tax system from multi-year funding in the Inflation Reduction Act, said Acting IRS Commissioner Doug ODonnell. With these new additional resources, taxpayers and tax professionals will see improvements in many areas of the agency this year. Weve trained thousands of new employees to answer phones and help people. While much work remains after several difficult years, we expect people to experience improvements this tax season. Thats just the start as we work to add new long-term transformation efforts that will make things even smoother in future years. We are very excited to begin to deliver what taxpayers want and our employees know we could do with this funding.

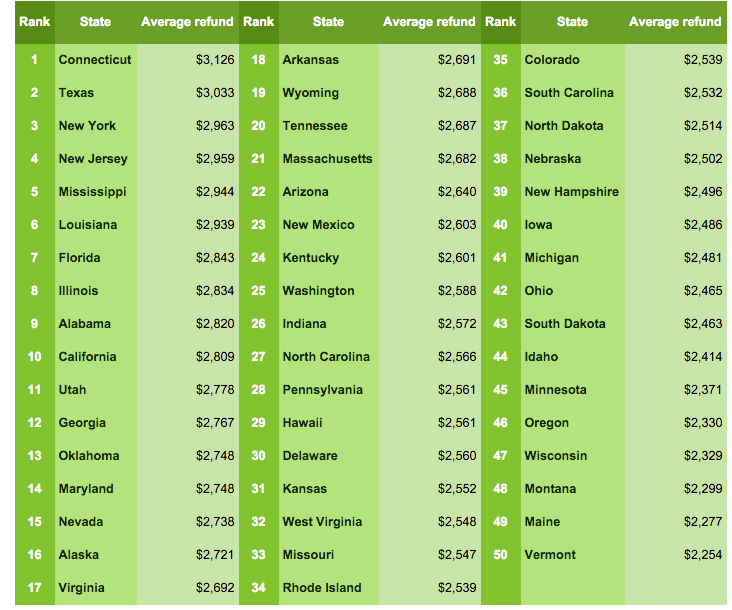

When To Expect Your State Tax Refund

State refunds are processed by each individual state, so processing times will vary. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

To get the current status of your state tax refund, contact your state tax agency or go to your states taxation website. See the table for some standard state refund processing times.

Processing begins when the return is received and ends when we post the refund to your account. I will update as states release their latest processing cycle times.

Latest update : The IRS is conducting significantly more ID verification checks to deal with the increase in online tax fraud, which is also causing state tax agencies to add additional security measures resulting in delays in state tax refunds.

| State |

|---|

| WI Refund 123 |

Im not going to be able to file my taxes in time. What should I do? If you cant make that mid April deadline for filing your taxes then file an extension. The IRS says it received requests for 11 million extensions, which amounts to about 8% of all tax returns.

Taxpayers who ask for an extension get an extra six months to fileyour new deadline will be in mid October. However you still need to make any expected tax liability payments. See this article for more details and restrictions on filing an extension.

Don’t Miss: What Happens If You Don T Do Your Taxes

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks.

North Carolina Property Tax

Many counties in North Carolina collect property taxes at an effective rate of less than 1%, making the state average effective property tax rate 0.77%, which is below the national average. Furthermore, the typical homeowner in North Carolina pays about $1,493 annually in property taxes, good for just a little more than $120 per month.

In general, however, rates are higher in North Carolinas largest cities. For example, in Mecklenburg County, which includes Charlotte, the effective property tax rate is 1.05%. If you are looking into buying a home in North Carolina or are considering refinancing, our mortgage rates guide has all the information you need about getting a mortgage there.

You May Like: Will Property Taxes Go Up In 2022

Irs Announces Tax Relief For Victims Of Hurricane Ian In North Carolina

NC-2022-10, October 5, 2022

WASHINGTON Victims of Hurricane Ian that began September 28 in North Carolina now have until February 15, 2023, to file various individual and business tax returns and make tax payments, the Internal Revenue Service announced today.

Following the recent disaster declaration issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in certain areas will receive tax relief.

Individuals and households affected by Hurricane Ian that reside or have a business anywhere in the state of North Carolina qualify for tax relief. The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after September 28, 2022, and before February 15, 2023, are postponed through February 15, 2023.

This means individuals who had a valid extension to file their 2021 return due to run out on October 17, 2022, will now have until February 15, 2023, to file. The IRS noted, however, that because tax payments related to these 2021 returns were due on April 18, 2022, those payments are not eligible for this relief.

Penalties on payroll and excise tax deposits due on or after September 28, 2022, and before October 13, 2022, will be abated as long as the tax deposits are made by October. 13, 2022.

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Also Check: How To Check Status Of Amended Tax Return

How Can I Get Help Finding My Refund

If you should have received your refund already but still havent seen it, first check the Department of Revenues website to see if the refund has been issued.

You can also contact your bank and ask whether the refund has been deposited to your account. If you chose to receive your refund by mail, double-check your mailbox, too.

If you suspect your mailed refund check has been lost or stolen, youll need to write and sign a letter to the department to request a stop payment on the missing check. Include your current address, Social Security number and the tax year, and ask for a stop payment or for the department to begin forgery proceedings.

Once the department receives your letter, it should mail you a new check within 30 to 60 days. But if someone has forged your signature on the original check, forgery proceedings will take at least 120 days.

Mail the letter to

North Carolina Department of Revenue

Attn: Customer Service

How To Apply State Refund To 2022 Taxes

To elect to have your 2021 state refund be applied to 2022 North Carolina taxes, you can follow these steps:

You May Like: Best Credit Card To Pay Taxes

Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

Recommended Reading: Taxes On Self Employment Calculator

My Refund Check Is Now Six Months Old Will The Bank Still Cash The Check

A check from the NC Department of Revenue is valid up to six months after the date on the check. If a check date is older than six months, you should mail a letter along with the refund check to NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh, NC 27602-1168. Your check will be re-validated and re-mailed to you.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Read Also: File Taxes With Credit Karma

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

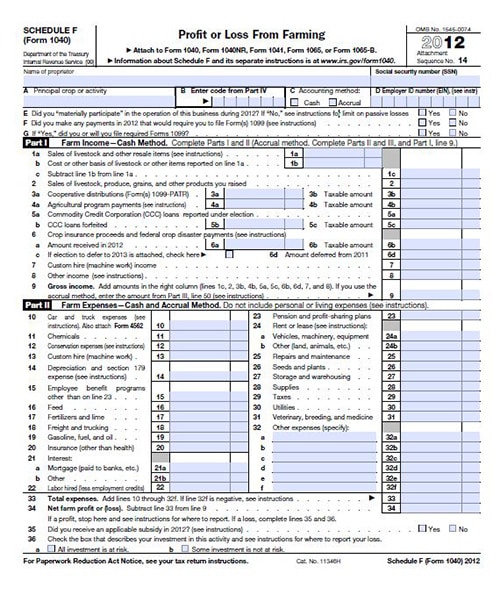

North Carolina Income Taxes

North Carolina moved to a flat income tax beginning with tax year 2014. For tax year 2021, all taxpayers pay a flat rate of 5.25%. That rate applies to taxable income, which is income minus all qualifying deductions and exemptions, as well as any contributions to a retirement plan like a 401 or an IRA.

In North Carolina, taxpayers can claim itemized deductions for charitable contributions, mortgage interest and property taxes. The deductions for the latter two categories cannot exceed $20,000. Most other deductions that were previously available in North Carolina, including the Net Business Income deduction and the College Savings Program deduction, are no longer available as of 2014.

Taxpayers who dont itemize their deductions can claim North Carolinas standard deduction. The standard deduction for the 2021 tax year is $10,750 for single filers, $21,500 for joint filers and $16,125 for heads of household. However, there is no personal exemption in North Carolina for filers, spouses or dependents. To file your federal tax return, you can look into tax preparation software or hire a professional accountant.

Also Check: Penalty For Not Paying Taxes Quarterly