New Jersey Residents: Be Prepared To Pay Sales Tax On Your Medical Supplies

In the state of New Jersey, medical supplies are considered to be taxable items. This means that if you are purchasing medical supplies from a store or online, you will be required to pay sales tax on those items. The amount of sales tax that you will owe will depend on the county in which you live.

Materials and supplies purchases According to the general rule, a retail sale is any sale to the general public. Unless specifically exempt by the New Jersey Sales and Use Tax Act, all retail sales of tangible personal property are taxable.

All expenses above 2% of your income can be deducted. Payments for doctors appointments, dental care, hospital stays, eye exams, eyeglasses, medicine, x-rays, or other diagnostic tests ordered by your doctor or dentist are examples of allowable medical expenses.

When vitamins and supplements are consumed outside of their home, they are generally exempt from sales tax in New Jersey. Is there any sales tax on vitamins in New Jersey? Vitamins and supplements are taxable unless further notice is received, which is the case in this case.

Unless specifically exempt by law, New Jersey imposes a 6625% Sales Tax on the sale of most tangible personal property, specified digital products, and certain services.

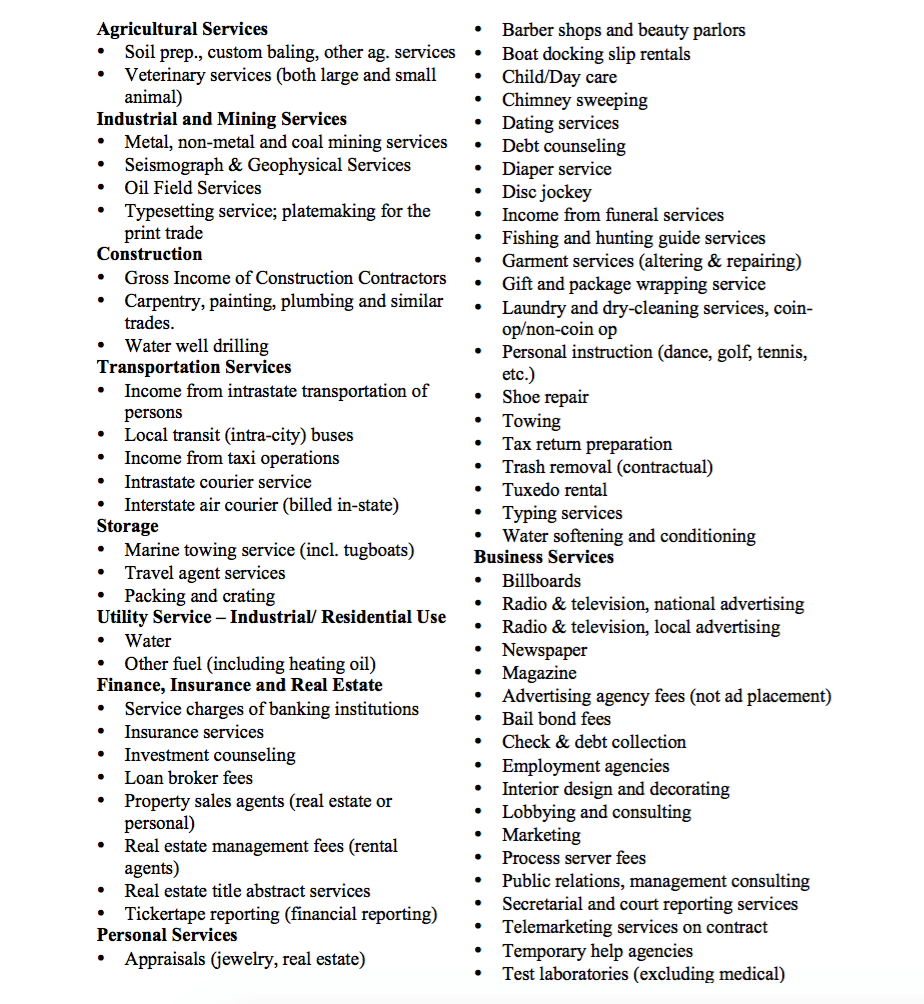

What Is Exempt From Sales Taxes In New Jersey

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how New Jersey taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

For more details on what types of goods are specifically exempt from the New Jersey sales tax see New Jersey sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in New Jersey? Taxation of vehicle purchases in particular are discussed in the page about New Jersey’s sales tax on cars.

Earned Income Tax Credit

ââYou can claim the New Jersey Earned Income Tax Credit if youâre eligible for the federal EITC, which is a refundable tax credit. Your NJEITC is 40% of your federal earned income tax credit amount. For example, if your federal earned income tax credit is $4,000, you may qualify for a NJEITC of $1,600.

Read Also: I Claimed 0 And Still Owe Taxes 2021

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent.Speak to your accountant for more information.

Protest Rights And Audit Finding Confirmation

Any contested issues that were unresolved prior to the audit report being issued can beprotested/appealed by the auditee. This is done after the New Jersey Division of Taxation issues the Notice of Deficiency/Audit Assessment.

You have the right to protest an Audit Assessment if you disagree with it.

First, inform the auditor assigned to your case that you disagree with the assessment:

- Clearly state the reason why you disagree and

- Provide all necessary documentation supporting your position.

If you are still not satisfied after contacting your auditor, you have the right to appeal. If you disagree with adetermination made by the Division, you may:

- You must send your request within90 days of the determination date

- You may represent yourself at the conference or choose another individual to represent you

- For tax periods starting on or after January 1, 1999 and

- If you paid the entire assessment within one year after the time to protest or appeal has expired and

- If you file within 450 days after the time to protest or appeal has expired.

If you have received a Final Determinationand haven’t talked to someone who has experience with New Jersey state and local tax, now is the time. Do it before these deadlines are missed.

Don’t Miss: Nys Dtf Pit Tax Paymnt

How 2022 Sales Taxes Are Calculated In New Jersey

The state general sales tax rate of New Jersey is 6.625%. New Jersey cities and/or municipalities don’t have a city sales tax.Every 2022 combined rates mentioned above are the results of New Jersey state rate . There is no county sale tax for New Jersey. There is no city sale tax for the New Jersey cities. There is no special rate for New Jersey.The New Jersey’s tax rate may change depending of the type of purchase. Some of the New Jersey tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the New Jersey website for more sales taxes information.

Terminating New Jersey Sales Tax Collection

A common question from remote sellers regarding New Jersey sales tax collection is whether you must indefinitely collect sales tax after initially surpassing the economic nexus threshold. The answer is no.

Businesses can request to be on a non-reporting basisif any of the following apply:

- The business does not make any sales of tangible personal property, specified digital products, or services subject to sales tax, and has not had a use tax liability averaging over $2,000 during the past three years.

- (Note: Businesses whose annual use tax liability exceeded $2,000 for three previous years must be on a reporting basis for Sales and Use Tax.

- Businesses with no taxable sales, who did not have a use tax liability exceeding that threshold, may report their use tax liability on an annual ST-18B.)

Its important to note that just because you terminate your New Jersey sales tax collection doesnt mean youre 100% off the hook. New Jersey still requires you to comply with its recordkeeping requirements, and you are still subject to their sales tax audits.

To request that your business be placed on a non-reporting basis for Sales and Use Tax.File Form C-6205-ST.

Recommended Reading: Home Office Tax Deduction 2022

Contact The New Jersey Department Of The Treasury

The New Jersey Sales Tax is administered by the New Jersey Department of the Treasury. You can learn more by visiting the sales tax information website at www.state.nj.us.

Phone numbers for the Sales Tax division of the Department of the Treasury are as follows:

- Local Phone: 826-4400

- Toll-Free Phone: 323-4400

What To Expect During An Audit

The typicalaudit process is shown in this flowchart. Detailed guidance for each stage of theprocess follows in the sections below.

New Jersey regularly audits businesses required to charge, collect, and remit various taxes in the New Jersey.

Many audits begin with a call from a New Jersey Department of Revenue’s sales tax auditor.

Shortly after the call, your business will receive aNotification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a New Jersey sales tax audit.

It is good to start with getting a New Jersey and local tax professional involvedto prepare for the audit.

You May Like: How Much Is Inheritance Taxes

Option : Voluntary Disclosure Agreement

New Jerseys lookback period: The standard lookback period isfour years or 16 quarters for returns filed quarterly.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period tofour years. Suppose you should have collected sales tax over the past ten years but didn’t. If that is the case, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: Tax On Food In Virginia

Filing And Remitting Sales And Use Tax: Frequently Asked Questions

All businesses that sell taxable goods and services in New Jersey must register with the New Jersey Division of Revenue and Enterprise Services to collect Sales Tax. This includes any person who makes seasonal or occasional sales at events such as a flea market or craft show.

Once your business is registered to collect Sales Tax, you will be required to file quarterly returns and make quarterly payments. Some sellers must also make monthly payments. You must make monthly payments only if you:

- Collected more than $30,000 in Sales and Use Tax in New Jersey during the prior calendar year and

- Collected more than $500 in the first and/or second month of the current calendar quarter.

What If You Didn’t Make Any Sales During a Quarter?

You must file a return for each quarter even if no tax is due and/or no sales were made during the period.

How Do You File?

File all Sales and Use Tax returns electronically, either online or by phone through the NJ Sales and Use Tax EZ File Systems.

What Form Do You File?

File quarterly Sales Tax returns on Form ST-50.

Make monthly payments using Form ST-51. If you collected $30,000 or less in New Jersey Sales and Use Tax during the prior calendar year, you are not required to make a payment for either the first or second month of the calendar quarter, no matter how much tax is due for that particular month.

When Do You File?

How Do You Pay?

- Electronic check ,

- Electronic funds transfer , or

What If You Make a Mistake?

| QUARTER |

|---|

New Jersey Income Taxes

New Jersey Income Tax Range

Low: 1.4%

High: 10.75%

Newark also imposes a payroll tax.

New Jersey Taxation of Social Security Benefits

Social Security benefits are not taxed by the state.

New Jersey Tax Breaks for Other Retirement Income

Taxpayers age 62 or older with New Jersey income of $150,000 or less can exclude some or all of their income from a pension, annuity, IRA, or other retirement plan. For taxpayers with gross income of $100,000 or less, the maximum exclusion is $100,000 for joint filers, $75,000 for single filers, and $50,000 for married taxpayers filing a separate return. For taxpayers with gross income between $100,001 and $125,000, the maximum exclusion is 50% of retirement income for joint filers, 37.5% of retirement income for single filers, and 25% of retirement income for married taxpayers filing a separate return. For taxpayers with gross income between $125,001 and $150,000, the maximum exclusion is 25% of retirement income for joint filers, 18.75% of retirement income for single filers, and 12.5% of retirement income for married taxpayers filing a separate return. on their New Jersey tax return.)

Taxpayers who are otherwise eligible for Social Security or Railroad Retirement benefits, but will never be able to receive those benefits because their employer did not participate in either program, may qualify for a special exclusion of $6,000 s) or $3,000 .

Military pensions and Railroad Retirement benefits are fully exempt.

Read Also: Your Tax Return Is Still Being Processed 2021

New Jersey Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be very difficult to get the case reopened.

After an audit, the auditor will issue a proposed assessment or audit report. This document details the auditors findings so its important to carefully review and understand its implications.

If, after discussing the areas of contention, the taxpayer still disagrees with the audit findings or any issue of fact or law, the auditor will advise the taxpayer of their right to discuss the matter or meet with the auditors supervisor.

The auditor will then list:

Specific issues of fact or law discussed with the taxpayer.

Laws, rules, or regulations supporting the auditors determinations and whether the taxpayer agrees or disagrees and

The methods the auditor used to make the determinations and whether the taxpayer agrees or disagrees.

Is The New Jersey Sales Tax Destination

New Jersey is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within New Jersey from a New Jersey vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

Also Check: Tax On Pension Lump Sum

Settling A New Jersey Sales Tax Liability

Along the way, or even after one of the critical notices are issued, there is the possibility to settle your New Jersey sales tax case by negotiating with the New Jersey Division of Taxation. Often, you can get better results here than with the auditor.

Without solid experience with state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements.

DO NOT try to negotiate a settlement without an experienced New Jersey state and local tax lawyer or other professional.

The Child And Dependent Care Credit

You can claim the child and dependent care credit if you qualify for the federal child and dependent care credit and your New Jersey income is less than $60,000. The credit is nonrefundable and is worth up to $500 per child or $1,000 for two or more children.

You may qualify if you paid someone to care for your child under the age of 13, a spouse or dependent who lived with you for more than ½ of the year and canât physically or mentally care for themselves.

Your New Jersey child and dependent care credit is a percentage of your federal child and dependent care credit based on your New Jerseyâs income as follows:

| If your New Jersey income is: | The amount of your NJ child and dependent care credit is: |

|---|---|

| Not more than $20,000 | 50% of the federal credit amount |

| Over $20,000 but not more than $30,000 | 40% of the federal credit amount |

| Over $30,000 but not more than $40,000 | 30% of the federal credit amount |

| Over $40,000 but not more than $50,000 | 20% of the federal credit amount |

| Over $50,000 but not more than $60,000 | 10% of the federal credit amount |

Recommended Reading: How To File Back Taxes Without Records

Contest A New Jersey Jeopardy Assessment

New Jersey may issue a Notice of Jeopardy Determination in certain situations. Thejeopardy assessment gives New Jersey Division of Taxation accelerated rights and it may immediately begin to try and collect.

To contest a jeopardy assessment, first, you must immediately pay the warrant amount. Then you have 90 days from the date of the action to appeal the Jeopardy Assessment. For more information, read yourappeal rights.

New Jersey Corporation Business Tax

Some states levy a tax on certain businesses for the right to exist as a legal entity and do business in the state. It’s usually called a privilege tax, transaction privilege tax or a franchise tax. There is no New Jersey franchise tax. However, the New Jersey Corporation Business Tax serves roughly the same purpose.The NJ CBT only applies to C Corporations and S Corporations LLCs are exempt from paying this tax. However, if your LLC is classified for tax purposes as either of those other entities, you will have to pay the New Jersey CBT.The NJ Corporation Business Tax rates vary according to corporation type, net income and length of tax period, among other factors. Talk to your accountant or tax advisor to determine whether you’re required to pay the NJ CBT, and if so, how much you must pay.

Read Also: Travel Trailer Tax Deduction 2021

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.