When To File Taxes In New York

When you register for sales tax, New York will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in New York. High-revenue businesses file more frequently than lower volume businesses, for example.

New York sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

New York Sales Tax Guide

Welcome to 1StopVATs New York sales tax guide. After reading this guide, you will be able to determine if you must register for sales tax in New York permit and know how much sales tax in New York your company should charge even if you are a remote seller. In case you dont find answers to your tax-related questions here, consult with the 1StopVAT team by clicking here.

How To Register For Sales Tax In New York

Okay, so you have nexus! Now what?

The next crucial step in complying with New York sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in New York on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Don’t Miss: Property Taxes In Austin Texas

Sales Tax New York Registration

A New York sales tax permit is called a Certificate of Authority and is issued by the New York State License Center free of charge. You can register for New York sales tax online or by visiting one of the organizations field offices. For the registration, you will have to submit your personal and business details.

New York City Details

Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Don’t Miss: H& r Block Tax Identity Shield

More Help With Taxes In New York

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

New York City Sales Tax

On top of the state sales tax, New York City has a sales tax of 4.5%. The city also collects a tax of 0.375% because it is within the MCTD. The total sales tax in New York City is 8.875%. This is the highest rate in the state. With such a high sales tax, its no wonder the cost of living in New York City is so high.

You May Like: How To File Unemployment Taxes

New York State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact New York residents.

Retirees: Least Tax-Friendly

New York’s state income taxes are generally average for most residents. However, New York City and Yonkers tack on their own income taxes, and there’s a commuter tax for people working in and around the Big Apple.

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

Also Check: Which States Do Not Tax Pension

Where Does New York Sales Tax Go

For the last full fiscal year, the state of New York collected $15.2 billion in sales taxes, which comprised about a fifth of its total tax revenue but just a third of what was collected from state income taxes. That money goes toward covering the nearly $100 billion in State Operating Funds spent each year.

In the city of New York, sales taxes also pay for a smaller but important share of the citys total budget. The 8.66 percent of the citys income coming from sales tax is the fifth-largest source of funding behind federal grants , income tax , state grants and property taxes . Thats all a part of the approximately $82 billion in tax revenue collected by the city against expenditures of just over $85 billion.

More on Money and Taxes

How Much Is New York Sales Tax Everything You Need To Know

Sales tax rates can vary in the Empire State. Taxes 101

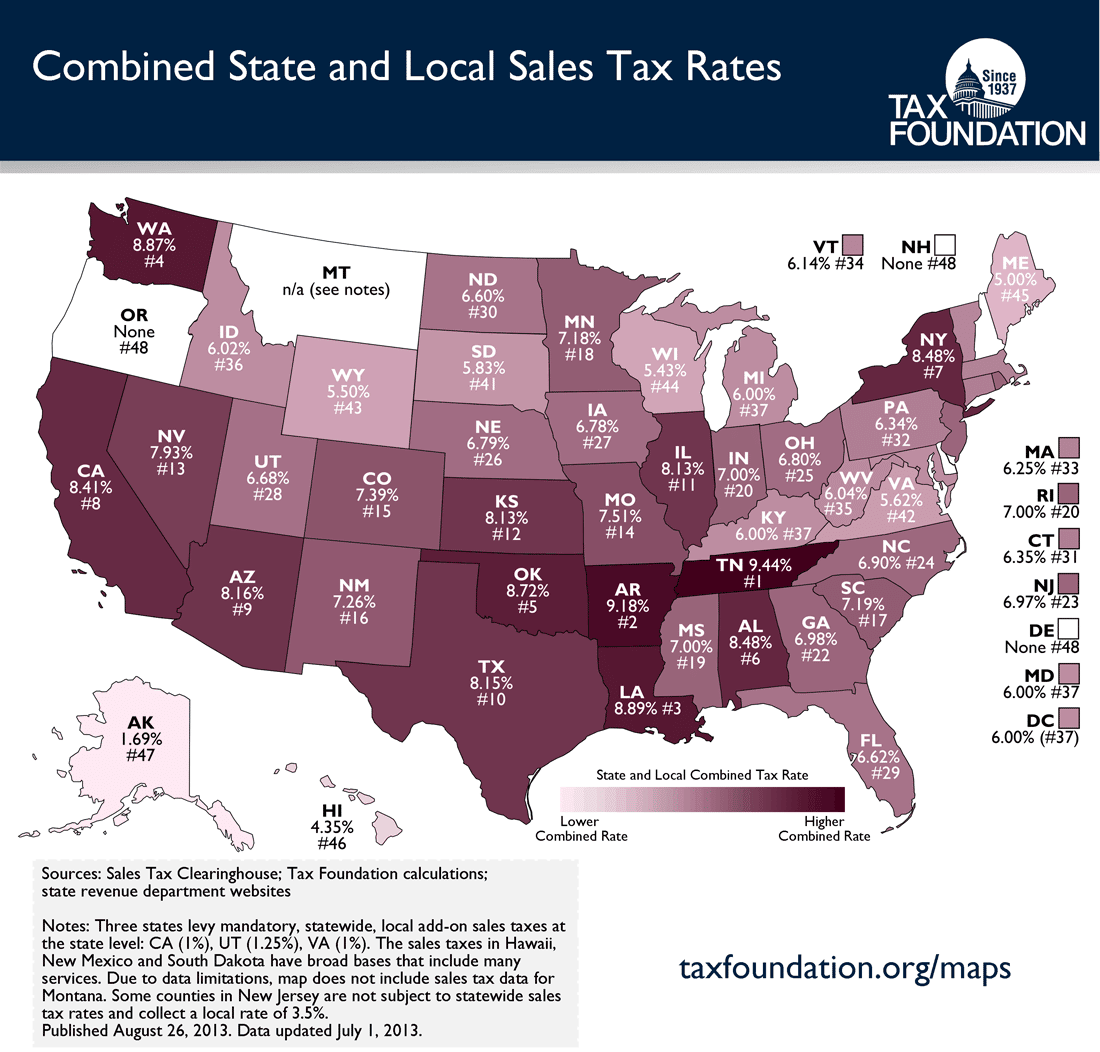

Although the city of New York has some of the highest sales taxes in the country, less than half of that is attributable to the states share of the pie. On the whole, the combined sales and use tax for the state of New York is just 4 percent, but once local and city governments add in their own rates, the average rate is pushed all the way up to almost 8.5 percent, putting New York among the 10 highest average sales tax rates in the country.

The New York City sales tax rate is much higher at 8.875 percent, including the state sales tax rate, a city sales tax rate of 4.5 percent and the Metropolitan Commuter Transportation District surcharge of 0.375 percent. But there are ways to get around sales taxes in New York City. Clothing and footwear purchases under $110 are exempt from city and state taxes, and if youre visiting the city but dont live there, you can even get a 10 percent discount to counterbalance the sales tax at certain stores by stopping at the visitors booth.

| 7% to 8.875% |

Don’t Miss: How Do The Rich Avoid Taxes

New York City Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

An Explanation Of New Yorks Sales And Use Tax

by frishkoff | Feb 4, 2022 | Business Advisory |

Most states charge a sales tax on retail goods and services. The state tax is relatively low but add on local and regional taxes and it starts to add up. In addition to sales tax, residents must pay use tax. Were used to paying tax, but how much is it exactly and how does sales tax differ from use tax?

What is Sales Tax

Very simply, this is a tax on the sale of goods and services that is imposed by the government. It is a percentage of the purchase price and is collected by the seller of goods or services. The sales tax percentage varies by state, with some states not imposing a tax. Currently, 48 states require sales tax. 38 states also have a local tax. The state tax is combined with the local tax where applicable.

What is Use Tax

Sales and Use Tax Rates

In 2022, the NY state sales and use tax rate remains at 4%. Depending on local tax rates imposed by a city, county, or school district, the total tax rate can be as high as 8.875%. The tax rate in the five boroughs is the highest in the state, at 8.875%. Thats the combined total of the city sales tax rate of 4.5%, NY sales tax rate of 4% and the Metropolitan Commuter Transportation District surcharge of 0.375%.

Register as a Sales Tax Vendor

Sales Tax Exemption

Some of the Tax Law exemptions:

Recordkeeping

Filing Requirements

Economic/Wayfair Nexus

If you have additional questions about sales and use tax or how to register your business, please reach out.

Read Also: Do You Get State Or Federal Taxes Back First

County City Taxes Mean New York State Sales Tax Rates Will Vary

Throughout the rest of the state, sales and use tax rates will vary depending on the county and city youre in. And New York counties typically add an additional 4 percent or more to your taxes every time you make a qualifying purchase. The highest rates are in the five counties that make up New York City, but Oneida and Erie county each have a 4.75 percent rate in addition to New Yorks 4 percent. The counties with the lowest additional sales tax rate are Saratoga County, Warren County and Washington County, only adding another 3 percent to every purchase.

Everything You Need to Know: New York State Taxes

Heres a look at each county in New York and its prevailing sales tax rate:

| 8% |

New York City Sales Tax Region Zip Codes

The New York City sales tax region partially or fully covers 309 zip codes in New York. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in New York here

Help us keep our data updated!

If you notice that any of our provided data is incorrect or out of date, please notify us and include links to your data sources . If we can validate the sources you provide, we will include this information in our data.

Data Accuracy Disclaimer

Tax-Rates.org provides sales tax data for “New York City” on an AS-IS basis in the hope that it might be useful, and we can offer NO IMPLIED WARRANTY OF FITNESS. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculations we provide or any consequence or loss resulting from the of use of the Data or tools provided by Tax-Rates.org.

Read Also: Is Auto Insurance Tax Deductible

Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

The Nyc Child And Dependent Care Credit

Full-year and part-year New York City residents who paid child care expenses for children under the age of four might be eligible to claim the Child and Dependent Care Credit. Your household federal adjusted gross income must be no more than $30,000 as of 2021. The credit amount can be as much as $1,733, depending on your income.

You can claim both the city and state credit if you qualify. This is a refundable credit.

You May Like: How To File Free Taxes

New York Sales Tax Rates By City

The state sales tax rate in New York is 4.000%. With local taxes, the total sales tax rate is between 4.000% and 8.875%.

New York has recent rate changes .

Select the New York city from the list of popular cities below to see its current sales tax rate.

Sales tax data for New York was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Whats Taxed And What Isnt

The majority of retail sales are subject to sales and use tax in New York. Some things, like cars and other motor vehicles, are taxed on the residence of the buyer and not the place where you actually buy the vehicle.

There are also a number of things that are exempt from sales tax. Some common examples are groceries, newspapers, laundering and dry cleaning, prescription drugs and feminine hygiene products. Clothing and footwear are not taxable if they are less than $110. If they are over $110, they are subject to regular sales tax rates. Any water delivered through mains and pipes is not taxable. However, public utilities like gas, electricity and telephone service are subject to sales tax.

Renting a car gets expensive in New York. If you rent a passenger car, New York state charges a sales tax of 6%. There is also a 5% supplemental tax if you rent the car within the metropolitan commuter transportation district . If you pay for any parking services , you will pay the New York sales tax of 4% plus any local sales taxes.

You can find a more complete breakdown of taxable goods and services with New York States Quick Reference Guide for Taxable and Exempt Property and Services.

Also Check: Credit Karma Tax Return 2020

Publication 873 Sales Tax Collection Charts For Qualified Motor Fuel Or Diesel Motor Fuel Sold At Retail

Publication 873 provides charts that show the amount of the local sales tax in the pump price of a gallon of automotive fuel. The charts in this publication apply only to jurisdictions that continue to impose sales tax on automotive fuels using a percentage sales tax rate. The charts in this publication are for use in verifying the sales tax due, not to establish pump prices.

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least annually. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Read Also: What Do You Need To Do Your Taxes