States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

|

Key Takeaways The states with the highest income tax for 2021 include California 13.3%, Hawaii 11%, New Jersey 10.75%, Oregon 9.9%, and Minnesota 9.85%. Eight states have no personal income tax, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. The states with the highest total sales taxes include Tennessee 9.55%, Louisiana 9.52%, Arkansas 9.51%, Washington 9.23%, and Alabama 9.22%. The states with the lowest total sales taxes are Alaska 1.76%, Oregon 0%, Delaware 0%, Montana 0%, and New Hampshire 0%. |

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

States With Local Income Taxes In Addition To State

The following states have local income taxes. These are generally imposed at a flat rate and tend to apply to a limited set of income items.

Alabama:

- Some counties, including Macon County, and municipalities, including Birmingham

California:

Colorado:

Delaware:

Indiana :

- Many school districts and Appanoose County

Kansas:

- Some counties and municipalities

Kentucky:

- Most counties, including Kenton County, Kentucky, and municipalities, including Louisville and Lexington

- All counties, and the independent city of Baltimore

Michigan:

Missouri :

New Jersey:

New York :

Ohio:

- Some school districts .

- RITA .

- Most cities and villages on earned income and rental income. Some municipalities require all residents over a certain age to file, while others require residents to file only if municipal income tax is not withheld by employer. Income is reported on a tax form issued by the municipal income tax collector, currently Cleveland‘s Central Collection Agency or the Regional Income Tax Authority , or a collecting municipality. Municipalities such as Columbus and Cincinnati sometimes also collect for neighboring towns and villages.

Oregon:

- Lane Transit District

- Tri-County Metropolitan Transportation District

- Other transit districts

Pennsylvania:

West Virginia:

New York Property Taxes

New York has no tax on personal property, such as vehicles and jewelry, but there are property taxes on real estate. These taxes are paid to local governments such as counties, cities, and school districts.

The state does not take a cut of these revenues. All property tax revenues go directly to the localities for their schools, police and fire departments, road maintenance, and other local services.

Most counties and municipalities must assess property taxes at a uniform percentage of value according to state law. Properties of equal value in the same community should pay the same amount in property taxes without accounting for exemptions. The owners of more valuable properties will pay more in taxes than the owner of less valuable properties.

Also Check: Best States To Retire In 2021 For Taxes

Where Do You Pay Income Tax For Out

You should always expect to file income taxes in the state where you live. If you cross state lines for your job, you may or may not have to file taxes in another state, too. Some states have agreements that allow workers to only file taxes where they live, regardless of where they work. Check with a tax professional to learn how state laws may apply to your situation.

States Without Income Tax

On the flip side, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington state, and Wyoming dont impose an income tax at all. New Hampshire falls into a gray area. It doesn’t levy a tax on earned income, but it does tax interest and dividends at a flat 5%.

Since they don’t collect income tax, some states generate revenue in other ways. Tennessee has one of the highest combined state and local sales tax rates in the country. Your paycheck might be safe, but you’ll be dinged at the cash register. New Hampshire and Texas have high property taxes in relation to home values. And Pennsylvania charged the highest tax on gasoline in 2021.

Recommended Reading: What Are The Taxes In Florida

New York Median Household Income

| Year | |

|---|---|

| 2011 | $55,246 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 10.9%. The top tax rate is one of the highest in the country, though only taxpayers whose taxable income exceeds $25,000,000 pay that rate.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

Itemized Deductions And Tax Credits

Most federal itemized deductions are allowed on New York returns. Deductions are available for college tuition and for contributions to the New York State 529 plan.

Several tax credits are available for expenses such as child and dependent care costs. The state has its own version of the earned income credit.

Read Also: Earned Income Tax Credit 2021 Release Date

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Things start to get bad when you look at sales taxes. New York’s average combined state and local sales tax rate is the 10th-highest in the country, according to the Tax Foundation.

And then things go from bad to worse when property taxes are added to the mix. New York’s median property tax rate is the eighth-highest in the U.S. New York also has an estate tax with a special “cliff” feature that can result in a big tax bill when you die.

On the bright side, New York is sending tax rebate payments to people who received at least $100 for either or both of the state’s child credit or earned income credit for 2021 tax year . New York started sending the child credit/earned income credit payments on October 12, 2022.

Combined Sales And Income Tax Leaders

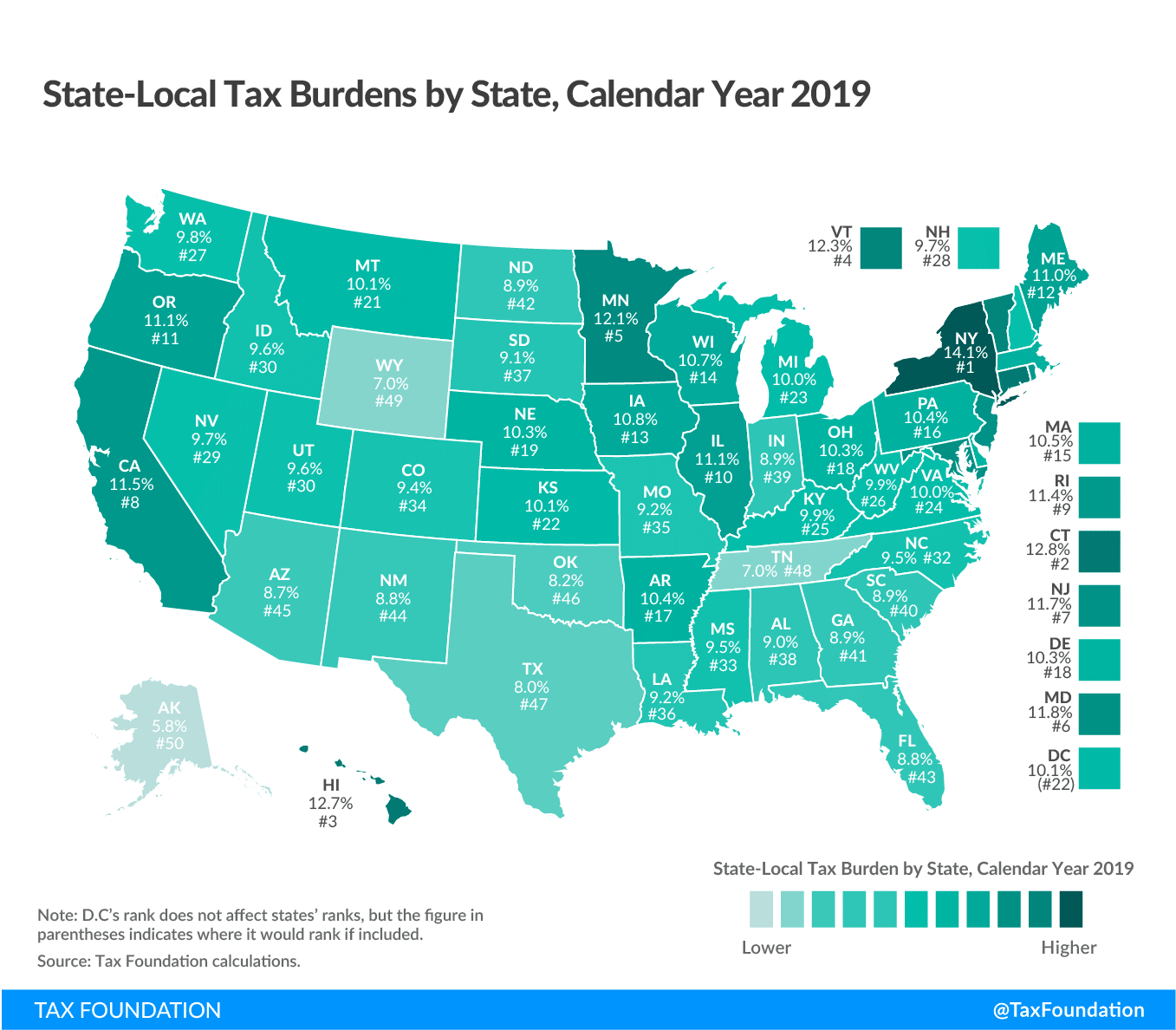

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Recommended Reading: Amended Tax Return Deadline 2020

Overview Of Income Tax Rate Changes

The legislation establishes three new marginal income tax rate brackets for individuals that are effective for the 2021-2027 tax years. Previously, the highest individual income tax rate of 8.82% was imposed on joint filers with income over $2,155,350 .

The new rate brackets and rates are as follows:

- 9.65% for joint filers with New York taxable income in excess of $2,155,350 but not more than $5,000,000.

- 10.30% for all taxpayers with New York taxable income in excess of $5,000,000 but not greater than $25,000,000.

- 10.90% for all taxpayers with New York taxable income in excess of $25,000,000.

States With The Highest Personal Income Tax Rates

A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 12.3% rate, unless you make more than $1 million. Then, you have to pay 13.3% as the top rate. The additional tax on income earned above $1 million is the state’s 1% mental health services tax.

The top 10 highest income tax states for 2021 are:

Each of these states has a personal income tax floor, deductions, exemptions, credits, and varying definitions of taxable income that determine what a citizen actually pays.

Don’t Miss: Minimum Income To File Taxes

Nys And Yonkers Withholding Tax Changes Effective January 1 2022

We revised the 2022 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2022. These changes apply to payrolls made on or after January 1, 2022.

- Calculate 2022 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2022 Yonkers resident and nonresident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Pay Tarrant County Property Taxes

Single Married Filing Separately And Head Of Household

| Taxable Income |

According to the 2022 tax brackets, a single filer will pay:

- 4.5% of income between $8,500 and$11,700 + $340

- 5.25% of income between $11,700 and $13,900 + $484

- 5.9% of income between $13,900 and $21,400 + $599.50

- 6.21% of income between $21,400 and $80,650 + $1,042

- 6.41% of income between $80,650 and $215,400 + $4,721

- 6.85% of income between $215,400 $1,077,550 + $13,466

- 8.82% of income over $1,077,550 + $72,523

On the other hand, joint filers will pay:

- 4.5% of income between $17,150 $23,600 + $686

- 5.25% of income between $23,600 $27,900 + $976

- 5.9% of income between $27,900 $43,000 + $1,202

- 6.21% of income between $43,000 and $161,550 + $2,092

- 6.41% of income between $161,550 and $323,200 + $9,312

- 6.85% of income between $323,200 and $2,155,350 + $19,674

- 8.82% of income over $2,155,350 + $145,176

To understand how tax brackets work for the better, think of them individually rather than seeing them as something like one that will take a certain portion of your income. The above list shows how much a taxpayer is going to pay in New York state income taxes. Having said that, seeing tax brackets as something you need to fill first in order to get to the tax rate that applies to your taxable income at maximum is a lot more accurate.

Income Tax Rates Run From 0% To More Than 13%

Halfpoint / Getty Images

Location is everything if you want to save a few income tax dollars. Overall, state tax rates range from 0% to more than 13%.

Learn which states have the highest tax rates, no taxes, and flat taxes and see a complete list of tax rates for every state in the union.

Don’t Miss: What Do I Need For My Taxes

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

TurboTax Tip: Personal income tax rates do not tell the whole state tax story. The states vary in their personal income tax floors, deductions, exemptions, credits, and definitions of taxable income. Sales and property taxes also affect the states affordability.

Historical New York Tax Policy Information

|

|

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

The historical New York tax policy information below is presented as it was written on Ballotpedia in 2015. For more current information regarding tax policy, click here.

| Tax policy in New York |

| Tax rates in 2015 |

| Tax collections per capita: $3,898 |

New York generates the bulk of its tax revenue by levying a personal income tax and a sales tax. The state derives its constitutional authority to tax from Article XVI of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Read Also: How To Calculate Mileage For Taxes

Other New York Tax Facts

At New Yorks Online Tax Center, taxpayers can view and pay tax bills, including estimated taxes view and reconcile estimated income tax accounts file a state sales tax no-tax-due return and upload wage reporting.

New York taxpayers can check the status of their refunds by using the New York State Department of Taxation and Finances online refund tracker.

New York taxpayers can learn about their rights in Publication 131.

For more information, visit the website of the New York Department of Taxation and Finance.

How New York State Business Income Tax Works

New York has a corporation franchise tax, which applies to both traditional corporations and to S corporations, and a tax known simply as the “filing fee,” which applies to LLCs, limited liability partnerships , and some regular partnerships. In addition, if income from your business passes through to you personally, that income will be subject to taxation on your personal New York tax return.

For traditional corporations, the amount of corporation franchise tax due is the highest of the following three tax bases:

- the corporation’s business income base

- the corporation’s business capital base, or

- a fixed dollar minimum tax.

Here’s a quick look at each of these three items.

The business income base is based on federal taxable income with certain New York-specific modifications. The default tax rate is 6.5%. However, a lower rate of 4.875% applies to qualified emerging technology companies and a 0.0% rate applies to qualified New York manufacturers. General business taxpayers with a business income base of more than $5 million pay 7.25%.

The fixed dollar minimum tax is based on a corporation’s New York State receipts. New York manufacturers and QETCs have a separate tax table. So do non-captive REITs and non-captive RICs .

As of 2022, the tax table for most corporations is as follows:

As of 2022, the tax table for New York manufacturers and QETCs is as follows:

Additional FMD rules, not covered here, apply to non-New York corporations.

Don’t Miss: Irs How To File Taxes