Office Of Professional Responsibility

OPR investigates suspected misconduct by attorneys, CPAs and enrolled agents involving practice before the IRS and has the power to impose various penalties. OPR can also take action against tax practitioners for conviction of a crime or failure to file their own tax returns. According to former OPR director Karen Hawkins, “The focus has been on roadkill the easy cases of tax practitioners who are non-filers.” The current acting director is Elizabeth Kastenberg.

Try Calling The Taxpayer Advocate Service

The Taxpayer Advocate Service is an independent organization within the IRS that can help people with tax problems they can’t resolve on their own. Every state has at least one local Taxpayer Advocate Service center that is independent of the local IRS office, and it reports to the national Taxpayer Advocate Service. You can see the local addresses and phone numbers for every local Taxpayer Advocate Service office here.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

You May Like: State Of California Estimated Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Easy Ways To Contact The Irs For Tax Help

The Balance / Julie Bang

Tax season can be an overwhelming time when you’re not a tax expert, but the IRS stands by to guide you through it. The agency makes itself accessible in many ways if you have questions about completing your tax return, if you want to check your tax refund status, or if you need help for another tax-related purpose.

Staff members are on hand to help you with questions or problems that might arise, so you can get your return completed and filed with as little hassle as possible. But the IRS cautioned in December that the COVID-19 pandemic continues to cause some delays in services.

Don’t Miss: Does Texas Have State Income Taxes

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Also Check: Pto Cash Out Tax Calculator

Your Tucson Tax Professionals

If you own a small business, youll probably have to navigate income tax, payroll tax, sales tax, excise tax, capital gains tax, property tax, and self-employment tax. Luckily, there are resources available to business owners throughout the United States. One such service is the tax preparation offered by Clear View Business Solutions.

Clear View has the expertise and attention to detail needed for tax policy adherence. Our team of Tucson-area fun accountants makes running the numbers completely stress-free. Dont spend all day on the line with the IRS

Find A Local Irs Office

If you can’t reach a live person at the IRS, you may want to make an appointment at a local Taxpayer Assistance Center Office. Use the IRS local office locator to find a location in your area.

Put your zip code in the search box and the radius you’re willing to travel. Then, a list of local Taxpayer Assistance Centers will appear. Each listing will show the address of the IRS office, its hours, and a list of local services. You can’t just show up. You need to schedule an appointment. Regardless of where you live, you can call 844-545-5640 to make an in-person appointment with IRS taxpayer assistance.

Recommended Reading: Irs Self Employment Tax Calculator

How The Internal Revenue Service Works

Headquartered in Washington, D.C., the IRS services the taxation of all American individuals and companies. For fiscal year 2020 , it processed more than 240 million income tax returns and other forms. During that period, the IRS collected more than $3.5 trillion in revenue and issued more than $736 billion in tax refunds .

Individuals and corporations have the option to file income tax returns electronically, thanks to computer technology, software programs, and secure internet connections. The number of income tax returns that use e-file has grown steadily since the IRS began the program, and the overwhelming majority are now filed this way. During FY 2020, nearly 94.3% of all individual returns made use of the e-file option. By comparison, only about 40 million out of nearly 131 million returns, or nearly 31%, used it in 2001.

As of October 2021, just over 112 million taxpayers received their refunds through direct deposit rather than by a traditional paper check, and the average direct-deposited amount was $2,851.

Although the IRS recommends filing tax returns electronically, it does not endorse any particular platform or filing software.

Why You Would Need To Call The Irs

According to the IRS, the IRS website should be your first resource for help and information because of the sheer volume of calls. The IRS will not address the following issues on the phone:

- You have questions about tax law

- You have transcript requests

- You need IRS forms

- You want to check your refund status, but its been less than 21 days since you filed

- You have complaints about your taxes or tax-related issues

You may want to call the IRS and speak with an actual person if:

- You received a notice from the IRS

- You will miss a deadline set by the IRS and need to request more time. For example, extensions for paying off your tax balance, to send more information, or to respond to a notice from the IRS.

- Wheres My Refund? says you need to call

- You require the amount you need to pay off for tax purposes

- You have questions about your IRS payment plan

- You want to know the status of any IRS action

- You need to confirm that the IRS received your payment

- You lost, never received, or received an incorrect Form W-2 and/or Form 1099-R

Read Also: Federal Tax Return Due Dates Chart 2022

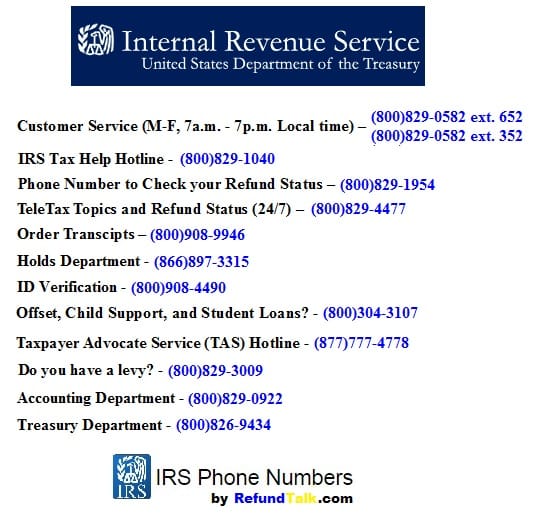

Other Irs Phone Numbers

The IRS maintains a range of other phone numbers for departments and services that deal with specific issues. Try one of these numbers if any of them makes sense for your situation.

- Businesses: 829-4933

- Innocent spouse tax relief: 681-4271

- International taxpayer advocate: 522-8601 522-8600

Between all these alternate numbers, youll find answers to an extremely wide range of tax filing questions.

Contacting The Irs By Phone

You May Like: Penalty For Not Paying Quarterly Taxes

Tas Releases Temporary Case Acceptance Criteria Updates

We understand there are many taxpayers awaiting help from the IRS with their 2020 tax returns. The Taxpayer Advocate Service is taking steps to help address this return inventory backlog by making a temporary change in our case acceptance criteria to better serve taxpayers and businesses. Read our FAQ updates on these changes and how we are advocating for taxpayers who need help the most. TAS appreciates your patience during this challenging tax season, while case advocates work diligently to address your tax concerns.

You Might Not Need To Call At All

The IRS readily admits that it has high call volumes, so it makes a lot of information available on its website, IRS.gov. Some topics the agency covers include:

- Filing and e-filing

- Refund status and other refund-related questions

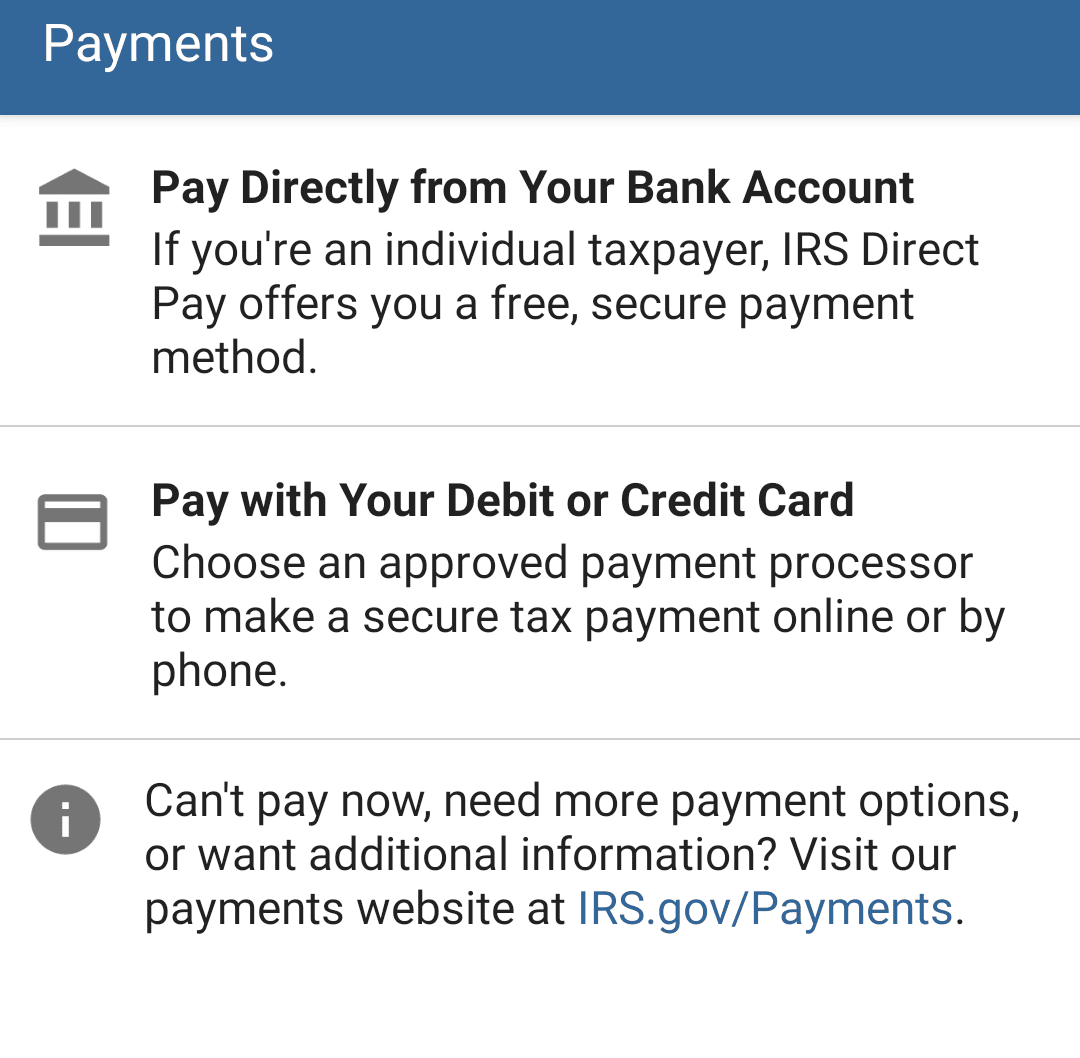

- Making tax payments

- Correcting errors

A help desk is also available for general questions. You can email the agency and get a response within 48 hours. However, the IRS help desk cant give legal advice or answer questions about your specific tax return or refund.

You may be able to find the answers you need online without the aggravation of calling the IRS and waiting on hold for a long time.

Read Also: What Is My Tax Identification Number

Be Ready To Verify Your Right To Call

The IRS takes steps to help protect taxpayers from identity theft. When you call, an IRS agent will need to verify your identity before talking to you about your specific issue. Having your tax return from the previous year can help with that.

And if youre a tax professional or an individual calling about someone elses issue, the IRS will need to confirm you have the right to act on that other persons behalf. If youre acting as someone elses legally designated representative, the IRS will need written or verbal confirmation from that person, and probably some paperwork such as a Tax Information Authorization form and a power of attorney.

What You Need When You Call The Irs

After you finally get through the long hold and reach a real person at the IRS, the last thing you want is to have to hang up and call back. That’s why it’s essential to be prepared before you call the IRS. Here’s what you need when you call the IRS:

- A copy of your last year’s tax return. The IRS uses info from the return to verify your identity.

- Social Security numbers and birthdates of everyone on the tax return you’re calling about. This information will be on the tax return, but some tax prep software blacks out these numbers on the printed copy of the return.

- Individual Taxpayer Identification Numbers for anyone on the return who doesn’t have a Social Security Number.

- Filing status from your last tax return.

- Any notices or letters you’ve received from the IRS.

To make the call easier, you may want to write down the questions you want to ask. Then, you won’t forget anything once you get a live IRS agent on the phone.

You May Like: Travis County Tax Office – Main

When Was The Irs First Established

The IRS was established in 1862 by then-President Abraham Lincoln, who instituted an income tax to pay for the Civil War. The tax was repealed in 1872, revived in 1894, and declared unconstitutional by the U.S. Supreme Court in 1895. In 1913, the 16th Amendment to the U.S. Constitution reinstated the federal income tax.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Also Check: Home Office Tax Deduction 2022

How To Speak Directly To An Irs Representative

The IRS indicates that “our phone and walk-in representatives can only research the status of your refund 21 days after you filed electronically 6 weeks after you mailed your paper return or if ‘Wheres My Refund?’ directs you to contact us.” Here’s how to get through to a representative:

- Select your language, pressing 1 for English or 2 for Spanish.

- Press 2 for questions about your personal income taxes.

- Press 1 for questions about a form already filed or a payment.

- Press 3 for all other questions.

- Press 2 for all other questions.

- Make no entry when queried for the SSN.

- Press 2 for personal or individual tax questions.

- Press 4 for all other questions.

How To Get Through To The Irs

Whatâs a taxpayer to do if you have questions and the information in your online account doesnât solve the mystery? What if the IRS sends you a billing notice for something you already paid?

Your first step should be to check your online account at IRS.gov. This free account is free to set up, and allows you to view information about your balances, prior tax records, payments and economic impact payments .

If your online account doesnât have the information you need, Bell offers a few tips for maintaining your cool as you navigate IRS systems during this incredibly trying time.

You May Like: How Are Taxes Calculated On Paycheck

Outsourcing Collection And Tax

In September 2006, the IRS started to outsource the collection of taxpayers debts to private debt collection agencies. Opponents to this change note that the IRS will be handing over personal information to these debt collection agencies, who are being paid between 29% and 39% of the amount collected. Opponents are also worried about the agencies’ being paid on percent collected, because it will encourage the collectors to use pressure tactics to collect the maximum amount. IRS spokesman Terry Lemons responds to these critics saying the new system “is a sound, balanced program that respects taxpayers’ rights and taxpayer privacy”. Other state and local agencies also use private collection agencies.

In March 2009, the IRS announced that it would no longer outsource the collection of taxpayers debts to private debt collection agencies. The IRS decided not to renew contracts to private debt collection agencies, and began a hiring program at its call sites and processing centers across the country to bring on more personnel to process collections internally from taxpayers. As of October 2009, the IRS has ceased using private debt collection agencies.

In September 2009, after undercover exposé videos of questionable activities by staff of one of the IRS’s volunteer tax-assistance organizations were made public, the IRS removed ACORN from its volunteer tax-assistance program.