Who Is Responsible For This Tax

A person who purchases a motor vehicle in Texas owes motor vehicle sales tax.

A Texas resident, a person domiciled or doing business in Texas, or a new Texas resident who brings into Texas a motor vehicle that was purchased or leased out of state owes motor vehicle use tax, the new resident tax or the gift tax, as applicable.

Do I Have To Pay Income Tax In Oklahoma

Whether or not you have to file an Oklahoma income tax return depends on your income and residency status.

- Residents: You must file a return if your income is higher than your allowable standard deduction amount plus any personal exemptions.

- Part-year residents: You must follow the same requirements as a resident. Additionally, a return must be filed if you earned more than $1,000 from Oklahoma sources during your nonresidency period.

- Nonresidents: If you earned more than $1,000 from Oklahoma sources, you must file a return in the state.

Oklahoma Sales Tax On Car Purchases:

Vehicles purchases are some of the largest sales commonly made in Oklahoma, which means that they can lead to a hefty sales tax bill. This page covers the most important aspects of Oklahoma’s sales tax with respects to vehicle purchases. For vehicles that are being rented or leased, see see taxation of leases and rentals.

Oklahoma collects a 3.25% state sales tax rate on the purchase of all vehicles. However it must be noted that the first 1,500 dollars spent on the vehicle would not be taxed in the usual way the cost for the first 1,500 dollars is a flat 20 dollar fee.

In addition to taxes, car purchases in Oklahoma may be subject to other fees like registration, title, and plate fees. You can find these fees further down on the page.

You May Like: Are Municipal Bonds Tax Free

How Does Oklahoma Figure Excise Tax

The excise tax is 3 ¼ percent of the value of a new vehicle. For a used vehicle, the excise tax is $20 on the first $1,500 and 3 ¼ percent thereafter. The value of a vehicle is its actual sales price. The annual registration fee for non-commercial vehicles ranges from $15 to $85 depending on the age of the vehicle.

How To Calculate Tag Title And Tax In Oklahoma

New vehicle: 3.25 percent of purchase price. Used vehicle: $20 up to a value of $1,500, plus 3.25 percent on the remainder value. All terrain vehicle: 4.5 percent of the purchase price, minimum $5.

How long does it take to get a duplicate title in Oklahoma?

- Time frame to get the title: 6-8 weeks. Cost to obtain: $12.50. Getting a duplicate title when the vehicle was last titled outside of Oklahoma. The registered owner of the vehicle must apply for a duplicate title through the state in which the vehicle was last titled in.

Recommended Reading: Sales Tax And Use Texas

States With Tax & Tag Charts Only

The following states provideTAX CHARTS& INFORMATION to help you determine sales and/or registration taxes:

Generally, these lists/charts will be organized and broken down by:

- Vehicle model years and weight classes.

- Sales tax percentages.

- Titling procedures.

- Duration of the registration.

If you need help interpreting your state’s chart or have questions about which category your vehicle will fall under,please contact your state’s DMV, MVD, MVA, DOR, SOS, or county clerk’s office directly.

Other Taxes And Fees Applicable To Oklahoma Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees Oklahoma car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the Oklahoma Department of Motor Vehicles and not the Oklahoma Oklahoma Tax Commission.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in Oklahoma on a new-car purchase add up to $1021, which includes the title, registration, and plate fees shown above.

Don’t Miss: How Much Is Tax At Walmart

What You Need To Know About Oklahoma State Taxes

The state of Oklahoma requires you to pay taxes if youâre a resident or nonresident that receives income from an Oklahoma source. The state income tax rates range from 0% to 5%, and the sales tax rate is 4.5%.

Oklahoma offers tax deductions and credits to reduce your tax liability, including deductions for disability-related expenses and qualified adoption expenses, as well as a tax credit for income tax paid to another state.

How Much Will My Tag And Title Cost In Oklahoma

Since youre registering a new car, youll have to pay the full $91.00 registration fee. After youve had the car for four years, the fee goes down to $81.00 and decreases in four-year intervals from there. Registering for a new title also carries a fee $17.00 in Oklahoma.

Also Check: When Is The Last Day To Turn In Taxes

Tax On Rebates & Dealer Incentives

The state of Oklahoma does not tax rebates and dealer incentives. In other words, be sure to subtract any rebates or incentives from the purchases price before calculating the sales tax amount.

As an example, lets say you want to purchase a new truck for $50,000 and the dealer provides a $4,000 rebate. You do not have to pay a sales tax on the $4,000 rebate. Therefore, the taxable amount is $46,000.

Oklahoma City Tax Title License Fees

Various costs and fees can pop up when buying a vehicle and also throughout your time owning the vehicle. Oklahoma City drivers looking for information on any tax, title, license or registration fees have come to the right place, as our team at Battison Honda has put together this handy guide to vehicle ownership costs. See what fees might pop up when purchasing a vehicle in Oklahoma City below.

Read more: 2022 Honda Civic Redesign Updates and New Features

Also Check: California Sales Tax By Zip Code

New Vs Used Vehicle Tax In Oklahoma City

The tax rate of a vehicle in Oklahoma City is determined depending on the type of vehicle. New vehicle tax will run shoppers 3.25% of the purchase price, while used vehicle are $20 up to a value of $1,500 in addition to 3.25% of the vehicles remaining value.

Automotive shoppers who are a part of an Oklahoma-based Native American tribe might have different fees or requirements that are specific to the tribe. Many Native American tribes in the state issue their own vehicle tags and registrations. Information around these can be obtained by contacting your tribes tax commission.

Read more: Honda Models with Automatic Stop and Start System Feature

Get all the details on vehicle purchase fees, including tax, title, and license fees in this guide from Battison Honda in Oklahoma City, OK. Come visit our showroom to find your next new vehicle today or to get more information on the costs and fees surrounding purchasing a new vehicle.

Sharing is Caring!

Buying A Car With Cash Instead

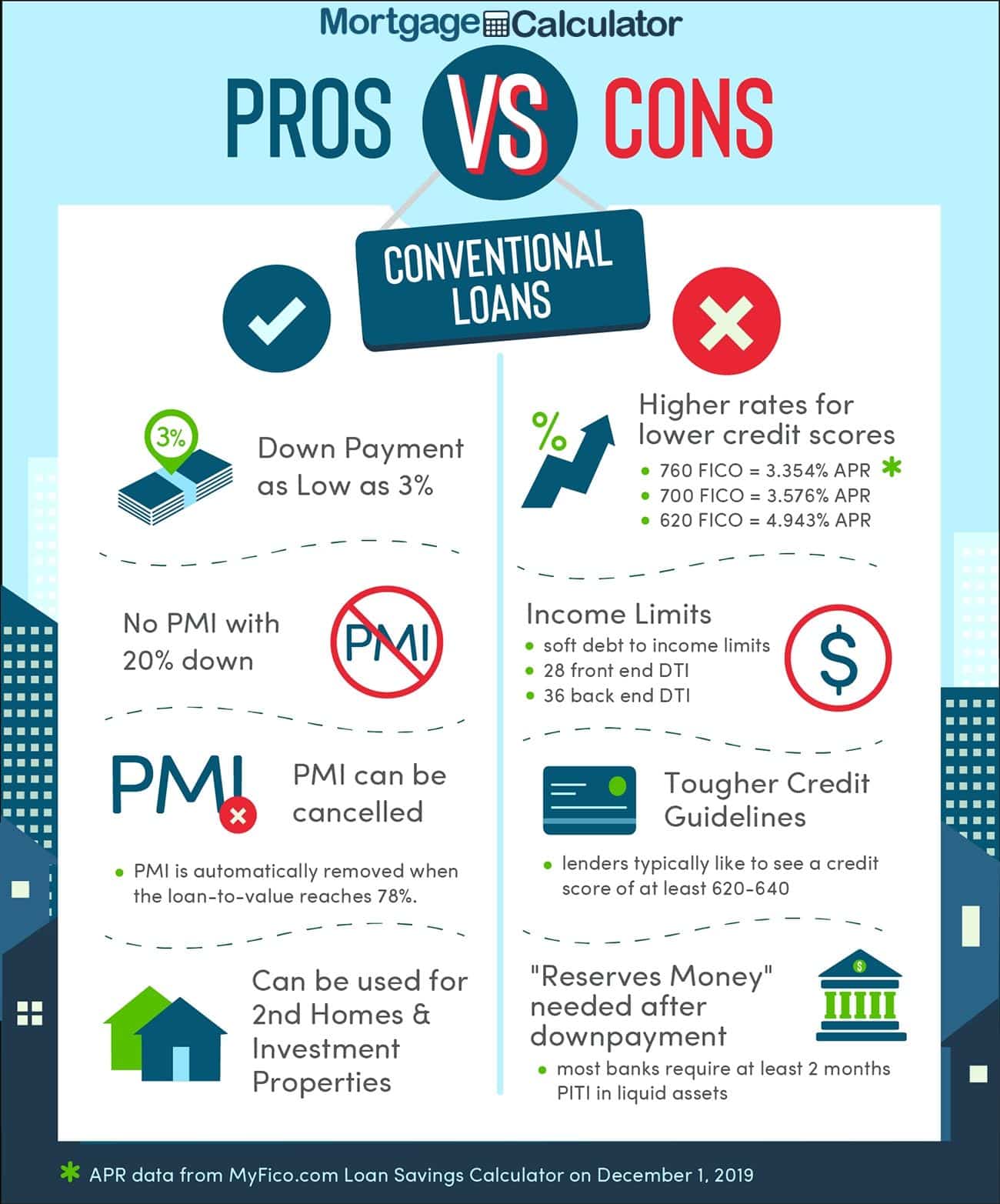

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Recommended Reading: Out Of State Sales Tax

Oklahoma City License And Learners Permit Fee

If you are looking to get your license or your learners permit in Oklahoma City you might be wondering how much doing so will cost you. For a standard Class D license applicants will be charged $38.50 to receive their new license. Learners permits will run applicants just $4. Class A and B licenses cost $56,50 and Class C licenses cost $46.50.

How To Figure Vehicle Tag Tax & Title For Oklahoma

To help you figure how much it will cost you to title your Oklahoma vehicle and register the tag, the Oklahoma Tax Commission provides a current schedule of all title, tag registration and miscellaneous fees on its website. Oklahoma also charges excise tax on all vehicles that aren’t statutorily excepted and provides an online guide to the calculation formulas for these fees as well. Calculating your tag, tax and title is a matter of identifying which formulas apply to your vehicle and plugging in the required data to arrive at the total amount you’ll owe.

Recommended Reading: How Do I Get My Tax Transcripts

How To Calculate Oklahoma Sales Tax On A New Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city and/or county. In Oklahoma, this will always be 3.25%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $50,000 with the state sales tax of 3.25%. You trade-in a vehicle for $5,000 and get an incentive for $1,000. Oklahoma does not charge tax on trade-ins or incentives/rebates, so you would subtract $6,000 from the car cost, to get $44,000, which is the taxable amount.

In this example, multiply $44,000 by .0325 to get $1,430. The total purchase price of the vehicle would be $45,430.

How Do You Figure Sales Tax On A Car In Oklahoma

The excise tax for new cars is 3.25%, and for used cars, the tax is $20.00 for the first $1500.00 and 3.25% on the remainder of the sale price. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20% of the average retail value of the car, regardless of condition.

Don’t Miss: How Long Does Your Tax Return Take

Sales Tax Credit For Sale Of A Used Vehicle

Simply complete a claim form and provide the documentation requested on the form. Separate forms must be used for each vehicle sold. No refund may be issued unless all of these items are entered completely and accurately. You may obtain a Claim for Sales or Use Tax Refund form at any local Revenue Office or you can download the form below: Note:

If a vehicle is sold prior to registering your new vehicle, you receive the tax savings immediately upon registering the new vehicle. If you sell your vehicle after registering the new vehicle, then you must submit a claim for refund.

| Title |

How Do U Figure Out Sales Tax

Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.

Don’t Miss: Morgan Stanley Tax Documents 2021

Vehicle Title Tax Insurance & Registration Costs

When you buy a new or used vehicle, youre always going to pay more than the sticker price. Thats because your state government sees a vehicle purchase as a great opportunity to squeeze some money out of you.

The basic DMV fees, like the title, license plate, and registration fees, are no biggie. But the car dealer may charge their own fees, too. Then, theres the vehicle sales tax and yes, this applies to private-party sales too. Some states charge extra on top of that, calling it a wheelage tax, personal property tax, use fee, excise tax, privilege tax or an ad valorem tax.

Well go through all the costs to be aware of when purchasing a new or used vehicle. Remember that many states also require proof of auto insurance coverage when youre registering your car. Need help finding the best deal on coverage? We can help you find the cheapest rates on car insurance.

Find the best insurance for your budget in just a few minutes!

How To Calculate Oklahoma Car Tax

Whether you live in Tulsa, Broken Bow or Oklahoma City, residents are required to pay Oklahoma car tax when purchasing a vehicle. The sales tax rate for the Sooner City is 4.5%, however for most road vehicles, there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owner’s name. The excise tax for new cars is 3.25%, and for used cars, the tax is $20.00 for the first $1500.00 and 3.25% on the remainder of the sale price. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20% of the average retail value of the car, regardless of condition. If it’s not within that range, an average value is used to derive the excise tax due. More detail on this topic can be found at the Oklahoma Tax Commission’s website under Motor Vehicles.

In addition to the vehicle excise tax, incorporated cities and counties of Oklahoma can opt to levy local taxes on car sales. The local tax rates vary, but consumers can find the associated tax rate for the city and county they live in to estimate the amount of local tax that is due to the state on the Oklahoma Tax Commission’s website. Current tax rates for sales and use tax across Oklahoma cities and counties are uploaded to the site quarterly. The site doesn’t have an Oklahoma car tax calculator, however the information provided gives consumers the information they need to calculate the estimated taxes.

Related Articles

Don’t Miss: Live In One State Work In Another Taxes

How Much Is Tag And Tax In Oklahoma

The excise tax for new cars is 3.25%, and for used cars, the tax is $20.00 for the first $1500.00 and 3.25% on the remainder of the sale price. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20% of the average retail value of the car, regardless of condition.

Do You Pay Sales Tax On A Car

Sales tax. When you purchase or lease a new or used car, you ll probably have to pay a sales tax or use tax. Buying a car out of your state typically wont save you from paying a sales tax. You must follow the tax rules of the state where you register the vehicle and pay any taxes when you bring the car back home.

Recommended Reading: Is Auto Insurance Tax Deductible

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

Oklahoma taxes vehicle purchases after rebates or incentives are applied to the price, which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost $9,000.

States With Online Tax & Tag Calculators

The following states offerFREE calculators to help you determine sales and/or registration taxes:

To use the calculators above including the car payments calculator NJ, you’ll usually need to enter some basic information about the vehicle you plan to purchase. The information you may need to enter into the tax and tag calculators may include:

- The vehicle identification number .

- The make, model, and year of your vehicle.

- The date that you purchased the vehicle.

- The date the vehicle entered the state you plan to register it in.

- The type of license plates/registration you need for the vehicle.

If you experience any issues with any of the free tax and tag calculators above, pleasecontact your state’s DMV, MVD, MVA, DOR, SOS, or county clerk’s office directly.

Recommended Reading: Sc State Tax Refund Status

Tax Paid To Another State Tax Credit

If you earned income in another state, you must report that amount on your Oklahoma return. However, you may be eligible for a tax credit worth a percentage of your earned income. If youâve claimed a similar credit in another state, you canât claim this credit on your Oklahoma return.

This credit is nonrefundable and doesnât carry forward.

Car Sales Tax For Trade

You do not have to pay a sale tax on the trade-in on your vehicle in the state of Oklahoma.

In other words, when calculating sales tax, be sure to subtract the trade-in amount from the car price.

Lets say that you’re purchasing a new car for $40,000 and your trade-in is valued at $10,000. This would put your new vehicle purchase price at $30,000, which is the taxable amount.

You May Like: What Is The Sales Tax

Other Costs To Consider When Purchasing A Vehicle

In addition to your state’s sales, use and property taxes, and any DMV, MVD, MVA, DOR, SOS, or county clerk titling and registration fees, you’ll need to consider the cost and fees for the following aspects of a vehicle purchase:

- Ordering a VIN check or vehicle history report.

- Getting a vehicle inspection, smog check, or emissions test.

- Buying car insurance.

- Performing any maintenance or upgrades.

For more information about some of those topics, please visit our pages on: