Doing Business In Our Region

Register your ficticious name or change your address if already registered with SunBiz

Once registered print your registration and make an appointment with Orlando Tax Office to file for your City tax receipt. You can also apply online or obtain the application and fill it out before going to the office. . If you are a home business, you will want to call and see if there are any special zoning questions or applications you need to submit. You may do better to have a commercial address since this makes for a simpler permitting process.

After you are done at the city you can proceed with Orange County for your county tax receipt . You can also find the application online and fill it out to save time.

Doing the entire process online will probably take one to two weeks. You can usually complete the process in one day by going in person.

You must complete this process in the order presented. Orange County will not issue a tax receipt without first seeing the city and state approvals.

Get In Touch!

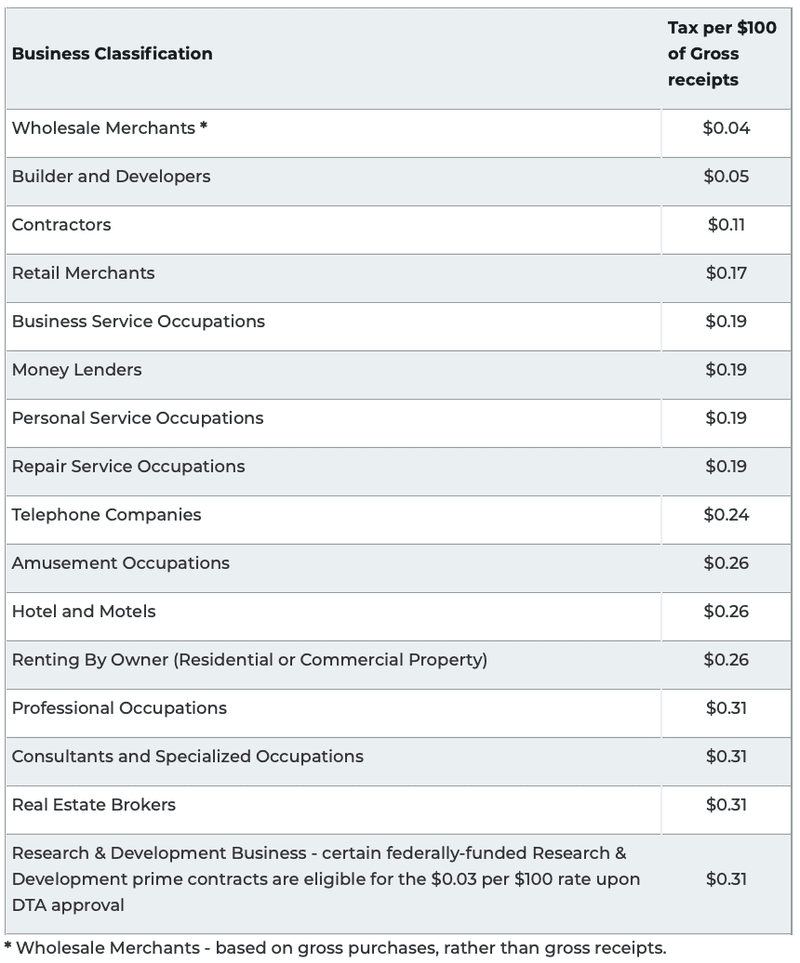

What Are The Costs Associated With An Orlando Business Tax Receipt

The calculation of business tax receipt fees is based on specific information provided on your business tax receipt application. There may be an application fee that applies to all business tax receipt applications as well. Your business tax receipt fees will be due annually no later than October 1. If you do not remit payment by October 1, you will incur a delinquency fee of 10% of your total fee and will increase by 5% each month it is overdue. If your business tax receipt fees are not paid in full by February 1, you will be subject to an additional fee. Your first year fees will be prorated based on the date that your business opens. If you open your business after January 1, your fees will be prorated at a 10% discount and will be discounted an additional 10% for each month after January until July 31, at which time a full yearâs fees will apply.

Do You Need To Obtain Other Licenses For Your Orlando Business

You may, depending on the type of business that you are conducting. For example, you may need to contact the IRS for a federal employers ID number or the Orange County Business Tax Office for an Orange County tax receipt. If you are serving food, you will need to contact the Department of Agriculture at 435-7352. Alcohol being served or sold at your business will require that you apply for and be issued a alcoholic beverage license. Call 245-0785 for more information about alcoholic beverage licenses. You may need any number of local, state, and federal permits or licenses, and it is best to contact the Office of Permitting Services at 246-2204 for information on additional licenses or permits.

Don’t Miss: Penalty For Missing Tax Deadline

Renewal Of Business Licenses

Once you have obtained a business license, a renewal will automatically be forwarded to the mailing address of record approximately thirty days before your expiration date. If you do not receive a renewal notice before the expiration date of the business license, please contact the Business Tax Office.

Failure to receive a renewal notice does not relieve the business owner of his/her responsibility in renewing the business license nor is it grounds for waiving any late penalties or interest due.

Do You Plan To Operate A Home

Those that are planning to run a home occupation will need to provide additional information in their business tax receipt application, such as a sketch of the floor plan of your residence, a one-time processing fee, and if you are not the owner of your residence, a notarized letter from your landlord approving your home-based business. If you are a condo owner, you will need a notarized letter from your homeownerâs association or property manager. In addition, you will need to complete a home occupation application for zoning purposes. Contact the Office of Permitting Services at 246-2204 for more information regarding home-based businesses.

Also Check: How To Calculate Mileage For Taxes

Get Your City/town Business Tax Receipt

To obtain a municipal Business Tax Receipt, contact your city or town.

The cities of Bay Lake and Lake Buena Vista do not issue a municipal Business Tax Receipt. Business Tax Receipts for businesses located in these cities are obtained directly from the Orange County Tax Collector no city or county zoning approval is required.

Overview: What Is A Business Tax Receipt

A business tax receipt is proof that your business is cleared by a local government to sell products and services.

Were not talking about a receipt showing that your business remitted its federal taxes. A business tax receipt is a sign of approval from a local government that you paid a nominal fee to start your business.

Many cities and counties require you to have a business tax receipt before your business opens its doors to the public. Obtaining a business tax receipt is one of the first steps in the business registration process.

Local governments charge a relatively low business tax — anywhere between $20 and $500 — for a business tax receipt. Most governments require that you renew it annually for the same amount.

Not all jurisdictions call a business tax receipt by that name. Some call them business tax certificates, business tax licenses, or something else entirely.

Your tax software might not tell you about this business tax, so do your due diligence to make sure youre following the rules to opening a business in your area.

Read Also: Penalty For Not Paying Taxes Quarterly

What Is A Business Tax Receipt

Most businesses in Orange County are required to pay a Business Tax. The Business Tax is imposed by the Orange County Board of County Commissioners to engage in or manage any business, profession, or occupation within Orange County, including its municipalities.

The Orange County Tax Collector collects business taxes under Florida Statute, Chapter 205 and Orange County Ordinance, Chapter 25.

Obtaining A New Business Tax Receipt

The cities of Apopka, Belle Isle, Eatonville, Edgewood, Maitland, Oakland, Ocoee, Orlando, Windermere, Winter Garden and Winter Park issue local Business Tax Receipts which vary according to business type and size. All businesses operating in these municipalities must obtain a Local Business Tax Receipt prior to obtaining an Orange County Business Tax Receipt.

Taxes for a new business can be paid at any time during the year and are pro-rated beginning April 1, at which time a half-year fee applies.

Read Also: Due Date To File Taxes 2022

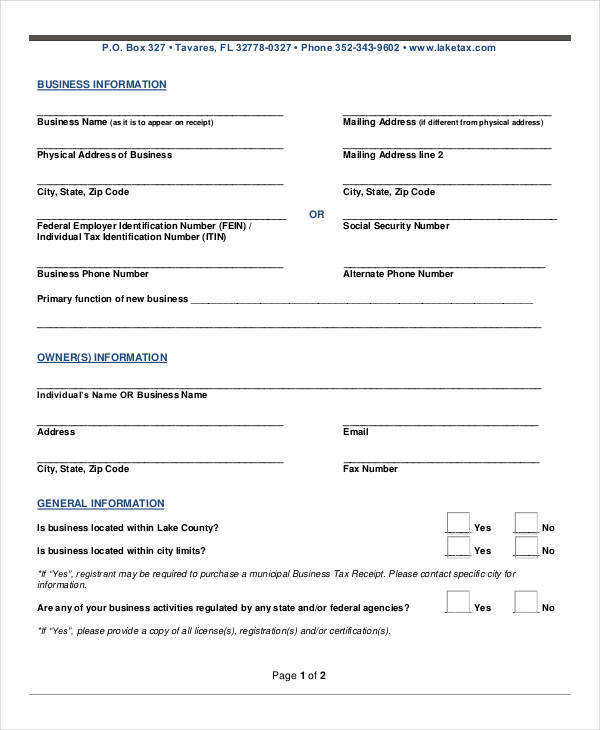

What Information Can You Expect To Provide For An Orlando Business Tax Receipt Application

When you fill out your application for an Orlando business tax receipt, you will need to provide only true and accurate information and you will need to verify that you have done so by signing your application. Anyone who knowingly provides information that is not true can be subject to criminal charges being brought against them and will risk their business tax receipt being denied or revoked. You will need to provide the estimated value of your inventory for applicable fiscal years dating back to 2007. Your name, address, phone number, and any other contact information needs to be submitted on your application. A detailed description of your business activities needs to be given. If it applies to your business, you will need to provide a FEIN, the name of the professional, a state license number, and the number of seats if your business is a restaurant. Provide the name, business address , and the phone number associated with your business. When you have completed your business tax receipt application, you may mail return it to the Office of Permitting Services at 400 South Orange Avenue, on the first floor of City Hall. If you have any questions or need any assistance completing your application, they can be reached by phone at 246-2204.

Confirm Your Business Location Is Within A City Or Town

You May Like: Payroll Tax Deposit Due Dates 2022

What Is The Cost Of The Edgewood Business Tax Receipt

- $98.12 for all commercial businesses $39.69 for home businesses, cosmetologists, etc. Please see our City Code for detailed business tax rates.

- Florida Statutes 205.162, 205.192, and 205.055 provide certain exemptions from the business tax receipt cost contact City Hall for more information.

- If renewal payment is not received by September 30, it shall be deemed delinquent and subject to a penalty of ten percent for the month of October, plus an additional five percent penalty for each month of delinquency thereafter until paid, but not to exceed 25 percent.

Do I Also Need An Orange County Business Tax Receipt

Yes. After you complete your applicable inspections, and receive a Certificate of Occupancy from Orange County, you will receive your Edgewood Business Tax Receipt. You can then apply for your Orange County Business Tax Receipt. You will need to renew your Orange County Business Tax yearly, as well as the City of Edgewood Business Tax. For more information on the county process, please .

Also Check: Federal Tax Return Due Dates Chart 2022

Changes To A Business

Changes made to a Business Tax Receipt status, such as a change of address, change of ownership or name change must be reported to the Tax Collectors Office in person these changes cannot be made over the phone. A nominal fee will be charged.

To make a change to a business, please visit the Tax Department, located at 200 S. Orange Avenue, 16th Floor, Orlando, FL 32801.

If you received a Business Tax Receipt Renewal Notice and are no longer in business or your business is no longer located in Orange County, please indicate that information on the Renewal Notice, then sign and return the notice to Tax Department, P.O. Box 545100 Orlando, FL 32854.

Federal Employer Identification Number

If your business is organized as a corporation or partnership, or if you engage or plan to engage employees, you will need a Federal Employer Identification Number for the purpose of withholding FICA taxes and Social Security taxes. To obtain an FEIN, contact the Internal Revenue Service at or . The nearest IRS office to Santa Ana City Hall is located across the street from the Orange County Superior Courthouse and the address is 801 W. Civic Center Dr., Santa Ana CA 92701.

Read Also: When Am I Getting My Tax Return

How Do I Start A Business What To Know Before You Apply

The details of your business operation will determine the type of Federal, State, County and City licenses, permits, certificates and approvals you will require prior to commencing business. Information on these various requirements are provided below with appropriate internet links.

For additional information about City of Santa Ana business licensing requirements, contact the Business Tax Office at . To inquire about City of Santa Ana zoning requirements for the type of business and its planned location, contact the Planning & Building Agency by phone at 647-5804 or by email at .

A Few Questions To Consider Before You Apply:

- Is your business located within the City of Port Orange and am I properly zoned? To confirm, check out the Citys Interactive Zoning Map or visit the Volusia County Property Appraiser website.

- Is your business registered with SunBiz? If yes, fantastic! If not, please visit the Division of Corporations – SunBiz.org to register prior to submitting your Business Tax Application with the City.

- Have you obtained an Employer Identification Number also known as a Federal Tax Identification Number? If yes, you are on track! If not, information on applying for an EIN can be found at the IRS website. This is required prior to submitting your Business Tax application with the City.

- Is a state license required to operate your business? Examples of businesses requiring a state license include but are not limited to the following: professional services, restaurants, auto dealers, vehicle repair and contractors. If your business does require a state license, this is required prior to submitting your Business Tax application with the City. For more information concerning requirements and applying for a state license, click here

Don’t Miss: Take Home Pay After Tax

Orange County Property Tax Bills Have Been Mailed

2022 Orange County property tax bills were mailed on August 4, 2022. Expect to receive your bill in the first week of August 2022. 2022 taxes are due September 1, 2022 and should be paid by January 5, 2023, to avoid delinquency.

Interest in the amount of 2% will be added to the amount past due on January 6, 2023 and additional interest in the amount of 0.75% is added at the first of each month that the taxes remain unpaid per North Carolina General Statutes 105-360.

FOR YOUR CONVENIENCE PAYMENTS CAN BE MADE SEVERAL WAYS:

- Online by Card or E-Check go to PayIt

- DROP BOX located outside our office door at the Gateway Center, 228 South Churton Street, Hillsborough

- to Orange County Tax Office, PO Box 8181, Hillsborough, NC 27278

- Phone payments by Card , a convenience fee is charged by a third party

- In person at the Gateway Center, 228 South Churton Street, Hillsborough

Cancellation Of Business License

To cancel an existing business license, advise the Business Tax Office in writing that you have ceased or will cease business or have or will sell your business or income property. Be sure to provide your Businesses License Tax account number and the date business has or will cease you must sign your written notification. You may make your cancellation notification by simply completing the Cancellation of Business License statement found on the back of your official Business License Tax Receipt or on the back of your Renewal Notification or your Notice of Business License Tax Due. Requests may also be submitted via email at and must include a signature block in lieu of a signature.

Read Also: Wisconsin Sales And Use Tax

State Employer Identification Number

If your business is organized as a corporation or partnership in the State of California, or if you engage or plan to engage employees in the State of California, you will need a State Employer Identification Number for the purpose of withholding State Income Tax, Disability and Unemployment Insurance. To contact the State Employment Development Department, call .

Orange County Tax Collector

Please Note

We are a service company that can help you file with the Orange County Tax Collector – Business Tax Department . We are not associated with this nor any other government agency. We offer paid services and software to help you file. You are not required to purchase our service to file – you may file directly with this agency without using our service.

Don’t Miss: Sales Tax In North Dakota

Fictitious Name Or Doing Business As

Fictitious Names and DBAs are one in the same. If you propose to use a fictitious business name, contact the Orange County Clerkâs Office and a local newspaper to schedule a publication of notice. Fictitious name statements are filed with the Orange County Clerkâs Office, located at 560 N. Broadway Street, Santa Ana, California 92701. To contact the Orange County Clerkâs Office, call or visit their web page at: www.ocrecorder.com. For more information on California Fictitious Name filing requirements, please see the California Business and Professions Code .

After Obtaining Your City/town Business Tax Receipt Visit Our Tax Department In Person

Applicants must bring their: Sunbiz Registration, any applicable state licenses, and original Social Security Card or provide their Federal Tax ID Number to complete the Business Tax Receipt process, which is as follows:

Don’t Miss: When Do I Have To File Taxes 2021

I’m A New Business What Do I Need To Get My Edgewood Business Tax Receipt

- Confirm the planned business is within the City of Edgewood limits.

Immediately after zoning approval from the City of Edgewood, please follow the steps below to avoid any delay in scheduling inspections and opening for business.

1. Create a Fast Track AccountCreate a Fast Track account using the online registration form. Please choose the Building” category when creating your account.

2. Review and PaymentApply online through Orange County Fast Track. Apply for a use permit. Please follow the steps on the fast track portal. ONLY upload the Use Permit application that has been stamped and approved by the City of Edgewood.

7. You Are All Set! With both your Edgewood and Orange County Business Tax Receipts, you are officially all set to open for business!