Consumer Use Tax Letters

If you received a letter from a business letting you know that you owe use tax, it is not a scam. You should verify that you did not pay sales tax on the item, and then file a consumer use tax return.

You do not need this letter when filing your federal income tax return, and you cannot pay it with your federal income tax. The use tax you owe is to Washington state.

Additional Sales And Use Tax Information

For additional information about the specifics of certain types of sales rates, fees and exemptions, visit the following two sections in the sales and use tax section for businesses:

- 1 cent on each sale where the taxable price is 20 cents.

- 2 cents if the taxable price is at least 21 cents but less than 34 cents.

- 3 cents if the taxable price is at least 34 cents but less than 51 cents.

- 4 cents if the taxable price is at least 51 cents but less that 67 cents.

- 5 cents if the taxable price is at least 67 cents but less than 84 cents.

- 6 cents if the taxable price is at least 84 cents.

- 1 cent if the excess over an exact dollar is at least 1 cent but less than 17 cents.

- 2 cents if the excess over an exact dollar is at least 17 cents but less than 34 cents.

- 3 cents if the excess over an exact dollar is at least 34 cents but less than 51 cents.

- 4 cents if the excess over an exact dollar is at least 51 cents but less than 67 cents.

- 5 cents if the excess over an exact dollar is at least 67 cents but less than 84 cents.

- 6 cents if the excess over an exact dollar is at least 84 cents.

Download our sales and use tax rate chart.

When The Customer Picks Up The Product

It doesn’t matter if your customer picks up their product if you operate in an origin-based state because all your sales are subject to your state’s sales tax anyway. But it’s considered to be a delivery if you’re in a destination-based state and the customer picks the product up at your business location. The destination of the sale would be your business location, so you would not charge the customer an out-of-state sales tax.

Read Also: How To Amend Tax Return Turbotax

How Sales Tax Works For Remote Sellers

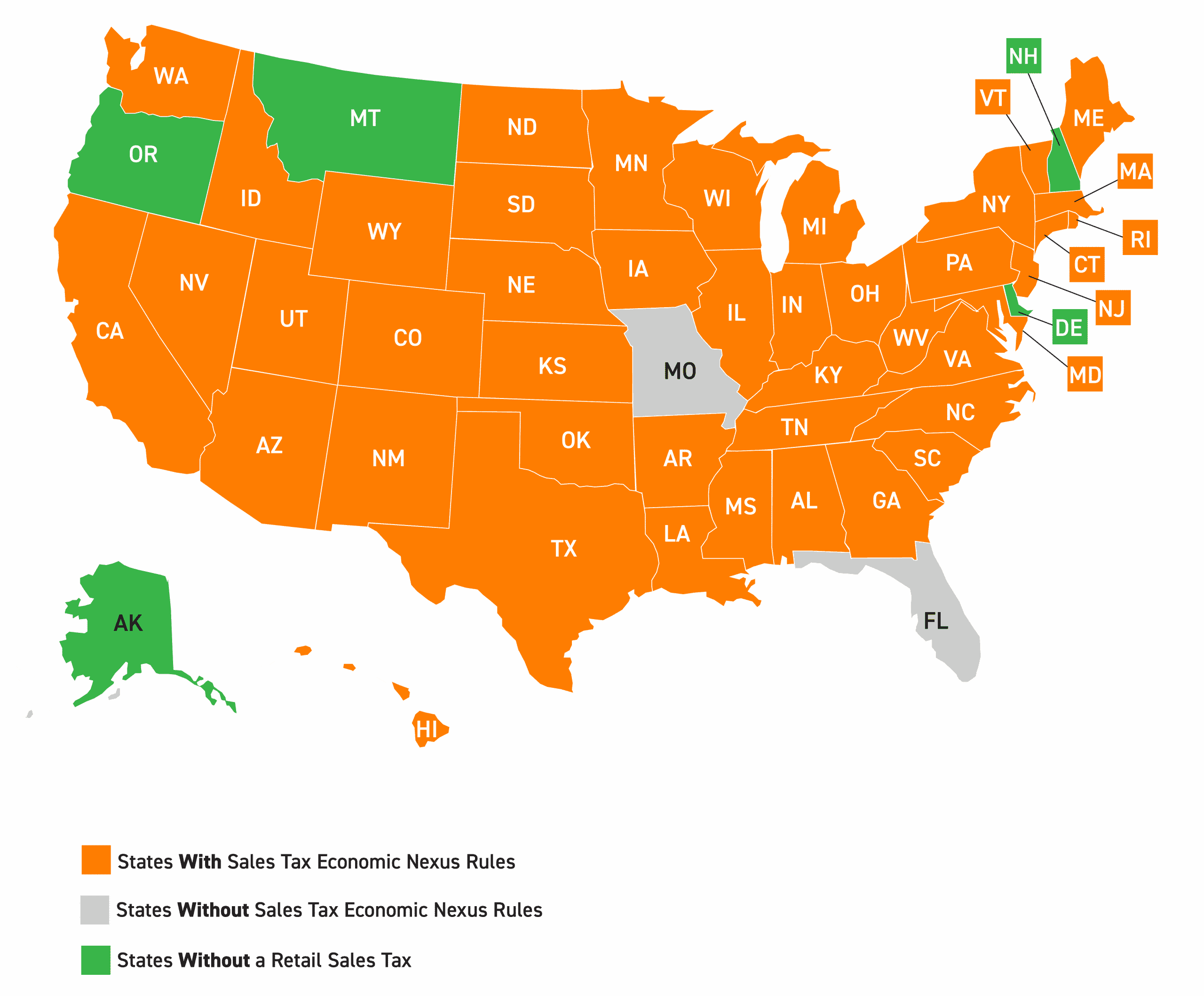

Earlier, we touched on how economic nexus is determined: youre considered to have nexus in a state because you had a certain dollar amount of sales in that state, or have a certain number of sales transactions in that state.

However, there are a number of other reasons remote sellers may find they have nexus in a state. Well go through the rules of each state later, but first lets review the most common types of nexus.

If you have any of the following arrangements as a remote seller, you may have nexus in multiple states, even if you have not hit the economic nexus threshold in that state. Keep in mind that the exact definitions and fine print differ with each state. Check individual state regulations if these rules apply to you.

When Buying A Car Out Of State Sales Tax

According to Carfax, you should pay sales tax to the state where you will register your vehicle , not to the state where you bought the vehicle. However, you may need to obtain a temporary registration card from the state where you purchased the car if you plan to drive it back to your home state.

When do you pay taxes when buying a vehicle out of State?

- If you are registering a new title for a car purchased out of state, you will still be required to pay the ad valorem tax on the vehicle. New residents must pay 50 percent of the ad valorem within 30 days of arriving in the state and the remaining balance within one year.

You May Like: Penalty For Not Paying Taxes Quarterly

Where Do I Pay Sales Tax If I Buy A Car Out Of State

If you’re buying from a dealership, they will likely be able to help you settle your tax liability with the proper authorities. If you’re buying a car in a private transaction, then you will probably pay sales tax in the state where you plan to register the car. If there are any complications, such as temporarily registering the car in another state so you can drive it home, then you may want to clarify your responsibilities with your home state’s DMV.

Trying To Think Of Items Bought Out Of State For Which Use Tax Should Be Paid What Sort Of Things Should I List And Is There A $ Minimum

Most states are doing this now anything you buy out of state that you pay no sales tax on, that you would have paid sales tax on if you bought in-state, you are supposed to pay the use tax. What that is will depend on where you live and how much you buy online, and from what sites. For example, Amazon now charges New York sales tax on my purchases, and so do the few other stores I order from, so even though I have online orders, they are all already taxed so I put zero. On the other hand, a few years ago I bought a computer from an out of state company that did not charge sales tax and that was more than $100.

You really need to think about what you buy and where from and if those places already charge you sales tax or not. If you arent sure, most states have a safe harbor amount based on your income they calculate an estimate based on your income and you can pay that with no questions asked. If you are sure you bought less out of state that was not taxed, then put the lower amount.

Also Check: Montgomery County Texas Tax Office

Do You Have A Nexus In Another State

Here’s another wrinkle: Your business may have a “nexus” in another state, meaning that you have an affiliation or some other legal connection there that effectively subjects you to its tax laws. You might be obligated to collect that other state’s sales taxes and file a sales tax return there even if your primary location is in an origin-based state.

Is It Worth Buying A Car From Another State

Sometimes buying a car out of state can save a lot of money. It can save you so much in fact that it might just be worth the drive. This is especially true if you live on or close to the border of another state. Another good reason to buy a car out of state is if you have your heart set on a specific make and model.

Recommended Reading: How To Pay Taxes Quarterly

About The Supreme Court’s Decision

Pursuant to the U.S. Supreme Courts 1992 decision in Quill Corp. v. North Dakota, sellers without a physical presence in a state were not required to collect and remit sales tax to that particular state. On June 21, 2018, the Court issued its ruling in South Dakota v. Wayfair, Inc., overturning its prior decision in Quill, such that physical presence is no longer required for sellers to be obligated to collect and remit sales taxes.

On June 21, Indiana Gov. Eric J. Holcomb offered the following statement regarding the Wayfair decision:

A lot about our world and economy has changed in the 26 years since our nations highest court last ruled on this issue. With the incredible evolution of technologies and the growth of internet sales, this Supreme Court ruling will help level the playing field between our Hoosier-based companies that operate retail stores and out-of-state companies that sell products and services online in our state. Were taking a careful look at the ruling to better understand its implications for Indiana.

As the Indiana Department of Revenue analyzes the contents of the Courts decision, see our Frequently Asked Questions to better understand how current Indiana laws and filing requirements apply to you. DOR is committed to being transparent in working with the business community to implement this historic decision.

Whats The Purpose Of An Audit

The primary purpose of an audit is to ensure voluntary compliance. State tax authorities use audits to investigate businesses suspected of misreporting sales and tax payments – whether intentionally or not. By evaluating a companys financial records, auditors can identify reporting oversights or mistakes and spot fraudulent activities. If a business is non-compliant with its sales and use tax obligations, states can require them to remit unpaid taxes and any applicable penalties and fees all money that increases state revenue.

Read Also: Is Hazard Insurance Tax Deductible

Consumers May Be Required To Report And Pay Sales Or Use Taxes

For consumers that order tax-free items online, but live in states that charge a sales tax, they are technically required to report that purchase to their state tax agency and pay the sales tax directly to the agency. When consumers are required to do so, it is often called a use tax.

The sole difference between a sales tax and a use tax is the person that ends up giving the money to the state government. When it is a sales tax, the retailer is the one handing over the money, while a use tax is handed over directly by the consumer. However, collecting use taxes on small purchases often costs more than simply letting the consumer not pay the use tax. Instead, state tax agencies try to focus more on collecting use taxes for big ticket items that are purchased online with no sales tax, such as cars and boats.

Be aware, there are a number of states that have stepped up their enforcement of their use tax laws and are now trying to make their state residents pay the taxes that should be paid.

How To Handle Sales Taxes When You Sell Across State Lines

E-commerce provides businesses with access to much larger markets, but it also complicates even the simplest of retail transactions. One of the most challenging aspects can be figuring out which sales taxes apply to individual sales, especially when you’re selling to out-of-state customers.

This article will provide an overview of when you should collect sales taxes for out-of-state sales. Learn how to keep track of everything along the way.

You May Like: When Are Llc Taxes Due

Resale And Incorporation Exclusions

Vendors may not recognize the resale and incorporation exclusions unless you provide them with a resale certificate with a signed statement that the purchases are for resale and including the buyer’s name, address and Maryland sales and use tax registration number. For more information on the use of resale certificates, contact Taxpayer Service and request Business Tax Tip #4, If you Make Purchases for Resale.

Delivery And Shipping Charges

Tax does not apply to separately stated delivery charges when delivery is made by common carrier, U.S. mail, or an independent contractor as long as the cost is the actual charge for the delivery.

Tax generally applies to delivery charges when delivery is made using your own vehicles. See Publication 100, Shipping and Delivery Charges for more detailed information.

Read Also: Tax Credits For Electric Vehicles

How Do You Handle The Paperwork And Filing

Unfortunately, collecting sales tax isnt quite as easy as tacking on an extra charge to your goods or services.

To legally collect sales tax, you need to get a sellers permit or license from your state. In some states, you will obtain a sellers permit on a state level. In others, youll also be required to obtain a license from your city, county, or jurisdiction.

To apply for a sales tax permit, visit your State Departments website. Look for the sales tax or sellers permit application under the Department of Revenue. Youll use that application to submit some basic information about your business, including your location, business type, and types of taxes you intend to collect.

As you collect sales tax, youll be required to remit it with a sales tax return to your state government on a regular basis. This may be required monthly, quarterly, or annually. How often you remit taxes will depend on how many sales youre making, as higher sales volume means more frequent filing.

When your state gives you your sellers permit, they should also let you know your filing frequency. At that same time, its wise to ask about your sales tax due date. Most states expect business owners to file their sales tax return by the 20th of the month following the taxable period, but this date can vary.

Sales And Use Tax Faqs

On January 1, 2008, changes to Arkansas state and local sales tax laws were for purposes of compliance with the Streamlined Sales Tax Agreement. Including Arkansas, the sales tax laws of nineteen states have been amended to be in conformity with the agreement which provides for uniformity among the states in tax administration processes, definitions of sales tax terms and equal application of tax laws to both in-state and out-of-state sellers registered to collect the sales tax.

The changes effective January 1, 2008 do not change the taxation for repair services performed at the customers location or for repair service occurring at the dealers store location where the property was brought to the store location by the customer and picked-up by the customer after the repair was completed. Taxation of repair services performed at the dealer location with the repaired property delivered or shipped by the dealer back to the customer at a location other than the store location is changed and is subject to tax at the point of receipt or delivery to the customer of the repaired property.

Local Tax Cap Changes

Rebates to Businesses of Additional Local Tax Paid on Purchases

Other

- Purchased items outside Arkansas that would be taxable if purchased in Arkansas

- Use, store, consume, or distribute these items in Arkansas, and

- Have not paid Arkansas sales tax or an equivalent amount to another state .

Also Check: Free Irs Approved Tax Preparation Courses

A Partnership Of States And Businesses

The marketplace law is expected to bring in an additional $300 million to Texas each year, while taxes collected by other remote sellers should generate an additional $200 million annually.

The responses of the Legislature and Comptrollers office to Wayfair are intended to level the playing field between in-state and remote sellers, while avoiding excessive burdens on the business community points stressed in the Supreme Courts decision. To that end, Texas policymakers have consulted other states and as many stakeholders as possible, including the Comptrollers taxpayer advisory group, the Texas Retailers Association, the Texas Taxpayers and Research Association and businesses including Amazon, Etsy, eBay and Walmart.

Differences among state tax laws and the sheer number of remote sellers mean that states must work together with taxpayers to bring order and predictability to sales tax collection.

The Comptrollers office will continue to develop best practices in conjunction with the Multistate Tax Commission , an intergovernmental state tax agency, and monitor other efforts at uniformity, such as the Streamlined Sales Tax Project , a tax simplification agreement among 24 states. The SSTP website offers sellers an easy way to register and collect taxes among member states, and while Texas isnt a member of the SSTP, the Comptrollers office has considered using its registration portal.

Do I Need To Collect Sales Tax If So How Much

Time for everyones favorite topic: taxes!

Still with us? If youve just launched your new business and youre ready to start making sales, you need to know whether you have to collect sales tax.

Knowing whether you need to charge sales tax isno surprise!pretty complex. Especially when sales tax laws make for dry reading and can differ from state to state.

Still, understanding your tax obligations is crucial for small businesses and retailersand it doesnt need to be quite as baffling as you might think.

Read Also: When Are Tax Payments Due 2022

Who Needs A Sales Tax License

Who is required to have a sales tax license? – Individuals or businesses that sell tangible personal property to the final consumer need a sales tax license. An application for a sales tax license may be obtained on our web site. In order to register for sales tax, please follow the application process.

Follow us

How To Keep Track Of Tax Rates

You’re responsible for collecting the correct and current sales tax rate on all sales that require that you collect sales tax. Sales tax rates can change at virtually any time with different rates in each state, county, and city, so it’s important to keep on top of them. Each state usually has an online database with current sales tax rates.

Most e-commerce platforms look up the customer’s address automatically and charge the applicable tax rate. You’re only responsible for selecting the jurisdictions for which you must collect the taxes.

Make sure that your technology providers update sales tax rates in real time to ensure that your tax rates remain compliant. With current accounting technology, it’s easier than ever to leverage systems and make sure you’re current with rates.

Read Also: How To File An Extension Taxes

Determining If You Have Nexus In A State

If you arent sure whether you have sales tax nexus, ask yourself the following questions:

- Do I have a physical presence in the state?

- Do I have someone working for me in the state?

- Do I have products stored in the state?

- Do my sales numbers or transactions exceed my states threshold?

- Do I cross state lines to sell my product?

If you answer yes to any of the above questions, you likely have sales tax nexus. If youre unsure about whether your business has sales tax nexus, contact your state for additional information.

Download our FREE whitepaper, How to Set up Your Accounting Books for the First Time, for steps and a checklist.