The Bbas Partnership Audit Rules

In 2015, the BBA replaced the partnership procedures enacted by the Tax Equity and Fiscal Responsibility Act of 1982 . Further amendments were made to the BBA by the Protecting Americans from Tax Hikes Act of 2015 and sections 201 through 207 of the Tax Technical Corrections Act of 2018.

Under BBA, as amended, the determination of adjustments and the assessment and collection of related tax occurs at the partnership level, rather than passing tax, penalty, and interest adjustments through to the partners. A partnership is allowed to make an election to push the adjustments out to its reviewed-year partners, which are those who held an interest in a partnership in the reviewed year. Unless your partnership makes a valid election out of the BBA for the partnerships tax year:

- your partnership is subject to the BBAs partnership audit rules

- you must designate a partnership representative for the partnership tax year and

- if the designated P.R. is an entity, you must also appoint a designated individual for the partnership tax year.

When Are Business Taxes Due In 2022

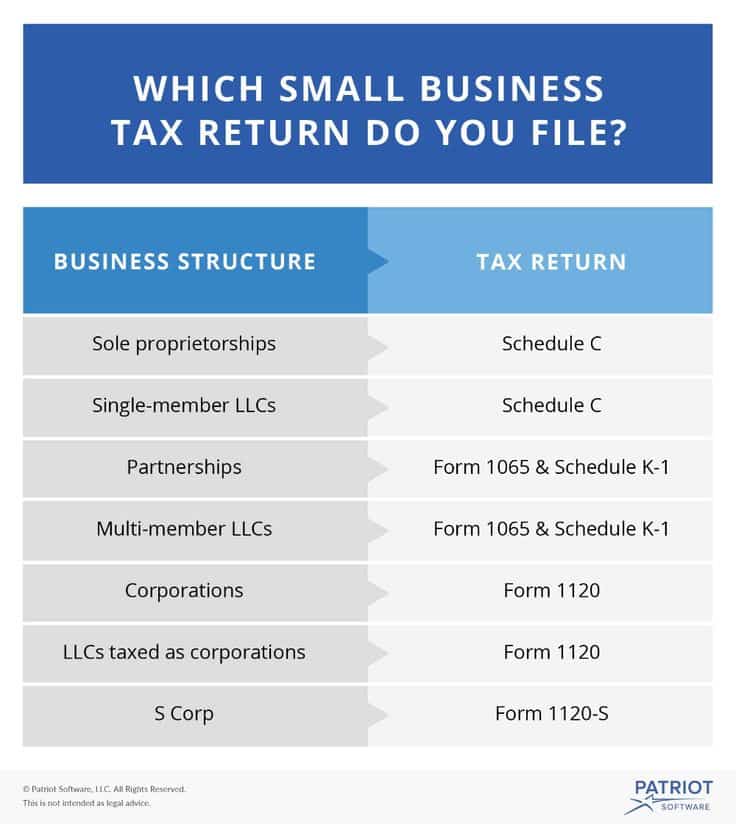

Many business owners ask questions like, When are S corporation taxes due? And When are LLC taxes due? If your business is an LLC, you might file as a sole proprietor, partnership, or corporation, depending on your business structure and even the corporation and partnership tax return due dates.

Well outline the details of these common business entities and their tax filing due dates below. But, if youre thinking you dont have the time or interest in completing your small business taxes, let a Block Advisors small business certified tax pro to assist you in all things tax.

Is The Deadline To File Taxes Extended 2020

The tax extension deadline for 2020 returns is approaching, but theres still time to avoid extra penalties and fees. Filers have until Oct. 15 to submit their extended return, originally due on May 17. Those who filed for an extension can skip late penalties by sending in their return by Oct.

Also Check: Loudoun County Personal Property Taxes

When Is Tax Day

While January to April is called âtax season,â the big âtax dayâ is usually April 15. If that falls on a holiday or weekend, it moves to the next business day.

Because April 15 falls on a Saturday and the 17th is the observation of Emancipation Day, this yearâs tax day is April 18, 2023. This is when individual taxpayers, sole proprietors, and C corporations need to file their taxes.

Note that if you are using a fiscal year that isnât the calendar year, your tax filing deadline is different and depends on your business entity and when your fiscal year ends.

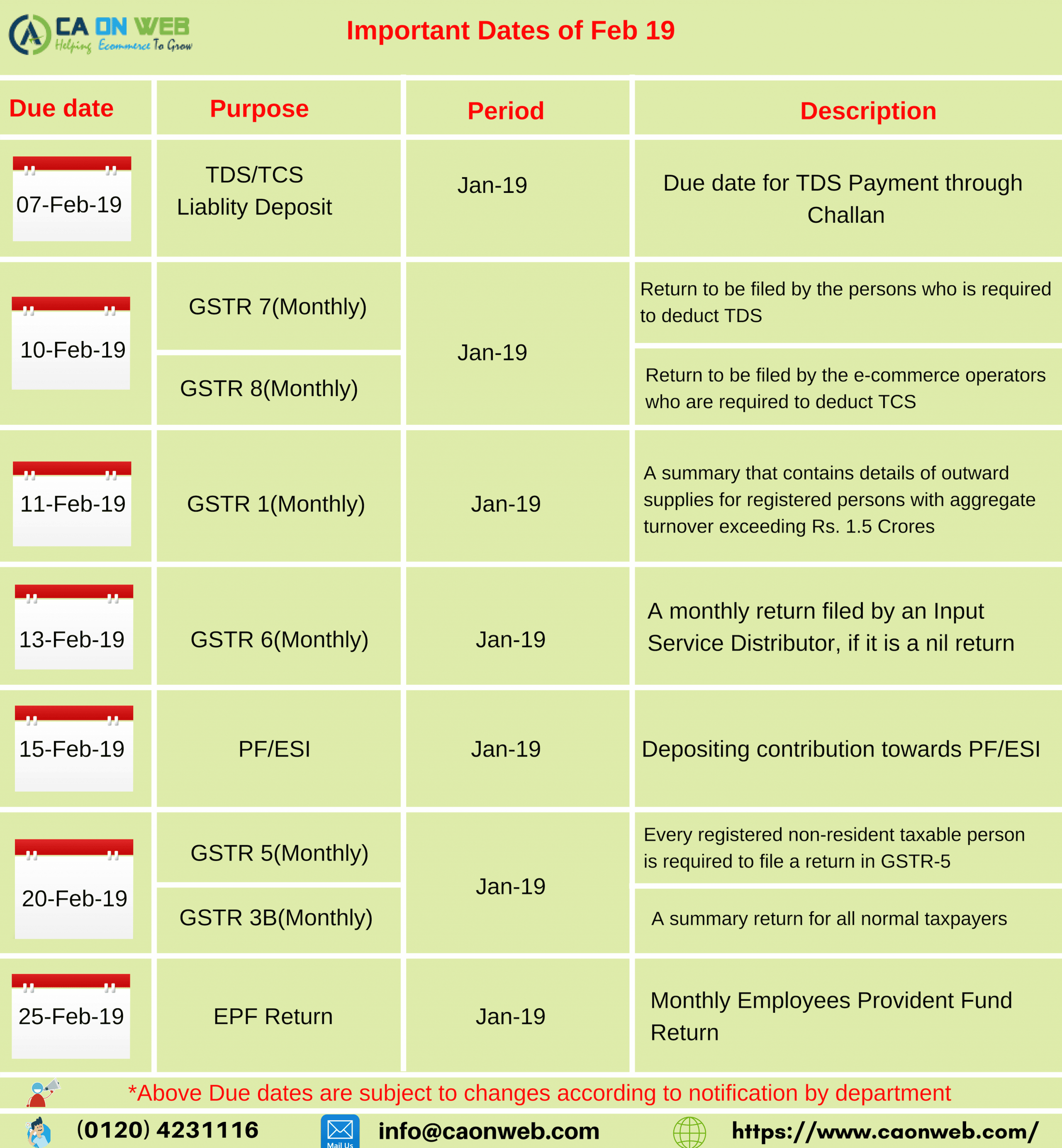

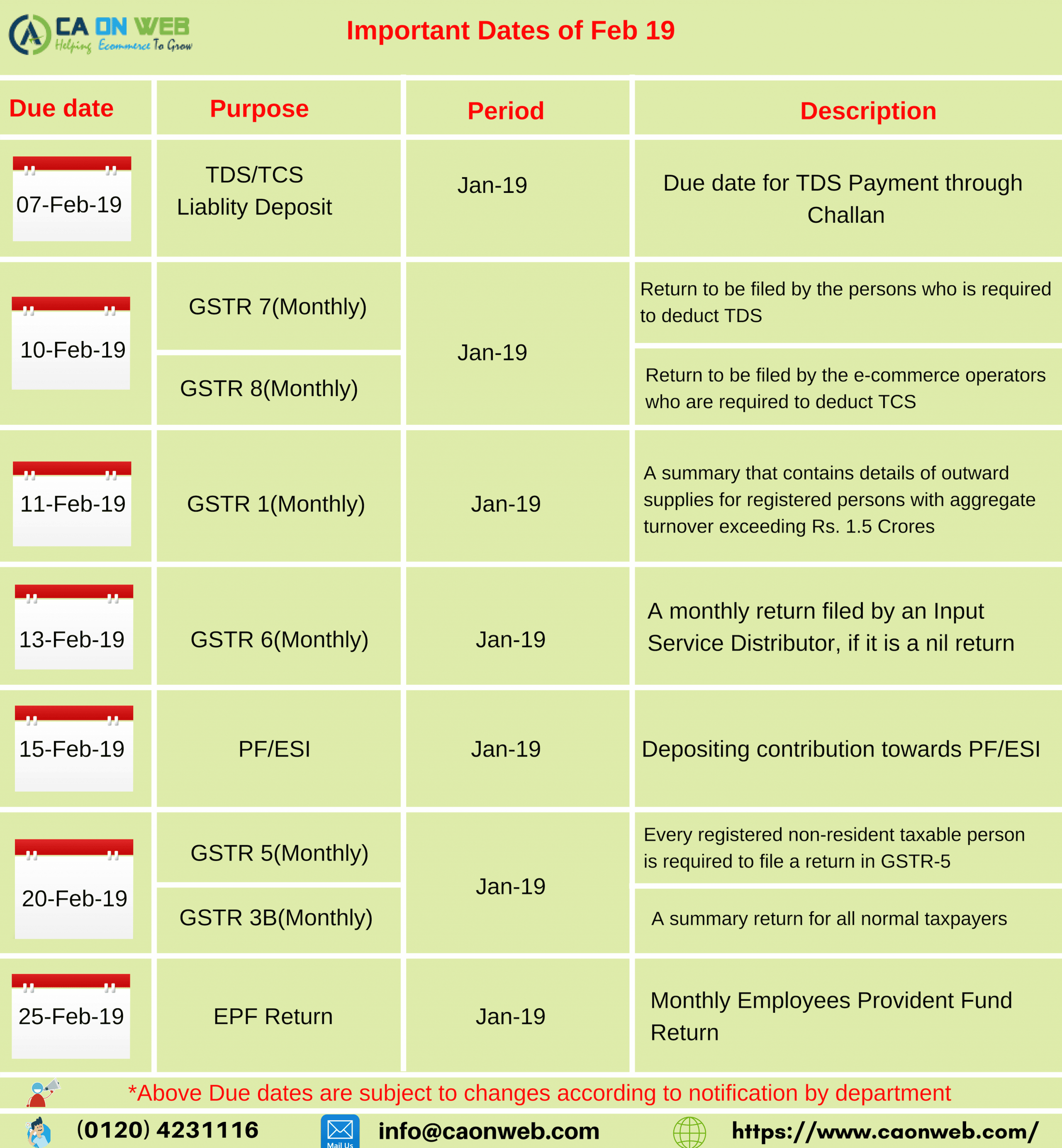

Reporting Due Dates For Taxes Fees And Reports

Due dates on this chart are adjusted for Saturdays, Sundays, and 2022 federal legal holidays. For applicable taxes, quarterly reports are due in April, July, October and January.

Note: When a reporting due date happens to fall on Saturday, Sunday, or a legal holiday, the reporting due date becomes the next business day. For example, for reports normally due on the 25th of the month, the due date is Dec. 26 instead of Dec. 25, which is Christmas Day . If Dec. 26 is a weekend day , then the reporting date becomes the next business day.

You May Like: Best Places To File Taxes

When Are 2023 Tax Extensions Due

You have right up until tax day to file for an extension. For individuals, that means you can still file for a tax extension right on April 18, 2023. The same goes for businesses: S corps and partnerships can still get an extension on March 15, and the last day for C corps to file for an extension is April 18.

Overruling Home Concrete In Cases Of Overstated Basis

In Home Concrete & Supply, LLC, 132 S. Ct. 1836 , the Supreme Court held that the extended six-year statute of limitation under Sec. 6501, which applies when a taxpayer omits from gross income an amount properly includible in excess of 25% of gross income, does not apply when a taxpayer overstates its basis in property it has sold.

In response to this decision, the act amends Sec. 6501 to add this language: An understatement of gross income by reason of an overstatement of unrecovered cost or other basis is an omission from gross income. The change applies to returns filed after the date of enactment as well as previously filed returns that are still open under Sec. 6501 .

Alistair M. Nevius is the JofAs editor-in-chief, tax.

Also Check: Which States Do Not Tax Pension

Corporate/unincorporated Tax Forms 2022 Tax Filing Season

|

2021 Corporation Franchise Tax Return Fill-in includes pages 1-6, Worldwide Combined Reporting Election Form, Combined Group Members Schedule, Schedule UB, and Schedule SR. |

On or before April 18, 2022 for calendar year filers on or before 15th day of fourth month following close of taxable year for fiscal year filers. |

|

| District of Columbia Low-Income Housing Tax Credit Allocation and Certification | File with D-20 | |

| Reporting Form for the Allocation, Transfer, Sale or Assignment of Low-Income Housing Tax Credit | File with D-20 | |

| Low-Income Housing Tax Credit Distribution Schedule | File with D-20 | |

|

Small Retailer Property Tax Credit Note: Schedule SR must be filed with either the Corporate Business Franchise Tax Return or the Unincorporated Business Franchise Tax Return . |

File with D-20 | |

| Underpayment of Estimated Franchise Tax By Businesses | File with D-20 | |

|

2021 Extension of Time to File Corporation Franchise Tax Return |

On or before April 18, 2022 for calendar year filers on or before the 15th day of the fourth month following the close of taxable year for fiscal filers. When you file your D-20, attach a copy of the FR-120 which you filed. |

|

| 2022 Declaration of Estimated Franchise Tax for Corporations |

Calendar Year Filers: Voucher # 1 – 15th day of 4th monthVoucher # 2 – 15th day of 6th monthVoucher # 3 – 15th day of 9th monthVoucher # 4 – 15th day of 12th month |

Unincorporated

Partnership

When Can I File My 2020 Taxes In 2021

Even though taxes for most taxpayers are due by April 15, 2021, you can e-file your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2021, when taxpayers should have received their last paychecks of the 2020 fiscal year.

Don’t Miss: What Is Social Security Tax

Individual Tax Returns Due

This is the deadline to file Individual tax returns . If your income is below $66,000 for the tax year, you can e-file for free using IRS Free File. If your income was above that, you can use the IRSâ free, fillable forms.

If youâre a sole proprietor filing Schedule C on your personal tax returns, the April 18, 2023 deadline applies to you too.

April 18 is also the deadline to file for an extension to file your individual tax return.

Us Tax Filing Deadlines And Important Dates In 2022

Are you a citizen of the United States or a Green Card Holder residing in Canada? Do you have an interest in the U.S. or foreign business entity? Are you a Canadian individual or a business owner with U.S. interests? Or maybe you are in charge of your business tax compliance? You should be aware of the important dates and deadlines of your income tax filing requirements.We designed this page to assist you or your qualified cross-border and U.S. tax advisor in determining U.S. tax filing deadlines that may apply to your case. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service is April 15 . However, an automatic extension to June 15 is granted to those U.S. citizens or residents whose tax home and abode, in real and substantial sense, is outside the United States and Puerto Rico. Further extensions may be requested by taking affirmative action and filing Form 4868 ), sending a letter with a relevant explanation to the IRS , and filing Form 2350 requirements extends the filing deadline to meet the FEIC requirements).

The extension of time to file ones tax return DOES NOT extend the time for making the tax payment. To avoid potential penalties and/or interest for late tax payment, please ensure that you either pay tax with a timely filed tax return or along with filing an extension to file the respective tax return.

You May Like: How Much Property Tax In California

Tax Deadlines: July To September

- :Deadline for employees who earned more than $20 in tip income in June to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in July to report this income to their employers.

- Deadline for employees who earned more than $20 in tip income in August to report this income to their employers.

- : Deadline forthird-quarter estimated tax payments for the 2021 tax year.

- : Final deadline to file partnership and S-corporation tax returns for tax year 2021, if an extension was requested .

When The Deadline Is Different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. Find out if you are eligible to pay this way.

HMRC must receive a paper tax return by 31 January if youre a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

Also Check: How To Become Tax Preparer

Who Cannot Be Included In A Composite Return Filing

-

Partners who are corporations are required to file Form CIFT-620 to report any partnership income.

-

Partners who are Louisiana resident estates and trusts are required to file Form IT-541 to report partnership income.

-

Partners who are themselves partnerships are required to file all applicable Louisiana tax returns. Refer to LAC 61:I.1401.

-

Partners who are Louisiana residents are required to file Form IT-540 to report partnership income. Refer to LAC 61.I.1401.

Filing Requirements

Louisiana Revised Statute 47:201.1 requires the electronic filing of all composite partnership returns. If tax credits are claimed on the composite return:

-

ALL nonresident partners must be included on the return, Form R-6922, and on the Schedule of Included Partners Share of Income and Tax that is included with the return.

-

ALL partners, including residents, corporations and other partnerships must be included on the Schedule of Not Included Partners Share of Income and Tax that is included with the return.

If the partnership is not required to file a composite return because all its partners have filed agreements to file on their own behalf, the partnership must make an initial filing in which it files all agreements with the LDR by the composite return due date.

Tax Filing Deadlines In 2022

Deadlines for filing taxes typically fall within the same, general range. When it comes to filing your 2021 tax return, these are the dates you need to know about.

- Receiving your W-2 Form: Your employer has until Jan. 31, 2022, to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- Individual income tax returns: April 15 falls on a weekday in 2022, but it is Emancipation Day which is celebrated in Washington, D.C., causing all businesses and government offices to close. Therefore, the filing deadline for your 2021 personal tax returnForm 1040 or Form 1040-SRis Monday, April 18, 2022 .

- Partnership and S-corporation returns:Returns for partnerships and S-corporations are generally dueMarch 15. If you request an automatic six-month extension, though, this date is Sept. 15.

- Corporation income tax returns: For corporations, the due date is April 18, 2022. The extended deadline is Oct. 17, 2022. The deadline for C-corp returns is typically the 15th day of the fourth month following the end of the corporation’s fiscal year if the corporation operates on a fiscal year, rather than a calendar year.

You May Like: What States Do Not Have Sales Taxes

Download And Fill Out Your Business Tax Return

IMPORTANT: Download and save the form to your computer, then open it in Adobe Acrobat Reader to complete and print. Using your web browser to complete the form may result in incorrect form calculations and other issues.

Download the free Adobe Acrobat Reader program.

Portland/Multnomah County Combined Business Tax Return for Partnerships

Heavy Vehicle Use Tax

The Heavy Vehicle Use Tax is imposed on taxpayers who operate one or more heavy vehicles on streets owned or maintained by the City of Portland. If you are subject to the Heavy Vehicle Use Tax, please complete HVT Schedule and include it with your Combined Tax Return.

Clean Energy Surcharge

All businesses that report total gross income of $1 billion or more and Portland gross income of $500,000 or more on their Combined Business Tax Return are required to file Form CES-2021.

Request for Extension of Time to File

If you need additional time to file your business tax return, you should file a Request for Extension by the original due date of your return, unless you have filed a timely extension to file with the IRS. This grants an additional six months to file your Combined Tax Return and/or Form CES. You must still pay all tax due by the original due date.

Additional Information On Returns Relating To Mortgage Interest

Sec. 6050H is amended to require new information on the mortgage information statements that are required to be sent to individuals who pay more than $600 in mortgage interest in a year. These statements will now be required to report the outstanding principal on the mortgage at the beginning of the calendar year, the address of the property securing the mortgage, and the mortgage origination date. This change applies to returns and statements due after Dec. 31, 2016.

Don’t Miss: Take Home Pay After Tax

What Is The Business Tax Filing Deadline For 2020

The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak. The filing deadline for tax returns has been extended from April 15 to July 15, 2020.

When Can We Start Filing Taxes

In January of each year, the IRS announces the date when people can start filing their tax returns. For example, in 2021, it announced on Jan. 15 that tax filing season would start on February 12, 2021. That was the earliest date that anyone could file for the IRS to accept and process their returns.

You May Like: Work At Home Tax Credit

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

When Are Business Taxes Due

6 min read

While Tax Day is the only date some people may have on their calendar, there are actually many important business tax deadlines throughout the year. To find out the answer to when are business taxes due? keep reading! Weve outlined everything you need to know here.

The business tax due dates youll need depend on your earnings as well as business structure. For example, if youre a single-member LLC, you might be penciling in different tax deadlines than a S corporation owner.

Recommended Reading: Sales Tax On Cars In Tn

Requesting An Extension Of Time For Filing A Return

For tax periods beginning before January 1, 2022, Revised Statute 47:1514 allows a six-month extension of time to file the partnership return to be granted on request. The extension request must be made electronically before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The two options for requesting an extension are as follows:

Filing an extension request electronically via the Louisiana Department of Revenue’s Online Extension Filing application or

Submitting the extension electronically through tax preparation software that supports the electronic filing of the Louisiana Application for Extension to File Partnership Return. See approved vendors.

Tax preparers can also utilize the bulk extension filing application to submit multiple extension requests. This application can be used by any firm who has an Electronic Filing Identification Number registered with LDR or any taxpayer who has a current Louisiana Account Number listed with LDR.

Effective for tax year 2022, Revised Statute 47:103 allows a six-month automatic extension of time to file the individual income tax return. If you know you cannot file your return by the due date, you do not need to file for an extension. No paper or electronic extension form needs to be filed to obtain the automatic filing extension.