What Are Estimated Tax Payments

When youre an employee, its your employers responsibility to withhold federal, state, and local income taxes and send that withholding to the appropriate government body. Those are prepayments on your expected tax liability when you file your tax return. Your Form W-2 has the withholding information for the year.

When you file, if you prepaid more than you owe, you get some back. If you prepaid too little, you have to make up the difference and pay more. Employee withholding is based on the most recent Form W-4 filed with the employers human resources department.

But if youre in business for yourself, you need to be your own HR department. That means you may need to make estimated payments. Paying estimated taxes requires you to estimate in advance how much you expect to owe the government in taxes for the current tax year.

You then send in four quarterly payments that together total that amount. The due dates for quarterly estimated payments fall near the middle of the months of April, June, September, and January.

If you dont make the quarterly estimated tax payments you need to, the IRS will hit you with a penalty for failure to pay estimated taxes. To avoid that, its crucial to know if youre responsible for estimated taxes, how to determine the amount, and how to send your payments efficiently.

How To Pay Estimated Taxes

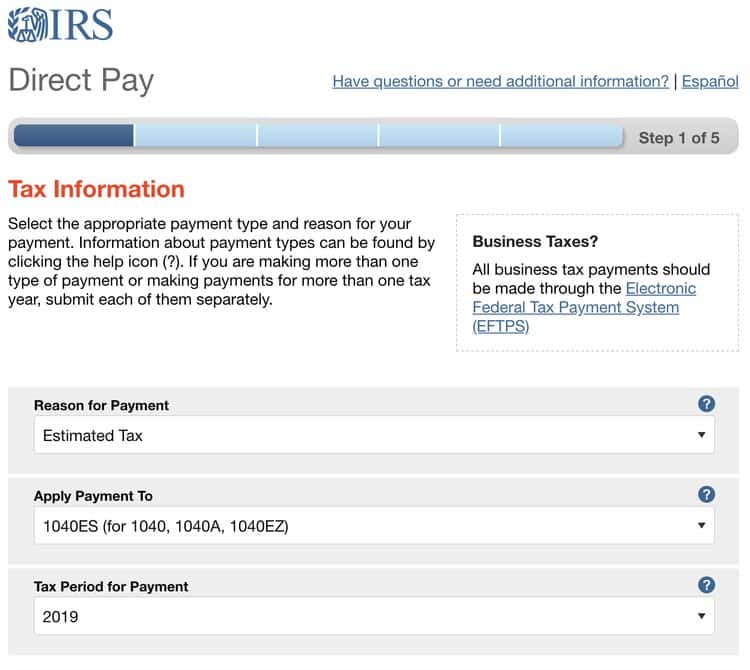

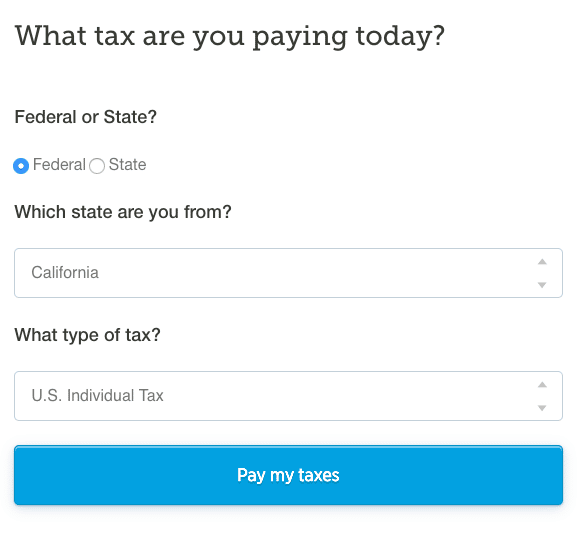

Form 1040-ES, Estimated Tax for Individuals, includes instructions to help taxpayers figure their estimated taxes. They can also visit IRS.gov/payments to pay electronically. The best way to make a payment is through IRS Online Account. There taxpayers can see their payment history, any pending payments and other useful tax information. Taxpayers can make an estimated tax payment by using IRS Direct Pay Debit Card, Credit Card or Digital Wallet or the Treasury Department’s Electronic Federal Tax Payment System . If paying by check, taxpayers should be sure to make the check payable to the “United States Treasury.”

Publication 505, Tax Withholding and Estimated Tax, has additional details, including worksheets and examples, that can be especially helpful to those who have dividend or capital gain income, owe alternative minimum tax or self-employment tax, or have other special situations.

Are Property Taxes Included In Mortgage In Texas

In Texas, property taxes are not included in your mortgage. You will be responsible for paying your property taxes in addition to your mortgage.

Each homeowner is required to pay taxes on their property, which varies depending on the local tax rate and the value of the property. Mortgage lenders frequently charge borrowers higher property taxes as part of their monthly mortgage payments. By including property tax payments in your mortgage payment, you protect your lenders interests. In the event that a homeowner is forced into foreclosure, his lender will almost certainly be required to pay the remaining property tax balance. If you are planning to buy a home, you should speak with the lender about paying property taxes. As a result, you should expect your taxes to be deducted from your mortgage payment. If you choose to set up an escrow account and pay your property taxes through it, you may have lenders lowering your interest rate.

You May Like: How To Report Tax Fraud To The Irs

Heres How And When To Pay Estimated Taxes

IRS Tax Reform Tax Tip 2018-140, September 10, 2018

Certain taxpayers must make estimated tax payments throughout the year. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty.

For tax-year 2018, the remaining estimated tax payment due dates are Sept. 17, 2018 and Jan. 15, 2019.

Estimated tax is the method used to pay tax on income that is not subject to withholding. This income includes earnings from self-employment, interest, dividends, rents, and alimony. Taxpayers who do not choose to have taxes withheld from other taxable income should also make estimated tax payments. This other income includes unemployment compensation and the taxable part of Social Security benefits.

The IRS urges everyone who works as an employee and who also earns or has income from other sources to perform a Paycheck Checkup now. Doing so will help avoid an unexpected year-end tax bill and possibly a penalty when the taxpayer files their 2018 tax return next year. They can do a checkup using the Withholding Calculator on IRS.gov.

Here are some things to know for taxpayers who make estimated payments :

Pay By Credit Or Debit Card Paypal Or Interac E

You can use a third-party service provider that offers payment by credit card, debit card, PayPal, or Interac e-Transfer. The third-party service provider will send your business payment and remittance details online to the CRA for you. Third-party service providers charge a fee for their services.

PaySimply and Plastiq are third-party service providers that you can use to make a payment:

- PaySimply accepts debit cards, credit cards, and payment services. This includes Visa, Mastercard, Amex, Union Pay, PayPal, and Interac e-Transfer.

- Plastiq accepts debit cards and all credit card brands. This includes Visa, Mastercard, and Amex.

You are responsible for making sure the CRA receives your payment by the payment due date. If you are using a third-party service provider, you must clearly understand the terms and conditions of the services you are using.

Please ensure that you set up your payment well in advance of your payments due date. Payment delivery is not immediate, and is determined by the third-party service provider that is used.

Heres how you can confirm your payment was received by the CRA:

You May Like: Are Real Estate Taxes The Same As Property Taxes

How Can I Make This Easier

If you’re married and your spouse has a regular job and is having taxes withheld, he or she may have enough taxes withheld to cover the two of you, Kane explains.

You can accomplish this by giving his or her employer a new Form W-4, instructing how much tax to withhold from each paycheck. You can change your W-4 any time. If youre getting a pension or annuity, use Form W-4P.

We Provide Qualified Tax Support

E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If youve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a help request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Dont Miss: How Does Getting Married Affect Taxes

Read Also: Sales Tax And Use Texas

People Who Aren’t Having Enough Withheld

The IRS says you need to pay estimated quarterly taxes if you expect:

You’ll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller. The threshold is 110% if your adjusted gross income last year was more than $150,000, or $75,000 for married filing separately.

How Do I Not Pay Income Tax

How to Reduce Taxable Income Contribute significant amounts to retirement savings plans. Participate in employer sponsored savings accounts for child care and healthcare. Pay attention to tax credits like the child tax credit and the retirement savings contributions credit. Tax-loss harvest investments.

Don’t Miss: Penalty For Filing Taxes Late If I Owe Nothing

When To Pay Estimated Tax

| Payment Period |

|---|

If I anticipate a sizable capital gain on the sale of an investment during the year, do I need to make a quarterly estimated tax payment during the tax year?

Answer:

Generally, you must make estimated tax payments for the current tax year if both of the following apply:

- You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits, and

- You expect your withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your current year’s tax return, or

- 100% of the tax shown on your prior years tax return.

There are special rules for:

- Farmers and fishermen

How do I know if I have to file quarterly individual estimated tax payments?

Answer:

Generally, you must make estimated tax payments for the current tax year if both of the following apply:

- You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

- You expect your withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your current years tax return, or

- 100% of the tax shown on your prior years tax return.

There are special rules for:

- Farmers and fishermen

Are there any special provisions related to estimated tax payments for farmers and fishermen?

Answer:

Additional Information:

Stop And Start Dates For Underpayment Interest

In general, we charge interest on underpayments starting on the due date of the amount you owe and will continue to accrue until the balance is paid in full:

- Tax is due on the return filing date extensions to file do not extend the date for payment of the tax.

- Penalties and additions to the tax due dates vary by penalty type:

- Failure to File penalty, also called the delinquency penalty, is due on the return due date, or extended return due date if an extension of time is filed.

- Failure to Pay, Underpayment of Estimated Tax by Corporations, Underpayment of Estimated Tax by Individuals and Dishonored Check penalties are due on the date we send you a notice or assess the penalty.

- Accuracy-related penalties are due on the return due date, or extended return due date if an extension of time is filed.

If you received a notice, you will not be charged interest on the amount shown if you pay the amount owed in full on or before the “pay by” date.

Read Also: When Does Tax Season End 2022

Who Does Not Have To Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck.

You dont have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident for the whole year

- Your prior tax year covered a 12-month period

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

Income Subject To Withholding

Income subject to Iowa income tax withholding includes all types of employee compensation, such as:

It does not matter if the income is based on the hour, day, week, month, year, or on a piecework or percentage plan. It also doesnt matter if the employee is paid in cash or in some other form.

Recommended Reading: Taxes On 2 Million Dollars Income

Penalty & Interest Charges

- You will receive penalty on your individual income tax return/payment if not paid within the specified time due per The Revenue Act of 1941.

- Penalty is charged at 5% for the first two months and then 5% for each additional month thereafter up to a maximum of 25%.

- Interest is calculated by multiplying the current interest rate by the amount of tax you owe.

- You may request a waiver of penalty in writing. You are required to explain your reason for late payment of tax. You must submit supporting documentation and meet the reasonable cause criteria outlined in the Revenue Administrative Bulletin 1995-4 before a waiver of penalty will be considered.

How To Dispute Insufficient Interest Paid

If you think we underpaid interest owed to you on refunds or credits you’re eligible for, you can file an informal claim or complete and send Form 843PDF for us to consider allowing additional overpayment interest. Make sure to include your own computation and reason for making the request for additional interest on Line 7 .

Your request must be received within six years of the date of the scheduled overpayment.

Read Also: What Is The Sales Tax

How To Estimate Your Taxes

If you use tax-preparation software from a company like H& R Block and owe $1,000 or more, the software typically calculates estimated tax payments. It also generates four Form 1040-ES vouchers for you to use to mail estimated payments for the coming year.

Otherwise, follow the IRS instructions on Form 1040-ES to determine how much you should pay in estimated taxes. Form 1040-ES includes vouchers in case you choose to send those payments by mail.

If you receive your self-employment income irregularly throughout the year, you may be able to pay different amounts throughout the year to more closely match your income. To avoid penalties, pay the minimum amount required for the quarter by the quarters due date.

You can also make more than four estimated tax payments during the year. You can get a 1040-ES payment voucher to fill out online to send with your extra payment.

Freelancers and independent contractors are frequently surprised at the sizable tax bill they face when they have a nice net profit for the year. The high amount is because they not only pay income tax on the profit, but they have to pay self-employment tax as well. Self-employment tax is part of your overall tax liability and is one thing that makes estimating total tax liability difficult.

What Is The Best Way To Pay Federal Taxes

IRS Payment Options: Debit, Credit & 7 More Ways to Pay Taxes IRS Direct Pay. The Electronic Federal Tax Payment System Make an IRS payment with a same-day wire transfer. Make an IRS payment with a debit card. Make an IRS payment with a credit card. Make an IRS payment with a check, money order or cashier?s check.

Read Also: Montgomery County Texas Tax Office

What Happens If I Forget To Pay

The IRS will charge penalties if you didnt pay enough tax throughout the year. The IRS can charge you a penalty for late or inadequate payments even if you’re due a refund when you file your tax return.

The IRS might give you a break on penalties if:

-

You were a victim of a casualty, disaster or other unusual circumstance, or

-

Youre at least 62, retired or became disabled this year or last year, and your underpayment was due to reasonable cause rather than willful neglect

Escape The Underpayment Penalty

You may be liable for an underpayment penalty if you pay less than 100% of your tax liability by the tax filing deadline. You can avoid the penalty if you meet one of the exceptions below:

Read Also: How Do I Get My Tax Transcripts

Companies That Accept Credit Card Debit Card And Digital Wallet Tax Payments

Each company has its own fee schedule, with credit card fees ranging from 1.87 percent to 2 percent of your tax bill and debit card fees of up to $3.95 per transaction. Additional convenience fees are tacked on in some cases.

And dont forget that if you dont pay off the credit card charge in full, youll start racking up interest on the taxes you paid.

You can find a low-interest credit card at Bankrate.

Your tax payment and the fees usually will appear separately on your card statement. If you itemize, note the fee amount. You can count that as a miscellaneous deduction when you file your 2017 return next year.

Read Also: How To Calculate Payroll Taxes