New Online Service For Virginia Beach Residents

Virginia Beach residents now have the option of paying their personal property taxes, real estate taxes, and parking tickets online. This new service is made available for free by the Virginia Beach Department of Finance. Residents can pay with their existing profile and log in to their account. Payments made prior to 7:30 p.m. will be processed the following business day.

How To Apply For Motor Tax

You can pay motor tax:

- In person at your local motor tax office

There are some differences if you are taxing a vehicle for the first time orif you are renewing your motor tax.

You will also need additional documentation if you are taxing a goods orcommercial vehicle, see the section on Commercial vehicles below.

Pay Any Brta Fees Through Bkash From The Comfort Of Your Home

Pay your car license, ownership registration, tax token renewal and various other fees through bKash at the BRTA Service Portal, and receive your tax token at the comfort of your home.

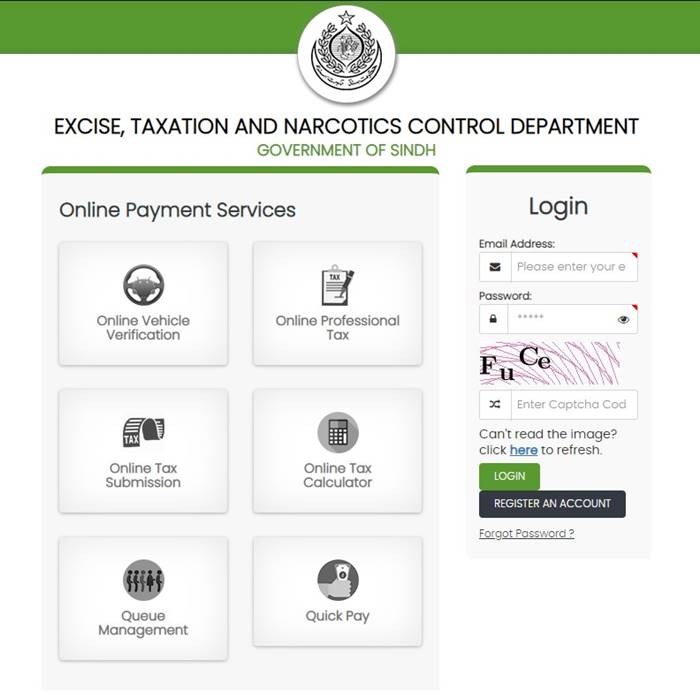

BRTA Service Portal

There are various online services available at the Bangladesh Road Transport Authority service portal. Car owners, drivers and sellers can apply for various services through online payment upon registration.

All services available at the BRTA Service Portal:

- Motor Vehicle Registration

- Route Permit Issue & Renewal

How to pay fees through bKash at the BRTA Service Portal?

You are required to have an account at the BRTA service portal in order to make any type of fee payments.

Visit to register for new accounts. Upon registration, you can apply for various services and pay fees through bKash.

In order to apply, click any one of the links below and provide your email/mobile number and password to log in:

Go to the payment page and follow the steps below when registering:

|

Provide the amount of money and mobile number to confirm your payment |

|

Type your bKash account number and click the Confirm button |

|

Provide the verification code to your mobile number |

|

Finally, provide the PIN number of your bKash account to confirm payment |

Service Charge

There is a convenience charge on the gross transaction amount which needs to be paid by the customer.

Superior Service for bKash customer:

Terms and Conditions

Read Also: Tax Credits For Electric Vehicles

How To Apply For A Refund For Motor Tax

You can claim a refund of motor tax if the vehicle:

- Has been scrapped, destroyed or sent permanently out of the State

- Has been stolen and has not been recovered by the owner

- Has not been taken out or used in a public place at any time since the issue of the current disc

As the owner, you can claim a refund if you have stopped using the vehicle:

- Due to illness, injury or other physical disability

- As you are absent from the country for business or educational purposes

- As you are serving overseas with the Defence Forces

You must return your tax discs immediately as refunds are generallycalculated from the first of the month after the disc is surrendered. A minimumof 3 unexpired whole calendar months must be left on the disc.

If the vehicle has been scrapped, you need a certificate of destruction froman End-of-LifeVehicle Authorised Treatment Facility.

Paying Motor Vehicle Tax

If you have a motor vehicle registered in your name, for example, a car or a motorcycle, you do not have to submit a separate motor vehicle tax declaration. Registering the vehicle in your name is your declaration. You then receive a payment notice from the Tax and Customs Administration. This indicates the amount of motor vehicle tax you must pay.

Don’t Miss: How To Find 2020 Tax Return

How To Calculate Your Car Tax In : : : :

If you paid your taxes at least a week ago, you can check the information on file with your local Department of Motor Vehicle office. A fee may be charged by the Department of Motor Vehicles. A $1 statutory fee for each tax years receipt is required for paper copies of tax returns. Personal property assessments are currently levied at 33%. You can estimate the amount you owe by multiplying the propertys estimated market value by your propertys X% assessment rate. The value has been estimated. Total tax rate * Assessed value / 100 x tax rate = estimated assessment value. The tax bill will most likely be in the range of $2,000 to $3,000. If you are unsure of the true market value of your property, you can request a prorate assessment from the assessors office. You will be able to pay your taxes in accordance with the schedule that the assessor provides.

No Comments

How To Pay Car Tax Online In Spain

Being behind the wheel of your own car has many advantages, from getting from A to B in your own time and space, to discovering new places. However, owning a car also comes with other considerations that can seem a hassle, but are legal requirements that you must keep up to date with.

Doing these necessary but boring ´life administration´ tasks, such as paying your car tax, can be a drag, but, thanks to the 21st century shift to technological systems and processes, there are now more options to complete these mundane tasks.

Many people do not know the ins and outs of paying taxes, and this can seem confusing at times, so I´m going to take you through the steps and requirements of how to pay car tax quickly and easily so that you can spend more time enjoying the open road.

First things first, here are some of the basics that you need to know:

You May Like: California Used Car Sales Tax

Will I Have To Pay Vehicle Property Tax If I Am Active Duty Military

Active duty non-resident military personnel may be exempt from North Carolina motor vehicle property tax. To qualify for an exemption, you must present a copy of your Leave & Earnings Statement to the county tax office. The statement should be for the month and year in which you register the vehicle and must include your Estimated Time of Separation date and a home of record other than North Carolina.

Military spouses may also qualify for exemption if their home of record is the same as the service members. In addition to providing a copy of the LES as described above, spouses must provide:

- a copy of their military I.D. card

- a copy of their out of state drivers license, voter registration card or most current state tax return.

If the vehicle is owned by a leasing company and leased to military personnel, the exemption cannot be applied and the taxes must be paid.

When Can I Apply For A Refund Of Vehicle Property Taxes Paid

An owner can apply for a refund of taxes paid when a motor vehicle is sold or registered out of state. The refund will be calculated on any full calendar months remaining in the registration period after the license plate is surrendered to the N.C. Division of Motor Vehicles. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund.

Within one year of surrendering the license plates, the owner must present the following to the county tax office:

- Proof of plate surrender to NCDMV

- Copy of the Bill of Sale or the new states registration.

Read Also: How To Report Tax Fraud To The Irs

When Do I Pay It

- There is a one-off vehicle registration tax that you have to pay when you register the vehicle, which nowadays is based on the % of environmental emissions of CO2that your car produces. This single payment is part of the registration process.

- You are also liable to pay the annual IVTM tax, which, in Spain, is paid in the period of March to May each year, but usually at the end of April.

- You must pay on time, if you don´t you will be liable for a recargo or late payment fee of 5% in the first month, which increases to 20% and is also applicable for interest charges. In addition, you need to be aware that, as a compulsory tax, if you do not pay it, the police have the power to impound your vehicle!

How Do I Pay It

In the past it was necessary to pay your car tax or IVTM in person at your local town hall office or ayuntamiento. However, in most municipalities now it is also possible to pay directly via certain banks, or by direct debit, or in some places, you can also make the payment online.

Various municipalities may make announcements in the period running up to the annual payment period, and some ayuntamientos may send you a reminder, but as I said before, the methods of payment and the services available differ depending on the local ayuntamiento systems in place, so please dont assume you will be reminded or that you can choose from all of the payment methods I mentioned above YOU MUST find out what services are available to you in your own area.

1. Paying in person at the ayuntamiento:

You can pay in person, or presencially, at your local town hall. It is worth checking in advance if you need to have an appointment or cita previa. When making the payment in person you will need to present the following documents in order for them to process the payment.

2. Paying in person at the bank:

3. Paying by SUMA4. Paying online.

– MADRID

– BARCELONA

Don’t Miss: Are Real Estate Taxes The Same As Property Taxes

Tag & Tax Together Program

In 2005, the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. The law transfers responsibility of motor vehicle tax collection to the N.C. Division of Motor Vehicles . This new Tag & Tax Together program was designed as a convenient way to pay annual vehicle tag renewals and property taxes in one transaction.

Beginning with renewal notices mailed in July 2013 and due in September 2013, your registration renewal and property tax will be due the same month each year. The NC DMV will send a new combined notice that includes both the vehicle registration fee and property taxes. You will not be permitted to renew your tag without paying all taxes owed on the vehicle.Please see the Tag & Tax Together Frequently Asked Questions section at the bottom of this page for additional information.

If you received a Combined Vehicle Registration Renewal and Property Tax Notice and have questions, please visit this page.

Making Tax Payments Simple

We realize that tax administration can be difficult, so we strive to make paying your taxes as simple as possible. We have created a Tax Portal that allows for same-day and future payments for all taxes administered by the Division of Taxation.

We allow for estimated payments, extension payments, payments with a tax filing, license renewal payments, bill payments and payments for various fees.

If you need help getting started, feel free to call us at or email at . If you are not ready to transition to the Tax Portal, we also support various legacy payment options, listed below.

Also Check: Do You Have To Pay Taxes On Life Insurance

What Is Motor Tax

You are legally required to have motor tax and display your motor tax discif you want to drive your vehicle in a public place. Motor tax is a chargeimposed by the Government on most motor vehicles, and it is collected by localauthorities.

To pay motor tax, you can tax yourvehicle online, visit your localmotor tax office or request the forms and complete them by post. A motortax disc is issued for 3, 6 or 12 months and how the rate is calculateddepends on your type of vehicle.

You should get a reminder about a month in advance if you are renewing yourmotor tax, and there are no changes in ownership or in the car details.

If you dont get a reminder, you can check your status onlineon motortax.ie.

Pay Or View Taxes Online

Quality Data Service and Invoice CloudThis is a fee-based service

- The fee for an e-check payment is $1.95 for real estate, personal property and motor vehicle.

- Tax bill online payment options include MasterCard, Visa, Discover, American Express, Apple Pay, Google Pay and PayPal. All credit transactions are subject to a 2.95% fee with a minimum charge of $1.00.

- The credit card fee for sewer use charges is a flat fee and has a maximum payment cap amount.

1709Paying Motor Vehicle Taxes online DOES NOT automatically clear you with the DMV.

Don’t Miss: When Does Tax Season End 2022

Important Dmv Release Notice

All outstanding vehicle taxes associated with your name and/or VIN#/plate #, including taxes not yet delinquent, must be paid in full for a release to be issued.

DMV System Upgrade: as of November 16,2015, the DMV no longer accepts paper tax releases.

DMV Delinquent Tax Release:

- Payments made in full will be posted to the account within 24 hours. A mass release file is sent electronically to the DMV daily after the posting of all payments, DMV files are then updated nightly during the work week. Please allow 48 hours for a release.

- Payments posted & paid by cash, money orders or certified bank check will be cleared using the above process.

- Payments made by personal checks in office or by mail will have an automatic five business day hold, unless you provide proof of payment before that time.

- All payments made online before 8 pm Monday-Thursday are uploaded & posted on the next business day . All payments made after 8 pm Monday-Thursday allow 48 hours to be posted. Payments made after 8 pm on Friday-Sunday would not be posted until the following Tuesday.

Convenience Fees for Online Payments

- ACH-Checking/Savings Account

Board Of Supervisors Approves 15% Tax Relief On Personal Property Taxes

Vehicle values climbed by an average of 33% or more as of Jan 1, 2022 according to the J.D. Power pricing guide. To help vehicle owners, the Fairfax County Board of Supervisors approved 15% tax relief for personal property taxes as part of their FY 2023 budget markup. This will be accomplished by assessing vehicles at only 85% of their market value rather than the normal 100%. This option is provided for the County to ensure the assessments do not exceed actual fair market value due to unusual or extenuating circumstances and when an assessment ratio lower than 100% may reasonably be expected to determine actual fair market value.

Use our vehicle value tax calculator to estimate your taxes for the year.

Read Also: Do Retirees Need To File Taxes

First Tax Payment When You Register The Vehicle

Youll pay a rate based on a vehicles CO2 emissions the first time its registered.

This also applies to some motorhomes.

You have to pay a higher rate for diesel cars that do not meet the Real Driving Emissions 2 standard for nitrogen oxide emissions. You can ask your cars manufacturer if your car meets the RDE2 standard.

| CO2 emissions | Diesel cars that meet the RDE2 standard and petrol cars | All other diesel cars | Alternative fuel cars |

|---|

This payment covers your vehicle for 12 months.

Changing A Vehicles Use

To change a vehicles use from commercial use to private use or fromprivate to commercial, contact your localmotor tax office to see if they will accept your vehicles change ofclassification and find out what documents they require.

Changing the classification of the vehicle may also change the amount ofmotor tax you need to pay. You should contact your localmotor tax office for information on this.

Don’t Miss: How To File An Extension Taxes

Paying Personal Property Taxes In Virginia

You can pay your personal property taxes using your online bank account. When using this method to pay taxes, you should make a separate payment for each tax account number. If you are filing a single tax return, please keep the personal property tax and VLF amounts as one grand total for each tax account number. You can check to see how much personal property tax you paid in Virginia by going to the Virginia State Division of Motor Vehicles website. For more information, contact the Personal Property Tax Division at 501-4263 or the Virginia Department of Finance.

What Happens If You Dont Pay Your Personal Property Taxes In Arkansas

If you fail to pay property taxes in Arkansas within one year of the due date, your home will be forfeited to the state. Property taxes in Arkansas are due on October 15.

Property owners in Arkansas are required to pay property taxes. If you do not pay your property taxes, you may lose your home. Taxation is based on the amount of money a property is worth. If you dont catch up on past-due payments, your house may be repossessed. According to Arkansas law, you have the right to redeem the home before certification and until the sale. All taxes, penalties, interest, and costs are due in order to redeem the property. If you do not redeem the title, the Commissioner transfers it to the person or entity that paid for it at the tax sale.

The lien on a home is usually assigned to the owner%27s tax lien more than the lien on a mortgage. If you sell your home through a tax forfeiture process, your mortgage will be wiped out. In other words, the loan servicer is likely to advance funds to pay delinquent property taxes in order to avoid this happening. Each month, you must pay approximately one-twelfth of the estimated annual property tax bill. Tax and other escrow expenses are then covered by the loan servicer on your behalf. When taxes are due, having an escrow account saves you from having to come up with a large sum of money.

Don’t Miss: When Are Tax Payments Due 2022