Get Help With Tarrant County Delinquent Property Taxes Now

Tax Ease is ready to help you with Tarrant County delinquent property taxes. We offer loan options with some of the lowest interest rates in the business, and we have a ton of experience helping Texans get their finances back on track. Reach out to us today or fill out an application to get the process started.

The Fort Worth Property Tax Lobby

There is only one location of the Property Tax Lobby in downtown Fort Worth. You can pay your taxes with a check, cash, a money order, online payments, debit cards, and credit cards. In Tarrant County, the median home value is $176,600. It may appear to be a small amount, but Tarrant County homeowners pay an average of $3,581 in real estate taxes. As a result, Tarrant Countys average effective property tax rate is quite high, at 2.10%. You can find out how much of your current taxes are due by going to the Property Tax Account Lookup application or calling us at 972-547-5020.

What Is The Fastest Way To Pay Off Tarrant County Delinquent Property Taxes

The quickest and easiest way to settle your Tarrant County delinquent property taxes is through a loan. It will immediately remove tax liens placed on your property and take care of your debts. Then, you can pay back the lending authority on the terms set in your contract, which are usually more affordable than the penalties youll rack up in delinquency.

You May Like: New York State Tax Refund Number

Your California Privacy Rights

If you are a California resident, you have the additional data rights listed below. You can exercise some of these rights by utilizing the prompts within messages we send you within your account settings, or within the privacy settings on our web pages. Otherwise, you are also able to exercise these rights by contacting our support team using the privacy support emails listed at the end of this Policy. Please note, if we cannot verify your identity we may deny certain data right requests. You can designate an authorized agent to submit requests on your behalf, but we require written proof of the agents permission and verify your identity directly.

California Civil Code Section 1798.83 permits our visitors who are California customers to request certain information regarding our disclosure of personal data to third parties for the third parties direct marketing purposes. To make such a request please send a letter to: Governmentjobs.com, Inc., 300 Continental Blvd. Suite 565, El Segundo, CA 90245 Attn: Privacy Department. Requests must include California Privacy Rights Request in the first line of the description and include your name, street address, city, state, and ZIP code. Please note Governmentjobs is not required to respond to requests made by means other than through the provided mail address.

Personal Data We Collect About You And Why

In this Section we set out general categories of personal data we may collect and the purpose for using your personal data, including the personal data collected and processed over the past year. We collect and process personal data to provide you the Services, fulfill our contractual responsibility to deliver the Services to our Customers, fulfill your requests, and pursue our legitimate interests and our business and commercial purposes. We also automatically collect data during your usage and collect other personal data about you from other sources. Your personal data will only be collected and used for purposes stated herein, where you provide additional consent, or as required by law or regulation – including national security or law enforcement requirements.

Information Provided by You.

We collect personal data from you directly when you visit our Services from either your computer, mobile phone, or other device, attend one our events, or communicate with our personnel. The categories of personal data we collect from you, including over the past year, involve the following:

You may voluntarily submit other personal data to us through our Services that we do not request and are not required for the relevant data processing activity. In such instances, you are solely responsible for such personal data.

Information Collected Automatically.

Information from Other Sources.

Information Collected When Using the PowerLine Application

Also Check: California Tax On Capital Gains

How Your Tarrant County Property Tax Bill Works

In Tarrant County, property tax statements are usually mailed in the first week of October. If you dont get a property tax statement, its important to contact the County or print a statement online. If you miss the deadline to pay your property taxes, I never got a statement in the mail will not work as an excuse for non-payment. Penalty and interest will still accrue.

The last day to pay your property taxes without incurring a late penalty is Jan. 31. All payments must be processed on or before 12 a.m. Central Standard Time on that date. If youre late making a property tax payment in Tarrant County, a penalty fee and interest will accrue.

The amount of penalty and interest applied to your bill will depend on how late your payment is. Beginning in February, late bills are subject to a 6% penalty and 1% interest. In March, the penalty jumps to 7% and the interest rate jumps to 2%. Penalty and interest continue to climb as the months tick by. By July, the combination of penalty and interest amounts to 18%. These steep penalties are why it behooves you to get your Tarrant County property tax payments in on time.

If you pay your property tax bill and then the County belatedly approves an exemption application or an appeal of your assessed property value , the County will issue you a refund check. Such property tax corrections can go in the other direction, too. If the County decides that you paid too little it can issue a supplemental tax bill requesting additional money.

Who Really Owns Your Property In Texas

Property taxes are among the most important and necessary expenditures that Texans make. Even if you pay taxes on a property, you are not legally entitled to own it. In Texas, regardless of who pays the taxes, the property is owned by whoever has clear title. Paying your property taxes on time does not guarantee you will be able to own the property rather, paying your property taxes on time does not guarantee your legal ownership. If you have any questions about property ownership in Texas, you should consult with an attorney. While a clear title can be a complicated issue, it is critical to consult an attorney if you have any questions about your rights or responsibilities.

Also Check: Where’s My Tax Refund Pa

Tarrant County Tax Penalty Avoid Penalties Pay Your Taxes By January 31 2014

The last day to pay 2013 property taxes to avoid penalty and interest is Friday, January 31, 2014.

All eight of the Tarrant County Tax Office locations are open Monday through Friday from 8:00am to 5:00pm to assist taxpayers with their property tax payments, but we encourage taxpayers to pay on-line whenever possible to avoid the crowds, stated Ron Wright, Tarrant County Tax Assessor Collector.

DONT STAND IN LINE ** PAY ON-LINE. Property taxes can be paid on-line at www.tarrantcounty.com by Visa, MasterCard and Discover.credit/debit cards, Credit/debit card payments are subject to convenience fees. In addition, on-line eCheck payments can be made for no additional convenience fees. Pay-by-phone is available 24/7 at 817.884.1110. All Tarrant County Tax Offices take over-the-counter credit/debit card payments- subject to convenience fees. If payment is being made by mail on January 31, it is recommended the taxpayer obtain a postmark validation from the post office.

Visit the Tarrant County Tax Office website at www.tarrantcounty.com or call the Customer Service Center at 817.884.1100 if you need additional assistance, locations of our tax offices or more information.

Most Recent

Sep How To Pay Your Property Taxes In Tarrant County

If you own property in Tarrant County, you are responsible for paying property taxes. The Tarrant County Tax Office accepts payments for property taxes in person, by mail, or online. In person: You can pay your property taxes in person at the Tarrant County Tax Office, located at 100 E. Weatherford Street, Suite 200, Fort Worth, TX 76196. The office is open Monday-Friday, 8:00am-5:00pm. By mail: You can also pay your property taxes by mail. To do so, simply send your payment to the Tarrant County Tax Office, P.O. Box 5690, Fort Worth, TX 76115. Online: The Tarrant County Tax Office also accepts online payments for property taxes. To pay online, you will need to create an account on the Tarrant County website. Once you have created an account, you will be able to log in and pay your property taxes.

The Tarrant County property tax rate is set by the county. In Tarrant County, the median home price is $170,300. Even though the median real estate tax in Tarrant County is $3,581, property owners pay a lot of money. As a result, Tarrant Countys effective property tax rate is quite high, at 2.10%.

Read Also: Lee County Tax Collector Fort Myers

The Pros And Cons Of Paying Taxes With A Credit Card

When you use your credit card to pay taxes, you will almost certainly incur a processing fee, which may amount to a significant portion of your payment. Furthermore, it is not always possible to receive free tax payment processing by credit card companies. The convenience of paying taxes with a credit card may be an excellent option for people in need of money quickly, but there are also a few better options if you have enough time to wait for a bank transfer.

Tarrant County Property Tax Loans

We are ready to help solve your Tarrant County property tax loans needs! Property Tax Funding offers a quick and easy application process with flexible payment plans and fast closings. Our property tax loans are only available for residential and commercial properties located in Tarrant County and throughout Texas.

Why Property Tax Funding?

-

Low Rate Guarantee lowest rates in Texas.

-

Easy Application and Fast Closings loans close in days.

-

Easy Qualification prior credit problems are not an issue.

-

Flexible Repayment Terms loan terms up to 10 years.

-

Zero Down Closings no out of pocket closing costs.

-

All Loans Serviced in House we will not sell your loan or your information.

Recommended Reading: Wv State Tax Department Phone Number

Tax Rate Calculation Worksheets

Updates to this page are ongoing. Please check back often if you do not find the information you need. Thank you.

Taxing Unit

Accessibility Notice: Due to the nature of these documents, they are provided as scanned images. If you require assistance in accessing the information, please contact the Tax Office at 817-884-1100.

Protesting Property Taxes In Tarrant County

The Tarrant Appraisal District determines the value of residential and commercial property each year. Tarrant County property taxes are based on this assessed value.

As a property owner, you may disagree with the appraisal districts findings. If you believe that the appraisal district has valued your property at more than it is worth, you have the legal right to file a protest to lower the amount of property taxes that you are paying.

Don’t Miss: Haven T Received Tax Return

Overview Of Tarrant County Tx Taxes

Tarrant County, Texas, whose county seat is Fort Worth, is one of the most populous counties in the country. At 2.10%, the county also has the fifth-highest average effective property tax rate of Texas’ 254 counties.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

When To Pay Property Tax

On February 1, current year taxes become delinquent and will incur penalty and interest.

An additional collection penalty will be charged on accounts that are delinquent on April 1 for personal property or July 1 for real property. Mineral accounts are considered real property.

The collection penalty will be 15 percent or 20 percent of the total taxes, penalties and interest due, depending on your taxing jurisdiction. After July, interest continues to accrue at 1 percent per month.

Taxes not paid by January 31 will increase, unless the half payment or a quarterly installment is applied to the account.

Half Payments: The first installment must be paid on or before November 30. The second installment must be paid on or before June 30.

Installment Payments for Over 65 or Disability Exemption: Due January 31, March 31, May 31 and July 31.

Penalty and Interest will be applied to accounts paid after the due date.

You May Like: How Much Property Tax In California

Calculating Property Taxes In Tarrant County

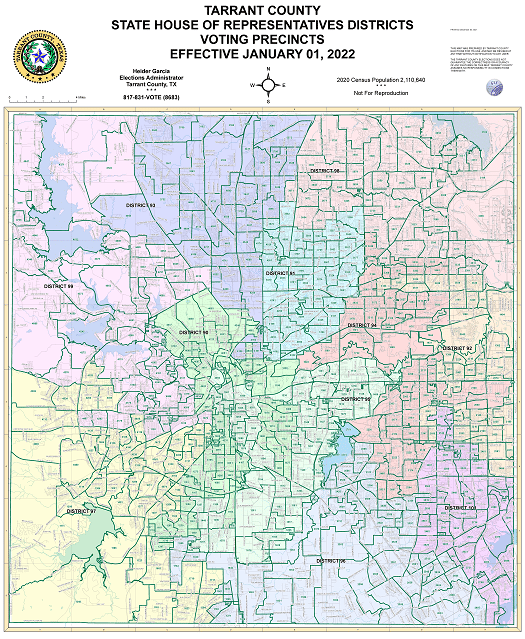

Property taxes are calculated based on assessed value each year. Rates vary based on the taxing entities associated with each property, including the city, school, and water district. For example, some taxpayers in Tarrant County could owe taxes to Tarrant County College or JPS Health Network based on the propertys taxing entity boundary.

Due to these factors, well use 2.5% or 0.025 per $100 as the tax rate for our example.

To calculate estimated taxes in Tarrant County, lets use a home with an assessed value of $750,000. The property is located in Colleyville, and the school is Grapevine-Colleyville Independent School District. Using the aggregate tax rate above, the homeowner could owe $18,750 in property taxes for the year.

Again, this is just an estimate and does not account for tax exemptions, taxing entity boundaries, etc.

If you are a homeowner in Tarrant County, the Tarrant County Appraisal District website provides current tax rates and other information for homeowners. This information can also be used to help estimate what you could owe in property taxes.

Introduction Scope Of This Policy

The purpose of this Privacy Policy is to describe how we collect, use, store, protect, and disclose personal data online and offline. This Policy applies to personal data we collect or use, and applications owned or controlled by Govermentjobs.com, Inc. , including our related brands NEOGOV.com, NEOED.com, Governmentjobs.com, Schooljobs.com, and our mobile app , or affiliated companies .

By using any part of the Services you agree that you have read this policy, your personal data will be processed as described herein, and you agree to be bound by this Policy. This Policy is incorporated into our Terms of Use. Definitions not explicitly defined herein shall retain the meaning as prescribed in the Terms of Use. Any dispute related to privacy is subject to the Terms of Use and this Policy, including limitations on liability.

We are the controller for the personal data discussed in this Policy, except as noted in the Where We Are a Service Provider section below.

You May Like: South Carolina Income Tax Rates 2021

How To Protest Property Taxes In Tarrant County

We recommend protesting your appraised value, even if you file on your own. To contest your property taxes, you will need to do the following:

For the best chance at lowering your property taxes, hire a trusted property tax reduction firm like NTPTS. To get started, register your property with our company.

How High Can Tarrant County Delinquent Property Taxes Get

Quite high. If your payment is late, youll immediately incur a 6% penalty and 1% interest fee in February, and each of these rates will go up for every month you dont pay in Tarrant County. Texas property tax penalties are notoriously strict, and theres an even bigger penalty that hits in July. Take a look at our Property Tax Penalty Chart to see just how your rates will rise.

During this time, a tax lien can also be placed on your property. Tax liens can cause you to lose your property to the government, and it will eventually be sold at auction.

Recommended Reading: Walmart Tax Refund Advance 2022

Want To Split Your Tarrant County Property Tax Bill Into 2 Payments Time To Act

If you want to pay your property tax bill in two installments, you have until Wednesday to make your first payment to qualify for the half-payment option.

Taxpayers who make qualifying and timely first installment payments have until June 30, 2023, to make their second payment, Wendy Burgess, Tarrant County tax assessor, said Monday in statement.

The tax office began mailing property tax statements in October. Statements can be obtained from the payment portal at taxonline.tarrantcounty.com/etax/ or by emailing to request one. Taxpayers can sign up for paperless billing to receive future statements via email.

Taxpayers who do not choose the half-payment option have until Jan. 31, 2023, to pay the full amount to avoid penalty and interest.

Payments can be made any of the eight tax office locations between 8 a.m. and 4:30 p.m. Monday through Friday. Electronic checks and credit cards are accepted at taxonline.tarrantcounty.com/etax/ or by phone at 817-884-1110.

For more information, call 817-884-1100 or email at .