If You Choose To Paper Filing

Returns sent by mail must be addressed correctly, have sufficient postage, and be postmarked by the U.S. Postal Service on the deadline. See the previous section for deadline information. Send returns via the U.S. Postal Service to one of these addresses, .

Visit www.taxbandits.com/form-941/941-mailing-address/ to learn more about the 941 mailing addresses.

What Are Payroll Taxes

First, let’s define what is meant by “payroll taxes.” They are the taxes you must pay on your payroll . Payroll taxes are reported and paid through IRS Form 941, the quarterly wage and tax report required for all employers. These taxes are:

- Federal income taxes : These are taxes you withhold from your employees’ paychecks. FIT pays for federal expenses such as defense, education, transportation, energy, and the environment, as well as for interest on the federal debt.

- FICA taxes : These are taxes you withhold from employees and the matching amount you set aside to be paid by your company. FICA stands for Federal Insurance Contributions Act.

Know The Tax Deadlines That Apply To You So You Don’t Get Hit With Irs Penalties Or Miss Out On A Valuable Tax Break

Getty Images

If you miss a tax deadline, the IRS can hit you hard with penalties and interest. For instance, the standard penalty for failing to file your annual tax return on time is 5% of the amount due for each month your return is late. If you pay your taxes late, the monthly penalty is 0.5% of the unpaid amount, up to 25% of what you owe, plus interest on the unpaid taxes. Similar penalties apply for missing other deadlines. And there could also be other negative consequences for being late, like losing out on a valuable tax break.

It’s easy to avoid these headaches, though just don’t miss the deadline! But we realize that it’s not always easy keeping track of all the various IRS due dates. So, for those of you who need a little help remembering when to file a return, submit a report or pay a tax, we pulled together a list of the most important 2022 federal income tax due dates for individuals. There’s at least one deadline in every month of the year, so play close attentionwe don’t want you to get in trouble with the IRS.

NOTE: Some of the 2022 due dates listed below are extended for victims of recent natural disasters. In addition, several 2021 due dates were extended to January 3, 2022, for other natural disaster victims. In the case of Mississippi water crisis victims, several 2022 deadlines are pushed into 2023. For more information on these extensions, see our articles for victims of:

Don’t Miss: How To Report Tax Fraud To The Irs

Getting Started With Employees

When you hire your first employee, you’ll need to get a federal employer identification number from the IRS if you do not already have one for your business. You may also need to get state and local tax numbers as well. In addition to assigning an employer identification number for use on all your correspondence, deposits, returns, and other documents, the tax agencies will usually supply you with information about your specific payroll tax obligations and may supply the forms you’ll need to use when you deposit the taxes and file returns.

For federal payroll tax purposes, you will have both reporting and depositing obligations. Although these relate to the same liability, the tax returns and tax deposits are generally done separately:

- Federal tax deposits must be made on a periodic basis.

- Federal tax returns must be filed on a quarterly or annual basis.

Also, it is important to note that different deposit rules apply to income and FICA taxes and to FUTA taxes.

Act now

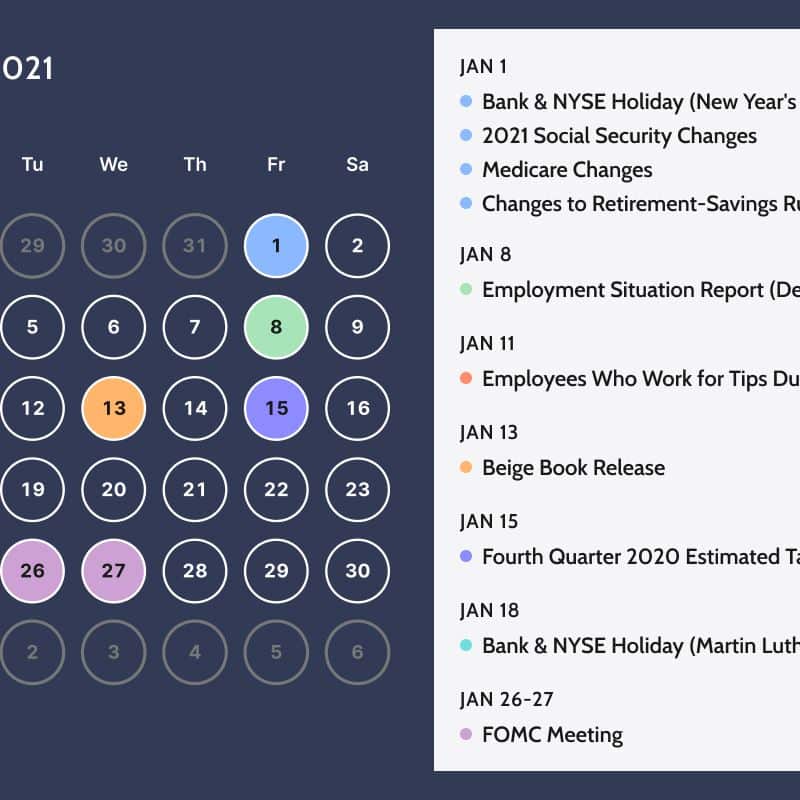

The multiple filing and due dates can be difficult to calculate and remember. In order to prevent missed deadlines, the IRS publishes an annual calendar of due dates: Tax Calendars for 2021 .

The IRS also provides a free, downloadable Tax Calendar that contains all the federal tax due dates for the year, as well as an electronic reminder system. This calendar is available on the IRS website.

May 2022 Tax Due Dates

|

Date |

|

|---|---|

|

Tips for April 2022 Reported to Employer |

|

|

May 16 |

Arkansas, Illinois, Kentucky and Tennessee Storm, Tornado and Flooding Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

|

May 16 |

Colorado Wildfire Victims’ Extended Deadline for Filing and Payment Obligations from January 1 to May 15 |

After a busy April, things slow down considerable in May for most people. There’s the typical deadline for employees to report tips received in April to their boss. That’s due by May 10.

In addition, victims of certain natural disasters also have extended due dates on May 16. First, victims of the severe storms, tornadoes and flooding in Arkansas, Illinois, Kentucky and Tennessee that began on December 10, 2021, can wait until May 16 to file federal returns or pay federal taxes that were supposed to be due between December 10 and May 15. People impacted by the Colorado wildfires that started on December 30, 2021, also have until May 16 to file returns and pay taxes originally due from December 30 to May 15.

Also Check: Minimum Income To File Taxes

Federal Employment Tax Schedules Deposits And Reporting

|

Deposit taxes for payments made Saturday Tuesday by the following Friday. |

The next business day. |

|||

|

Reporting Dates |

Report your total taxes deposited for the quarter, using Form 941, by April 30, July 31, October 31 and January 31. |

Report your total taxes deposited for the quarter, using Form 941 and Form 941 Schedule B, by April 30, July 31, October 31 and January 31. |

Report your total taxes deposited, using Form 941, by January 31. |

Report your total taxes deposited for the quarter, using Form 941 and Form 941 Schedule B, by April 30, July 31, October 31 and January 31. |

Federal And State Unemployment Insurance Taxes

Both federal and state unemployment insurance taxes are paid entirely by the employer.

-

FUTA taxes are owed if you paid a minimum of $1,500 in wages in the previous calendar year or quarter. Deposits are due the last day of the first month that follows the end of the quarter.*

-

Each state also has specific rates and deposit schedules. This article by the Small Business Administration has links to each of the state unemployment insurance tax office.

-

California, Hawaii, New Jersey, New York, Rhode Island and Puerto Rico also require that employers pay for temporary disability insurance.

Also Check: Selling House Capital Gain Tax

How The Irs Determines Payroll Tax Deposit Dates

You cant deposit payroll taxes whenever you want. Your schedule and frequency is based on a lookback period. Here are the steps to find the correct payroll deposit dates for your business:

Find the lookback period: The lookback period is the time frame you use to determine whether you deposit taxes on a monthly or semiweekly basis. Your tax liability during the lookback period determines which schedule you must follow. The lookback period if youre using Form 941 starts July 1 of one calendar year and runs to June 30 of the next calendar year.

Federal Income Social Security And Medicare Taxes

When are federal withholding taxes due? And, when are Social Security and Medicare taxes due? The good news is that all three of these taxes are due at the same time. The bad news is that the due date depends on your business and when the IRS tells you to pay the taxes.

But, theres good news again! There are only two deposit schedules: semiweekly or monthly. Every employer must use one of these schedules. You do not get to choose your schedule. When to pay federal payroll taxes depends on the IRSs guidelines. The IRS bases your deposit schedule on a lookback period.

If you are a monthly depositor, deposit all federal income, Social Security, and Medicare taxes by the 15th day of the following month. For example, taxes you incur in January are due by February 15. If the 15th day falls on a banking holiday or weekend, deposit on the next business day.

Remember that the pay date plays a role in paying the taxes if youre a monthly depositor. For example, you pay your employees semimonthly. You pay your employees on February 15 for the pay period January 15 through January 31. The taxes for that pay period are due March 15 because you paid your employees in February even though the pay period was in January.

Semiweekly depositors must follow a strict tax deposit schedule:

To learn even more about monthly and semiweekly deposit schedules, check out IRS Publication 15.

Read Also: Sale Of Second Home Tax Treatment

Apa’s Payroll Tax Calendar For 2022

Payroll professionals need to keep track of a dizzying number of federal tax reporting and withholding deadlines, as well as reporting requirements, throughout the year. The APA Compliance Calendar for 2022 has been released on the APA website and makes sense of all of these due dates.

The Compliance Calendar includes the filing dates for Forms 941, deposit due dates for withheld federal employment taxes, as well as the requirements for filing and distribution of Forms W-2, 1095-C, 1099-MISC, 1099-NEC, and more. The calendar also includes the dates within which employers may make lawful shortfall deposits.

Not a member of APA? Check out the many benefits you get when you join!

Edward Kowalski, Esq. is Manager, Payroll Information Resources, for the APA.

Why You Should Follow This Golden Rule

Since the IRS has identified small businesses as the largest source of uncollected taxes theyre pretty serious about solving this problem. Its considered a federal crime not to comply and employers are 100% personally liable for these taxes, even if youre incorporated as a limited liability company. This means that even if your company has filed for bankruptcy, the IRS can still come after your personal assets.

Should you find yourself in a financial bind when your employment taxes are due, the IRS has a special installment agreement that gives you the ability to spread your payments out incrementally.

Don’t Miss: How Much Do You Have To Make To Claim Taxes

Federal Payroll Return Requirements

Along with actually depositing your federal payroll taxes, you also have an obligation to file periodic returns that show how you computed your tax liabilities. As is true for deposits, the returns you must file for your income and FICA taxes are different from the returns you file for your FUTA taxes.

Federal Income Tax And Social Security And Medicare Tax

In general, employers who withhold federal income tax, social security or Medicare taxes must file Form 941, Employer’s Quarterly Federal Tax Return, each quarter. This includes withholding on sick pay and supplemental unemployment benefits.

File Form 945, Annual Return of Withheld Federal Income Tax, if you are filing to report backup withholding.

Recommended Reading: Calculate Pay Check After Taxes

Monthly Deposit Schedules Vs Semi

boonchai wedmakawand / Getty Images

As a small business owner, one of your most important responsibilities for payroll is to make sure federal payroll taxes are deposited according to IRS requirements.

The payroll process includes:

- Accounting for amounts withheld from these paychecks

- Making deposits of taxes withheld from paychecks

- Reporting on taxes withheld and deposits made

This article gives you the basics of the deposit part of this process.

Payroll Services And Payroll Software

If all of this work seems overwhelming, consider either a payroll service orpayroll software. A payroll service is an outside company that takes over all of your payroll functions, including sending out reports and payments when they are due, for both federal and state payroll taxes.

Payroll software can help you with all the details and can make the deposits for you by connecting with your payroll account. Be sure the software can remind you when payments are due.

Read Also: I Claimed 0 And Still Owe Taxes 2021

Payroll Tax Due Dates

Reports and deposits are listed by due date. When the due date falls on a Saturday, Sunday, or legal holiday, the next business day is considered the last timely date.

Reports and deposits listed by due date. Reports included in this table:

- DE 9 Quarterly Contribution Return and Report of Wages

- DE 9C Quarterly Contribution Return and Report of Wages

- DE 3BHW Employer of Household Worker Quarterly Report of Wages and Withholdings

- DE 3HW Employer of Household Worker Annual Payroll Tax Return

- DE 88 Payroll Tax Deposit

- DE 88 Payroll Tax Deposit

| Due Date |

|---|

Preparing And Filing Form W

At the end of the year, the employer must complete Form W-2, Wage and Tax Statement, to report wages, tips and other compensation paid to an employee. File Copy A of all paper and electronic Forms W-2 with Form W-3, Transmittal of Wage and Tax Statements, to the Social Security Administration . File Copy 1 to an employees state or local tax department.

Recommended Reading: State Of Oklahoma Tax Refund

Payroll Tax Penalties Can Be Severe

There really aren’t too many opportunities for reducing your exposure to payroll taxes. If you hire employees and pay them any kind of compensation, it’s a given that you’re going to have some payroll tax liabilities.It is unwise to try and avoid employment tax liability by classifying your workers as independent contractors. The IRS, the Department of Labor and their state counterparts are aggressively targeting employers to uncover misclassification, and the penalties are severe.

Perhaps your biggest opportunity for realizing any kind of real savings is to make sure you tend to each of your obligations and avoid getting hit with penalties. Many of the potential payroll tax penalties are the same ones you’ll find when you’re dealing with other types of taxes. For example, there are both criminal and civil penalties for failing to timely file payroll tax returns or to timely deposit taxes you owe.

There are, however, a couple of penalties of which you should be particularly mindful as you deal with your payroll tax obligations:

100 percent penalty. The biggest risk you face in administering your payroll tax obligations is that you can be held personally liable for all income and FICA taxes that you willfully either fail to withhold from your employees’ wages or fail to pay to the IRS and your state tax agencies.

In some cases, a reckless disregard of obvious facts will suffice to show willfulness.

An Overview Of Federal State And Local Payroll Tax Deposit Schedules

From the moment you hire your first employee, you quickly realize theres a lot more to payroll than simply issuing a check. For example, there are federal, state and even local taxes that need to be deposited and reported. Of course, just to keep things interesting, theres an accompanying maze of deadlines. But dont worry, this article will help keep you on the right path.

Read Also: Hr Block Free Tax Filing

Required Filings And Due Dates

Find information and resources about required filings and due dates to help you follow Californias payroll tax laws.

Employers are required to report specific information periodically. You can find more detailed information to follow in the California Employers Guide . We also offer no-fee seminars to help you follow Californias payroll tax laws

You are required to electronically submit employment tax returns, wage reports, and payroll tax deposits to us. You can use e-Services for Business to fulfill this e-file and e-pay mandate.

Tax Deposit Due Dates

In general, there are different due dates for the deposit of taxes depending on the return the taxes are reported on, past filing history and additional factors. These deposit due dates often are different from the filing due dates of tax returns.

You must use the Electronic Federal Tax Payment System to make all federal tax deposits. Depositing the taxes alone does not report the taxes or relieve you of the requirement to file a return. If the due date for making your deposit falls on a Saturday, Sunday, or legal holiday, then you may make your deposit on the next business day.

Don’t Miss: Lovetothe Rescue.org/tax-receipt

Futa Tax Return Rules

Unlike income and FICA tax returns, which are due quarterly, the FUTA return is an annual return. The deadline for filing Form 940, Employer’s Annual Federal Unemployment Tax Return is January 31 following the end of a calendar year. However, the “Saturday, Sunday, Holiday Rule” applies if the due date falls on a non-business day. For example, the deadline for filing your 2015 FUTA tax return is January 31, 2016. But this day is a Sunday, so the return will be due on February 1, 2016.

If you’ve been timely with each of your FUTA tax deposits during the year, you’re entitled to an automatic 10-day extension. The IRS may allow you a further extension upon your written request..

How To Avoid Form 941 Late Filing Penalties

You can avoid penalties and interest if you do all of the following:

- Deposit or pay your taxes on or before the deadline, using EFTPS.

- File your fully completed Form 941 on time.

- Report your tax liability accurately.

- Submit valid checks for tax payments.

- Furnish accurate Forms W-2 to your employees.

- File Form W3& Copies A of Form W2 with the SSA on time & accurately.

You May Like: How Does Tax Write Off Work