What Happens If You Don’t Pay West Virginia Property Taxes

In West Virginia, the first installment of taxes is due on September 1st and becomes delinquent on October 1st. The second installment is due on the following March 1st and becomes delinquent on April 1st. .

The tax lien, including interest and other charges, attaches to the home on July 1st. . The sheriff can then sell the lien at a tax lien sale, which is a public auction, sometime after October 14 and before November 23. . The property is sold to the highest bidder who pays at least the amount of taxes, interest, and charges. .

The high bidder gets a certificate of sale. . If no one makes a bid, the sheriff will issue the certificate to the state auditor. .

Important Information About The Tax Office

After the assessor places property, real and personal, on the record books, the levy rates are applied and it is the duty of the Sheriff’s Tax Office to collect the taxes as assessed.Taxpayers receive a two and one-half percent discount on the first installment if paid by September 1. Postmark is accepted. This discount is applied to the second installment if paid by March 1 of the following year. Again, Postmark is accepted.The first installment becomes delinquent if NOT paid by October 1. The second installment becomes delinquent if NOT paid by April 1 of the following year. Interest is accrued at nine percent per annum.Taxes remaining unpaid after April 30 are subject to publication. If delinquent taxes are published, additional fees will be charged.

Property Tax Amendment Could Cost Schools And Local Governments $515 Million Take Control Away From Local Governments And Voters

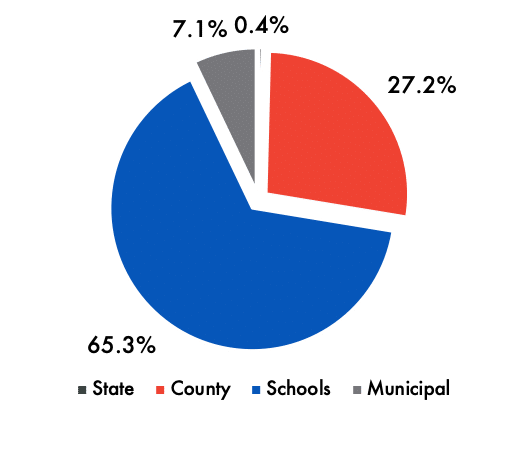

Earlier this week, the West Virginia Legislatures Joint Committee on Finance heard from a West Virginia Association of Counties official about the significant potential fiscal impact of the Property Tax Modernization Amendment. If passed, the amendment which will be on the ballot this November for voters to consider would lead to the fulfillment of a long-term goal of state legislators to take control of a significant portion of property tax revenue in order to give mostly out-of-state businesses a large tax cut. If passed, it would amend the constitution to give the state legislature the authority to exempt business machinery and equipment, business inventory, and personal vehicles from property taxation, resulting in a severe loss of revenue for counties and local governments and marking a significant shift in power away from local governments and to state government.

According to the West Virginia Association of Counties testimony, 2021 property tax revenue included $219 million from business machinery and equipment, $84 million from business inventory, $26 million from other business personal property, $136 million from personal vehicles, and $50 million from supplemental property taxes, or taxes that were owed from previous years but paid in TY 2021, summing to a total of $515 million. At $515 million, the property tax amendment would give the legislature control of 27 percent of total local property tax revenue in the state.

You May Like: Percent Of Taxes Taken Out Of Paycheck

West Virginia Property Tax

Buying a home in the Blue Ridge Mountains? The Shenandoah Valley? If so, youll want to know about property taxes in the Mountaineer State. West Virginia has some of the lowest property tax rates in the country. Its average effective property tax rate of 0.59% is lower than all but six other states. That rate is also about half the national average. Read on to learn the most important aspects of West Virginias property tax and to learn about rates from around the state.

If youre planning a move to West Virginia or considering refinancing, youll want to take a look at our West Virginia mortgage guide. It has mortgage rates and important information on mortgages in the Mountain State.

Looking to calculate your potential monthly mortgage payment? Check out our mortgage calculator.

Notice About The Right To Redeem In West Virginia

At any time after August 31st of the year after the sheriff’s sale, and on or before October 31st of that same year, the purchaser has to prepare a list of those to be served with notice of the right to redeem and request the state auditor to prepare and serve the notice. . The auditor must send you the notice on or before the 30th day following the request. .

You May Like: What Is Real Estate Tax

West Virginia Offers Several Payment Options For Taxes

West Virginia accepts ACH Credits, ACH Debits, and Credit Card transactions. If you have: paid the debt within the previous six months do not have any outstanding balances or unfiled returns for personal income taxes and have not defaulted on previous payments, you may be eligible for a six-month payment plan. If you pay your income tax using a credit card via its website, you will be charged a 24% convenience fee. You can file and pay taxes with TurboTax separately, but you will still be charged a convenience fee by one of the payment processors .

Notice You’ll Get Before A Tax Lien Sale

The sheriff will send you , by certified mail, a notice of the delinquency along with the sale date no less than 30 days before the sale. The sheriff must also publish the notice in a newspaper or, if a newspaper isn’t available, the sheriff will post the notice in a public place. .

Look Out for Legal Changes

In this article, you’ll find details on property tax sale laws in West Virginia, with citations to statutes so you can learn more. Statutes change, so checking them is always a good idea. How courts and agencies interpret and apply the law can also change. And some rules can even vary within a state. These are just some of the reasons to consider consulting an attorney if you’re facing a tax sale.

Recommended Reading: How Much Property Tax In California

You Can Now Pay Your Bills Taxes And Other Expenses Online In West Virginia

For many West Virginia residents, the internet serves as the primary mode of payment for their shopping and banking. As youve probably been keeping up with the news, online commerce is growing at an even faster rate than previously thought. Its no surprise then that many people are looking for ways to pay their bills, taxes, and other expenses online. In West Virginia, there are numerous ways to pay bills, taxes, and other expenses online. MyTaxes, for example, can help you begin electronic payments through the ACH debit method. Visa, MasterCard, American Express, Discover, and Discover are accepted credit cards. If you need to locate your property tax bill, the treasurer and tax collectors website at http://ttc.lacounty.gov can be used. The instructions can be found on the screen. There is now nothing left to do. There is no need to be concerned. If youre looking for an easy way to pay your bills, taxes, and other expenses online, you should visit the MyTaxes website or the treasurer and tax collectors websites.

West Virginia Gov Justice Floats Car Tax Rebate Bill In Latest Amendment 2 Development

An attendee of an event at Twin Falls Resort State Park listens as Revenue Secretary Dave Hardy discusses Amendment 2.

CHARLESTON, W.Va. Gov. Jim Justice recently unveiled proposed legislation to effectively remove West Virginias personal property taxes on vehicles by providing a rebate to residents the latest development in the ongoing debate surrounding Amendment 2.

Justice, a Republican, opposes the passage of Amendment 2, while Republican leaders in the West Virginia Legislature support it.

Amendment 2 formally called The West Virginia Authorize Tax Exemptions for Vehicles and Personal Property Used for Business Amendment or the Property Tax Modernization Amendment would authorize the West Virginia Legislature to be able to change Article X of the state Constitution to exempt tangible personal property used for business activities and the tax on motor vehicles from state property taxes. The amendment does not mandate any change, leaving it up to the Legislature.

Gov. Jim Justice talks about his opposition to Amendment 2 during an event at Twin Falls Resort State Park in Wyoming County.

Justice has repeatedly said the car tax is only coupled with the tangible personal property tax as bait to entice voters to support Amendment 2.

The refundable credit is paid from the West Virginia general revenue fund and does not in any way interfere with the property tax revenue stream guaranteed to local governments and school boards since 1932, Justice said.

Justice

Recommended Reading: Irs Tax Return Copy Online

Pay Wv State Taxes With Credit Card

The West Virginia State Tax Department offers taxpayers the ability to pay their state taxes with a credit card. The credit card payment option is available for individual income tax, corporate income tax, and estimated tax payments. Taxpayers can make credit card payments online, by phone, or by mail. A convenience fee is charged for using a credit card to pay taxes.

How Property Taxes Work In West Virginia

You can pay property taxes in West Virginia in two annual installments, the first due by Sept. 1 and the second due by March 1. You will receive a 2.5% discount on each of the installments if you pay your taxes before the due date. Taxes paid at least a month late also accrue interest at the rate of 9% per year.

West Virginias property taxes are based on the assessed value of a property and the total tax rate that applies to the property. Assessed value is based on, but not equal to, the true value of the property. Homes are reappraised at least once every three years in West Virginia. The objective of the appraisal is to determine the full market value of the property the price a seller would receive for it on the market.

Assessed value is equal to 60% of that appraised value. Assessed values are updated annually based on market data, and to incorporate improvements or changes made to the property. Homeowners must be notified if assessed value increases by more than $1,000 or 10% in a given year. This gives the homeowner a chance to appeal the assessors valuation.

Recommended Reading: Deadline To File 2021 Taxes

West Virginia’s Outlier Status

West Virginias outlier status in taxing business inventory as part of tangible personal property is pinpointed as a competitive disadvantage in the WV Forward blueprint. And since businesses can simply relocate their property and operations to the majority of states that do not impose TPP taxes, they not always an optimal way of raise revenue.

Does A Mortgage Survive A Tax Deed Process In West Virginia

Property tax liens almost always have priority over other liens, including mortgage liens and deed of trust liens. Because a property tax lien has priority, if you lose your home through a tax deed process, mortgages get wiped out. So, the loan servicer will usually advance money to pay delinquent property taxes to prevent this from happening. The servicer will then demand reimbursement from you .

The terms of most mortgage contracts require the borrower to stay current on the property taxes. If you don’t reimburse the servicer for the tax amount it paid, you’ll be in default under the terms of the mortgage, and the servicer can foreclose on the home in the same manner as if you had fallen behind in monthly payments.

Read Also: States That Are Tax Free

Justice Proposes Cutting Personal Income Taxes By 50 Percent Over Three Years

Gov. Jim Justice called for a 50 percent reduction in West Virginias personal income tax over three years, calling the proposal a tsunami and the biggest tax cut in the history of this state.

In his State of the State address, Justice suggested the reduction could be 30 percent the first year, then 10 percent each of the following two years.

I hope and pray we will move and move quickly, the governor said.

This is one of several instances the governor has called for a substantial cut to the personal income tax, and the proposal has never prevailed.

In 2021, after the governor spent weeks campaigning for income tax cuts that would have been counterbalanced by raising sales taxes, the House of Delegates voted down his proposal 100-0. Last year, when the governor pushed for an income tax cut in special session, senators ignored it in favor of a rival personal income tax proposal.

This time the challenge is, Senate leaders have talked about having their own budget proposal and their own tax plan, independent of what the governor wants to do. Prior to the start of the session, the description of the Senate plan blended rebates for a range of personal property taxes along with personal income tax cuts.

Senate President Craig Blair, R-Berkeley, said earlier in the day that he would be open to the governors proposal.

House of Delegates leaders and the governor have focused on income tax cuts, although delegates also wanted to hear the specifics of the governors proposals.

Amendment Two On Personal Property Taxes Is Resoundingly Defeated

Amendment Two, the hottest issue on West Virginia ballots, was defeated on Election Night.

It was an absolute, ill-fated idea, said Gov. Jim Justice, who campaigned around the state against the amendment. The governor added, Weve heard the voice of the people.

The MetroNews decision desk called Amendment Two as defeated after the measure fell behind by thousands of votes.

With 69 percent of the vote in, MetroNews unofficial results showed 234,982 votes against the amendment and 122,768 in support.

Its a little bit of a surprise. Youre always nervous, waiting around on the results of an election, said Matt Harvey, the Jefferson County prosecutor who is president of the West Virginia Association of Counties. I really felt an energy against Amendment Two, and I think were feeling that today.

Amendment Two would allow the Legislature to exempt personal property taxes on peoples vehicles and also on what businesses pay on their inventory, equipment and machinery.

Property taxes, governed for decades by the state Constitution, are a main piece of how local governments pay for services like school systems, ambulance services, libraries and more.

West Virginia voters were being asked to decide whether to give the Legislature more authority to exempt some of those taxes.

This turned out to be the biggest race on the ballot, Harvey said during MetroNews Election Night coverage.

More Election Coverage

Don’t Miss: Iowa State Tax Refund Status

How Do I Get A Receipt For My Personal Property Tax Wv

If you paid by email and provided the email address and account number used when making the payment, you can print a receipt by returning to the Pay Taxes website and entering these details. Only tickets paid online are available for printing on the website. Our office can also assist you with any other receipt requests by calling 304-357-0210.

The Personal Property Tax On Vehicles In West Virginia

Vehicles in West Virginia are exempt from personal property taxes. In other words, 60% of the NADA low book value is tax-deductible as a vehicles value. If you are late in paying this tax, you may be able to lose your vehicle.

Mar How To Pay Your Personal Property Taxes Online In West Virginia

There are a few things to keep in mind when paying your personal property taxes online in West Virginia. The first is that you need to have your tax bill handy, as you will need the account number from it. Secondly, you will need to use a credit or debit card to pay your taxes online. And finally, be sure to confirm your payment by printing or saving a copy of the receipt for your records.

Choose Pay Taxes by Credit Card or visit https://epay.wvsto.com/tax/Default.aspx to pay with a credit card.

If you prefer to pay your personal income taxes electronically, you can do so by visiting the MyTaxes Website, where youll find the Pay Personal Income Tax link and a link for ACH Debit payment processing. The following credit cards are accepted: American Express, Discover, Visa, and MasterCard. Please see the Credit Card Payments page for more information.

If you are late on your property taxes in West Virginia, you may lose ownership of the home. Real estate owners are required by law to pay property taxes. The government uses these taxes to fund public services such as schools, libraries, roads, and parks.

Recommended Reading: How To Get My 2020 Tax Return

Overview Of West Virginia Taxes

West Virginia has some of the lowest property tax rates in the country. Its average effective property tax rate of 0.59% is lower than all but six states. That rate is also about half the national average.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Do I Still Owe Taxes If I Do Not Receive A Tax Statement

Yes, just like other bills you may owe, you are still required to pay a personal property tax even if you did not receive a statement from the Sheriff. In fact, the West Virginia legislature has included such a duty in W.Va. Code §11A-1-8. If you do not receive a tax statement before August 1st of each year, please contact our office and we will be glad to send you another copy.

Recommended Reading: Capital Gains Tax In California Real Estate