How To Speak To A Live Person At The Irs

To reach the IRS, just pick up the phone and call 1-800-829-1040. Then, prepare to wait on hold for a long time. Make sure you’re ready when the agent answers if you’re not, you will have to hang up and start the process over again.

The IRS’s phone trees are impossibly long, and although most menus let you push “9” to hear your options again, it typically only repeats once before disconnecting you.

To reach a live person at the IRS about your individual taxes, select these options: 1, 2, 1, 3, 2, ignore two requests for your Social Security Number, 2, 4.

If you want to talk with a live person about your business taxes, select these options: 1, 2, 1, 3, 2, ignore two requests for your Social Security Number, 1, 4.

Here’s exactly what happens when you call. These instructions are correct as of September 2022, but the IRS phone tree is subject to change.

- Select 1 for English

- Select 2 for personal income tax returns

- Select 1 for tax forms, tax history, or payments

- Select 3 for all other questions

- Select 2 for all other questions.

- Then, the system will ask for your Social Security Number or Employer Identification Number. It will ask twice. Just wait don’t enter anything.

- Then, press 2 for individual taxes or 1 for business taxes.

- Finally, press 4 for all other inquiries.

At this point, you will be put on hold until a live agent answers the phone. This is the fastest way to reach a real person at the IRS.

Reasons To Call The Irs

You can call the IRS for the following reasons:

- To ask questions about your tax refund.

- To get the balance due on your account.

- To check if the IRS has received a payment you’ve sent for an individual tax return.

- To ask questions about an existing payment arrangement.

- To find the location of an IRS office.

- To learn about free tax prep services for qualified people.

- To report that your W2 or 1099-R was lost, incorrect, or not received.

- To ask questions about federal taxes.

- To ask questions about tax returns or other tax-related issues.

This list covers a broad range of concerns. If you don’t see your particular issue, you may need to call one of the specific numbers listed below instead of the IRS’s general number. For some of the reasons above, the IRS has tools that are designated to answer those questions. It may often be faster to use the IRS tools rather than calling to get your answer . See the available tools below to answer some common questions without having to call the IRS.

How To Contact An Irs Agent Directly

When youre having a hard time finding an IRS agent to talk to, you should follow a certain procedure to eventually connect to the IRS customer service. You must go through several steps, but fortunately, the IRS system makes it possible to use this method for now.

Over time, the system may be updated by the IRS therefore, the way you can speak with an agent directly may change too. For now, here is the one thing you can do to talk to a real person from the IRS:

Don’t Miss: Georgia Payroll Tax Calculator 2021

What Not To Do To Try To Get Answers From The Irs

Being persistent when you call the IRS and even trying some of the tips for navigating the automated system may help you get what you need in due time. Just remember that youâre not the only taxpayer in this frustrating situationâyouâre one of millions trying to get answers.

With three stimulus rounds and the enhanced child tax credit on top of routine taxes, âthatâs a lot to put on any system, from an infrastructure and manpower standpoint,â Bell says.

What not to do? Donât put the IRS on blast on social media , and donât ask your friendsâ friend who works for the IRS to look into your case for you.

âThey canât help you. You donât want to get them in trouble,â Bell says.

Get Forbes Advisorâs ratings of the best overall tax software, as well as the best for self-employed individuals and small business owners. Get all the resources you need to help you through the 2022-2023 tax filing season.

How Do You Speak To A Live Person At The Irs

Did this post save you a ton of time and heartache? Consider buying me a cup of coffee. Thanks so much!

Also Check: Tax Credit For Wood Stove

Why The Irs Avoids Email

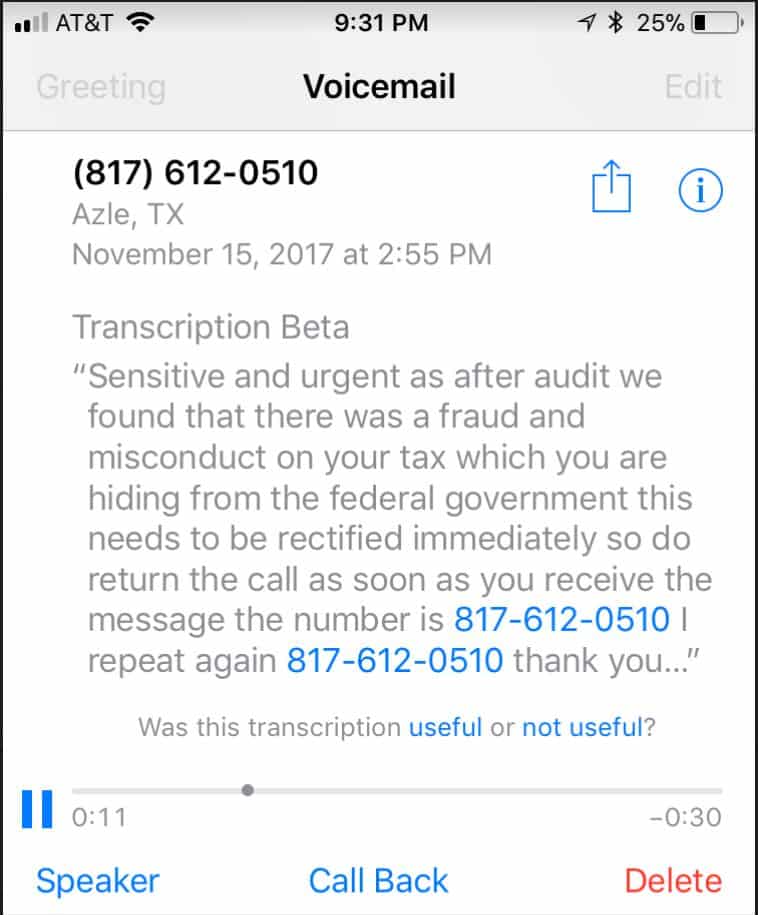

The IRS has taken a decisive stand against phishing and fraud scams. It regularly issues warnings that it will never contact a taxpayer via email, so youre most likely the target of a scam if you receive one purporting to be from the IRS. The agency only initiates contact with taxpayers through good old U.S. Postal Service snail mail, by telephone, or a personal visit, under some rare circumstances. And you probably won’t receive a call or visit if you haven’t received a mailed, paper warning first.

The phishing issue involves fake emails sent by scammers who claim to be the IRS. They seek personal information, either to issue you a refund that you never knew you had coming or to tell you that you owe taxes you werent aware of. The IRS does provide an email address for reporting this kind of activity: . But this is the email addresss only purpose. You wont receive any other type of assistance by reaching out there.

Contact The Taxpayer Advocate Service

If youâve exhausted the first three methods, it may be time to exercise your last resort: The Taxpayer Advocate Service . Itâs an independent office within the IRS that works to protect taxpayers, and itâs free to use. Since 2011, the TAS has handled more than 2 million taxpayer cases.

Every state has at least one TAS office. If you havenât been able to reach anyone at the IRS or havenât received a response in the time frame you were promised, the TAS may be able to help you if your problem is causing a financial struggle while you wait for a resolution, you may also qualify for help.

Recommended Reading: How Much Is Unemployment Tax

Rich Young Professionals Flee New York California In Droves: Study

The continuing decline in New Yorks share of the nations income millionaires should be a vivid warning sign for Gov. Hochul and the Legislature, McMahon said.

Experts have blamed a confluence of factors for the Big Apple emptying out, including the overall cost of living, pandemic-era lockdown policies and rising crime rates.

Overall, an estimated 300,000 New Yorkers reportedly left the city in 2020 taking roughly $21 billion in income with them.

Nassau County, which ranks second behind Manhattan in the number of millionaire residents in the state, lost 12 filers in 2020, according to the study of the IRS data by McMahons think tank.

Other suburban areas saw gains in millionaire filers, led by Suffolk County, which includes the Hamptons. There was an increase of 722 millionaire filers, or 21%, in 2020 compared to 2019.

The Hudson Valley also saw a net increase in wealthy earners. Westchester County became home to 233 more millionaires in 2020, while Dutchess County reported an additional 147 millionaires. Dozens more millionaire filers moved to Ulster, Putnam and Columbia counties in 2020.

The ramifications of the flight of wealth to other states could be significant for New York City and the state. A shrinkage of the tax pool could likely have an adverse impact on the funding of vital public services like schools, mass transit, and police and fire departments.

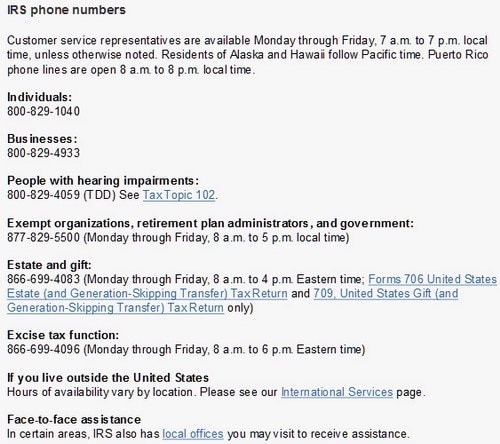

Irs Phone Numbers List For Fast Customer Service

Steve Rogers

The main IRS number is 800-829-1040. Its a toll-free number that you can use for any tax concern. There are also other IRS numbers that you can use to shorten the process and go directly to offices that handle specific issues. Weve collected a list of numbers that will help you go directly to the office that has the information you need.

Don’t Miss: Status Of Federal Tax Return

Get In Touch If You Cant Pay

Reach out to the IRS immediately if you owe a tax bill and you arent able to pay it in full. You should file your return promptly by the filing deadline and pay as much as you can at that time. The IRS might then help you work out an installment agreement to pay the balance over time.

You can easily apply for an installment agreement online. This quick communication can help minimize penalties and interest on what you owe.

Visit Your Local Irs Office

If your question or problem isnt something youre able to solve over the phone, visiting a local IRS office is an option. Sometimes sitting down face to face with a real person is the best approach, even if it isnt the fastest.

The IRS maintains several hundred local offices, sometimes called Taxpayer Assistance Centers, located in small and midsized cities as well as large metropolitan areas. You can locate an office near you with the IRS Taxpayer Assistance Center Office Locator.

If youre dealing with an issue that assistors arent able to solve over the phone or you just cant seem to get a clear answer, then an in-person visit may be the best option for you. Make sure to schedule an appointment, though, as walk-ins generally arent accepted. You can do so through the locator link above or by calling 545-5640.

Read Also: How To Report Virtual Currency On Tax Return

Making An Offer In Compromise

The IRS will always attempt to collect the full amount of your back taxes where possible. However, the IRS might agree to accept a lesser amount if it is the most the IRS could expect to collect in a reasonable period of time. Acceptance of your offer in compromise will depend on a full financial disclosure which will establish the following:

- Whether you can pay

Also Check: Donate A Vehicle Tax Deduction

Where Is My Refund

Before calling the IRS to ask about the status of a refund for the current year, we recommend that you first enter the following link where is my refund in Spanish to check the status of your refund.

If you do not get any information, first make sure you have entered your information correctly, such as the TAX ID , marital status and the value of the refund.

It is important to note that if only one of the people worked they will have to put the SSN of the person who worked, or if both worked, it is most likely that they will have to put the SSN or ITIN of the person who have higher income.

If you file your return electronically, it can take 24 to 48 hours for a report on the status of your refund to appear, if I file it on paper it can take up to 21 days before I can have a report online, if I send it on paper along with an ITIN renewal can take 6 to 10 weeks to see a report.

If when verifying your information you get the following message: You may not have entered your correct information. Please verify your personal data and try again it is because you have entered something wrong, or if you are sure that you entered all your information correctly it is important that you verify with your tax preparer if your taxes have already been accepted electronically by the IRS, because Until the IRS accepts them, you will not be able to see the status of your refund either.

- Check Option 2 for Spanish

- Then Mark Option 1 for refund, check 1040 status

- By ú last Mark Option 1 Refund

Also Check: How To Calculate Tax On Social Security

How To Report Phishing And Scams:

The IRS doesnt initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information.

If you receive a call from someone who is not an IRS employee but is claiming to be one, report the incident to the appropriate law enforcement agencies:

- If IRS-related, please report to the Treasury Inspector General for Tax Administration via their online complaint form.

- If Treasury-related, please report to the Office of the Treasury Inspector General via OIGCounsel@oig.treas.gov

Please report IRS or Treasury-related fraudulent calls to phishing@irs.gov . When reporting the call, youll need to include the telephone number and a brief description of the communication.

Full instructions on how to report IRS scams can be found here:

Transfer More Than $20000 You’ll Still Get A Form

Even though the delay means that people during the 2023 tax season will only get tax forms if they meet the earlier guidelines of receiving more than $20,000 in payments and making more than 200 transactions in a year, anyone who makes a profit from any sort of income is legally required to pay tax on that money.

Postponing the reporting “does not change the rules regarding taxability of income,” the National Taxpayer Advocate, an independent advocate within the IRS, noted this week. “As before, taxpayers must report all income on their tax return, whether they received a Form 1099 or not. Taxpayers should continue to track and report their taxable income from all sources electronic and nonelectronic.”

However, the IRS underscored that personal transactions, such as repaying a friend for a shared meal, aren’t meant to be tracked by the now-delayed rule on reporting $600 in side-gig income.

“The law is not intended to track personal transactions such as sharing the cost of a car ride or meal, birthday or holiday gifts, or paying a family member or another for a household bill,” the IRS emphasized Friday.

Some tax professionals had also warned that people who used apps for business as well as personal transactions could be confused by amounts reported on the new forms and potentially wind up paying more than they would need to in taxes or have to spend hours untangling their finances to determine what was business income and what wasn’t.

- In:

You May Like: Tax Id Numbers For Businesses

Visiting Your Local Irs Office When Youre In The United States

There are local TACs in every state. Youre not able to just show up at any time, and need to make an appointment. To make an appointment, call 844-545-5640.

To see the addresses and phone numbers of the TACs, select your state on the IRS website here:.

Tax questions & tax return help outside the United States

When youre living outside the United States, getting good US tax help can be hard.

Many people have questions that require excellent working knowledge of the tax treaty that exists between the country theyre living in and the United States.

Expat US Tax offers free and paid consultations to US citizens and Green Card holders living abroad.Getting the right advice now can pay huge dividends in your short and long term future.

Irs Says It Will Delay Requirement To Report $600 In Gig Work On Taxes

The IRS said it is delaying a controversial requirement by one year that would have led to more online sellers and gig workers having income reported to the nation’s tax agency.

The rule change would have required payment platforms such as Venmo, Paypal or Cash App to send tax forms called 1099-Ks to anyone receiving over $600. Previously, such payment services only had to report users’ income to the Internal Revenue Service if they had more than 200 transactions, exceeding $20,000 in revenue.

Online selling platforms including eBay, Etsy and Poshmark had pushed back hard against the proposal to lower the reporting limit to $600, claiming it would create confusion and make it harder for sellers to earn a living. Meanwhile, Republican members of Congress said the plan was an example of government overreach that would ensnare people using apps to pay friends and family.

“The IRS and Treasury heard a number of concerns” about the changes, acting IRS Commissioner Doug O’Donnell said in a Friday statement. “To help smooth the transition and ensure clarity for taxpayers, tax professionals and industry, the IRS will delay implementation” of the new rule, the statement said.

“The additional time will help reduce confusion during the upcoming 2023 tax filing season and provide more time for taxpayers to prepare and understand the new reporting requirements,” he added.

You May Like: Taxes On 2 Million Dollars Income