How Is My Tax Bill Calculated

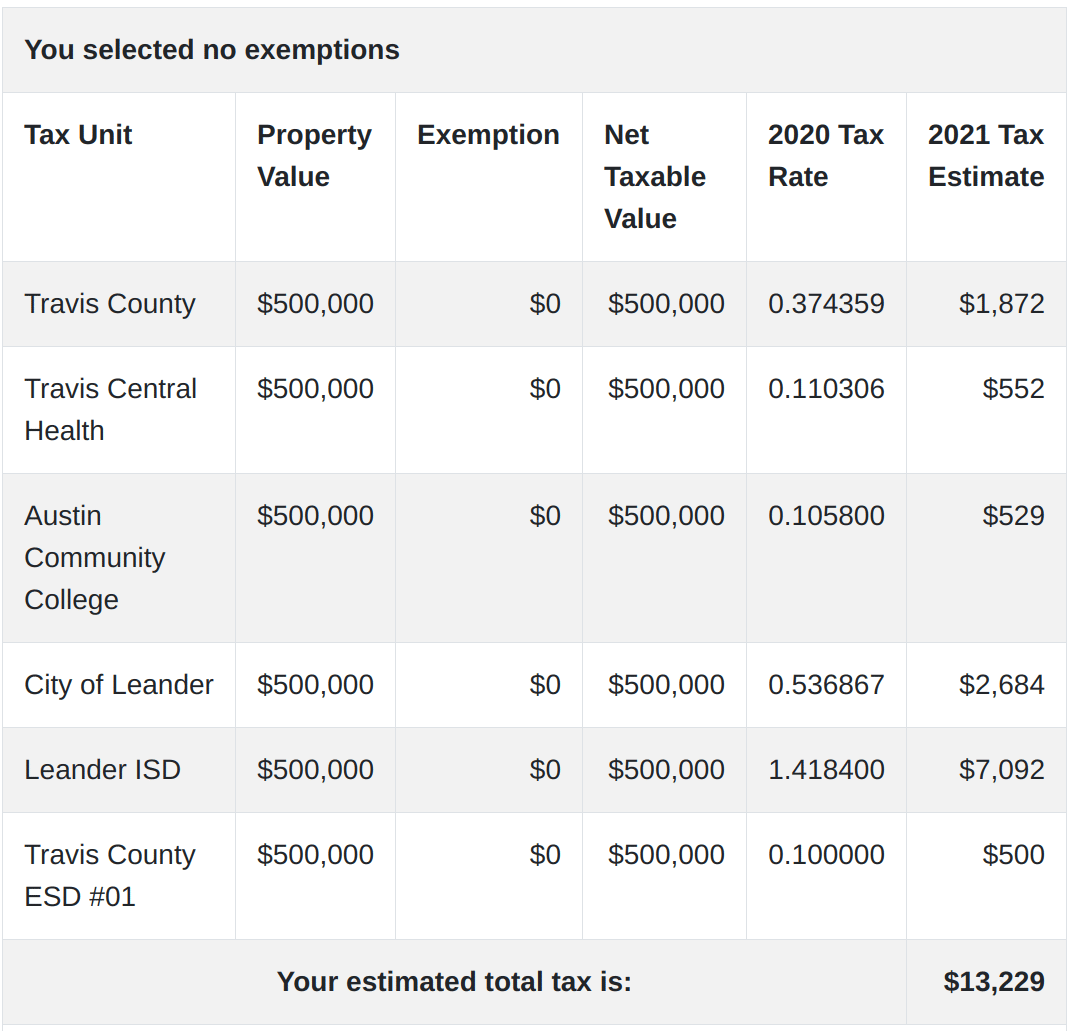

Multiple taxing units like your school district, county, and city tax each property. Most taxpayers will get only one bill from the local assessor-collector that combines the taxes owed to each taxing unit.⯠For property owners with a mortgage, the tax bill will be sent to your mortgage company to be paid from your escrow account.

Austin County Property Tax Appeal

Austin County calculates the property tax due based on the fair market value of the home or property in question, as determined by the Austin County Property Tax Assessor. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value.

As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Austin County Tax Assessor’s office is incorrect. To appeal the Austin County property tax, you must contact the Austin County Tax Assessor’s Office.

Are You Paying Too Much Property Tax?

Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year.

We can check your property’s current assessment against similar properties in Austin County and tell you if you’ve been overassessed. If you have been overassessed, we can help you submit a tax appeal.

Is your Austin County property overassessed?

You will be provided with a property tax appeal form, on which you will provide the tax assessor’s current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate.

If your appeal is denied, you still have the option to re-appeal the decision. If no further administrative appeals can be made, you can appeal your Austin County tax assessment in court.

Who And How Determines Austin Property Tax Rates

State statutorial rules mandate fair real estate market values be set by in-state counties. Any revenue impact of that evaluation is prohibited from being a component in this procedure. Except for capped residential homestead property, estimated values must also be recorded at full market value. With regard to homestead appraised values, increases cannot exceed ten percent each year.

The state Code requires new property assessments at least every three years. Usually new appraisals utilize a broad-based technique applied to all alike property in the same locality without separate property tours. Absent individual property visits and notice of your houses particularities, for example significant water damage, those tax cutting occurrences might be missed.

Appraisers started by making a descriptive catalogue of all non-exempt property, aka a tax roll. These rolls offer details regarding all property lying within that localtys borders. After being constructed, structures were classified by such characteristics as structure kind, size, and age. Where the real property is located and how it was utilized were also determinants used to put together these sets and then assign market values en masse to them all. Now, without a new checkup, using often outdated, possibly inaccurate descriptions with only recent property sales figures being up-to-date assessors must rely upon those collectively affixed estimated market worth.

You May Like: California State Tax Deadline 2021

Proposed Property Tax Rates Now Available Online Fortravis County Property Ownerstaxpayers Can Review Their Potential Property Tax Bills At Travistaxescom

AUSTIN, Texas Travis County property owners can now review proposed tax rates and the impact they could have on their 2022 property tax bills online at TravisTaxes.com.

According to Travis Central Appraisal District Chief Appraiser Marya Crigler, Right now, Travis County taxing entities are making important decisions about their budgets and tax rates that will impact property tax bills. Property owners who are concerned about rising property taxes should take this opportunity to get involved in the process.

TravisTaxes.com allows a property owner to type in their address and review the proposed tax rates for the taxing entities that pertain to their property. The website breaks down how much of their tax bill goes to each taxing entity, lists upcoming hearings that owners can attend to participate in the budget process, and provides a convenient online option where taxpayers can send feedback to their local taxing entities.

In addition, TravisTaxes.com makes it easy for property owners to see the impact that increased entity budgets will have on their property tax bills by comparing what a propertys tax bill would be if taxing entities adopted their no new revenue rates to their potential property tax bill using the proposed rates. State law requires taxing entities to calculate and publish their no new revenue rate to make it easier for the public to evaluate how budgetary decisions impact property tax bills.

About the Travis Central Appraisal District

Dawn Brady Morrisappeals Manager Senior Ptc

Dawn joined Texas Protax in 2007 and specializes in both commercial and residential properties in Travis, Williamson and Hays Counties. Dawns commercial emphasis is on apartment and office properties. For residential properties, Dawn specializes in downtown high rise condo tower valuation.

Prior to joining the Texas Protax team, Dawn worked as a commercial appraiser with the Travis Central Appraisal District. Dawn valued the Travis County Office Portfolio for over five years. Her area of expertise included offices, major industrial, hotels/motels, banks, golf courses and funeral homes.

Dawn currently is on the Board of Directors for the Texas Association of Property Tax Professionals and the TAPTP Conference Chairperson.

Dawn is a third generation Austinite, a true unicorn and a true advocate of living south of the river! Hook em and Go Cowboys!

Read Also: How Long Does Turbo Tax Take

Austin County Property Tax Deduction

You can usually deduct 100% of your Austin County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. Texas may also let you deduct some or all of your Austin County property taxes on your Texas income tax return.

Has this page helped you? Let us know!

Jonathan Bawcom Senior Property Tax Consultant

As a native Austinite and student of math and sciences at Arizona State University, Jonathan began his career as a drafter for a steel manufacturing company out of Buda. In 2015, Jonathan joined Texas Protax and is now a full-time agent. After bravely donating a kidney in 2016, he now has to remind his waiter, No salt on the rim, please, when ordering a Margarita.

Also Check: Property Tax Exemption For Disabled In Texas

Austin Area Property Tax Rates

If you are relocating to the Austin area from another state, your property taxes may be higher here than where you lived previously. The offset is that in Texas you will not be paying any state or local personal income taxes. Depending on your level of income and the value of your home, your total annual state and local tax bill may be less than it is where you are currently living. Additionally, Texas is one of only 12 states in the nation without a residential real estate transfer tax. In fact, recent U.S. Census data shows Texas ranks 37th among the 50 states in percentage of per capita personal income spent on state and local taxes.

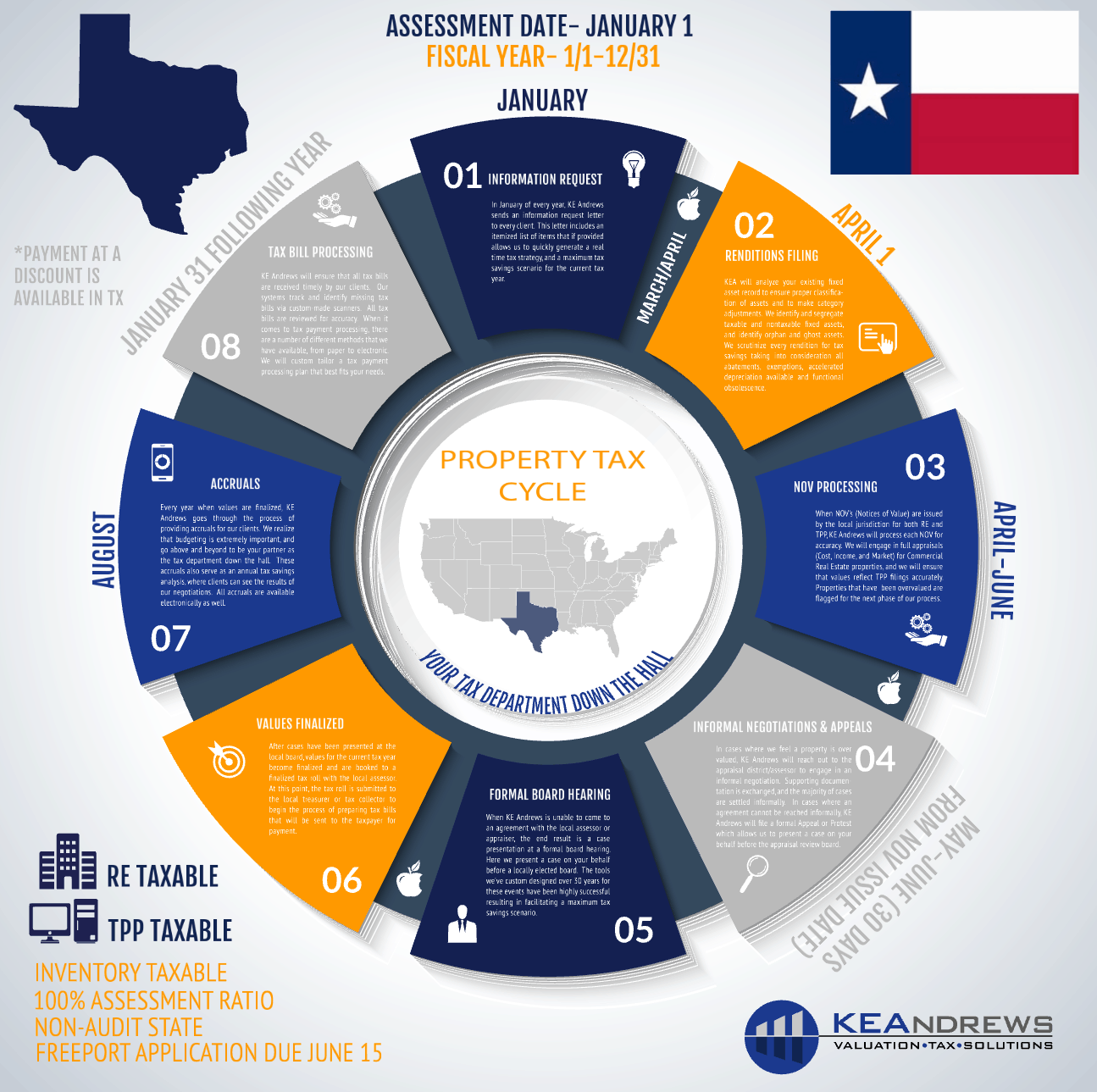

Property taxes are calculated by multiplying the assessed value of the property minus applicable homestead, age 65+ and disability exemption amounts by the mil rates levied by the taxing authorities that have jurisdiction where the property is located. Texas state law defines the assessed value of real property as the market value of a property on January 1, the first day of the tax year. Official property tax exemption information can be found at State of Texas Comptroller property tax exemptions.

Property taxes typically are paid in a single annual payment that is due on or before December 31, the final day of the tax year.

What Are Property Taxes Like In Austin

The property tax rates in Texas are among the highest in the country. Texas ranks 3rd among other states in the percentage of property value and 14th in median property tax. The state still retains an affordable cost of living, however, thanks to no state income tax and a relatively low sales tax. Property taxes are a primary source of revenue for Texas governments, paying for public services such as roads, hospitals, emergency responders, and schools.

Austins property tax rates, while not the highest, are among the highest in Texas. The median property taxes paid in Austin come to around $6,600 annually. Austinites are charged around $2.23 per $100 of taxable value in Travis county and $2.34 per $100 of taxable value in Williamson county.

Also Check: Tax Implications Of Selling Stock

Austin Cities/towns Property Tax Rates

The following table provides 2017 the most common total combined property tax rates for 29 Austin area cities and towns. Complete lists of Austin school districts and counties in the Austin-Round Rock-San Marcos metro area are shown by clicking on these Austin school districts property tax rates and Austin counties property tax rates jump links.

To show the combined total tax rates for all of the Austin cities and towns listed below, change Show entries to All. To display the tax rates for only a specific city or town, enter its name in the Search box. Click on the column headings to change the table sort order.

| property tax rates |

|---|

Austin Property Tax Guide: How To Lower Your Austin Property Tax

Texas Real Estate SourceTexas Real Estate Source

Property taxes can be confusing, especially in a big city like Austin. Texas property taxes are assessed locally and used to fund local projects and public services like schools and hospitals. When you own a home in Austin, the property taxes you pay will be used locally.

Every year, county appraisal districts in Texas assess property values to determine how much property tax is owed on a commercial or residential property. Property taxes are calculated according to local taxing entities’ rates, including school districts, city governments, and others.

Many factors go into figuring out your property taxes, and much of your tax rate depends on where your property is located. Several taxing entity jurisdictions may overlap your property’s location.

In this article, we simplify property taxes in Austin and discuss what goes into calculating property taxes. Well look at the different tax entities, tax rates, and ways for anyone living in or moving to Austin to lower property taxes.

You May Like: Washington State Capital Gains Tax 2022

How To Handle A Property Tax Appeal

Are you concerned that your homes appraised value has been overestimated? If so, you can file a property tax appeal with your countys appraisal district. At Kelly Legal Group, we have successfully represented many clients in property tax appeals. We can also assist you if you are facing foreclosure due to annual property taxes owed.

Contact us today by reaching out online or by calling .

Krystin Danchaksenior Property Tax Consultant

Krystin joined the Texas Protax residential team in 2008. She graduated with a Bachelors Degree in Urban Studies and Art History from the University of Texas in 2011. While at UT, her Urban Studies concentration was in Urban Planning and Real Estate. She used her studies to further her knowledge and skillset in Property Tax Consulting. Her interest and understanding of Real Estate and Urban Planning has made her an integral part of the residential team.

She is also an avid football fan. Hook em Horns!

Don’t Miss: Amend Tax Return Online Free

Tax Rates In Surrounding Areas

Maybe you want to move to Austin, but the tax rates and total property costs are swaying your decision. Dont worry you can always choose an area close to Austin.

For reference, here are some of Texas taxes rates for properties near Austin, Texas.

- Pflugerville: 2.38%

- San Marcos: 2.2%

- Dripping Springs: 2.0%

These arent all the neighboring cities in Austin, Texas, but just a few to help you get an estimate of what they would be like. To better assess your property taxes in Austin, please consult the appraisal district for your county.

Local Austin Property Tax Expertise With A National Footprint

Over the last three years, Austin has become one of the fastest-growing commercial real estate markets in the country, with an influx of companies, particularly from the tech industry, relocating to and expanding in the city. Ryans Austin-area property tax experts have the local expertise and national presence to represent both existing property owners as well as those entering the Austin market for the first time. This local and national approach makes Ryan the only commercial property tax provider that can handle diverse portfolios seamlessly, ensuring tax minimization in the Austin market, including Bastrop, Bell, Brazos, Caldwell, Hays, Travis, and Williamson counties.

You May Like: How To Get Extension On Taxes 2021

Reason Number Three These Taxes Are Set At A Local Government Level

The State of Texas doesnt determine what your property tax bill will be, as this is set by your local authorities. While this is a good thing in some ways, as it keeps the power to change taxes local to your own community, it does mean that the state government cant act to regulate or influence this taxation. The most they can do is pass a bill that tightens regulations on tax hikes, pass a law that allows residents of Texas to vote on tax increases in their local community, or increase state funding for public education . For these changes to occur, they would have to be passed by the state legislature, which hasnt happened at this point. In fact, state funding for public education has dropped in recent years from 45% to 38%.

Overview Of Texas Taxes

Texas has some of the highest property taxes in the U.S. The average effective property tax rate in the Lone Star State is 1.69%, well above the national average of 1.07%.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Also Check: Look Up State Tax Id Number

Steve Williamsproperty Tax Consultant

Steve joined the Texas Protax team in 2019. After leaving the U.S. Army, he worked for Texas premier parent-taught driver education course and quickly rose to the position of Vice President of Operations. He also spearheaded the establishment and growth of a new t-shirt printing shop in Lakeway.

Steve and his wife currently have five children, all boys and they have been active foster parents for more than seven years. They have owned and managed residential and commercial rental properties for more than 15 years.

Having spent the previous two decades teaching driver education, Steve hopes appealing property tax increases will be slightly less dangerous.

Austin County Homestead Exemption

For properties considered the primary residence of the taxpayer, a homestead exemption may exist. The Austin County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes.

Getting a Homestead Exemption may also help protect your home from being repossessed in the case of a property tax lien due to unpaid Austin County property taxes or other types of other debt.

In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. To get a copy of the Austin County Homestead Exemption Application, call the Austin County Assessor’s Office and ask for details on the homestead exemption program. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space.

Don’t Miss: States With No Retirement Income Tax

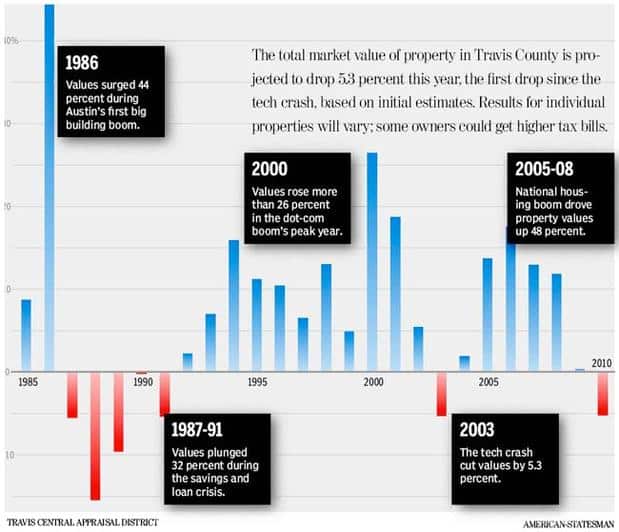

Will Property Tax Rates Rise Next Year

Tax rates rose twice during the years of 2017-2019 in Austin, TX. However, a new 2020 bill was signed into law, affecting how much tax rates can go up during a single year.

This bill states that the local government can no longer raise revenue collection by more than 3.5% without voter approval.

For the 2022-2023 FY, the proposed tax rates in Travis County and Williamson County are lower than the 2021-2022 FY.

The Value Of Your Travis County Home Has Gone Up A Lot That Doesnt Mean Your Property Taxes Will

People who own property in the Austin area recently received new valuations from the local appraisal district. This number, known as your appraised value, estimates what your property would currently sell for in Austins record-breaking housing market.

The appraisals are a lot higher than they were last year. According to the Travis Central Appraisal District, on average, appraised values rose 56% over the past year.

But if you live in the house you own, and have filed what is called a homestead exemption, the amount you have to pay taxes on is entirely different. This is called your taxable value, and it is probably much lower than the estimate of what your home would sell for unless you bought your house in the past year. Then those numbers are likely the same.

Still confused and in shock? We got you.

The appraised value of my home went up more than 50% in the last year. Does that mean my taxes will go up that amount?

Almost certainly no.

If your property tax bill does go up and we dont know that it will its almost certain it wont increase by anywhere close to that amount. Thats because while the amount your home would sell for can go up any amount year over year, the state limits how much of that value you can be taxed on.

But he wont be taxed on that amount. The Net Appraised column shows Largeys taxable value.

So, Ill ask again: Will my taxes go up?

We dont know yet.

Recommended Reading: Free Irs Approved Tax Preparation Courses

Read Also: Still Haven’t Received My Tax Refund 2022