How Your Alameda County Property Tax Bill Works

Wondering what the payment schedule for Alameda County property taxes looks like? The first installment is due on Nov. 1, and is considered delinquent if not paid by 5 p.m. on December 10. Delinquent payments are subject to a 10% penalty.

The second installment is due on February 1 of the following year and is considered delinquent if not paid by 5 p.m. on April 10. As with the November deadline, late payments will incur a 10% penalty.

If December 10 or April 10 happens to fall on a Saturday, Sunday or a legal holiday, your payment wont incur a 10% penalty as long as its made by 5 p.m. on the following business day.

If you have the money on hand and you want to knock out both property tax installments at once, you can pay the Total Amount Due by the December 10 deadline. Be sure to include both installment pay stubs if youre paying by mail.

Often, homebuyers include property tax payments with their mortgage payments and the mortgage company remits the property taxes to the county. If you have this arrangement in place and then the lender stops paying your property taxes , you can simply view and pay your bill online, or contact the county to receive a duplicate tax bill complete with payment stub if you plan to pay by mail.

Earned Income Tax Credit: The Caleitc Or Yctc Tax Credits

You can claim the California Earned Income Tax Credit if you work and have low income , both credits are a refundable credit. The amount of the credit ranges from $243 to $3,027. You can also qualify for the Young Child Tax Credit if you have a qualifying child under the age of 6. If you qualify for the young child tax credit, you may receive up to $1,000.

California Property Tax Calculator

| Estimate Property Tax |

Our California Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States.

To use the calculator, just enter your property’s current market value . For comparison, the median home value in California is $384,200.00. If you need to find your property’s most recent tax assessment, or the actual property tax due on your property, contactyour county or city’s property tax assessor.

Please note:

Don’t Miss: Property Tax Exemption For Disabled In Texas

San Francisco County California Property Tax Calculator

| Estimate Property Tax |

Our San Francisco County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States.

To use the calculator, just enter your property’s current market value . For comparison, the median home value in San Francisco County is $785,200.00. If you need to find your property’s most recent tax assessment, or the actual property tax due on your property, contactthe San Francisco County Tax Appraiser’s office.

Remember:

How Are Property Taxes Levied

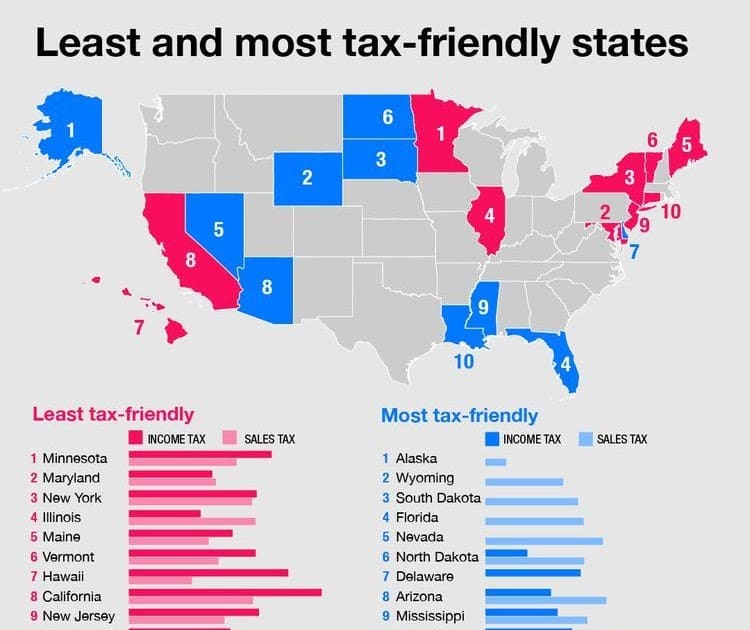

Property taxes are levied on real estate by governments, typically on the state, county and local levels. Property taxes are one of the oldest forms of taxation. In fact, the earliest known record of property taxes dates back to the 6th century B.C. In the U.S., property taxes predate even income taxes. While some states don’t levy an income tax, all states, as well as Washington, D.C., have property taxes.

For state and local governments, property taxes are necessary to function. They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself.

You may have noticed already that the highest-ranked public schools are typically in municipalities with high home values and high property taxes. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. For the latter group, this means funding all county services through property taxes.

To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona.

Recommended Reading: Is Spousal Support Tax Deductible

How To Calculate Salary After Tax In California In 2023

The following steps allow you to calculate your salary after tax in California after deducting Medicare, Social Security Federal Income Tax and California State Income tax.

Overview Of Riverside County Ca Taxes

Riverside County taxpayers face some of the highest property tax rates in California. The countys average effective tax rate is 1.04%. However, rates can vary wildly depending on where you live within the county.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Recommended Reading: How To File Taxes Without W2 Or Paystub

Paying Your Riverside County Property Taxes

As a taxpayer in Riverside County, youll be responsible for making sure your property taxes are paid in two installments spread out during the year. If your property tax payments are included in your mortgage payment, your mortgage company will receive the bill and youll receive an extra copy for reference. If you get any supplemental tax bills in the mail, its a good idea to check in with your lender to find out who will pay this added bill.

Your first installment is due beginning Nov. 1 and no later than December 10 each year. The years second installment is due beginning Feb. 1 and no later than April 10. Its important to note that any unpaid tax balance remaining after either due date is subject to a 10% penalty and other fees.

You have several different payment methods for covering your annual property taxes. The Riverside County Tax Collector offers the option to pay property tax payments online and by automated phone call.

The Tax Collectors Office accepts payment by credit card at a 2.28% convenience fee and by debit card for a $3.95 flat fee. If you prefer to pay online but dont want to pay any added fees, you also have the option to pay by e-Check as well.

Overview Of Property Taxes

Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAsset’s tools to better understand the average cost of property taxes in your state and county.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Don’t Miss: Iowa State Tax Refund Status

Santa Clara County Property Tax Rates

The average effective property tax rate in Santa Clara County is 0.85%. But because the median home value in Santa Clara County is incredibly high at $1,061,900, the median annual property tax payment in the county is $9,059, the second-highest in California behind Marin County.

Your city, county, school district and other taxing authorities all contribute to your property tax bill. The property taxes you pay on a home are called secured taxes.

Secured taxes are due in two installments on November 1 and February 1, respectively. If these payments aren’t made by December 10 or April 10, they become “delinquent.” June 30 is the end of the fiscal year for Santa Clara County, so if you still have delinquent payments by July 1, your account will be transferred to the delinquent tax roll. In conjunction with this, you’ll receive a 10% penalty and a $20 fee.

Thats why its important to stay on top of your property taxes and file appropriate change of address forms so the county knows where to find you. You can change your mailing address in the county system by phone, by email or on a Mailing Address Change form thats downloadable on the Santa Clara County government website. Failure to receive a property tax bill doesnt excuse late penalties, so the bill went to my old address wont get you off the hook if you miss a property tax deadline.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Pay Capital Gains Tax

Don’t Miss: States With No Tax On Retirement Income

Orange County Property Tax Breaks

Looking for a way to lower your property tax bill? If you own a home, you may be eligible for a homeowners exemption. Orange County residents can qualify for the exemption if they own and occupy a property that serves as their primary residence on Jan. 1 of any given tax year.

If you qualify for the full exemption, $7,000 of your homes value will be exempt from taxation. If you dont own and occupy a primary residence on January 1, you may qualify for a partial exemption if you file a claim with the Orange County treasurer-tax collector by December 10. Filing a claim by February 15 will ensure that you receive your full exemption the following tax year.

Another tax-saving program allows senior citizens and blind and disabled individuals to postpone the payment of property taxes on their primary residence. To qualify, your annual household income must be $49,017 or less and you must have at least 40% equity in your home.

Senior citizens may also save money on property taxes through Propositions 60 and 90, which allow them to transfer the base value of a former residence to another residence as long as they follow certain rules. For example, the new property must be of equal or lesser value than the first home. In Orange County, seniors can take advantage of these property tax benefits even when their replacement home is located in another county in California.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

You May Like: New Jersey Sales Tax Filing

Overview Of California Taxes

Californias overall property taxes are below the national average. The average effective property tax rate in California is 0.73%, compared to the national rate, which sits at 1.07%.

| Enter Your Location |

| of Assessed Home Value |

- About This Answer

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. Please note that we can only estimate your property tax based on median property taxes in your area. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county’s effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

…read more

Income Tax In California: How Is It Calculated And Collected

If you are resident in California, or if you are a non-resident but do business in California, you are required to submit an income tax return if you have earned over a certain threshold. The threshold is subject to change, but you can see a recent chart here.

Calculating your income tax can be done on your own or with the help of a professional service. The FTB offers an online tax calculator to make things easier. You need to know your filing status, which can be one of these five:

- Head of household

- Qualifying widow

You also need to know which form you will be using to file. There are three different forms, and which one you use will depend on the amount of your taxable income, your filing status, your residency status .

The three forms are:

- Form 540 NR: Long or Short

You can find full details of which form you should choose on the FTB website. Once youve used the form to find your taxable income, simply enter it into the calculator to find out how much you owe.

For many taxpayers, your state income taxes will be withheld from your paycheck, based on the withholding allowances you chose on Form DE4. If you filled out the form correctly, it is likely that when you file your income tax return, you will not owe additional taxes, and might even get a refund.

You May Like: Number To The Irs For Taxes

Refund Or No Amount Due

Line 115 â Refund or No Amount Due

Did you report amounts on line 110, line 112, or line 113?

- No

- Enter the amount from line 96 on line 115. This is your refund amount. If it is less than $1, attach a written statement to your Form 540 requesting the refund.

- Yes

- Combine the amounts from line 110, line 112, and line 113. If the result is:

- Less than line 96, subtract the sum of line 110, line 112, and line 113 from line 96 and enter on line 115. This is your refund amount.

- More than line 96, subtract line 96 from the sum of line 110, line 112, and line 113 and enter the result on line 114. This is your total amount due. For payment options, see line 111 instructions.

How Do California Property Tax Rates Work

The local government, when assessing property taxes, first uses the 1-percent tax from Proposition 13 .

This is also known as the General Tax Levy. Its just step one in the assessment.

The second step in the assessment is the voter-approved taxes such as school district, city, and water taxes. The same taxes most people pay as part of their property tax.

The third step in the assessment is the specialty taxes such as Mello-Roos taxes, a tax designed to fund special public facilities such as schools and parks.

This method is used to insure various public services are funded.

Recommended Reading: Can I File Taxes Now