The Education Donations Portal 20 Is Now Available

You may now register to receive donations as a Montana Public School District or Student Scholarship Organization.

For more information on tax credits for qualified education contributions, please see our guide.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible.

Unfortunately, it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

We encourage all Montanans to file early and electronically. This is the easiest and most secure way to file and get your refund as quickly as possible.

Remember, we are here to help. Please contact us if you need additional assistance.

Registered Charities And Similar Organizations

Charities and non-profit organizations are eligible for reduced property taxes.

Current legislation requires Council to rebate a minimum of 40 per cent of total property taxes payable by a charity and permits rebates of between 0 per cent and 100 per cent to organizations deemed to be similar to a charity.

Review the application form and Tax Rebates for Charitable Organizations policy, or contact the tax office of your local municipality to determine your eligibility for a charitable rebate.

Providing that all eligibility requirements are met, the following rebates will be provided:

- Legions and other similar organizations as defined under section 325 section 6.1 of the Assessment Act 100 per cent of taxes paid

- Navy Leagues as defined under section 6 of the Assessment Act 100 per cent of taxes paid

- All other eligible charities as defined in subsection 248 of the Income Tax Act and have a registration number issued by the Canada Customs and Revenue Agency 40 per cent of taxes paid

Applications will be accepted between Jan. 1 of the tax year and Feb. 28 of the following year.

Change In Circumstances After Exemption

It is important that our office be notified of any changes in property ownership or occupancy, net worth, or income since the exemption may be affected. If the property is transferred or placed in a trust, or ceases to be the applicants residence or property, immediate disqualification could occur. Distributions from retirement accounts are included in income even if rolled into other investments and could result in disqualification. Please consult with staff before transferring property, moving or requesting a lump sum distribution from a retirement account.

When qualified real property is sold or title is transferred, the last qualifying owner dies, or the property ceases to be the primary residence, real property taxes are pro-rated based on the number of full months the property and owner continue to qualify. The property ceases to be the primary residence when the last qualifying applicant is occupying a hospital, nursing home or other facility for physical or mental care and are not expected to return to the residence.

Don’t Miss: Va State Tax Refund Status

Donotpay Can Help You File Property Tax Appeals

Filing property tax appeals is the last resort to lowering your taxes. You should use this option in case one of these situations applies to your case:

You can use DoNotPay to appeal your previous property assessments. We will help you negotiate with your assessor and collect the evidence to lower the assessed value.

Missing Property Tax Exemptions Homeowners Can Apply For Certificates Of Error

If your home was eligible for the Persons with Disabilities Exemption in tax years 2021, 2020, 2019, or 2018 and the exemption was not applied to your property tax bill, the Assessors Office can help you obtain a refund through what is called a Certificate of Error.

Certificate of Error applications for tax years 2021, 2020, 2019, or 2018 can be filed now by clicking the links below. As a reminder, it is recommended to apply online so that the application can be easily tracked and our representatives can provide status updates.

As a reminder exemptions are reflected on the second installment property tax bill.

1. One of the following documents is required.

- Class 2 Disabled Person Illinois Identification Card from the Illinois Secretary of State’s Office.

- Proof of Social Security Administration disability benefits. This proof includes an award letter, verification letter, or annual cost of living adjustment.

- Proof of Veterans’ Administration disability benefits. This proof includes an award letter of total disability, pension statement, or statement showing compensation rated at 100%.

- Proof of Railroad or Civil Service disability benefits is an award letter of total disability.

If a taxpayer can not provide proof with one of the items listed above they will need to submit the Illinois Department of Revenue’s Form PTAX 343-A Physician’s Statement of Proof of a Disability. The taxpayer may also be required to be re-examined by an IDOR designated physician.

Recommended Reading: Are Gofundme Donations Tax Deductable

Exemption For Persons With Disabilities And Limited Incomes

Local governments and school districts may lower the property tax of qualified disabled homeowners by providing a partial exemption for their legal residence.

This exemption provides a reduction of up to 50% in the assessed value of the residence of qualified disabled person, Those municipalities that opt to offer the exemption also set an income limit. The income limit may be as low as $3,000 and as high as $50,000.

Localities have the further option of giving sliding scale exemptions of less than 50 percent to persons with disabilities whose incomes are more than $50,000. Under this option, qualifying persons may receive a 5% exemption if their income is below $58,400.

Check with your local assessor for the income limits in your community.

Note: If your property receives the senior citizens exemption, it cannot also receive this exemption. If you qualify for both exemptions, you can choose the more beneficial option.

Nj Property Tax Deduction For Senior Citizens And Disabled Persons From A To Z

Anyone who owns property needs to pay property taxes. The good news is that homeowners have the right to ask for help paying property taxes based on different criteria. In NJ, the property tax deduction for senior citizens and disabled persons is one such option.

DoNotPay can help you determine if you are eligible for this property tax exemption.

Also Check: Aarp Foundation Tax-aide Site Locator

Property Tax Exemptions For Blind Or Totally Disabled Persons

The following information is compiled from the Disabled Tax Relief Program page on the State of Connecticut Office of Policy and Management website: www.ct.gov/opm/cwp/view.asp?a=2985& q=383142& opmNav_GID=1807

State law provides a $1,000 property tax exemption for Connecticut property owners who are permanently and totally disabled. Property owners must be at least 18 years old. There is no income or asset restriction. This program is administered by the State of Connecticut Office of Policy and Management.

Property owners must provide documentation proving legal blindness or permanent disability to the town assessors office prior to October 1 of the year prior to application.

NOTE: Connecticut towns also provide a $3,000 exemption for property owners who are legally blind. Check with your towns assessors office to see if your town has additional tax exemptions for residents with disabilities.

TO FIND PROVIDERS IN CONNECTICUTS COMMUNITY RESOURCES DATABASE:Search by program name: Assessor

Public Act 78 Of 2016

Public Act 78 of 2016 was signed by the governor on April 12, 2016, with an effective date of July 11, 2016, replacing Public Act 66 of 2012. PA 78 allows local municipalities to be reimbursed for real and personal property taxes lost due to the exemption for eligible senior citizen and disabled housing facilities under MCL 211.7d. Under §7d, municipalities receive a payment in lieu of taxes from the Michigan Department of Treasury.

For facilities enrolled in the program before January 1, 2009, the payment in lieu of taxes will equal the amount of taxes paid on the property in the 2008 tax year and will remain frozen for the duration of the exemption. For facilities enrolled in the program January 1, 2009 and after, the payment in lieu of taxes will be based on the tax liability in the first tax year the exemption is approved and will remain frozen for the duration of the exemption.

In both cases described above, the state will only pay real and personal property taxes, not millage rates of up to 18 mills for school operating, hold harmless rates, 6 mills for state education tax, administrative fees, special assessments, penalties, and interest fees. and ).

Read Also: Amend My 2020 Tax Return

Tax Relief For Elderly & Disabled

York County offers a program to taxpayers who are age 65 or older or permanently disabled, which exempts, or partially exempts the tax on their real estate or mobile home. To qualify for this program property owners must meet the following requirements:

- Assets cannot exceed $220,000

- Be age 65 or older or permanently disabled as of December 31st of the year immediately preceding the current tax year

- Must file an application with the Commissioner of the Revenue annually on or before April 1st

- One owner incomes must be $55,000 or less and two owner incomes must be $55,000 or less

- Owner applying must reside on the property

If you or anyone in your household is required to file a Federal Income Tax Return, a copy of Form 1040 must be submitted along with the application. Each individual must submit a copy of the Annual Social Security Statement/Annuity Statement, W-2 , 1099 , and any other statement providing the source of income, along with the application.

Commissioner of the Revenues Office

Physical Address

What Is The Disability Property Tax Exemption

A property tax exemption for a disabled individual reduces the property tax burden for disabled homeowners.

This essentially lowers a homes taxable value, which decreases the annual taxes the homeowner owes on the property.

There is no single federal disability property tax break that homeowners qualify for.

Instead, all tax exemptions are at the state and local levels.

To understand your options, we recommend you look to your state for information.

You May Like: California Llc First Year Tax Exemption

Payment In Lieu Of Tax Statement

After the facility is determined to be exempt under MCL 211.7d and entered into the program, the Department of Treasury will issue the payment in lieu of tax to the appropriate local tax collecting unit by December 15 of each year the facility is exempt. The procedure for submitting payment in lieu of tax statements to Treasury for payment is as follows for the first year the facility is exempt:

Homes Built For People With Disabilities

The Province provides a property tax exemption for a portion of the assessed value of all new homes built to accommodate seniors and people with disabilities who would otherwise require care in an institution .

In the past, only the value of alterations or additions made to existing homes to accommodate people with disabilities was exempted from property taxation. New homes with custom-built features did not qualify for any exemption. Ten per cent of the assessed value of new homes built to accommodate seniors or persons with disabilities will also be exempt from property taxation.

For additional information, call 1-866-296-6722, or .

Don’t Miss: Which States Are Tax Free

Qualifications To Receive Tax Relief For Renters

To qualify for tax relief for renters under the Tax Relief Program, you must be at least 65 years of age or permanently and totally disabled and reside in Fairfax County.

The gross income of the applicant and any relatives residing in the dwelling may not exceed $22,000. Income shall be computed by combining the gross income from all sources of the preceding year. Relatives residing in the dwelling may exclude the first $6,500 of income. There is no deduction for a relative who has no income. Applicants who are permanently and totally disabled may exclude the first $7,500 of income.

Total combined net assets of the applicant and spouse may not exceed $75,000 as of December 31 of the preceding year for which relief is sought.

To receive relief, applicants must pay 30% or more of their gross income towards their rent. This amount may be prorated based upon the length of residence in the county during the application year.

Applicants must provide a copy of the lease agreement and rental receipts or cancelled checks for each month of the preceding year documenting the amount of rent paid.

Applicants residing in and owning a mobile home located on land for which rent is paid may be granted either rent relief on the land or personal property relief.

Advantages To Using Curadebt

Once youve got a clearer picture of what CuraDebt can offer you lets look into the advantages that come with using CuraDebt.

In the beginning, CuraDebt is only charged once youve paid off your debt. Furthermore, they only charge 20% of the cost, whereas most companies charge you 25%.

Then, if youre done in the process of debt resolution you can also sign up for their credit restoration program.

Its a great method to improve your credit without going into debt again. However, the program runs in a different way for each individual dependent on the circumstances of your case.

Lastly, CureDebt looks into your credit to help with settlements and negotiations. It means that your debt wont increase over time. Theyll also investigate any creditor violations with the help of their own experts.

Don’t Miss: Sales And Use Tax Exemption Certificate

Requesting Approval Denial And Notification

For new facilities seeking to enter the program, the owners must submit the following initial application documents to their local assessor and Department of Treasury:

There are three deadline dates that must be met in order for Department of Treasury to finally approve the exemption and make the first payment in lieu of taxes. Facility owners and local units of government are strongly encouraged to contact Treasury to ensure paperwork has been timely received. Failure to timely submit paperwork may delay entry into the program by one full year, resulting in a property tax liability for the facility owners.

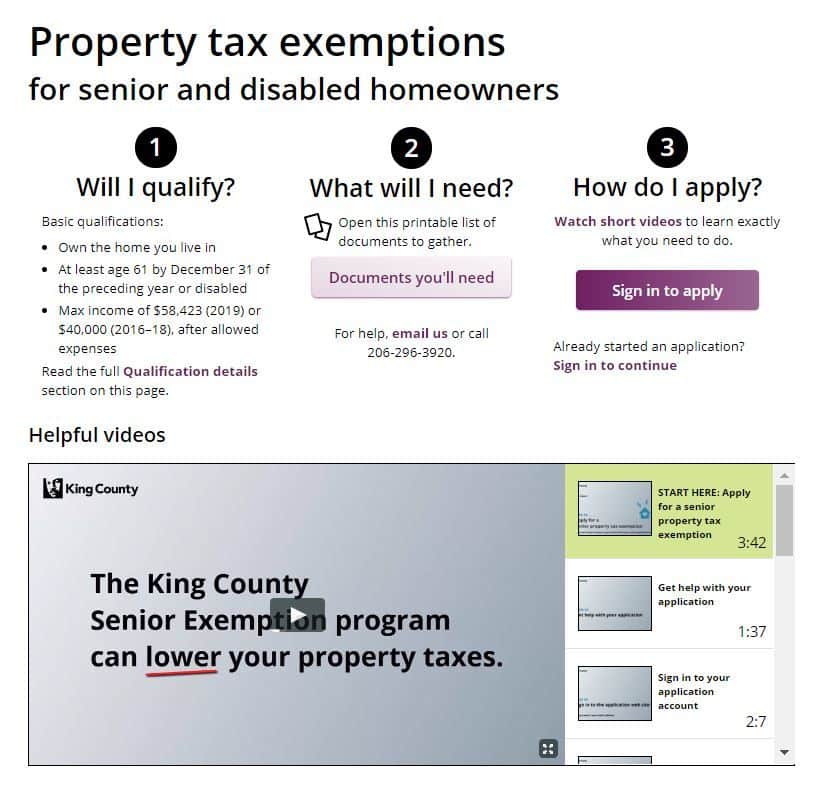

~ Age Or Disability ~

On December 31st of the year before the tax is due, you must meet one of the following criteria.

- At least 61 years of age

- Unable to work because of a disability OR a disabled veteran with a service-connected evaluation of at least 80% or receiving compensation from the United States Department of Veterans Affairs at the 100% rate for a service-connected disability.

Only one spouse is required to be at least 61 years of age or disabled. However, if the qualifying spouse dies, the remaining spouse must be 57 or older to continue the exemption.

A doctors verification or written acknowledgement/decision from the Social Security Administrator or Veterans Administration is required for the disability exemption.

You May Like: If You Sell Crypto Do You Pay Taxes

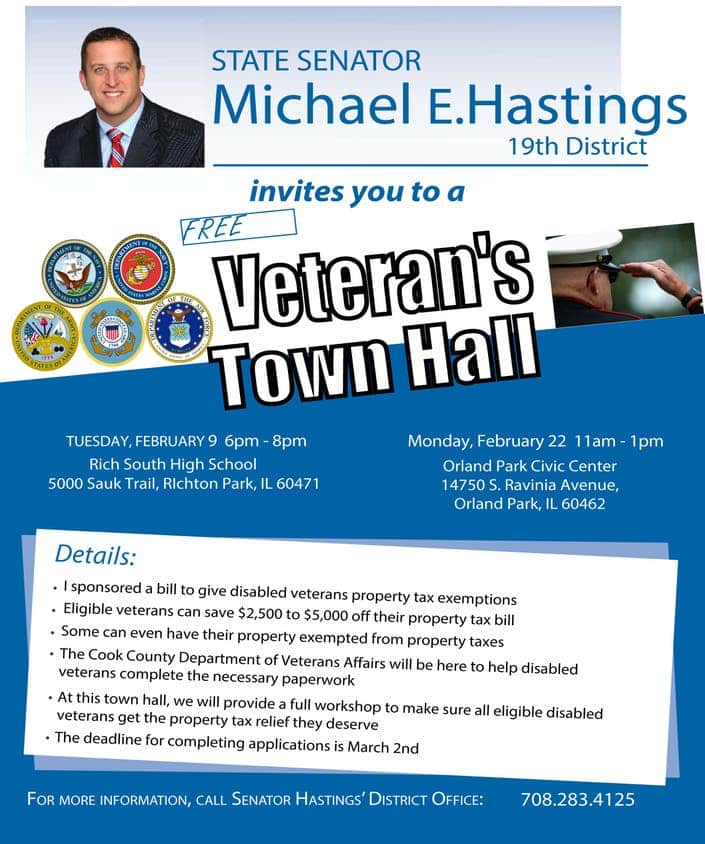

Property Tax Exemption For Disabled: 11 Things You Need To Know

If youre a disabled veteran or homeowner, you may be looking for some tax relief perhaps even a property tax exemption.

Well, youre in luck!

Did you know that most states offer some sort of property tax exemption for disabled homeowners?

This can reduce your annual tax burden significantly and allow you to free up funds for other purposes.

Heres what you need to know about taking advantage of this property tax exemption.

Water Rebate And Solid Waste Rebate Programs

- have a combined household income of $50,000 or less

- be 65 years of age or older, OR

- be 60-64 years of age and be in receipt of an Allowance under the Old Age Security Act if widowed, be in receipt of the Spouses Allowance under the Old Age Security Act, OR

- be 50 years of age or older and be receiving either a pension or a pension annuity resulting from a pension plan under the Income Tax Act , OR

- be a person living with a disability and be in receipt of disability benefits

You May Like: What Does It Mean To Write Off Taxes

Montana Disabled Veteran Property Tax Relief Application

| Montana Disabled Veteran Property Tax Relief Application | 2023 |

| Montana Disabled Veteran Property Tax Relief Application | 2022 |

To be the nation’s most citizen-oriented, efficiently administered, state tax agency.

DOR Mission Statement

- Make payments online using the TransAction Portal.

- Request a Payment Plan

- You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

- Payment Vouchers

- You may also make payments by mail using a payment voucher. The appropriate payment vouchers for each tax taype are available in our Forms Repository.