What Are Property Tax Assessments

A tax assessment for property determines the value so that the amount of tax due can be calculated. Typically this assessment will be carried out by a government assessor.

For homeowners who have used a mortgage to buy their property, the property taxes are likely part of your monthly payment to the lender. Mortgage lenders will estimate the property taxes and add them to your monthly payment. This money will be paid into an escrow account so that the property taxes will be paid on time and in full.

This means borrowers dont have to worry about saving enough money to pay property taxes when they are due. A new tax assessment will show you if your escrow payments will likely increase and by how much.

If you have a tax assessment and disagree with the result, it could be possible to appeal the new valuation. You should expect annual increases in your property taxes. It is rare that they go down.

California Property Tax History

A quick history lesson about previous tax laws is helpful in understanding the full implications of Prop. 19.

In 1986, voters approved Prop. 58, which permitted inheritors to keep the tax assessed value of the grantors, who are generally parents or grandparents. In combination with Prop. 13, this meant that children could be gifted or inherit their parents’ home at fair market value while paying property taxes at the lower assessed rate of the parents.

In addition, the inheritors were not required to live in the home and could keep it as an investment property. The rules also allowed parents to transfer up to $1 million per spouse or $2 million total in assessed value on additional properties without changing the tax assessment.

But with Prop. 19, kids who are gifted a house or who inherit a house must live in the property in order to benefit from property tax exclusions, and those tax benefits are now capped,” said Macdonald. Heirs will be able to pay property taxes on the current assessed value and exclude up to another $1 million in assessed value. Any currently assessed value above that amount would be taxable.”

How Are Property Taxes Calculated

Your property tax bill is based on the assessed value of your property, any exemptions for which you qualify, and a property tax rate.

Your property tax assessment is determined on a certain date. In many jurisdictions, that assessed value is decided annually. In some jurisdictions, however, it’s done every three years, only when the property is transferred, or on another schedule. In some areas, the assessed value is the in other areas, the market value is multiplied by an assessment rate to determine the assessed value.

Exemptions might include a decrease in the assessed value of your property if you are an owner-occupant . The decrease in your property’s assessed value says nothing about the actual market value of your property, but it does help lower your tax bill.

The property tax rate, also called a multiplier, or mill rate is a percentage by which the assessed value of your property is multiplied to determine your tax bill.

Property taxes pay for things like public schools, community colleges, libraries, local government employees’ salaries, parks and recreation, sanitation, sewer, police and fire protection, roads, and other local needs such as mosquito control. Each of these items can have its own percentage rate that is multiplied by the assessed value of your property to determine a portion of your bill. The taxes you owe for each item are totaled to determine your final property tax bill.

Your Property Tax Assessment: What Does It Mean?

Read Also: When Is Tax Returns Due

Definition Of Real Estate Taxes

Real estate taxes are calculated on most private property in the United States. Some communities, such as Alaska, do not impose property taxes, but these communities are the exception, not the rule. Property tax levies are used to help pay for local services, such as road maintenance, cleaning, public schools, and local administrative offices. Property taxes are calculated as a percentage of the estimated value of the property tax. Local claims that pass with the majority vote are sometimes subject to property taxes.

If I Believe The Information On This Notice Is Incorrect How Do I Appeal

If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

Appeals can be filed with our office or with the Cook County Board of Review. Please see our section for information on how and when to file an appeal with our office. Visit for information and deadlines about appeals with their office.

Don’t Miss: Free Irs Approved Tax Preparation Courses

Check Your Assessment Annually

You should check your assessment on the tentative assessment roll each year.

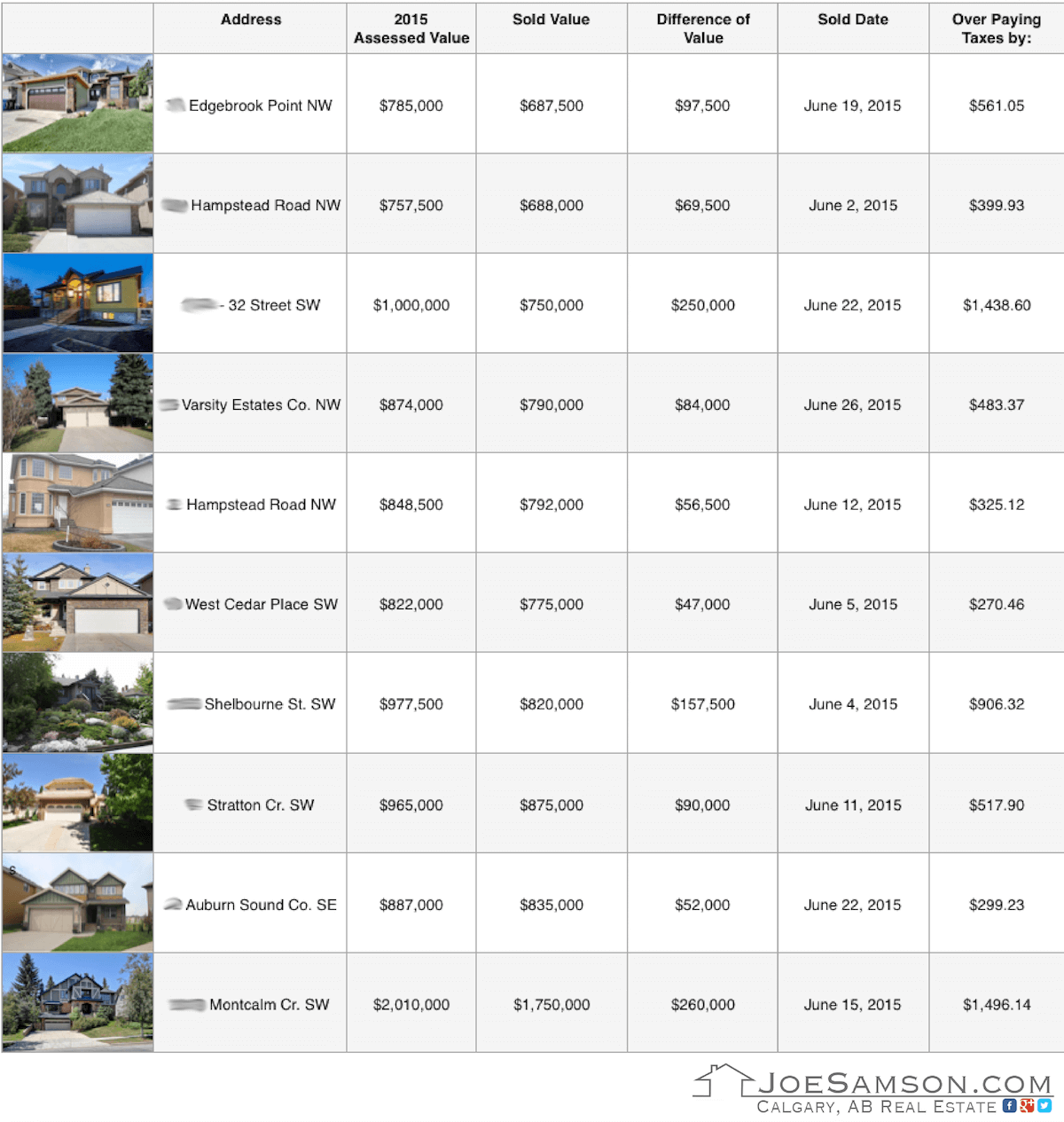

If your assessment or the estimated market value for your property is higher than the price for which you can sell your home, you should discuss it with your assessor. See How to estimate the market value of your home.

If the assessor does not reduce your assessment, you can contest your assessment.

Also Check: Is 1040paytax Com Real

Citizen’s Guide To Property Tax

What is the purpose of property taxes?

Property taxes are a primary source of funding for local government units, including counties, cities and towns, townships, libraries and other special districts including fire districts and solid waste districts. Property taxes are administered and collected by local government officials. These funds are used to pay for a variety of services including welfare police and fire new construction and maintenance of buildings local infrastructure like highways, roads and streets and the operations, including salaries, of the local units of government.

Property taxes are an ad valorem tax, meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayer’s property. The statewide average revenue distribution for each property tax dollar is as follows:

- Special Unit: $0.07

Breakdown is based on average expenditure per dollar of property tax levied in Indiana for taxes payable in 2018.

The Department’s website offers a variety of resources to educate and inform taxpayers on this process. The site also features search tools to provide taxpayers with sales disclosure and assessment information on properties statewide. This information can be used in the appeals process or to allow taxpayers to better understand how assessors determine a property’s assessed value.

You May Like: Advance Premium Tax Credit Repayment

How They Calculate Your Property Taxes

The assessed value, the tax rate, and exemptions will be the basis for the property tax calculation.

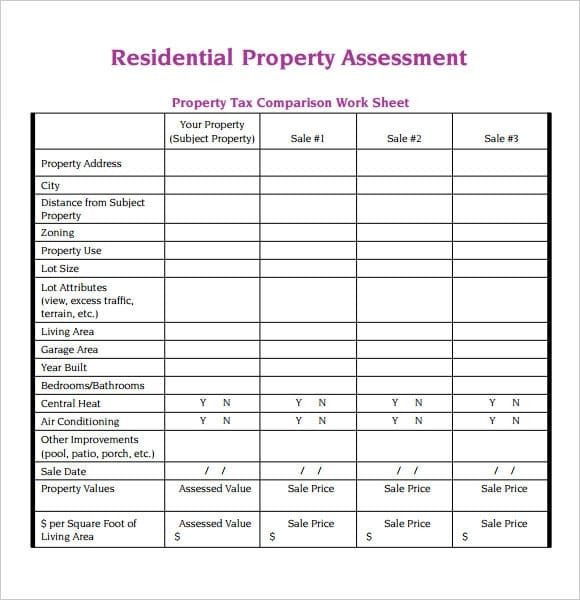

The assessment will consider factors like square footage, property upgrades, and the number of bedrooms and bathrooms.

If you have improved your home, it could affect the assessment and your tax bill.

Also, changes in the property market can change the assessment. If the market in your area has seen house prices rising, it will likely increase your taxes following the next assessment.

How Do Property Tax Assessments Work

Depending on your county and state, property tax requirements can vary. Typically, they will be paid on an annual basis. Assessors will value the property once every five years.

When it comes to evaluating the value of your home, multiple factors go into the assessment. Neighboring homes sales and prices are determined, and the local government budget is considered when deciding on property taxes.

Read Also: Take Home Pay After Tax

Charges From Province Of British Columbia

On your Property Tax Bill there are charges from the Province of British Columbia for school taxes and for other regional bodies including:

- BC Assessment Authority

These taxing authorities determine the amounts payable and the City collects on their behalf.

Approximately 40% of a typical residential property tax bill is collected on behalf of other agencies that are outside the Citys budget control.

What Affects Your Property Tax Bill

In addition to the assessed value of your property, your bill is based on what your property is used for . Some usessuch as land and buildings used for religious or spiritual purposesmay exempt these properties from taxes. Different uses may be taxed at different rates, but taxation should be at a uniform ratethat is, the multiplier should be the same for all properties in the same category. Within that category, factors such as your property’s size, construction type, age, and location can affect your tax rate.

If property tax bills are based on current real estate values in your area, you can expect differences in your bill from year to year. Even if your bill is not affected by the market value of your property, it can still be affected by changes in the tax rate for any component of the property tax.

Tax authorities can increase your bill by increasing the assessed value of your property and/or by increasing the tax rate. Likewise, they can lower your bill by decreasing the assessed value of your property and/or by decreasing the tax rate.

Recommended Reading: Nys Dtf Pit Tax Paymnt

Determining Your Assessed Value

Assessment Ratios

| Tax class 2, 3 and 4 | 45% |

Limits on Increases for Class 1, 2a, 2b and 2c properties.

- Tax class 1 – 6% per year, no more than 20% over 5 years.

- Tax class 2a, 2b, 2c – 8% per year, no more than 30% over 5 years for building with 10 or less units.

- Tax classes 2 and 4 – Read about Transitional Assessed Values for information on how your Assessed Values are phased in.

- The assessed value on your notices from the Department of Finance may be different than what you would get if you multiply your Market Value by the assessment ratio. This is because of the limits on assessment increases.

- You may find that even when your Market Value has gone down, your Assessed Value continues to go up. This will happen if your actual Assessed Value, taking into account limits on assessment increases, is lower than the assessment ratio – 6% for tax class 1 or 45% for tax class 2a, 2b, 2c.

EXAMPLE OF A 1-3 FAMILY HOME

YEAR 1

YEAR 2

YEAR 3

Additional Information

What Is A Property Tax Assessment

At the end of every year, Homeowners typically receive a bill to pay property taxes. While they arent the most exciting bill to pay, its worth mentioning that they do go toward good causes, including funding essential public works and services.

Determining how big your property tax bill will boil down to your property tax assessment. As a Homeowner, its helpful to know how property tax assessments work, including what is considered in them.

Well cover all the property tax assessment basics in this article, including the details of paying them now and in the future. Keep reading for more information.

Don’t Miss: Is Ein And Tax Id The Same

What Is The Main Difference Between Property Tax And Tax Assessment

While property taxes and tax assessment determine one another, they are not the same. People still confuse these terms, so we will try to clarify:

- Property taxa tax that the government levies on the land, real estate, and certain types of personal property

- Tax assessmenta value assigned to a property for the purposes of levying and collecting property taxes

The Difference Between A Tax Assessment Vs Appraisal Value

In short, a real estate appraiser, mortgage lender, or tax assessor will determine the fair market valuation of the house at that specific time. Appraisers visit homes to evaluate the condition of the property and any alterations that were made to the home. All improvements are taken into account, as well as the areas external market value in comparable sales. This information is used to determine the fair buyer market value for the house. Real estate assessments are carried out annually to determine how much property tax is due by the homeowner. Lets break down these terms in more detail:

You May Like: Who Does Taxes For Free

The Bottom Line: For Home Buyers Market Value Matters Most

The assessed value of a home is critical for tax purposes. But ultimately, the fair market value of a home will be determined by a variety of other factors.

As you consider home options, realize that the assessed value and tax rate can change regularly. And with those changes, youll be required to pay a variable tax bill each year.

A more significant factor that will permanently affect the monthly expenses surrounding your mortgage is the mortgage rate. With that,getting the best possible mortgage rate will continue to benefit you for the full life of your home loan.

Ready to explore your mortgage options?Talk to a mortgage expert today about available options.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

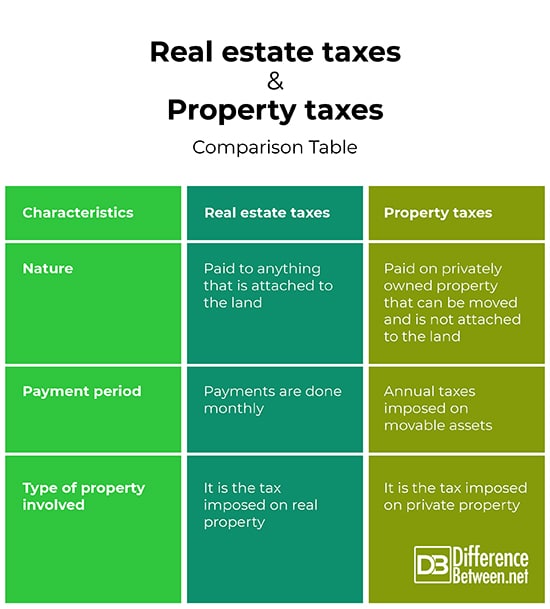

Property Tax Vs Property Tax

If you own a house or a car, you probably know the property tax. Local governments charge these fees and use the money to pay for projects and services for the good of the community, such as schools, libraries, road construction, and emergency services.

There are two types of property taxes, one for real estate and the other for personal property, and the tax you have to pay is reduced if the property in question can be moved.

The terms “property taxes” and “real estate taxes” are often used to mean the same thing and, in most cases, it is. However, while real estate taxes only cover property taxes, such as a house, rental property, or vacation home, property taxes can also include personal property, such as vehicles and furniture. Therefore, the annual registration tax for your vehicle would pass as property tax. There is a huge difference between what the government considers real estate and personal property.

Read Also: How Long To Get Tax Return

What Are California Tax Assessments

Property taxes typically are based on assessed value rather than current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

However, in California, laws have been passed that artificially limit the tax assessed value over time, explained Walker.

In 1978, California voters approved Prop. 13, a constitutional amendment known as ‘The People’s Initiative to Limit Property Taxation’ that was meant to protect older residents who were unable to keep up with large property tax increases,” said Walker. Several propositions since then have tinkered with property taxes.”

Homeowners who plan to transfer their residence to their children now or as part of their inheritance should seek professional advice, so they understand the impact of the new property tax rules, said Bruce M. Macdonald, an attorney with Carico Macdonald Kil & Benz LLP in El Segundo, Ca.

The change in property tax rules could be significant for some families, because it’s not that unusual in California to have a house that was assessed at $150,000 when the parents bought it to be worth $5 million 40 years later,” said Macdonald.

When the kids could inherit their parents’ house at the assessed value of $150,000, the property taxes would be approximately $1,500. Now, if the house is assessed at $5 million, that would incur a significantly higher tax bill,” he explained.

Property Taxes And Escrow

Many homeowners have an escrow account that contains funds set aside for expenses, including taxes and homeowners insurance. This account allows you to spread your tax and insurance payments out over the course of any given year rather than make one large payment annually.

However, if your property tax payments go up, it can cause a shortage in your escrow account that could lead to either the need for an additional one-time payment or higher escrow amounts to be deposited into your monthly mortgage payment in the next year.

Don’t Miss: Is Home Insurance Tax Deductable

How Often Do Assessed Values Change

The assessed value of a property can change frequently. However, the frequency will depend on the state and local laws that affect the property.

For example, a reassessment of a propertys value may only be required once every 5 years or as often as once per year. With that, if an assessed value seems to be too high, it may not be the deterrent that it first appears to be, if assessments happen often. An upcoming reassessment could alter the assessed value to a more appropriate level.

What Does Total Assessment Mean On Property Taxes

There are several types of tax assessment-related values, including:

- Appraised valuea value of a property based on the fair market valuea price the buyer would be willing to pay for the property in question

- Assessed valuean adjusted valuea market value multiplied by the assessment ratio. The assessed value affects only the tax bill

- Taxable valueassessed value minus the applicable property tax exemptions

The total assessment represents the value of every property in the state. How does this affect taxpayers? Tax rates in a state or county are determined based on the total assessed property valuea tax rate is a necessary revenue divided by the total assessed property value. Say that a state or county needs $1 million in tax revenue. If a total assessed property value is $100 million, the property tax rate is going to be 1%.

Read Also: How Long Do Taxes Take To Process

See If You Meet The Requirements For A Property Tax Exemption With Donotpay

Whatever part of the country you live in, you will be able to find certain property tax exemptions created to help people who could use some tax relief. The property tax exemption programs usually apply to veterans, senior citizens, and disabled people. DoNotPay can assist you with finding out whether you can apply for any of the exemptions available in your state in under five minutes. You only need to follow these steps:

We will also help you apply for the exemption if you meet the criteria!