Austin County Property Tax Rate

Contents

Because Austin County uses a complicated formula to determine the property tax owed on any individual property, it’s not possible to condense it to a simple tax rate, like you could with an income or sales tax.

Instead, we provide property tax information based on the statistical median of all taxable properties in Austin County. The median property tax amount is based on the median Austin County property value of $146,500. You can use these numbers as a reliable benchmark for comparing Austin County’s property taxes with property taxes in other areas.

Our data allows you to compare Austin County’s property taxes by median property tax in dollars, median property tax as a percentage of home value, and median property tax as a percentage of the Austin County median household income.

While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis, you can use our Austin County property tax estimator tool to estimate your yearly property tax. Our property tax estimates are based on the median property tax levied on similar houses in the Austin County area.

Property taxes are managed on a county level by the local tax assessor’s office. If you need to find out the exact amount of your property tax bill or find other specific information, you can contact theAustin County Tax Assessor .

Tax Rates In The Surrounding Metros

Since property taxes are assessed at the county and city level, they vary by location. If you live in the Travis county portion of Austin, your taxes will be different than if you live in north Austin, which is in Williamson County. It is important to consult the appraisal district for your county to ensure you are using the correct rates to estimate your potential property taxes.

Please note, some cities have a community college tax rate. If a community has that tax, it has been included under other.

*The data in this chart was compiled by the Austin Chamber of Commerce from the County Assessors or Appraisal Districts. This table is designed to provide a typical tax rate for the mentioned counties and cities and should not be used as an exact rate. Please consult the County Appraisal Districts for current tax rates and information.

With No State Income Tax Texas Is Seen As A Fiscal Promised Land Heres The Downside

- Print icon

- Resize icon

Texas is once again witnessing the largest population growth in the nation as people increasingly migrate to what they see as the fiscal promised land.

While greater job opportunities and certainly warmer weather await, the impact on their pocketbooks in terms of taxes and fees may leave them wondering if they should search elsewhere for their sought-after kingdom of economic milk and honey.

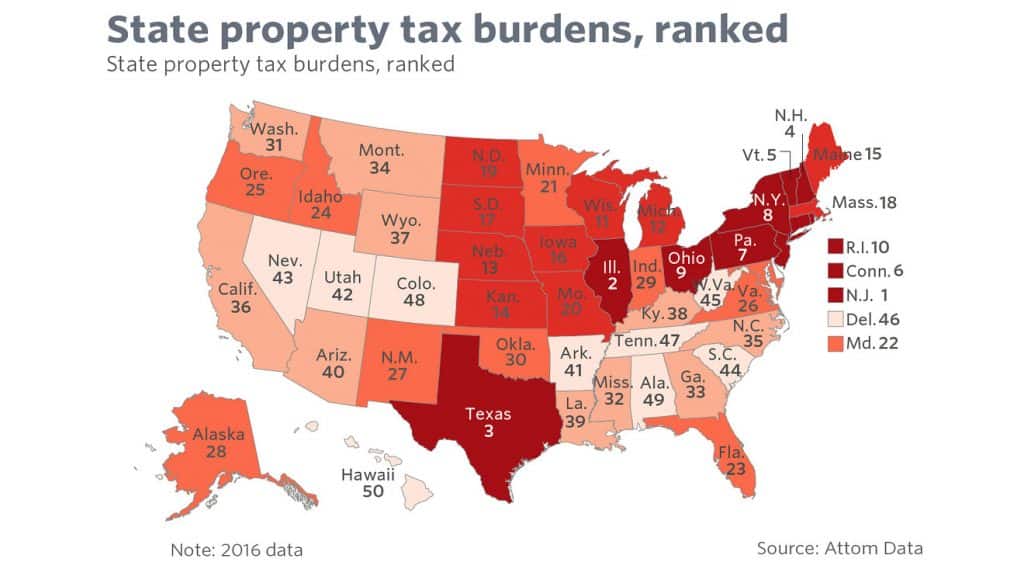

Texas has no personal income tax a significant benefit compared to states like California, New York and New Jersey that have high income-tax rates. According to the Tax Foundation, the states total tax burden is the sixth-lowest in the nation.

However, for many new residents, including some retirees, the overall tax burden may not be much less than in the state they left. Thats because Texas state and local taxes fall disproportionally on lower-income individuals. That is, the lower a taxpayers income, the greater the percentage of income is paid in taxes. In fact, the state is currently ranked 46th in tax progressivity.

Texas tax regressivity is mainly the result of its heavy reliance on sales taxes in the absence of a state income tax. Texas has an average combined state and local sales tax of 8.20%, ranking it 14th among the states.

Texas has been cited as having the second-most overvalued housing market in the nation. And, of course, renters cant avoid these property taxes insofar as landlords are able to raise rents.

Beyond property taxes

Don’t Miss: Amended Tax Return Deadline 2020

How To Save Money:

Homeowners can save money through exemptions. The most used exemption is homestead.

Travis County homestead exemptions include:

- General Residence Homestead Exemption

- Person age 65 or older

- Disabled person

- 100% disabled veteran

- Disabled veteran or survivor

- Donated residence of partially disabled veteran

- Surviving spouse of an armed services member killed in action

- Surviving spouse of a first responder killed in the line of duty

The Tax Code also allows for a chief appraiser to determine if a property qualifies for a temporary exemption if that property has been damaged. Also, property owners have until April 30 to apply for an exemption for certain solar and wind-powered energy units.

The Texas Constitution requires local taxing entities to let the public know about tax proposals in order to get public input. Travis County and Williamson County both have a website for people to search for their address and see the tax breakdown by each entity.

The other way to save is to participate in public budget hearings. Voters can pressure taxing entities to lower rates and cut costs.

Estimating Your Property Tax

Having an estimate of the property tax you might pay will help you to create a complete budget for homeownership, but it can be difficult to know where to begin. There are online tools such as Travis Countys Property Tax Estimator but not all counties and appraisal districts have them available, and generic national tools will often provide very generalized rates that can be far off base as they are unable to take into account varying school districts, special districts, and other differing factors.

While it may seem daunting, it is possible to calculate your estimated taxes with just a little research of your own.

First, visit the website for your county appraisal district to ensure that you have the current property tax rate for your home or property.

Don’t Miss: Local County Tax Assessor Collector Office

How To Lower Your Property Tax Bill As May 15 Protest Deadline Approaches

More Videos

AUSTIN, Texas Even if you had no increase on your property value, the bill could still increase.

Taxing entities, like cities and school districts, determine how much to charge. In Travis County, more money goes to Austin ISD than any other taxing entity in the county at $1.5 billion.

One homeowner may pay five or more taxing entities including city, county, school district, health district and community college district.

One way for property value to increase but keep the tax bill the same would be for taxing entities to lower what they charge.

In 2021, school districts in Travis county lowered their rates. Homeowners would pay less, unless the property value increased by more than the savings.

Some cities, like Leander, also lowered rates. The City of Austin did not.

Austin raised the property tax rate from $0.5335 per $100 taxable value in 2020 to $0.541 in 2021.

That would be an additional $38 on a $500,000 home.

Notice Of 2021 Tax Year Proposed Tax Rate For City Of Austin

A tax rate of $0.5542 per $100 valuation has been proposed by the governing body of the City of Austin.

|

Proposed Tax Rate |

|

$0.5542 per $100 |

The no-new-revenue tax rate is the tax rate for the 2021 tax year that will raise the same amount of property tax revenue for the City of Austin from the same properties in both the 2020 tax year and the 2021 tax year.

The voter-approval rate is the highest rate that the City of Austin may adopt without holding an election to seek voter approval of that rate.

The proposed tax rate is greater than the no-new-revenue rate. This means that the City of Austin is proposing to increase property taxes for the 2021 tax year.

A PUBLIC HEARING ON THE PROPOSED TAX RATE WILL BE HELD ON Aug. 11, 2021, at 10 a.m. Austin City Hall, 301 W. Second Street, Austin, Texas.

The proposed tax rate is not greater than the voter-approval tax rate. However, you may express your support for or opposition to the proposed tax rate by contacting the members of the City Council of the City of Austin at their offices or by attending the public hearing mentioned above.

YOUR TAXES OWED UNDER ANY OF THE TAX RATES MENTIONED ABOVE CAN BE CALCULATED AS FOLLOWS:

Property tax amount = x / 100

FOR the proposal: Steve Adler, Natasha Harper-Madison, Vanessa Fuentes, Sabino “Pio” Renteria, Gregorio “Greg” Casar, Ann Kitchen, Leslie Pool, Paige Ellis, Kathie Tovo

AGAINST the proposal: Mackenzie Kelly, Alison Alter

PRESENT and not voting:

ABSENT:

Recommended Reading: Corporate Tax Rate In India

Things To Know About Commercial Property Tax Rates In Austin

Austin, Texas is well known for its rapidly growing and competitive residential real estate market, but the commercial real estate industry is also booming in the Texas capital. Austin was ranked as one of the Top 10 Commercial Markets of 2021 by the National Association of Realtors.

Yet, as the demand for and cost of commercial properties rises in Central Texas, so do property taxes. If you own commercial real estate in Austin or are thinking about investing, here is what you should know about commercial property tax rates and how to protest them, if needed.

What Are Commercial Property Taxes?

Property tax levies on commercial property are similar to those on residential propertybut commercial property tends to create a bigger tax bill. Thats because commercial property taxes are based on the assessed value of the real estatetheyre worth more than a home and they generate income, so the property tax bills are steeper.

Texas Property Taxes are Notoriously High Without a state income tax, local entities in Texas rely on property taxes to fund their schools and local government. As a result, property taxes on commercial property tend to skew higher, since municipalities depend on them to pick up the slack.

2020 tax rates

How to Protest Commercial Property Tax Assessments

The Value Of Your Travis County Home Has Gone Up A Lot That Doesnt Mean Your Property Taxes Will

People who own property in the Austin area recently received new valuations from the local appraisal district. This number, known as your appraised value, estimates what your property would currently sell for in Austins record-breaking housing market.

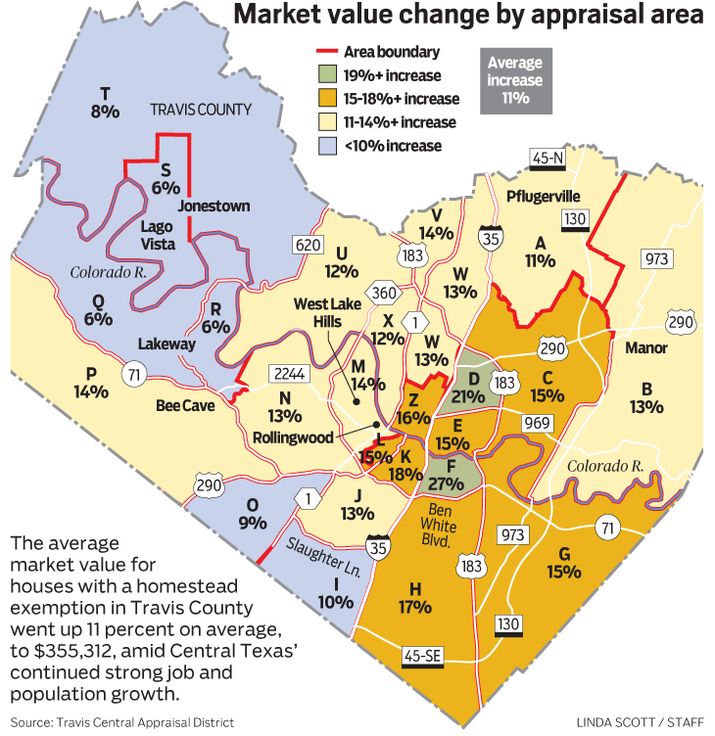

The appraisals are a lot higher than they were last year. According to the Travis Central Appraisal District, on average, appraised values rose 56% over the past year.

But if you live in the house you own, and have filed what is called a homestead exemption, the amount you have to pay taxes on is entirely different. This is called your taxable value, and it is probably much lower than the estimate of what your home would sell for unless you bought your house in the past year. Then those numbers are likely the same.

Still confused and in shock? We got you.

The appraised value of my home went up more than 50% in the last year. Does that mean my taxes will go up that amount?

Almost certainly no.

If your property tax bill does go up and we dont know that it will its almost certain it wont increase by anywhere close to that amount. Thats because while the amount your home would sell for can go up any amount year over year, the state limits how much of that value you can be taxed on.

But he wont be taxed on that amount. The “Net Appraised” column shows Largey’s taxable value.

So, Ill ask again: Will my taxes go up?

We dont know yet.

Sure. Maybe.

Recommended Reading: Free Irs Approved Tax Preparation Courses

Austin County Property Tax Deduction

You can usually deduct 100% of your Austin County property taxes from your taxable income on your Federal Income Tax Return as an itemized deduction. Texas may also let you deduct some or all of your Austin County property taxes on your Texas income tax return.

Has this page helped you? Let us know!

Austin Cities/towns Property Tax Rates

The following table provides 2017 the most common total combined property tax rates for 29 Austin area cities and towns. Complete lists of Austin school districts and counties in the Austin-Round Rock-San Marcos metro area are shown by clicking on these Austin school districts property tax rates and Austin counties property tax rates jump links.

To show the combined total tax rates for all of the Austin cities and towns listed below, change Show entries to All. To display the tax rates for only a specific city or town, enter its name in the Search box. Click on the column headings to change the table sort order.

| property tax rates |

|---|

You May Like: Penalty For Filing Taxes Late If I Owe Nothing

Has Anyone Tried To Fix This

Texas legislators have tried numerous ways to limit property tax growth.

Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation to $25,000.

State law also limits the taxable value of a home from rising more than 10% in a given year on an owners primary residence. In Travis County, the median market value of a home grew nearly 54%. But the median taxable value of a home in Travis County rose by about 11% after also accounting for the construction of new homes just coming onto tax rolls for the first time.

In 2019, lawmakers passed a pair of laws aimed at slowing growth. House Bill 3 was an $11.6 billion school finance bill that included $5.1 billion to lower school district taxes, $6.5 billion in new school spending and caps on school districts tax rates. Senate Bill 2 required many cities, counties and other taxing units to get voter approval if they want to raise the property tax revenue they collect from all property owners by 3.5% or more than the previous year.

According to a study by the Texas Taxpayers and Research Association, the bills worked sort of. The study says Texas taxpayers would have shelled out $6 billion more in property taxes than they did in 2021 if not for the two bills the result of falling tax rates.

But that doesnt mean everyones paying less in taxes. School tax rates dropped by 13% since the bills passed in 2019, but taxable property values rose by 23%, according to the study.

What Does Property Tax Revenue Fund In Austin

The property tax in Texas is a local tax, assessed and collected locally and spent locally. More than 3,700 local governments in Texas school districts, cities, counties, and other special districts collect and spend this money.

The majority of community services are paid for through local property taxes in Travis County. These local assessments do not benefit the state government. Your local property taxes go toward funding various essential programs, including your public schools , city streets, county roads, police departments, fire protection, and other vital services in Travis County. One hundred twenty-seven municipal governments fall under the jurisdiction of Travis County.

As a property owner in Austin, Texas, you may fall under certain homestead exemptions, but you will want to check with your county appraisal district. Additionally, you can attend tax rate public hearings if youre involved in your local government.

Read Also: Sale Of Second Home Tax Treatment

What Is The Austin County Property Tax

Proceeds from the Austin County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. Property tax income is almost always used for local projects and services, and does not go to the federal or state budget.

Unlike other taxes which are restricted to an individual, the Austin County Property Tax is levied directly on the property. Unpaid property tax can lead to a property tax lien, which remains attached to the property’s title and is the responsibility of the current owner of the property. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Property tax delinquency can result in additional fees and interest, which are also attached to the property title.

In cases of extreme property tax delinquency, the Austin County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. Proceeds of the sale first go to pay the property’s tax lien, and additional proceeds may be remitted to the original owner.

Austin Property Tax: What Can You Expect When Moving Here

One of the often-overlooked long-term expenditures in the home buying process is the annual property taxes. It is important to have a reasonable expectation of what you will be paying in order to budget accordingly, especially if you are relocating. But, what exactly is a property tax, and what is it for?

Property taxes are taxes assessed and charged annually based on 100% of the market value of your home or property. They are collected at the city and county level, so tax rates will vary by location. All revenue from property taxes are used to support and maintain community infrastructure.

Don’t Miss: How To Find 2020 Tax Return

Tax Rates In Surrounding Areas

Maybe you want to move to Austin, but the tax rates and total property costs are swaying your decision. Dont worry you can always choose an area close to Austin.

For reference, here are some of Texas taxes rates for properties near Austin, Texas.

- Pflugerville: 2.38%

- San Marcos: 2.2%

- Dripping Springs: 2.0%

These arent all the neighboring cities in Austin, Texas, but just a few to help you get an estimate of what they would be like. To better assess your property taxes in Austin, please consult the appraisal district for your county.