Figure : Percent Of Total Housing Units In Housing Value Range 2019

As Figure 2 above shows, average state and local sales tax revenues per capita are nearly identical in the two states , which is perhaps not surprising given average state and local sales tax rates of 8.68 percent and 8.19 percent in the Golden and Lone Star states, respectively .

Intergovernmental revenue from the federal government represents the next largest category of revenues for both California and Texas, accounting for about one-sixth of revenues in both states. These revenues are mainly federal matching funds for each states Medicaid program, which provides health insurance for low-income individuals . The much greater per capita intergovernmental revenues in California largely reflect the states much larger Medicaid program, which enrolls 13 million versus just 5 million in Texas. The difference in Medicaid enrollment between the two states surged in 2014, when California expanded its Medicaid program as called for in the Affordable Care Act while Texas did not .

Other Reasons Why You Should Move To Texas

Everythings bigger in Texas. Theres no doubt youve heard our state motto. So, when it comes to being big the state itself takes the top spot in the continental U.S. From the largest cowboy boots in San Antonio to Big Tex to King Ranch to donut and cinnamon rolls theres plenty of roadside attractions and food to fill weekends and one-day trips.

Southern hospitality. Texas pride runs deep. Here, Texans love Texas and theyll tell you so. And, theyll also take the time to welcome you, tell you the best places to go and eat, where to shop, what festivals to attend, and where to find the best places to hear music. Now, thats hospitality.

Austin ranks No. 6 as The Best Cities to Raise a Family in 2018. And according to SmartAsset, the primary reasons why is because of Austins quality of schools and positive economic conditions.

Property Tax As A Percentage Of State

New Hampshire, New Jersey, and Connecticut top several categories in our property tax ratings by state. They hold the 1st, 2nd, and 3rd position as states with the highest total property tax as a percentage of state-local revenue. Their percentages are 38.59, 29.22, and 26.39, respectively. Alabama holds the last place here as its total property tax collected represents only 7.09% of the state-local revenue.

Don’t Miss: When Is Tax Returns Due

What Are Property Taxes

Property taxes, or real estate taxes, are paid by a real estate owner to county or local tax authorities. The amount is based on the assessed value of your home and vary depending on your states property tax rate. Most U.S. homeowners have to pay these fees, usually on a monthly basis, in combination with their mortgage payments. If you pay off your loan, you receive a bill for the tax from local government occasionally during the year.

The money used for the property tax goes toward the community. It supports infrastructure improvements, public services and local public schooling.

Reason Number Two Property Values Are On The Increase

How Are Property Taxes Calculated in Texas in Relation to Property Values?

Ad Valorem Tax is based on an items assessed value, so ad valorem property taxes refer to the assessed value of a property. Texas tax laws dictate that an appraisal district in each county, administered by a chief appraiser, is responsible for appraising property values each year.

For a home appraisal, property tax is determined as a percentage of your homes value, so the more your home increases in value, the higher your property tax bill will increase. For example, a residential property in Austin that is appraised at a value of $250,000 will pay around $4,933 per year. If this same homes value increases to $275,000, the annual property tax bill will increase to $5,426. This is great for selling your home but is a substantial increase in annual taxation if youre not. If property owners do not agree with the property appraisal value or find that their home has been overvalued, they can lodge a formal protest with the appraisal review board to have the property re-evaluated.

Recommended Reading: Sales Tax In North Dakota

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

Other Essential Property Tax Trends

Besides our list of property taxes by state, we also analyzed a few other essential trends associated with this type of tax. In the section below, we will go over the importance and effects of property tax in each state. Learn how vital of an income source this tax is as well as what percentage of personal income it represents.

Before we move on, however, lets first see the stats for the USA as a country. The state property tax contributes 30.08% towards the overall income. The total property tax as a percentage of state-local revenue is 16.93%, while the property tax percentage of personal income stands at 3.12%. Finally, the per-capita property tax in the US is $1,618.Scroll down to find all about these vital property taxes by state segments.

Don’t Miss: Filing Taxes With No Income

Who Benefits By Having No Income Tax And High Property Taxes

Living in a state with no income taxes offers both benefits and drawbacks to individuals and businesses. While a lack of income tax is beneficial to all households from a financial standpoint, the more a homeowner earns, the more money they can save by living in a state with no income taxes.

States with no income tax may either compensate with increased rates on other tax types or spend less on public infrastructure. In the former case, residents may still see decreased earnings, as money not spent on income tax is spent through other channels .

If a no-income-tax state chooses to spend less on public infrastructure, then residents may have access to fewer public services and benefits as a consequence. For instance, income taxes typically fund the state-managed parts of the road network, education infrastructure , local law enforcement agencies, and other public services.

Examples:

- A single person earning $1 million a year in Wyoming must pay an effective tax rate of 32.94% to the federal government but $0 to the state, resulting in an after-tax income of $670,572.

- A single person earning $1 million a year in California pays the same effective federal tax rate of 32.94% but also an effective federal state tax rate of 13.24% , resulting in an after-tax income of $538,200.

Which Counties Have The Lowest Property Taxes In Texas

Each county in Texas is responsible for setting its own property tax rates, resulting in taxes in Texas that vary across the state. When you compare property taxes with other counties, keep in mind that, typically, counties with low property taxes have smaller populations. As of 2020, the five counties with the lowest property tax rates in Texas were:

You May Like: Income Tax Rates In South Carolina

Opportunity Vs Location: A False Dichotomy

Some may contend that location-based opportunity triumphs over increased tax burdens. I propose that its a bit more nuanced.

Lets take Washington versus California for example, two states generally regarded as having high-income generating opportunities.

Residents of California can expect to pay $12,500 more annuallyor 14% higher taxesas a percent of income compared to Washingtonians, thanks largely in part to the states zero percent state income tax. In essence, while earning $50k more in California may outweigh the tax-savings of living in Washington, remote and hybrid work changes the game.

That all said, lets move on to my calculations in this article:

- Property tax was based off median home prices per state and state averages for real estate taxes.

- Income tax rate was based on the median household income from the U.S. Census Bureau with rates from The Tax Foundation.

- Sales tax was based on U.S. Bureau of Labor Statistics household spending averages with the addition of gas and personal property taxes. Note: the average person spends about $25k a year on taxable goods and services but this can go up significantly if you make large purchases such as a car.

Now, lets first look at the worst tax states in America to evaluate whether taxes effect where people live, or if opportunity triumphs.

These percentages are calculated using median values for income, housing, and spending.

Figure : Government Revenues And Spending 2019

Total revenues and total spending by all three levels of government in 2019 were $6.77 trillion and $7.65 trillion, respectively, representing approximately one-third of the $21.43 trillion in 2019 GDP .. One notable contrast between the two pairs of government finance numbers is that in contrast to the federal government most state and local governments have laws requiring them to balance their budgets and prevent them from running deficits. Because of this and given the strong state of the economy in 2019, the state and local government sector ran a modest surplus while the federal government ran an almost $1 trillion deficit that year.

California and Texas differ significantly with respect to the overall size of their state and local government sector. As shown in Appendix Table 2, Californias state and local governments spent $16,145 per state resident in 2019, while Texas counterparts spent just $10,024 per resident. The revenue figures were similar at $16,879 and $9,997, respectively .

The state government raises slightly more revenue than local governments in both states, but local governments actually spend slightly more due to their receipt of state revenues. In California, state transfers account for nearly one-third of local government revenues while the corresponding share in Texas is just one-fifth. This likely reflects a greater effort in California to transfer funds from high- to low-income parts of the state.

Read Also: Where’s My Tax Credit

How Having No Income Tax Impacts Your Earnings

If you live in a state that doesnt levy personal income taxes, it means that your state government does not require you to pay taxes from your wages, pension, retirement plan plan or IRA), or Social Security income.

Example: An individual with a yearly salary of $80,000 living in a state imposing a tax rate of 5.25% for their income bracket must pay a yearly income tax rate of $4,200, reducing their yearly earnings to $75,800 .

Best Tax States Surprising Or Revealing

If someone were to quiz you on the tax friendliest state using the Big Three calculation, your first reaction may be Texasbut you would be wrong. Some of these tax friendly states Im about to explore may get unfairly crossed off your list of places to relocate. All things considered, these states offer serious advantages that are worth a second look.

Here are 9 states that have zero state income tax and surprise, surprise, they represent the top 6 overall tax friendliest states.

You May Like: How To Get Old Tax Returns

Figure : Ca Vs Tx State And Local Revenues Per State Resident 2019

In contrast, property tax revenue per state resident is somewhat higher in Texas than in California . This difference is especially striking when one considers that the median value of a home in California is almost three times higher than in Texas .

Figure 3 contrasts the distribution of these values in these states. As this figure shows and according to U.S. Census data, 57.8 percent of California units have a value of $500,000 or more while just 7.8 percent in Texas do. The higher property tax revenues in Texas are therefore driven by higher rates.

Consistent with this, property taxes as a share of the value of owner-occupied housing were recently estimated to be more than twice as high in Texas as in California . Much of this difference is driven by Californias Proposition 13, a 1978 ballot measure limiting the rate at which property taxes can grow to less than 2 percent annually.

Figure : Net Immigration Ca Vs Tx 2001

These divergent trends were driven by two factors depicted in Figure 4 and Figure 5. First, immigration to the U.S. plummeted by 55 percent, from just over 1 million in 2015 to 477,000 in 2020 . However, and as Figure 5 shows, the decline was much more pronounced in California than in Texas .

Second, net migration from California to other states more than tripled from 2015 to 2020 . During this same period, Texas continued to attract more people from other states than the number that left it and this remained stable, declining by just 6 percent . Similar to the rest of the country, both California and Texas saw declines in their birth rates and increases in their mortality rates in each year from 2015 to 2020 .

Recommended Reading: Irs Track My Tax Return

Cost Of Living In California

MIT compares the costs of six different typical expenses for each state: food, child care, medical, housing, transportation, and “other.”

In all areas, California was more expensive than Texas. The average single adult could expect to eat with $3,792 a year in California versus $3,177 in Texas.

MIT sets the living wage for an adult with one child in California as $83,917 before taxes compared to about $59,652 in Texas. On average, Texas also has less expensive medical care than California.

Housing is the largest single expense category in MIT’s calculation it is also the area where Texans saw the largest advantage. Housing costs are an impressive 48% higher in the Golden State than in the Lone Star State. The difference was more pronounced for bigger families.

California does win out on transportation costs the average adult in Texas spends 9.9% more on getting around than his Californian counterpart.

Lumping expenses such as entertainment, dining out, pet care, and other possible expenses together, the “other” category is another win for Texas its average residents spend 5.4% less here.

Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: How Are Taxes Calculated On Paycheck

Where Does The Money Come From

In both California and Texas, taxes are the largest source of revenue for the state and local governments, although the composition of this tax revenue differs significantly between the two states. As Appendix Table 1 shows, state and local tax revenue per capita in California was $7,326 per state resident versus just $4,709 in Texas. This difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per capita in California but $0 in Texas, which is reflected in Figure 2 below.

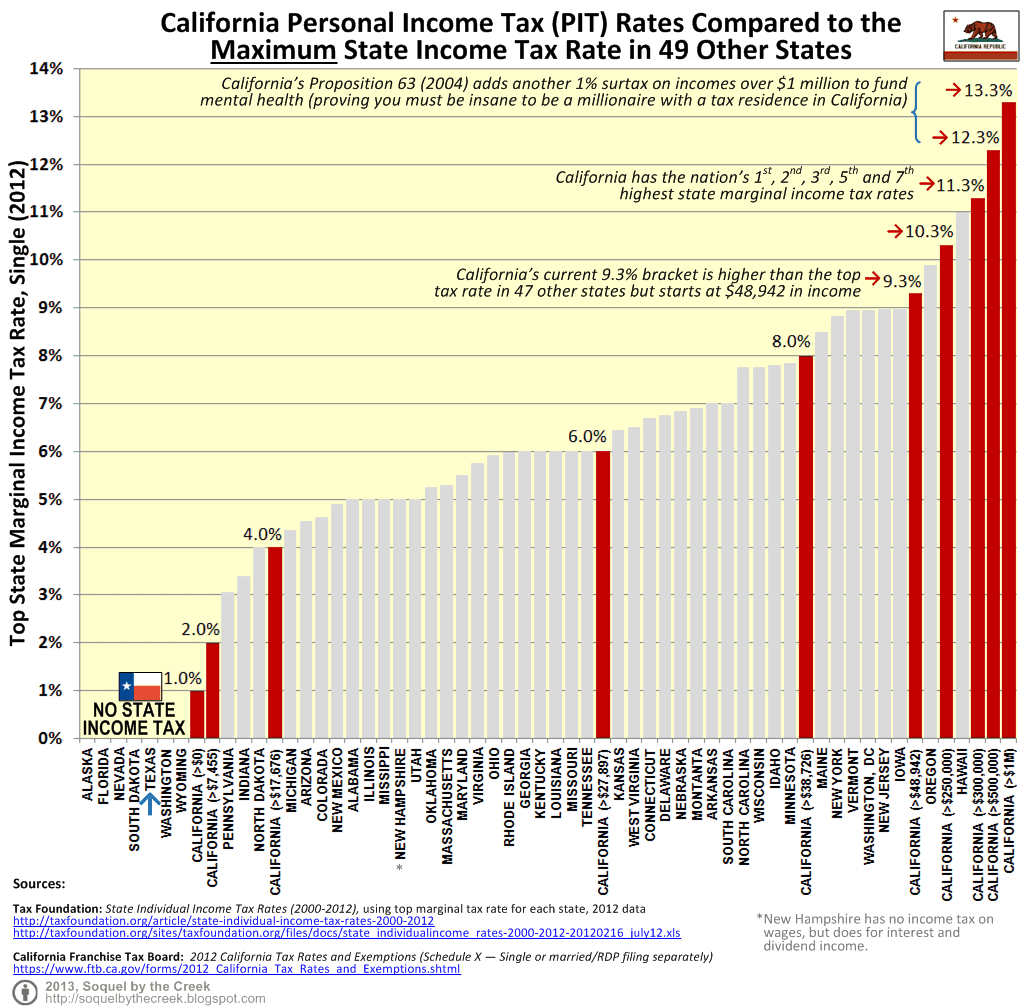

To put an even finer point on the difference, California has the countrys highest top marginal individual income tax rate, while Texas is one of just eight states with no individual income tax . Recent research suggests Californias tax hikes from nearly a decade ago caused a large number of wealthy residents to leave the state .

California Property Tax Rates

Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. This is the single largest tax, but there are other smaller taxes that vary by city and district.

Voter-approved taxes for specific projects or purposes are common, as are Mello-Roos taxes. Mello-Roos taxes are voted on by property owners and are used to support special districts through financing for services, public works or other improvements.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home’s purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

The table below shows effective property tax rates, as well as median annual property tax payments and median home values, for each county in California. Assessed value is often lower than market value, so effective tax rates in California are typically lower than 1%, even though nominal tax rates are always at least 1%.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage payment calculator.

Read Also: Tax Preparation Services Springfield Il