How To Calculate Taxable Income On Rental Properties

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.There are 7 references cited in this article, which can be found at the bottom of the page. This article has been viewed 90,145 times.

If you own property that you rent out to tenants or vacation property that you rent to others when you are not using it, you may have taxable rental income. Rental income is subject to ordinary income tax.XResearch source You typically use Schedule E, Supplemental Income and Loss to calculate your taxable income on any property you own and rent out.XTrustworthy SourceInternal Revenue ServiceU.S. government agency in charge of managing the Federal Tax CodeGo to source

Earned Vs Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. It’s money that you make from other money. Even if you’re actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, “unearned” doesn’t mean you don’t deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

What Expenses Are Not Deductible

There are some expenses the CRA specifically doesnt allow:

- The market value of any services or labour you perform isnt a deductible expense.

- If you live in the house or building you rent out, you can only claim expenses associated with the rented part of the building.

- The land transfer taxes you paid when you purchased the property arent deductible. Theyre part of the cost of the property and can usually be included in the CCA calculation for the building.

- You cant deduct payments towards your rental propertys mortgage or loan.

- You cant claim penalties shown on your Notice of Assessment from the CRA.

Don’t Miss: How Does Tax Write Off Work

Comparison Of Ontario Land Transfer Taxes With Other Provinces

I am a first-time home buyer

History of the Ontario Land Transfer Tax

Introduced to Ontario in 1974, the ConservativeOntario Governmentpresented the provincial Land Transfer Tax to property buyers with a starting percentage of 0.3% for up to $35,000 of the purchase price of property and 0.6% for the rest. In 2008, a municipal Land Transfer Tax was introduced in addition to the provincial one to home buyers in Toronto and a Non-Resident Speculation Tax became effective for the Greater Golden Horseshoe Region in 2017. Ontarios Land Transfer Tax rates were last updated in 2017. Land transfer tax rates in Ontario arent changed often. When Ontario land transfer tax rates were last updated in 2017, it was the first update in 20 years since 1997.

Toronto Land Transfer Tax

Toronto currently has the highest Land Transfer Tax rates in Canada. Since 1974, the cost grew seven times faster than the increase in house prices themselves and now cost an average of $20,000. On top of the provincial tax, Toronto home buyers within the area encircled by Etobicoke, Steeles Avenue, Scarborough, and Lake Ontario also have to pay a municipal tax that is equal to the Ontario tax rates. To account for the additional cost to Toronto homebuyers, first-time home buyers in Toronto can receive a rebate of up to $4,475.

You May Like: What Form Do You Need To File Taxes

What Expenses Can I Claim For My Rental Property

When you invest money back into your rental property, some of those expenses are deductible against your rental income. Common deductions property owners can make include:

-

Interest on your mortgage

-

Money invested in marketing your rentals

-

Any cleaning or maintenance fees

-

Expenses for hiring property management professionals

-

Legal or bookkeeping expenses

Lets take a look at what some common deductions would look like on a property that brings in $25,000 in rent each year.

-

Total Rental Income: $25,000

-

Rental Income After Expenses: $11,550

Should I Look At An Investment Property

Before deciding whether to buy an investment rental property, you should take into consideration the capital gains tax you may have to pay when you come to sell.

It might not apply to you if the property is or has been your home, but otherwise, its treated the same as the sale of any other asset. Basic-rate taxpayers will pay 18 per cent and higher or additional rate taxpayers will pay 28 per cent on the money made over the personal allowance for the tax year.

You May Like: California Tax On Capital Gains

How To Calculate Cash

Cash-on-Cash ratio calculates how much cash a rental property generates compared to how much cash has been paid for it. In other words, it is a ratio of cash flow to investment cost of a rental property.

This metric is very similar to ROI. The only difference between them is that ROI looks at net income while CoC looks at cash flow. When it comes to rental properties, the difference between net income and cash flow is the principal mortgage payment. Principal mortgage payments are not subtracted from net income because it is not an expense even though it does require a cash payment. On the other hand, cash flow does not account for principal mortgage payments because even though it is part of income, it does not come in the form of cash. The following formulas are used to calculate the cash-on-cash ratio.

Generally speaking, cash-on-cash tend to be lower than ROI

Are There Ways To Reduce These Tax Liability

Absolutely!

Recapture tax can be reduced by using capital cost allowance of another property against the property being sold.

If you dont have a second one, you can consider buying another property in the same calendar year.

Capital gain taxes can be reduced by any capital assets that you own that already have unrealized capital losses, such as, loss on any stock or mutual funds in any unregistered accounts.

Until next time, happy Canadian Real Estate Investing and enjoy the heat.

Cherry Chan, CPA, CA

Also Check: How Much Percent Is Tax

How Do I Claim Mortgage Costs

Theres no simple answer to this question because there are so many factors to consider. Your wealth, tax bracket, home cost, etc. will all impact what percentage of the closing cost that may or may not be tax-exempt. Additionally, you need to see which approach, taking a standard deduction or deducting your closing costs, will save you the most money.

The IRS lists the following costs as deductible:

- Sales tax issued at closing

- Real estate taxes charged at the closing

- Mortgage interest paid at closing

- Real estate taxes that were paid for by the mortgage lender

- The interest you paid at the houses purchase

- Loan origination fees

The following are not deductible:

- Pre-move-in utility charges

How To Calculate Roi On A Rental Property

Return on investment is a ratio between the return from an investment over the cost of the investment. This means that ROI shows how much you will make from your rental property as a percentage of the total cost per year, and can be used to see if your rental property is worth the investment.

There are different ways to calculate ROI for different investment purposes. Some people may prefer to calculate ROI on the whole investment while others may choose to calculate the gain based on theprice per square foot. Return on investment for rental properties is usually calculated using a net income and the cash paid to acquire the property, which is called an investment cost of the property.

A positive ROI figure means that you are making money, while a negative ROI will mean that you are losing money. Likewise, a higher ROI means that you are making more money per dollar invested, suggesting that your investment is producing fruitful returns. However, unreasonably high ROIs may prompt a second look.

If a property is bought with cash only, then the investment cost is equal to the price of the property plus closing costs and any repairs made to the property. On the other hand, if a property is financed with a mortgage, then the investment cost is equal to thedown paymentplus closing costs and any repairs made to the property.

Don’t Miss: Johnson County Property Tax Search

How To Get Started In Real Estate Investing

How do you get into investing in real estate? The first is to thoroughly investigate the area you are considering buying in. The average rent in Vancouver for a 1-bed apartment is $2176/month, whereas, a 1-bed apartment in Edmonton is just $1026/month. That is a difference of $13 800 a year!

The top tip for investing in real estate for beginners is to start locally. If you know the area well or, better yet, have lived there you will have a wealth of knowledge to advantage you in making a wise investment. Maybe a property is beautiful, roomy and looks like a sure-fire winner. But wait! That sleepy-looking bar over the road that was empty when you visited at 3 pm is in fact the most popular student night in town! How will you rent to a family if Latin Fusion Wednesday is keeping them up all night?

If you know an area you will also have a good idea of what kind of tenants you are likely to attract. Different types have their advantages and disadvantages. If it’s an area with a lot of young, social people and good bars you will never have a problem filling a vacancy. On the other hand, you will probably have a high turnover rate and an elevated rate of repairs and maintenance. A suburban family home might take longer to fill but when a lease is signed, your tenants are likely to stay for the long term, especially if they have school-age children.

Why Invest In Rental Properties

Rental properties are an attractive investment opportunity for a number of reasons:

Even though there are a lot of responsibilities to being a landlord, you still have to put in less time and effort than you would in a regular job. Moreover, by hiring a property management firm, there is even less for you to do. This makes rental properties a great investment opportunity that constantly generates income.

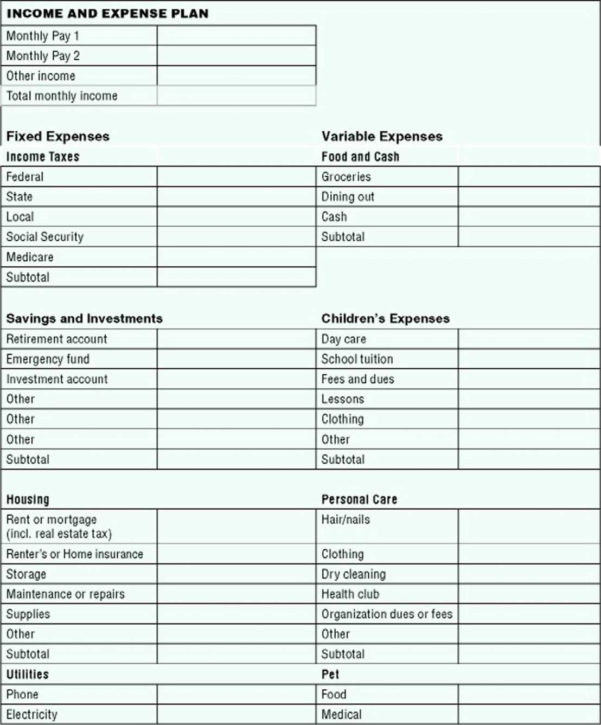

When you own a rental property, there are a number of expenses that you can write off to lower your tax obligation when you file yourincome taxreturn. These expenses include:

Interest – if you purchase your investment property through a loan, you get to deduct the mortgage interest you have paid for during the year in your yearly income tax return.

Depreciation – Rental property owners can depreciate their property by 3.636% yearly over 27.5 years. They can write off this depreciation as an expense when filing their income tax return.

Repairs – Any repairs you make on the rental property can be deducted from the tax return on the year during which you made the repairs.

Insurance – You can deduct insurance premiums that are related to your rental property and to you as a landlord. For example, you can deduct landlords insurance premiums from your income tax returns.

Don’t Miss: Tax Loopholes For Small Business

Easily Calculate Your Cyprus Rental Tax

Disclaimer

The above calculator is not a legal or Tax advice and no one should rely on it. This form has been prepared as a general guide for information purposes only as many other tax aspect should be taken into account. Please note that it is not a substitution for professional advice or an advice at all. One must not rely on this Form without receiving independent advice based on the particular facts of his/her/its own case. No responsibility can be accepted by the authors or the company for any loss occasioned by acting or refraining from acting on the basis of this publication.

How Do I Avoid Paying Tax On Rental Income

While it is illegal to avoid or skip paying taxes on rental income without cause, it is possible to use tax credits for your business as well as legal deductions to lower the tax burden you or your business faces.

The best way to ensure your business is properly organized to keep your tax rates as low as possible is to work with a CPA year-round. Choose a CPA that is familiar with real estate tax laws to ensure you are working with a specialist who can truly make a difference in your business.

Read Also: Irs Address To Mail Tax Returns

How Do I Apply For The Ontario First

You can claim the first-time homebuyer refund at the time that your property is being registered, or you can claim the refund at a later date. If you are claiming the refund at registration, your real estate lawyer can claim the refund electronically if they are registering your property through Ontario’s electronic land registration system.

If your property is being registered through paper forms, your refund can be claimed at a land registry office by submitting the following documents:

The tax refund will reduce the amount of land transfer tax payable. If you are currently not eligible for the refund, but plan on becoming eligible and claiming the refund at a later date, you will need to pay the entire amount of the land transfer tax at registration. When claiming the refund at a later date, which will need to be within 18 months, you will need to make a refund claim directly to theOntario Ministry of Finance. You will need to present the same documents as above, along with:

- Proof of Occupancy

- Proof of Citizenship or Permanent Residence

If You Carry Out Work On A Property Before Leasing Or Renting

Some costs of work on a property before you lease or rent it will be capital expenses, and therefore not allowable expenses. This includes if you buy a property in a derelict or run-down state, and either you paid a substantially reduced price for it or it was not in a fit state for rental.

Any works done to put it back into a fit state for letting are unlikely to be repair works. They will be capital works as they will improve the property. The costs for these works will not be an allowable expense.

Read Also: Do You Have To Pay Taxes On Life Insurance

What Is Qualified Business Income

Another tax break that rental property owners can take advantage of is the Qualified Business Income, or QBI, deduction. This deduction allows property owners to deduct upwards of 20 percent from your taxable rental income. QBI has a maximum threshold of $315,000 for taxpayers who are married and filing jointly, and $157,000 for individuals. For those with income that falls under the threshold, you can claim the full 20% deduction.

If you make more than the threshold, you will still get a deduction. However, its a complicated deduction process, and will likely require the help of a tax professional in order to navigate.

How To Calculate Landlord Income Tax

The process flow to the right defines the factors affecting your income tax calculation as a landlord. When calculating your income tax, it is easier to look at the process in reverse and understand how each of the elements are calculated. A common mistake that landlords make when submitting their tax return is to combine their own expenses and the expenses generated from the properties. This is incorrect, the correct tax process is to separate those expenses .

Net income = Gross Taxable Income – Income Tax Payable and National Insurance

Gross Taxable income = Gross Income – Personal Expenses

Gross Income = Profit from Properties + Personal Earnings

Profit from Properties = Income from Properties – Expenses from Properties

Don’t Miss: Federal Taxes On Capital Gains

Stock Market Too Rocky For You Heres Why Fractional Ownership Is The Best Alternative Investment Now

Most of us started 2022 with high hopes for what the new year would bring. But we had no idea what it had in store for us. Russia-Ukraine war. Inflation. A major surprise indeed, right? As obvious as it is, 2022 has so far been unkind to investors, with most major stock markets, including the S& P 500, suffering significant losses and entering bear markets. At the heart of all this volatility is the uneasiness of investors. So, where else can we invest with ease then? Fractional ownership of the commercial real estate. When we mention investing in stocks to friends and family, one of the first questions they ask is, Arent stocks risky?I dont want to risk losing my money, or anything along those lines. Well, yes. The stock market may undoubtedly be a hazardous place to spend your money if you dont grasp the dangers connected with investing in stocks and take necessary measures to reduce those risks.