Ira Contributions After Age 70

For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs.

For 2019, if youre 70 ½ or older, you can’t make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

Q: Why Might Someone Choose The Tax Benefits Of A Traditional Ira Over Those Of A Roth Ira

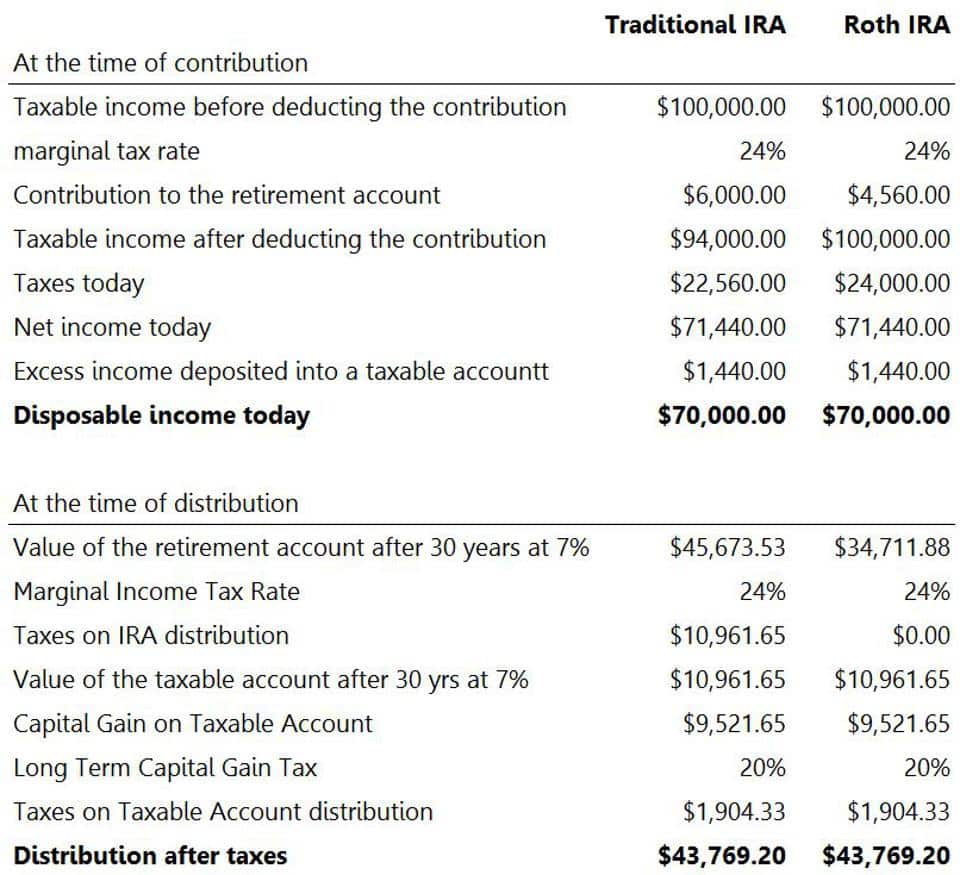

Hayden: You’re going to pay some taxes with either type of IRAso it’s really a question of whether paying taxes now or later makes the most sense for you. With a Roth IRA, you’ll pay taxes on your contributions now but you can usually take tax-free withdrawals in retirement. If you think you’ll be in a higher tax bracket in retirement, a Roth could give you significant tax savings down the road. But you won’t get a tax deduction up front.

Traditional IRA contributions, on the other hand, may be tax deductible. This allows you to delay taxes on your contributions until you take money out in retirement, which may make saving a little easier. But you must meet certain requirements to get the tax deduction. Keep in mind that both types of IRAs can make sense depending on your goals, so many investors use both in their portfolio.

How Roth Ira Withdrawals Are Taxed

You can withdraw contributions from a Roth IRA at any time, for any reason, with no tax or penalty. Youve already paid taxes, and the Internal Revenue Service considers it your money.

Withdrawals of earnings work differently. Only qualified withdrawals are tax- and penalty-free. The IRS considers a withdrawal to be qualified if youve had a Roth IRA for at least five years and the withdrawal is taken:

- When youre age 59½ or older

- Because you have a permanent disability

- By a beneficiary or your estate after your death

- To buy, build, or rebuild your first home

Withdrawals that dont meet these conditions are considered non-qualified distributions. You may be on the hook for income taxes and a 10% early withdrawal penalty, depending on:

- How old you are when you take the withdrawal

- How long it has been since you first contributed to a Roth IRA

- How you intend to use the money

- Whether you qualify for an exception

The earnings portion of a non-qualified distribution from your Roth IRA is included in your MAGI to determine Roth IRA eligibility.

Heres a rundown of the rules for Roth IRA withdrawals:

| Roth IRA Withdrawal Rules |

|---|

| Due to an IRS levy |

You May Like: Self Employed Tax Write Offs

How Can Paying Off Student Loan Debt Soon Help Save For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account. The new regulation will take effect in 2025.

How To Take Full Advantage Of The Benefits

The primary benefits of contributing to an individual retirement account are the tax deductions, the tax-deferred or tax-free growth on earnings, and if you are eligible, nonrefundable tax credits. To get the most out of contributing to your IRA, its important to understand what these benefits mean and the limitations placed on them.

Also Check: What Date Do You Have To File Your Taxes By

A Traditional Ira Is An

A Traditional IRA is an Individual Retirement Account to which you can contribute pre-tax or after-tax dollars, giving you immediate tax benefits if your contributions are tax-deductible. With a Traditional IRA, your money can grow tax-deferred, but youll pay ordinary income tax on your withdrawals, and you must start taking distributions after age 72. Unlike with a Roth IRA, there are no income limitations to open a Traditional IRA. It may be a good option for those who expect to be in the same or lower tax bracket in the future.

Recommended Reading: Taxes Grieved

Are Contributions To A Roth Ira Deductible On The Michigan Individual Income Tax Return

No. The Michigan Income Tax Act does not provide for the subtraction of contributions to Roth IRAs. Qualified distributions from the Roth IRA are not included in adjusted gross income and therefore, are not deductible on the Michigan individual income tax return. Under a Roth IRA, the contributions are taxed and the distributions are not.

Follow us

Recommended Reading: At What Income Do You Have To File Taxes

Qualifying For A Tax Deduction

Only in very rare situations can you deduct losses in your Roth IRA account. To qualify for the deduction, you must close all of your Roth IRA accounts, including Roth IRA accounts that have profits.

Your traditional IRAs need not be closed, as they are treated separately, and the value of your Roth IRA from the previous year or at any point during the time the account was open does not matter. You must show a loss from your tax basis in the account.

What About Required Minimum Distributions

Another big difference between the two is that with a traditional IRA, you must begin taking required minimum distributions once you reach your ârequired beginning date.â

The required beginning date for taking RMDs from a traditional IRA is age 722. Generally, distributions from IRA assets for which a deduction was taken on the contributions are taxed as regular income at the time of distribution.

âWith a Roth IRA, there are no minimum withdrawal requirements for the original account owner, so if youâre planning to use your IRA as another way to keep on investing for your heirs, a Roth IRA may be the better choice for you,â Greenberg notes.3

Also Check: How To Add Sales Tax On Square

What Are Retirement Account Changes For Employers

The retirement account rule changes in the Secure 2.0 Act of 2022 will impact employers at least as much as employees. The biggest change for companies will be that, starting in 2025, any new 401 or 403 plans must automatically enroll workers who don’t opt out.

Contributions from workers automatically enrolled will start at a minimum of 3% and a maximum of 10%. Each year after 2025, those amounts will rise 1% until they reach a range of 10% to 15%. Retirement plans created before 2025 will not be subject to the same requirements.

The retirement rule changes will also give employers the opportunity to offer employees “pension-linked emergency savings accounts” that will act as hybrids between emergency and retirement savings. Employers can automatically enroll workers at up to 3% of their salary, with a contribution cap of $2,500.

Contributions to these emergency accounts will be taxed like Roth contributions and will qualify for employer matching. Employees can make four withdrawals per year from the account with no penalty or additional taxes. If they leave the company, they can withdraw the emergency account as cash or roll it over into a Roth account.

If You Earn Too Much To Contribute

In order to contribute to a Roth IRA, you must have employment compensation, and there are also income limits. If your income is over the IRS limits, the only way you can take advantage of a Roth IRA is by converting money from an existing retirement account, such as a traditional IRA.3 There is a cost, though. Youll generally need to pay taxes on what you convert, but any after-tax contributions to a traditional account will not be taxable. The rules are complex, so if you have made after-tax contributions to a traditional account and youre interested in conversion, be sure to consult with a tax advisor.

Dont Miss: Pastyeartax Reviews

Read Also: Sales Tax In New York

Changes In Roth Ira Rules

The Tax Cuts and Jobs Act of 2017 made some changes to the rules governing Roth IRAs. Previously, if you converted another tax-advantaged account IRA, Savings Incentive Match Plan for Employees IRA, traditional IRA, 401 plan, or 403 plan) to a Roth IRA and then changed your mind, you could undo it in the form of a recharacterization.

That is no longer the case. If the conversion occurred after Oct. 15, 2018, it cannot be recharacterized back into a traditional IRA or back into its original form.

Which Ira Contributions Are Tax

Roth IRA contributions are not tax-deductible. The benefit you receive is not an upfront deduction, but the ability to take tax-free withdrawals once you hit retirement.

Traditional IRA contributions can generally be deducted from your taxes. As an added bonus, this is considered an above-the-line deduction, which means you can deduct your contribution even if youre not itemizing deductions.

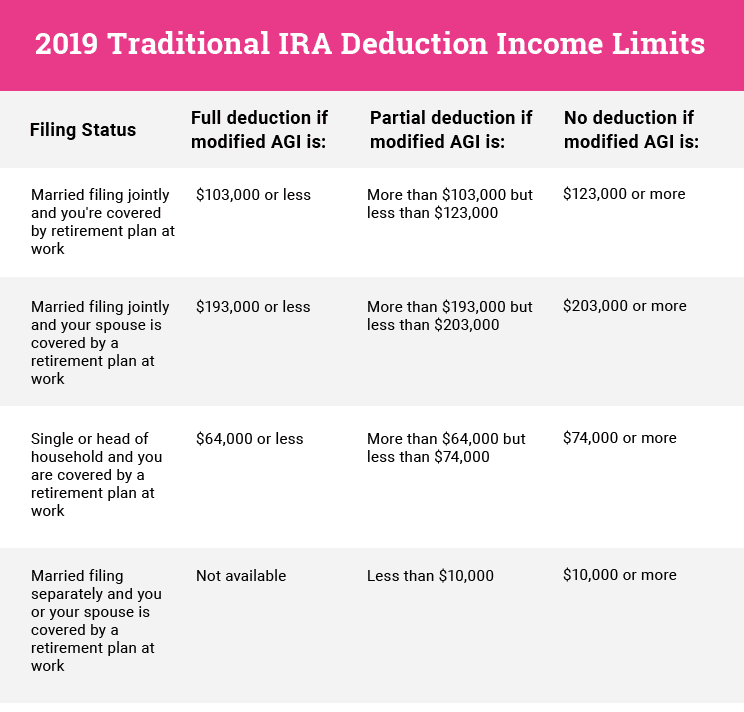

However, not everyone is eligible to deduct their contribution from a traditional IRA. If you or your spouse have an employer-sponsored retirement plan like a 401, you may not be able to deduct your full contribution. Whether youre eligible for a full or partial deduction also depends on MAGI and filing status.

Lets say youre covered by a retirement plan at work and you want a deduction for your IRA contributions. For the 2022 tax year, the phase-out range for single and head of household tax filers is $68,000 to $78,000, with no IRA deduction allowed for filers with a MAGI higher than $78,000 and who have a workplace plan. For the tax year 2023, the phase-out range for single and head of household tax filers rises to $73,000 to $83,000, with no IRA deduction permitted for filers with a MAGI above $88,000 and access to a workplace plan.

For married couples filing jointly, the phase-out range for tax year 2022 is $109,000 to $129,000. For the tax year 2023, married couples filing jointly have a phase-out range of $116,000 to $136,000.

You May Like: Filing Taxes Online For Free

Amount Of Roth Ira Contributions That You Can Make For 2022

This table shows whether your contribution to a Roth IRA is affected by the amount of your modified AGI as computed for Roth IRA purpose.

| If your filing status is… | And your modified AGI is… | Then you can contribute… |

|---|---|---|

| or qualifying widow |

< $204,000 |

|

| or qualifying widow |

> $204,000 but < $214,000 |

|

| or qualifying widow |

> $214,000 |

|

| and you lived with your spouse at any time during the year |

< $10,000 |

|

| and you lived with your spouse at any time during the year |

> $10,000 |

zero |

| single, head of household, or and you did not live with your spouse at any time during the year |

< $129,000 |

up to the limit |

| single, head of household, or and you did not live with your spouse at any time during the year |

> $129,000 but < $144,000 |

a reduced amount |

| single, head of household, or and you did not live with your spouse at any time during the year |

> $144,000 |

zero |

Converting A Traditional Ira To A Roth Ira

If you are strapped for cash, the Roth IRA option may be a tougher commitment to make. The traditional IRA takes a smaller bite out of your paycheck because it reduces your overall tax liability for the year.

Even if you feel that you have to forgo the Roth option for now, you might consider converting your account from a traditional IRA to a Roth IRA in a few years, when youre more financially comfortable. But be aware that all the taxes you were deferring in the traditional IRA will come due in the year when you do the conversion.

A Roth IRA is generally the better choice if you think you will be in a higher tax bracket after retiring. Income tax rates could increase. Or your overall income could be higher due to a variety of factors, such as Social Security payments, earnings on other investments, or inheritances.

If youre considering converting from a traditional IRA to a Roth IRA, you may be able to lessen your tax liability if you time the conversion right. Consider making the move when the market is down , your income is down, or your itemizable deductions for the year have increased.

Don’t Miss: New Mexico State Tax Refund

Who Can Make A Roth Ira Contribution

Contributions to a Roth IRA are made after taxes have been deducted. Roth IRA contributions eligibility is determined by your income.

In 2021, people with modified adjusted gross incomes of less than $140,000 for single filers and $208,000 for married filers filing jointly will be able to contribute to a Roth IRA, while income phase-outs may lower your maximum contribution.

The cumulative maximum annual contribution for all of your IRAs is:

- 50 years old and below $6,000

- 50 years old and above $7,000

What to Do if You Make Too Many Roth IRA Contributions?

In dealing with a contribution that went over the limit, its crucial to understand the phrase net income attributable, or , which refers to any income produced by over-contributed funds since they were deposited in the Roth IRA.

Amount Of Your Reduced Roth Ira Contribution

If the amount you can contribute must be reduced, figure your reduced contribution limit as follows.

Recommended Reading: When Can You File Your Taxes

How To Qualify For A Roth Ira

You might be wondering what it takes to qualify for a Roth IRA, to begin with. Here are the main factors to consider when figuring out whether or not you can contribute to a Roth IRA this year:

- You must have taxable, earned income. During the year you want to contribute to a Roth IRA, you mustve earned income from a full-time or part-time job, self-employment, or a small business.

- Your contribution limits are based on your age. If youre under the age of 50, you can contribute a maximum of $6,000 combined to a Roth IRA or traditional IRA account. If youre over age 50, the maximum you can contribute is $7,000.

- You must meet income guidelines. Depending on your income, you might be able to contribute up to the maximum limit, be allowed to contribute a reduced amount, or might not be eligible to contribute to a Roth IRA. Also keep in mind that, if your income fluctuates, you might be able to contribute to a Roth IRA in certain years and not others.

For 2021, married couples filing a joint return must earn less than $196,000 to make the maximum contribution. Between $196,000 and $205,999, the maximum contribution begins phasing out.

For single filers, heads of household, or married filing separately without living with their spouse that year, the phase-out range starts at $124,000 and ends at $138,999. Anyone who falls into that category and earns less than $124,000 can contribute the maximum contribution for the year.

Millions Of 529 Accounts Hold Billions In Savings

There were nearly 15 million 529 accounts at the end of last year, holding a total $480 billion, according to the Investment Company Institute. That’s an average of about $30,600 per account.

529 plans carry tax advantages for college savers. Namely, investment earnings on account contributions grow tax-free and aren’t taxable if used for qualifying education expenses like tuition, fees, books, and room and board.

However, that investment growth is generally subject to income tax and a 10% tax penalty if used for an ineligible expense.

This is where rollovers to a Roth IRA can benefit savers with stranded 529 money. A transfer would skirt income tax and penalties investments would keep growing tax-free in a Roth account, and future retirement withdrawals would also be tax-free.

Also Check: When Does Tax Season Start 2022

Tax Deductions For Traditional Roth Iras

Whether you have access to a workplace retirement account or not, everyone with earned income can contribute to their own IRA. However, depending on your income, work situation and the type of IRA chosen, your contributions may or may not be tax-deductible. There are several types of IRAs available and its important to know whether IRA contributions are tax-deductible. A financial advisor may also be able to help with some of these questions. Consider using SmartAssets free advisor matching tool today to find advisors who serve your area.

You Wont Be Forced To Take Distributions Once You Reach A Certain Age

One reason so many people love the Roth IRA is that it offers flexibility in retirement. Not only can you take out your contributions early if you need to, but you arent forced to take distributions once you reach a certain age, either.

A 401 and traditional IRA, by comparison, force you to take distributions at age 70 1/2 or pay a penalty. If you want as many financial options as possible when it comes to riding out your retirement, this is a huge benefit.

Don’t Miss: What Are The Taxes In Florida