Here’s When It May Make Sense To Use A Roth :

- You’re in a lower marginal income tax bracket now than you expect to be in retirement

- If Roth contributions won’t reduce the amount you’re saving for retirement. Maxing out Roth 401 contributions reduces your take home pay more compared to pre-tax deferrals. If you can’t keep the same dollar-for-dollar retirement savings, it’s probably best to go back to the traditional 401. This calculator can help you estimate the impact of making Roth vs traditional 401 contributions

- Your retirement savings and retirement income are currently heavily weighted towards tax-deferred assets

- Adding the Roth contributions to your taxable income won’t cause any adverse tax implications

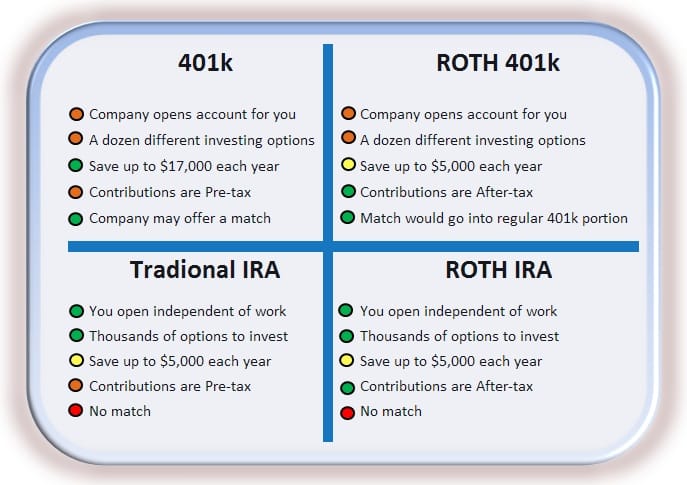

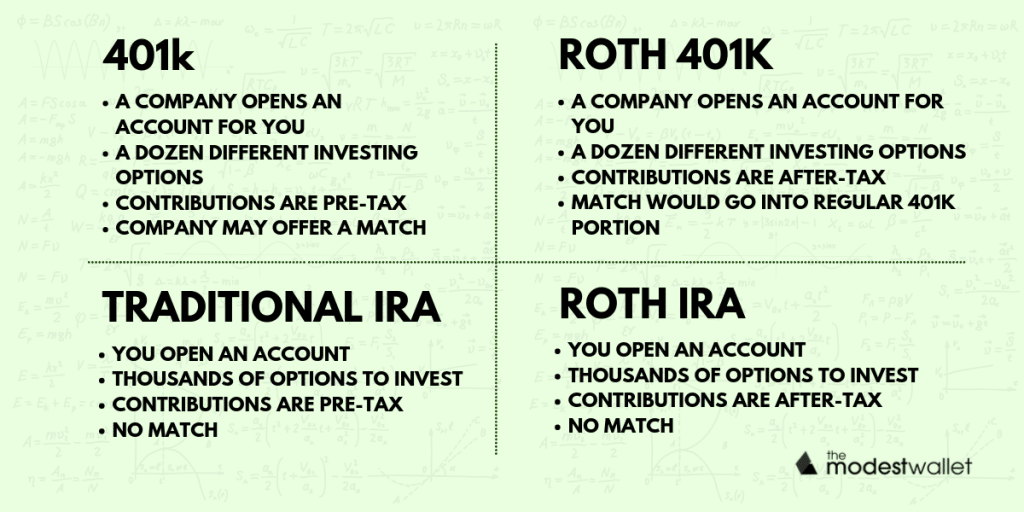

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pretax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

Recommended Reading: How Is Property Tax Paid

Do You Want To Pay Taxes Now Or Later

Trying to navigate the complicated income tax code in the U.S. can make the Roth vs. traditional 401 decision-making process seem complicated. But it all comes down to whether you want to pay taxes now or when you withdraw the money . Deciding on the better option for you requires a little retirement planning to determine when you think you will be in a higher marginal tax bracket.

If you are in the early stages of your career and are currently in a lower income tax bracket, the Roth option is appealing. You can lock in known income tax rates today that could be lower than your future income tax bracket during retirement, when you will need your savings.

However, it likely makes more sense to take the tax breaks today with a pre-tax traditional 401 contribution if you’re in your peak earning years and nearing retirement. You might find yourself in a lower tax bracket during retirement than immediately before leaving the workforce, depending on whether you have other assets or income sources and how much taxable income they provide.

Significant assets held within your 401 can increase your taxable income in retirement as well.

Roth Vs Traditional 401 And Your Paycheck

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Don’t Miss: File Income Tax Return India

Frequently Asked Questions About Roth Contributions

When we are educating 401K plan participants on this topic, there are a few frequently asked questions that we receive:

Do all retirement plans allow Roth contributions?

ANSWER: No, Roth contributions are a voluntary contribution source that a company has to elect to offer to its employees. We are seeing a lot more plans that offer this benefit but not all plans do.

Can you contribute both Pre-Tax and Roth at the same time to the plan?

ANSWER: Yes, if your plan allows Roth contributions you are normally able to contribute both pre-tax and Roth to the plan simultaneously. However, the annual deferral limits are aggregated for purposes of all employee elective deferrals. For example, in 2021, the maximum employee deferral limits are as follows:

-

Under the age of 50: $19,500

-

Age 50+: $26,000

You can contribute all pre-tax, all Roth, or any combination of the two but those amounts are aggregated together for purposes of assessing the annual dollar limits.

Do you have to set up a separate account for your Roth contributions to the 401K?

ANSWER: No. The Roth contributions that you make out of your paycheck to the plan are just tracked as a separate source within the 401K plan. They have to do this because when it comes to withdrawing the money, they have to know how much of your account balance is pre-tax and what amount is Roth. Typically, on your statements, you will see your total balance, and then it breaks it down by money type within your account.

K: Roth Vs Traditional

A traditional 401k involves saving money when tax has been deducted from the paycheck. Although this leads to lower taxable income, you will have to pay your tax obligations in the future when you retire and start cashing out money.

A Roth 401k involves after-tax contributions, meaning tax is applied to your income before you take out funds to put in your Roth 401k. You have no tax break now, but you save that for later. When you retire and start cashing out income from your Roth 401k, you will not have to pay any taxes. Just make sure that you have held the account for five years or more by then.

Both types primarily vary on the tax benefit. The good news is that you do not have to choose one of the two options. You can contribute to both plans. If you take this route, see that the total contribution does not go beyond the maximum limit set for the applicable year. In 2021, the maximum yearly limit is $19,500.

Don’t Miss: When Are Llc Taxes Due

Theres More To Consider Than You Think

- The start of the year is the perfect time to review your retirement savings, including pre-tax versus Roth 401 contributions.

- Pre-tax savings offers a write-off and tax-deferred growth, while Roth deposits may grow levy-free.

- However, theres more to consider than future brackets, according to financial experts.

The Roth 401 & Roth Ira Rules Work Together

Okay. Moving on. Theres one thing you need to be very well aware of as a Roth 401 investor, and thats the Roth IRA five-year rule. And what this basically says is that, when you put money into a Roth IRA, you can always pull out the amount that you put in completely tax-free and penalty-free, because that was your money, it was after-tax.

Now, lets say you put $1,000 into a Roth IRA and it grows to $1,500 over the next few years. If you pull that $1,500 out, the $1,000, your contribution, is going to be tax-free. The $500 may or may not be taxable. And heres the rule. You must be at least age 59 and a half and have the account open for five years for that $500 to not have any tax consequences or implications at all.

The tricky part about the Roth 401 is, the Roth 401 is a designated Roth account per IRS rules. So it doesnt follow, it doesnt play by the same rules that your Roth IRA does.

The tricky thing about the Roth 401, if you have no other Roth IRAs, you retire and you roll over that Roth 401 into a new Roth IRA that you set up, you have a new five-year rule. That five-year clock now starts. So while you can pull out your contributions and so forth, there is possibly taxes and penalties on the growth, depending on your circumstances, your situation.

However, its just smart. Get the seasoning done. Dont even have to worry about it.

Recommended Reading: How To File An Extension Taxes

Roth 401 Contribution Limits

Roth 401 contributions are subject to the same limits as pretax 401 contributions. If a plan allows Roth contributions, your total salary deferral contributions Roth, pretax, or a combination of both are limited to $20,500 for 2022. If you are age 50 or older, you can also contribute up to $6,500 more as a catch-up contribution, for a total of up to $27,000 for 2022.

Age 49 and under

Additional $6,500

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Are Municipal Bonds Tax Free

Your Tax Situation Will Help You Decide

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

Saving for retirement can put you on the path to true financial independence. With rising concerns about the solvency of Social Security beyond 2037 and the savings burden placed on individuals, choosing to participate in an employer-sponsored 401 plan can have a positive impact on your future retirement preparedness. But you have another critical decision to make after choosing how much to contribute to the plan: whether to contribute to a traditional 401 or a Roth 401.

If you understand the differences between a traditional and a Roth 401 and identify the contribution limits, you can decide which option makes more sense for you. You may even be able to reduce your total lifetime income taxes.

More Money Now Vs Later

It can be hard to turn your back on those attributes, but is a Roth 401 suitable for you? Here are the factors to consider.

-

It may cost you more on the front end to use a Roth 401. Contributions to a Roth 401 can hit your budget harder today because an after-tax contribution takes a bigger bite out of your paycheck than a pretax contribution to a traditional 401.

-

The Roth account can be more valuable in retirement. Thats because when you pull a dollar out of that account, you get to put that entire dollar in your pocket. When you pull a dollar out of a traditional 401, you can keep only the balance after paying taxes on the distribution.

When you pull a dollar out of a Roth 401, you get to put that entire dollar in your pocket.

-

Contributing the maximum to either account each year yields the same pot of money in retirement. The traditional 401 balance would then be reduced by your tax rate in retirement, whereas the Roth 401 balance would remain whole.

Read Also: How To Check If Your Taxes Were Filed

Is A Roth 401 Right For Me

You should get professional tax advice to understand whether pretax or Roth or some combination of the two are best for you.

Some of the factors that cause people to choose the Roth option include:

- Anticipating their 401 savings will grow significantly in value before they retire and wanting to take advantage of the tax-free growth on earnings

- Expecting their tax rate will be higher in the future and can afford to save with the after-tax option, now

- Wanting some of their income in retirement to be tax-free

- Desiring tax-free assets for their beneficiaries after they die

- Earning too much money to be eligible to contribute to a Roth IRA

I have never… I mean NEVER worked with a better Customer Service Crew before and my background is Customer Service! Ubiquity is fantastic. Love, Love, Love Catherine, Doug and the rest of the crew!

What Is A Roth 401

Like a traditional 401, the Roth 401 is a type of retirement savings plan employers offer their employeeswith one big difference. Roth 401 contributions are made after taxes have been taken out of your paycheck. That way, the money you put into your Roth 401 grows tax-free, and youll receive tax-free withdrawals when you retire. Folks, whenever you see tax and free in the same sentence, thats a reason to celebrate!

The Roth 401 was introduced in 2006 and combines the best features from the traditional 401 and the Roth IRA. With a Roth 401, you can take advantage of the company match on your contributions, if your employer offers onejust like a traditional 401. And the Roth component of a Roth 401 gives you the benefit of tax-free withdrawals.

You May Like: Free Irs Approved Tax Preparation Courses

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Vs Roth : Which One Is Better

12 Min Read | Apr 25, 2022

If youve read through your companys benefit package lately, you probably noticed a new option when it comes to saving for retirement: the Roth 401.

Just over the last five years, the number of plans offering a Roth 401 has skyrocketed. About 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

Younger savers are starting to take advantage of this new option and the tax benefits that come with it. In fact, Gen Z is now the most likely group to put money in their Roth 401 at work.2

How about you? If you have a choice between a Roth and traditional 401 at work, which one should you choose? Lets dig into some of the differences between these options so you can make the best decision.

Recommended Reading: Out Of State Sales Tax

Tax Planning Considerations To Optimize Your Retirement Portfolio Savings

A strategic tax plan is one of the most important steps toward accumulating wealth, and it is something our financial planners spend a lot of time on with their clients.

In concept, its simple. Investors must redistribute fully taxable income into the most tax-efficient environment possible, allowing them to save more and pay less to the government. Its likely most are already doing the basics like 401, traditional IRAs, Roth IRAs, and so on, but successful investors should periodically evaluate their tax savings plan and ensure it is still applicable to their personal and business goals.

When the goal is to compound savings to increase long-term growth, getting more money into tax-advantaged environments is the most effective way to do this, CPA Brittany Frazier says. Taking advantage of the Roth bucket can be very appealing when looking at the long-term, especially when you can afford to take the tax hit up front.

But a heavy weight toward Roth is not such a slam dunk for all investors. Lets do a quick review of the pre-tax and Roth buckets.

KNOW THE ROTH BASICS

The biggest difference between a Roth savings environment and the traditional, pre-tax savings environment is how contributions and withdrawals are taxed.

The key difference between Roth and traditional pre-tax savings is that over the long-term, the growth in the Roth is never taxed, whereas the growth in the pre-tax is taxed once withdrawn.

WHY ROTH?

HOW TO GET MONEY INTO THE ROTH ENVIRONMENT

Roth IRA