The Exceptions To The Rule

Okay, so what we’ve described in the preceding paragraphs is the general rule. But note that two common exceptions exist to the general rule:

Exception #1: If an S corporation used to be a regular C corporation and the corporation retained some of its profits from the “C corporation” years and the corporation while an S corporation pays some of those old C corporation profits out to shareholders, that payment is a dividend. And that dividend is taxed to the shareholders. Under current tax law, the dividend is taxed at a preferential qualified dividends rate, which is 15% or less in most cases.

Exception #2: If an S corporation shareholder receives a distribution that exceeds his or her basis in the S corporation, the in-excess-of-basis distribution gets treated as a long-term capital gain and, therefore, may be taxed. This business about a distribution in excess of basis gets tricky. But as a generalization, S corporations and their shareholders get into this situation when they retain very little of their profits inside the corporation and instead borrow money for items like fixtures and equipment. In effect, in this situation, and often without realizing it, the S corporation borrows money from someone like the bank and then directly or indirectly uses this borrowed money to pay distributions to shareholders.

Final Thoughts On S Corps

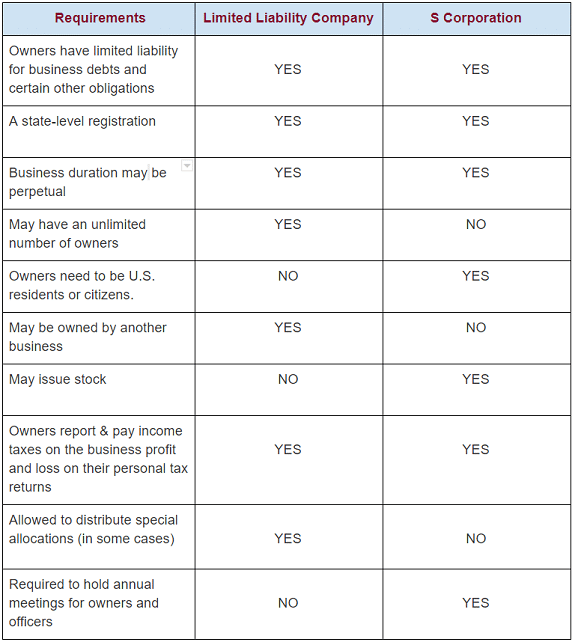

Electing to form your small business as an S corp can be a time-consuming, effort-intensive, and costly process. It is important for you to understand all the benefits, drawbacks, and implications ahead of time. If youre considering forming an S corp for your small business, ask yourself:

- Do you envision your company having shareholders? How many?

- Do you have the budget for the operational overhead that comes with an entity type thats more complex to run and file taxes for than an LLC?

- Can your business afford to pay you a reasonable salary?

- Are you equipped to appoint a board of directors and hold annual board and shareholder meetings?

- Do you envision selling shares of your company to international investors or other business entities?

Determining The Taxability Of S Corporation Distributions: Part I

|

SUMMARY |

|

|

Under Sec. 1368, anS corporations distribution of cash or property may give rise to three possible tax consequences to the recipient shareholder: a tax-free reduction of the shareholders basis in the corporations stock,1 a taxable dividend,2 or gain from the sale of the stock .3 These options are not mutually exclusive a single distribution may result in two or even all three of those consequences.

You May Like: What Do You Need To Do Your Taxes

How Can Adp Support S Corp Payroll Needs

ADP understands that payroll can be challenging, even for S corporations with just a few employees or a single individual wearing many hats. We offer payroll services that are designed to help small business owners minimize administrative burdens, so they can focus more of their time on what made them want to be an entrepreneur in the first place.

How Much Salary Is Reasonable

To determine a reasonable salary, S corporation owners can purchase compensation analysis reports or conduct their own research using the Bureau of Labor Statistics and other sites that provide salary information. Once a suitable figure is found, it may have to be adjusted to individual circumstances. For instance, owners might decide to lower their salary if theyre not working for the S corporation full time or if assets contributed more towards their profits than their labor. Its also important to note that the IRS typically doesnt require S corporation owners to pay themselves if their business isnt generating any income.

Read Also: How To Apply For An Extension On Taxes

Other Taxes Paid By S Corporations

The S corporation pays the same taxes as other businesses, including:

An S corporation must pay employment taxes on employee pay, including withholding and reporting federal and state income taxes, paying and reporting FICA taxes, worker’s compensation taxes, and unemployment taxes. Also, if the S corporation owns a building or other real property, property taxes are required to be paid on this property.

S corporations are required to pay state sales taxes and excise taxes in the same manner as other business types. Check with your state department of revenue for more information on sales and excise taxes.

Some states levy franchise taxes, state income taxes, or gross receipts taxes on S corporations each year. Check with your state department of revenue to see if your state requires these taxes.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

S Corporation Earnings Distributed By A C Corporation

Sometimes the owners of an S corporation will want to convert to a C corporation, such as when they want to increase the number of shareholders beyond what is allowed for an S corporation or to issue preferred stock. In such a conversion, any undistributed earnings from the S corporation are considered a return of investment during a 1-year grace period from the date of the conversion. Afterwards, any distribution from the S corporation’s retained earnings will be treated as a taxable dividend that does not affect the basis of the stock. Distributions from accumulated E& P are treated as taxable dividends.

You May Like: Maryland Sales And Use Tax

Do S Corp Owners Need To Be On Payroll

S corporation owners who perform more than just minor work for the business typically need to be on the payroll because they must pay themselves a reasonable salary. Owners who take a salary thats below market value for the services they perform or claim all of their income through shareholder distributions may be audited and penalized by the IRS.

Determining A Reasonable Salary For S Corporation Shareholders

There are no set guidelines in the tax code that show a business owner how to determine shareholder’s salaries. However, here are some things you can consider in order to make the decision process easier:

- What responsibilities each shareholder has.

- How experienced each shareholder is.

- How committed each shareholder is to the corporation.

- What dividends each shareholder receives.

- The wage income of employees who are not shareholders.

- The salaries set forth by businesses that are similar to your business.

Don’t Miss: Is Ein And Tax Id The Same

Richmond Hill Property Tax Calculator 2022

The City of Richmond Hill is located in the Regional Municipality of York and is home to over 202K residents. The population of Richmond Hill increased by 3.6% from 2016 to 2021. Richmond Hill real estate prices have increased by 4.5% from June 2021 to JUne 2022 with the average sold price of a house in Richmond Hill being $1.35M in June 2022. Single-family detached houses are by far the most commonly sold property type on the Richmond Hill real estate market, accounting for approximately 50% of sales volumes, followed by sales of townhouses and condominiums. Richmond Hills real estate market was ranked as the 5th most expensive real estate market in the Greater Toronto Area, based on average selling price of homes in June 2022.

Richmond Hill property tax is based on the assessed value of your home. Every four years, the Municipal Assessment Corporation conducts an evaluation of properties all over Ontario and submits assessed values for each of them. This assessed value can differ significantly from the market value of your property. Your final property tax amount is calculated by multiplying the Richmond Hill final property tax rate for the year by the MPAC property assessed value.

You can calculate your property tax using either your home’s MPAC assessed value or your home’s most recent market price. Just enter the price and type of your property, and we will give you an instant property tax estimate.

General Rules For Cost Basis In An S Corporation

Every S corporation shareholder has their share of profits taxed even if they didn’t receive those profits.

However, if distributions aren’t higher than the shareholder’s cost basis, that shareholder is not taxed on distributions.

A shareholder’s cost basis can be increased according to how much he contributes to the corporation and by his share of the corporate income. It can be decreased by distributions and losses in the business.

You May Like: H & R Block Tax Estimator

Assessed Value Of A Property

Property value assessments in Ontario are conducted every four years by the Municipal Property Assessment Corporation . They conduct assessments for all types of property in Ontario ranging from residential properties to farms to commercial properties. For residential properties, they use a number of factors, including market price, to determine the assessed value of a property. While they release overviews of their valuation guidelines, there is no transparency in the assessment of a specific property.

Homeowners may find that the assessed value of their property differs significantly from its market price. There is also no way to retrieve and compare the assessed value of other properties.

Understanding An S Corporation

S corporations get their name from Subchapter S of the Internal Revenue Code, under which theyve elected to be taxed. The key characteristic of a corporation filed under Subchapter S: It may pass business income, losses, deductions, and credits directly to shareholders, without paying any federal corporate taxmaking it something known as a pass-through entity. This gives it some special tax benefits under 2017s Tax Cuts and Jobs Act. However, it is liable on the corporate level for taxes on specific built-in gains and passive income.

Aside from its tax status, an S corp is similar to any other corporation, or C corporation as theyre officially known. Its a for-profit company, incorporated under and governed by the same state corporation laws. It offers similar liability protection, ownership, and management advantages as a C corporation. It must also observe internal practices and formalities: Have a board of directors, write corporate bylaws, conduct shareholders meetings, and keep minutes of significant company meetings.

The main difference between an S corp and a C corp is how each is taxed: Profits from a C corp are taxed to the corporation when earned, then taxed to the shareholders when distributed as dividends, creating a double tax. An S corp may pass income directly to shareholders without having to pay federal corporate taxes.

Also Check: How Much Tax Is Taken From My Check

How To Qualify As An S Corp

Not all corporations can become S corps. To successfully elect S corp formation, your business must meet certain requirements set forth by the Internal Revenue Code:

- Your S corp must be a domestic company based and operating in the United States.

- Your S corps shareholders must be permitted under the Internal Revenue Code. Your shareholders must be actual people that are US citizens or permanent residents. You may not have more than 100 shareholders overall.

- Your S corp may only issue a single class of stock. It cannot issue common and preferred stock, like C corps can.

- Your S corp may not be an insurance agency, a bank, or a designated domestic international sales corporation .

- Your shareholders must unanimously consent to electing S corp status.

S Corporation Distributions Part I: Taxable Or Not Taxable That Is The Question

Since the mid-1980s the S Corporation has probably been the most popular entity for new businesses. Additionally, countless existing C Corporations have chosen to convert to S Corporations. Why the popularity? The S Corporation generally provides a single-level of taxation on income generated by the corporation, whereas the C Corporation produces a double taxation of its earnings. S Corporation income passes through to the shareholders and is subject to tax on the shareholders individual income tax return. C Corporation income is first taxed at the corporate level and then, when distributed to the shareholders, taxed again as a dividend. When an S Corporation distributes its income to the shareholders, the distributions are tax-free. Or are they? As one of my partners often reminds me, the answer to every tax questions is It depends. With respect to the taxability of S Corporation distributions, he is absolutely correct. However, regardless of the facts and circumstances, there are only three possible tax consequences attributable to any S Corporation distribution: tax-free, taxable dividend, or gain from the sale of the stock. A distribution might result in one or more of these outcomes. We will address the basic distribution rules in this article and cover more complicated, yet common, scenarios as well as some planning opportunities to mitigate potential tax implications, in our June edition.

Recommended Reading: Tax Credit For Electric Vehicle

S Corporation Shareholders Are Required To Compute Both Stock And Debt Basis

The amount of a shareholder’s stock and debt basis in the S corporation is very important. Unlike a C corporation, each year a shareholder’s stock and/or debt basis of an S corporation increases or decreases based upon the S corporation’s operations. The S corporation will issue a shareholder a Schedule K-1.

It is important to understand that the K-1 reflects the S corporation’s items of income, loss and deduction that are allocated to the shareholder for the year. The K-1 shows the amount of non-dividend distribution the shareholder receives it does not state the taxable amount of a distribution. The taxable amount of a distribution is contingent on the shareholder’s stock basis. It is not the corporation’s responsibility to track a shareholder’s stock and debt basis but rather it is the shareholder’s responsibility.

If a shareholder receives a non-dividend distribution from an S corporation, the distribution is tax-free to the extent it does not exceed the shareholder’s stock basis. Debt basis is not considered when determining the taxability of a distribution.

Us Income Tax Return For An S Corporation

Although they are largely exempt from corporate taxes, S corporations must still report their earnings to the federal government and file tax returns.

Form 1120-S is essentially an S corps tax return. Often accompanied by a Schedule K-1, which delineates the percentage of company shares owned by each individual shareholder, Form 1120-S reports the income, losses, dividends, and other distributions that the corporation has passed onto its shareholders.

Unlike C corps, which must file quarterly, S corps only file once a year, like individual taxpayers. Form 1120-S is simpler than tax forms for C corporations, too. The version for 2021 ran five pages.

As long as a company elects S corporation status , it must file Form 1120-S. The form is due by the 15th day of the third month after the end of its fiscal yeargenerally, March 15 for companies that follow a calendar year.

Like individuals, S corporations can request a six-month extension to file their tax returns. To do so, they must file Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns by their returns regular due date.

Recommended Reading: Department Of Tax Debt And Financial Settlement Services

Reporting S Corporation Payroll And Distributions

You will need to report earnings and profits in several ways:

- Payroll returns need to be filed with the IRS and your state department of revenue.

- End of year payroll returns like a W2 need to be filed with the proper agencies.

- Payroll amounts will be reported on your Form 1120S.

- Distributions are reported and filed on an 1120S and your personal tax return.

S Corporation Tax Calculator

There are several advantages to forming a business entity. It protects your personal assets, gives you more financial visibility, and can make it easier to manage your taxes. If you choose the right type of corporate structure, you can significantly lower your yearly tax bill.

The easiest way for most business owners to reduce tax bills is to be taxed as an S Corporation. You can do this either by:

Forming a Limited Liability Company but electing to be taxed as an S Corporation.

Reduce Self-Employment/Payroll Taxes by Being Taxed as an S Corporation instead of a Sole Proprietorship or Partnership.

To understand why getting taxed as an S Corporation is more tax effective, its useful to understand the types of taxes you will need to pay.

Don’t Miss: Montgomery County Texas Property Tax

How S Corporation Distributions Work

An S Corporation is a pass-through entity. That means that the net income from the S Corporation is passed through to the shareholders. The shareholders report the business income or loss on their personal tax returns. S Corporations are required to pay a salary to shareholders who work in the company . That salary would be taxable to the recipient and a deduction to the business. Both pay their share of payroll taxes. The salary and payroll taxes paid by the business reduce the business income. The shareholder can take distributions against the income of the business. Its not a deduction and so it doesnt change the amount of taxable income. There are no payroll taxes on the distributions from an S Corporation.

S Corporations also can pay tax free benefits to shareholders, but the amount you can receive tax free is greatly reduced. S Corporation tax free benefits arent great for shareholder/employees.