Do I Need A Texas Sales Tax Permit If I Am A Remote Online Seller

If you are a remote seller and are based in Texas, you will need to collect sales tax and have a Texas sales tax permit. The only way around this is if you are an occasional seller, which means that you are not in business full time. If you are selling items to customers outside of Texas, you are not required to collect Texas sales tax. It is, however, recommended that you keep your online sales records for at least four years.

Dont Miss: Free Irs Approved Tax Preparation Courses

What Is Exempt From Sales Taxes In Texas

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how Texas taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

EXEMPT

For more details on what types of goods are specifically exempt from the Texas sales tax see Texas sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Texas? Taxation of vehicle purchases in particular are discussed in the page about Texas’ sales tax on cars.

An Overview Of Texas Sales And Use Tax

Sales tax is a tax paid to state and local tax authorities in Texas for the sale of certain goods and services. First adopted in 1961 and known as the “Limited Sales and Use Tax”, sales tax is most commonly collected from the buyer at the point of sale. Municiple sales tax was enacted in 1967.

As a business owner selling taxable goods or services, you act as an agent of the state of Texas by collecting tax from purchasers and passing it along to the appropriate state or local tax authority. As of March 2019, sales and use tax in Texas is administered by the Texas Comptroller of Public Accounts.

Any sales tax collected from customers belongs to the state of Texas, not you. Its your responsibility to manage the taxes you collect to remain in compliance with state and local tax laws. Failure to do so can lead to penalties and interest charges.

Use tax is similar to sales tax, but applied where goods are consumed rather then where purchased.

In most cases, sales tax is collected at the point of purchase. However, there are a number of cases when this may not be the case:

In each of the above cases, a use tax may now be required to collect sales tax. In such instances, the tax burdon shifts to the consumer who is required to

Use tax laws in Texas apply to goods purchased out of the country but consumed in Texas.

To summarize, use tax is due when goods are purchased tax free by a merchant and then converted for use, consumption, or enjoyment by that same merchant.

You May Like: Taxes On 2 Million Dollars Income

Texas Sales Tax Filing Frequency

Texas has taxpayers file on a monthly, quarterly, or annual basis depending on their average annual tax liability :

Monthly: For average annual tax liabilities above $100,000

Quarterly: For average annual tax liabilities between $10,000 to $100,000

Annually: For average annual sales tax liabilities between $0 to $10,000.

Discounts: There is an early filing discount of 0.5% in Texas. There is also an early payment discount of 1.25%.

Late Fees: There is a $50 late filing penalty in Texas per each late return. Read more here.

Texas Sales Tax Exemptions For Manufacturing

Texas offers broad sales and use tax exemptions for manufacturers. Machinery and equipment used in the production process qualify for sales tax exemptions within Texas. Repair parts and labor to qualifying machinery and equipment are also exempt. Consumables including lubricants and chemicals consumed during the manufacturing process are exempt if their use is necessary and essential to prevent the failure, decline or deterioration of exempt manufacturing equipment. Safety apparel or clothing used by employees during the manufacturing or processing of tangible personal property is exempt provided that the apparel or clothing is not sold to the employees and the manufacturing process would not be possible without the use of such apparel or clothing. Utilities consumed during production also qualify for an exemption, however a valid utility study conducted by an engineer must document the percentage of utilities consumed for exempt purposes on any meter with mixed taxable and non-taxable use. Agile Consulting Groups sales tax consultants have a wealth of experience within the state of Texas and can ensure taxpayers are maximizing the benefit of Texas sales tax exemptions for which they qualify.

For more information on Texas sales tax exemptions please visit the sites below.

You May Like: How Is Property Tax Paid

Who Is Responsible For Use Tax

Texas sellers are required to collect and remit sales and use tax to the Comptrollers office on their sales of taxable items or obtain a resale or exemption certificate in lieu of collecting the tax.

A Texas purchaser owes state and local use tax if they buy taxable goods and services that are stored, used or consumed in Texas from a seller who does not charge Texas sales tax. If the seller does not have a permit or fails to charge sales and use tax, the purchaser must pay the use tax directly to our office unless an exemption applies.

For example, if you buy a shirt through an online auction from a seller in Ohio who does not charge Texas tax, or if a New York electronics store sells you a camera through its website and does not charge Texas tax, you owe Texas use tax on the sales price of the item.

Items bought in another country and used in Texas are also subject to Texas use tax. For example, if you buy taxable items in Mexico that you bring back to Texas, you owe Texas use tax on the purchase price of those items.

You must pay state and local use tax if you have the item delivered to, or use the item in, an area that imposes a local tax. If you buy an item from a seller located in a part of Texas with no local taxes, you will only pay state sales tax on that purchase. See Publication 94-105, Local Sales and Use Tax Collection A Guide for Sellers, for additional information regarding local use tax.

I Should Have Collected Texas Sales Tax But I Didnt

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Texas sales tax, the primary options are to:

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Texas and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If youre unsure what your past liabilities are,contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Recommended Reading: Do I Pay Taxes On Social Security

Contest A Texas Jeopardy Assessment

Texas may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Texas Comptroller accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has20 days to contest the assessment and must place a security deposit to fight the issue.

How Do I Save During Texas Tax

When you shop for qualifying items from Friday, Aug. 5 through Sunday, Aug. 7, 2022, you will save on Texas state sales tax, which is 6.25% as well as any local taxes but will be a maximum of 8.25% when combined with Texas state tax.

The following items will qualify for tax exemption:

- Footwear priced under $100: Boat shoes, cross trainers, dress shoes, hiking boots, cowboy boots, flip-flops, jellies, running sneakers, safety shoes, sandals, slippers, tennis shoes and walking shoes.

- Clothing priced under $100: Jackets, jeans, dresses, jogging apparel, baby clothes, hunting and fishing vests, blouses, shirts, sweaters, sweatshirts, tennis clothes, trousers, underclothes, pajamas, golf clothes, scout uniforms, workout clothes and raincoats.

- Accessories priced under $100: Baseball hats, rain hats, bow ties, neckties, childrens backpacks, belts, leather gloves, winter hats, scarves, shawls and wraps.

- School supplies priced under $100: Binders, chalk, book bags, calculators, cellophane tape, compasses, composition books, crayons, erasers, folders, glue, highlighters, index cards, school supply kits, legal pads, lunch boxes, markers, notebooks, paper, pencil boxes, pencil sharpeners, pencils, pens, protractors, rulers, scissors and writing tablets.

- Face masks priced under $100: Cloth and disposable fabric face masks.

Also Check: How Much Foreign Income Is Tax Free In Usa

Texas Sales Tax Nexus

Sales tax nexus is a term that means that a retailer has a significant presence within a state. If you have nexus in Texas, you are required to collect and remit sales tax on your businesss orders.

A business with a physical presence within the state of Texas will have nexus. That means if you have an office within the state, you must collect sales tax on retail sales.

Other activities that create Texas sales tax nexus are:

- Having an employee, or another agent who operates under the authority of the seller, within the state

- Having an independent salesperson within the state

- Having a distribution center in Texas

- Storing products within a Texas-based warehouse, including Fulfillment by Amazon warehouses

For a complete list of activities that may cause your business to have nexus in Texas, please refer to this web page maintained by the state of Texas.

If you are unsure whether your business is required to collect sales tax, consult with a tax attorney or other licensed professional.

I Received A Texas Sales And Use Tax Audit Notice What Should I Do

Texas regularly audits businesses that are required to charge, collect, and remit various taxes in the state. Businesses that receive a sales and use tax audit notice should consider the following:

- Unless you have experience handling Texas sales and use tax audits, how can you trust that the states auditor is abiding by the rules and following proper procedure?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to the limiting exposure and shaping the results. Are you confident in doing that on your own?

If you are unsure of the answer to these questions and you do not have experience handling Texas sales tax audits, hiring a professional might be right for you.Contact us and learn how our sales tax professionals can give you the peace-of-mind and confidence you need during your audit.

Please visit our resource pages for more detailed information and to help you evaluate critical decisions during your Texas sales and use tax audit.

Recommended Reading: Do You Have To Pay Taxes On Inheritance

Collecting Sales Tax In Texas

Businesses that make their products or services available for sale in Texas can unwittingly be held liable for Texas sales or use tax. This means that anyonea business or an individualoffering products or services for sale in the state of Texas, whether online, in their living room, or through brick-and-mortar stores, is generally responsible for collecting sales tax from their customers. In turn, they have an obligation to remit any collected sales tax to the Texas Comptroller of Public Accounts.

Any person who collects a tax holds the tax in trust for the benefit of the state and may be held liable for the full amount of the tax collected plus any accrued penalties and interest. In Texas, individuals and business owners are generally legally responsible for knowing whether they need a Texas sales and use tax permit, determining which products are subject to tax, and for collecting and remitting the tax and applicable local tax to the Texas Comptroller.

Texas Sales Tax Audit Process

Theaudit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive a Texas Sales and Use Tax Audit Notice

Many audits begin with a call out of the blue from a Texas Comptrollers sales tax auditor. Shortly after the call, your business will receive an audit notice which confirms that you were lucky enough to be chosen for a Texas sales and use tax audit. To prepare for the audit, it is likely a good idea to start by getting a state and local tax professional involved.

What to Expect From A Texas Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested .

What to Expect During The Audit

Once the necessary records are received, the auditor will:

- Conduct the audit by comparing your Texas sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Texas sales tax return.

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to Texas. This often leads to shocking results for the unsuspecting taxpayer during an audit.

Read Also: How Are Taxes Calculated On Paycheck

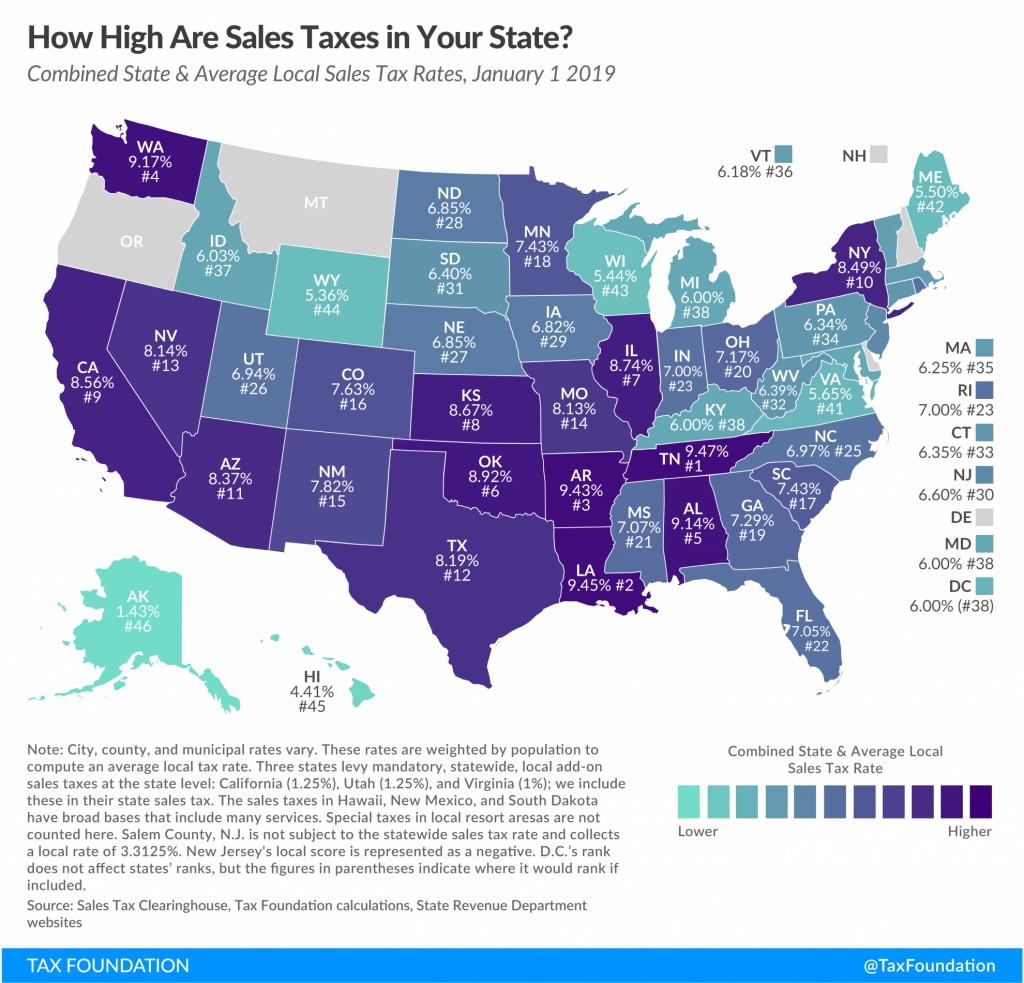

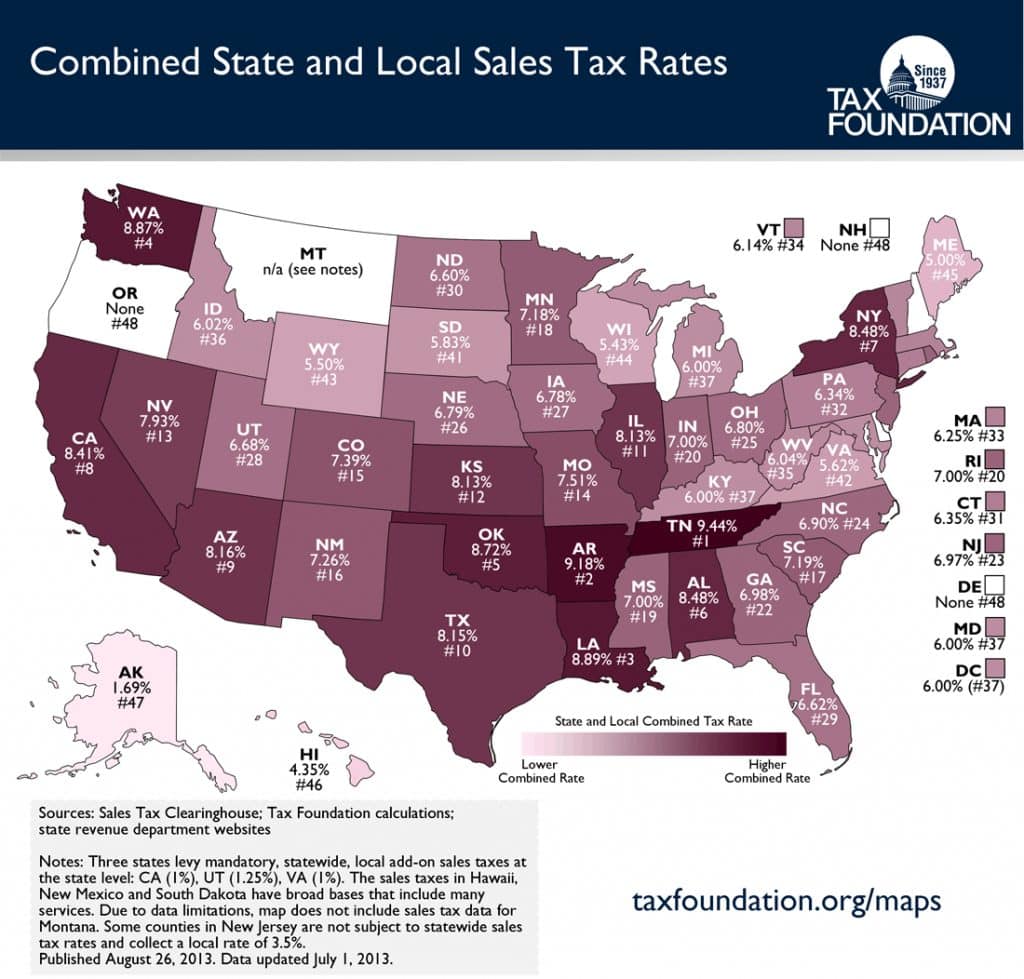

Texas Sales Tax Rates

Texas sales tax varies by location. There is a statewide sales tax of 6.25%. In addition, local taxing jurisdictions such as counties, cities, special purpose districts, and transit authorities can impose a sales tax of up to 2%, for maximum tax rate of 8.25%.

Texas has a few transit authorities, departments, and districts that impose their own sales and use tax. Find those rates and districts here.

Texas is an origin-based state for in-state retailers, meaning that a retailer should charge its local rate on all in-state orders. Out-of-state sellers are expected to use the tax rate at the destination of the order, which makes the calculation more difficult due to the variety of taxes and rates across the state.

Filing Texas Sales Tax Returns

Electronic filing for sales tax is required for businesses that have paid $10,000 or more in the preceding fiscal year. Electronic filing may be done through WebFile, a part of the states eSystems portal. It may also be done via Electronic Data Interchange . To find out more about filing electronically, visit the Texas Comptroller website. They even have a series of instructional videos about how to use WebFile.

If youve paid less than $10,000 in the prior fiscal year, you may file a paper report, but the electronic method is encouraged.

If you have a sales tax permit and no taxable sales to report you may also report via Telefile.

Recommended Reading: Penalty For Filing Taxes Late If I Owe Nothing

Monthly Update: Sales Tax

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 2 minutes

SALES AND USE TAX COLLECTIONS

Sales and use tax collections year-to-date are up across the state. Collections are outpacing inflation. Most of the cities in metro Houston that collect the tax have seen substantial increases YTD. The jump has come from both consumer and business purchases, suggesting that the state and local economies continue to expand.

Glenn Hegar, Texas Comptroller of Public Accounts, notes that collections have accelerated in the manufacturing, construction, and mining and logging sectors. Also, collections related to restaurants and services have picked up. However, collections from furniture, sporting goods, and hobby stores have begun to soften. May collections continue to exceed pre-COVID numbers, but growth has slowed somewhat over the past three months.

LOCAL COLLECTIONS

Sales tax collections in the 12 most populous Houston-area cities YTD totaled $484.2 million, up from $425.1 million in the comparable period in 21.

ABOUT THE SALES AND USE TAX

The Texas Comptroller of Public Accounts releases allocated payments from the sales and use tax monthly. There is a two-month delay between when the tax is collected and when it is allocated. March sales data will be available in May.

Prepared by Greater Houston Partnership Research Division

Patrick Jankowski

Requirements Of A Texas State Permit Holder

Once you receive your Texas Sales Permit and your doors are open for business, you now have the right to charge customers a sales tax on taxable items and services. Examples of taxable items include physical products such as clothing, furniture, computer equipment, software and services like auto repair and house cleaning. Key goods and services that are exempt from sales tax include groceries, medications, utilities and fuel. A full list covering taxable services can be found on the Texas Comptrollers website.

If your business is collecting a sales tax, the money will need to be sent to the Texas Comptroller of Public Accounts. The state sales tax is 6.25 percent, but the taxable amount may vary depending on where your business is located and the city or district tax rate. To get an accurate idea of what your sales tax rate is, use the Sales Tax Rate Locator.

Filing frequency for a business will be determined by the Comptroller of Public Accounts. In most cases, this will depend on the level of activity and volume of sales generated by your business. Your obligation for submitting sales tax returns may be monthly, quarterly or annually. For businesses generating about $10,000 a month, filing sales tax returns will be a monthly obligation with a deadline on the third week of each month.

Also Check: Personal Tax Return Due Date 2022