Are Shipping & Handling Subject To Sales Tax In Texas

In the state of Texas, the laws regarding tax on shipping and handling costs are relatively simple. Essentially, if the item being shipped is taxable, and if you charge for the shipping as part of the order, then the shipping charge is considered to be taxable. If the item is not taxable, then the shipping is not seen as being taxable either.

Texas Sales Tax Deadlines

Once a businesss sales tax application has been approved, it will receive a letter with instructions on how often it must file a sales tax return. Returns may be due monthly, quarterly, or yearly.

Monthly Filers: Due on the 20th of the following month.

| Period |

|---|

Annual Filers: Due on January 20 for the previous years taxes.

If a due date falls on a Saturday, Sunday, or legal holiday, the deadline is extended until the next business day.

What Is Exempt From Sales Taxes In Texas

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how Texas taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

EXEMPT

For more details on what types of goods are specifically exempt from the Texas sales tax see Texas sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Texas? Taxation of vehicle purchases in particular are discussed in the page about Texas’ sales tax on cars.

You May Like: How To Find 2020 Tax Return

Is The Texas Sales Tax Destination

Texas is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.

What Is The Texas Tax

Texas Tax-Free Weekend is the annual summer sales tax holiday that focuses on tax-free items for back-to-school shopping. The goal is not only to help people save, but to inspire residents to get out and support Texas businesses. Spending limits are kept below $100 to make sure this helps out for essential items, rather than luxury items. The spring tax-free weekends are dedicated to helping Texans invest in preparing their homes for storms as well as adding energy-saving appliances.

You May Like: Amended Tax Return Deadline 2020

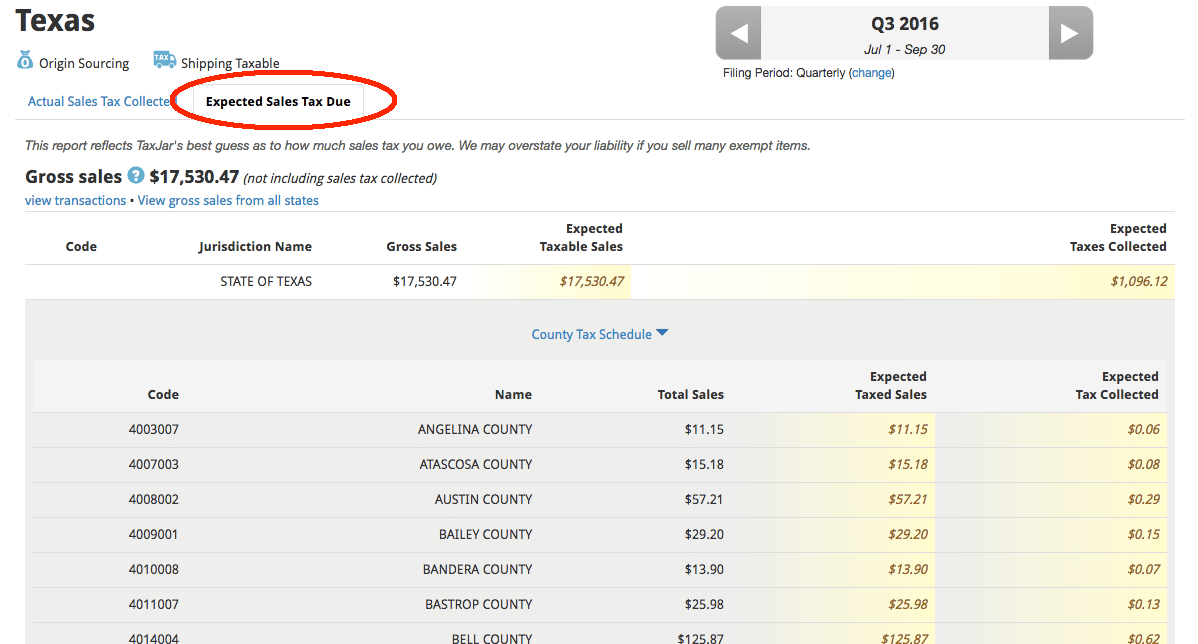

Sourcing Sales Tax In Texas: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale . Texas does a little of each.The origin address is used first. However, if the local tax rate from the origin address is less than 2 percent, the destination address is used to apply additional local tax up to the state-mandated 2-percent limit.For example:

- If an order is placed in person at a place of business in Texas, the rate is based on where the order is placed

- If an order is fulfilled at a sellers place of business in Texas, the rate is based on where the order is fulfilled

- If an order isnt fulfilled at a sellers place of business in Texas, but is received at a sellers place of business in Texas, the rate is based on where the order is received

- If an order isnt received or fulfilled at a sellers place of business in Texas, but is fulfilled at a Texas location, the rate is based on where the order is shipped or delivered

- If the order is received, fulfilled, and delivered from a location outside of Texas, and the seller doesnt have nexus with Texas, no tax is due

For additional information, see Local Sales and Use Tax Collection A Guide for Sellers.

When You Need To Collect Texas Sales Tax

In Texas, sales tax is collected on the sale, lease, or rental of tangible goods and some services. The tax is collected by the seller and remitted to state and local tax authorities. The seller acts as a de facto tax collector. However, how does a seller know when they are required to collect sales tax in Texas?

The 1992 Quill Corp. v. North Dakota ruling held that a state could only require a company to collect, file, and remit sales tax if the seller had a substantial physical presence in the state. For many online sellers, this meant they did not have to collect tax on sales to consumers located in Texas. This, however, was overturned in 2018 with the South Dakota v. Wayfair, Inc. ruling by the Supreme Court.A lot has changed with regards to sales tax lawsTo help you determine whether you need to collect sales tax in Texas, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

You May Like: Local County Tax Assessor Collector Office

What Transactions Are Generally Subject To Sales Tax In Texas

In the state of Texas, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. An example of items that are exempt from Texas sales tax are items specifically purchased for resale.This means that an individual in the state of Texas purchases school supplies and books for their children would be required to pay sales tax, but an individual who purchases school supplies to resell them would not be required to charge sales tax.

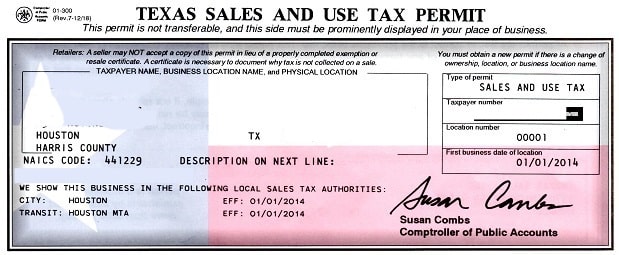

Do I Need A Texas Sales Tax Permit If I Am A Remote Online Seller

If you are a remote seller and are based in Texas, you will need to collect sales tax and have a Texas sales tax permit. The only way around this is if you are an “occasional” seller, which means that you are not in business full time. If you are selling items to customers outside of Texas, you are not required to collect Texas sales tax. It is, however, recommended that you keep your online sales records for at least four years.

Don’t Miss: Free Irs Approved Tax Preparation Courses

Texas Sales Tax Exemptions For Healthcare

Texas divides hospitals and healthcare facilities in to two categories for purposes of sales and use tax exemptions nonprofit and for profit entities. The rules are straightforward for nonprofit hospitals and healthcare facilities because all items sold or leased to, or stored, used or consumed by organizations created for religious, educational or charitable purposes are exempt from Texas sales and use tax. For profit hospitals and healthcare facilities have more complex rules, but there are a number of categories of purchases which qualify for Texas sales tax exemptions. Some prominent exemptions include: hospital beds and replacement parts, intravenous or IV systems and their components, hypodermic needles and syringes, medical kits if the cost of the exempt items included in the kit are greater than the cost of the taxable items, medical oxygen and other drugs, prosthetic devices, labor charges and maintenance agreements for radiation emitting equipment such as x-rays, and orthopedic appliances and devices )

About The Texas Sales Tax

The state of Texas has relatively simple sales tax rate, and utilizes a flat state tax rate. However, the local cities, counties, transit authorities , and special purpose districts do have the ability to charge local taxes, which will vary depending on location. These local tax rates would be in addition to the state rate. Local jurisdictions also have the ability to impose some other additional taxes if they so choose, which would be cumulative with the state taxes of the same nature.

Recommended Reading: Sale Of Second Home Tax Treatment

Can You Return Or Exchange Items During Texas Tax

Yes, you can still return or exchange items during Texas tax-free holidays, but make sure to have your original receipt. If you want full reimbursement for items purchased before tax-free holidays, youll need to prove with documentation that tax was paid with a valid receipt. For exchanges, if its the same item no tax will be due. However, if you exchange an item after tax holiday for a different item, the new item is subject to sales tax.

If I Was Charged Tax During the Tax Holiday Can I Request a Refund of Tax Paid?

Yes, if the items you purchased qualify as exempt during a tax-free weekend you will qualify for a refund of the tax paid. Your refund can be either directly from the seller or the seller may give you a Form 00-985 and ask you to file for your refund with the Texas Comptrollers office.

Are Any Goods Exempt From Sales Tax

Unprepared food, medical supplies, and food stamps are some of the goods that are exempt from sales tax in Texas. They are listed accurately in state law.

Before starting any business activity, we recommend you review the rules and laws established by the Texas Comptroller of Public Accounts to determine what taxes apply to you.

Some merchants have discounts on sales taxes they can claim the 0.5% discount of tax declared and paid on time. If you make payments in advance, you can claim the 0.5% discount along with the 1.25% discount for payment.

Also Check: Penalty For Filing Taxes Late If I Owe Nothing

Texas: Sales Tax Holiday Tax Free Weekend

TX: The Comptroller encourages all taxpayers to support Texas businesses while saving money on most clothing, shoes, school supplies, and backpacks tax-free during the annual tax holiday weekend. Eligible items may be purchased tax-free in a Texas store or from an online or catalog seller doing business in Texas. In most cases, you do not need to issue an exemption certificate to the seller to purchase eligible items duty-free.

This years sales tax holiday begins Friday, Aug. 5, and goes through midnight Sunday, Aug. 7.

The sales tax exemption only applies to qualifying items you purchase during the sales tax exemption period. Therefore, items purchased before or after-sales tax exemption do not qualify for the exemption, and no tax refund is available.

Who Is Responsible For Use Tax

Texas sellers are required to collect and remit sales and use tax to the Comptrollers office on their sales of taxable items or obtain a resale or exemption certificate in lieu of collecting the tax.

A Texas purchaser owes state and local use tax if they buy taxable goods and services that are stored, used or consumed in Texas from a seller who does not charge Texas sales tax. If the seller does not have a permit or fails to charge sales and use tax, the purchaser must pay the use tax directly to our office unless an exemption applies.

For example, if you buy a shirt through an online auction from a seller in Ohio who does not charge Texas tax, or if a New York electronics store sells you a camera through its website and does not charge Texas tax, you owe Texas use tax on the sales price of the item.

Items bought in another country and used in Texas are also subject to Texas use tax. For example, if you buy taxable items in Mexico that you bring back to Texas, you owe Texas use tax on the purchase price of those items.

You must pay state and local use tax if you have the item delivered to, or use the item in, an area that imposes a local tax. If you buy an item from a seller located in a part of Texas with no local taxes, you will only pay state sales tax on that purchase. See Publication 94-105, Local Sales and Use Tax Collection A Guide for Sellers, for additional information regarding local use tax.

Texas Sales Tax Exemptions For Manufacturing

Texas offers broad sales and use tax exemptions for manufacturers. Machinery and equipment used in the production process qualify for sales tax exemptions within Texas. Repair parts and labor to qualifying machinery and equipment are also exempt. Consumables including lubricants and chemicals consumed during the manufacturing process are exempt if their use is necessary and essential to prevent the failure, decline or deterioration of exempt manufacturing equipment. Safety apparel or clothing used by employees during the manufacturing or processing of tangible personal property is exempt provided that the apparel or clothing is not sold to the employees and the manufacturing process would not be possible without the use of such apparel or clothing. Utilities consumed during production also qualify for an exemption, however a valid utility study conducted by an engineer must document the percentage of utilities consumed for exempt purposes on any meter with mixed taxable and non-taxable use. Agile Consulting Groups sales tax consultants have a wealth of experience within the state of Texas and can ensure taxpayers are maximizing the benefit of Texas sales tax exemptions for which they qualify.

For more information on Texas sales tax exemptions please visit the sites below.

How Do I Save During Texas Tax

When you shop for qualifying items from Friday, Aug. 5 through Sunday, Aug. 7, 2022, you will save on Texas state sales tax, which is 6.25% as well as any local taxes but will be a maximum of 8.25% when combined with Texas state tax.

The following items will qualify for tax exemption:

- Footwear priced under $100: Boat shoes, cross trainers, dress shoes, hiking boots, cowboy boots, flip-flops, jellies, running sneakers, safety shoes, sandals, slippers, tennis shoes and walking shoes.

- Clothing priced under $100: Jackets, jeans, dresses, jogging apparel, baby clothes, hunting and fishing vests, blouses, shirts, sweaters, sweatshirts, tennis clothes, trousers, underclothes, pajamas, golf clothes, scout uniforms, workout clothes and raincoats.

- Accessories priced under $100: Baseball hats, rain hats, bow ties, neckties, childrens backpacks, belts, leather gloves, winter hats, scarves, shawls and wraps.

- School supplies priced under $100: Binders, chalk, book bags, calculators, cellophane tape, compasses, composition books, crayons, erasers, folders, glue, highlighters, index cards, school supply kits, legal pads, lunch boxes, markers, notebooks, paper, pencil boxes, pencil sharpeners, pencils, pens, protractors, rulers, scissors and writing tablets.

- Face masks priced under $100: Cloth and disposable fabric face masks.

Calendar Of Texas Sales Tax Filing Dates

Depending on the volume of sales taxes you collect and the status of your sales tax account with Texas, you may be required to file sales tax returns on a monthly, semi-monthly, quarterly, semi-annual, or annual basis.

On this page we have compiled a calendar of all sales tax due dates for Texas, broken down by filing frequency. The next upcoming due date for each filing schedule is marked in green.

Simplify Texas sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Texas Tax Code Chapter 151 Limited Sales Excise And Use Tax

Disclaimer: These codes may not be the most recent version. Texas may have more current or accurate information. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. Please check official sources.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Missouri sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Personal Liability For Sales Taxes Collected And Not Paid

Matters of sales and use tax should be taken seriously. This is especially important because business owners can be held personally liable for sales taxes collected and not paid over to the Comptroller of Public Accounts. Sales tax collected by business owners are held in trust for the state government by the business owners. For this reason, the business owners can be held accountable in their personal capacity for state sales tax collected but not paid over to the state government.

How To File A Texas Sales And Use Tax Return

This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow’s content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 16,458 times.Learn more…

If you own a business in Texas that sells products or provides taxable services, you must collect state and local income tax from your customers and pay that money to the Texas Comptroller’s Office on either a monthly, quarterly, or yearly basis. The state sales and use tax is 6.25 percent, but cities and counties can add up to 2.00 percent on top of that, for a maximum total rate of 8.25 percent. Those additional local taxes vary greatly throughout the state.XResearch source