How 2022 Sales Taxes Are Calculated In Memphis

The Memphis, Tennessee, general sales tax rate is 7%. Depending on the zipcode, the sales tax rate of Memphis may vary from 7% to 9.75%Every 2022 combined rates mentioned above are the results of Tennessee state rate , the county rate , the Memphis tax rate . There is no special rate for Memphis.The Memphis’s tax rate may change depending of the type of purchase.Please refer to the Tennessee website for more sales taxes information.

How To Calculate Sales Tax

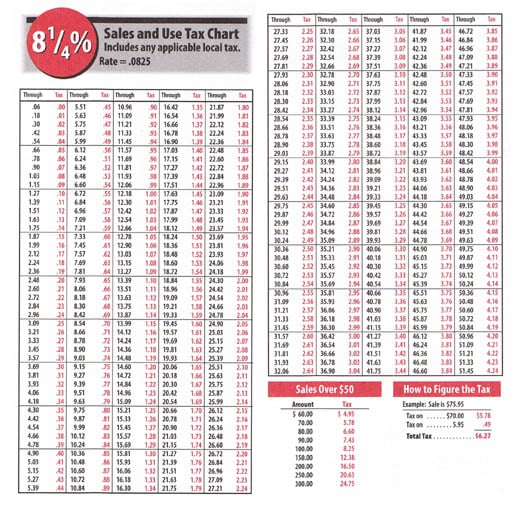

Multiply the price of your item or service by the tax rate. If you have tax rate as a percentage, divide that number by 100 to get tax rate as a decimal. Then use this number in the multiplication process.

For example say you’re buying a new coffee maker for your kitchen. The price of the coffee maker is $70 and your state sales tax is 6.5%.

Tennessee Sales Tax Rates By City

The state sales tax rate in Tennessee is 7.000%. With local taxes, the total sales tax rate is between 8.500% and 9.750%.Food in Tennesse is taxed at 5.000% .

Tennessee has recent rate changes .

Select the Tennessee city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Tennessee was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

You May Like: Income Tax By State Ranked

Central Business Improvement District & Gulch Business Improvement District

The Central Business Improvement District , established by Metro Ordinance in 1999, is an annual assessment, in the form of a tax, from the Nashville District Management Corporation, a 501 , of privately owned properties within the CBID boundaries. Read more about the CBID and its functions.

The Gulch Business Improvement District , established by Metro Ordinance in 2006, is an annual assessment fee, in the form of a tax, from the Nashville District Management Corporation, a 501 , of privately owned properties within the GBID boundaries. Read more about the GBID and its functions.

The 2017 approved rate for the CBID is $.001294 per dollar of assessed property value. See BL2017-787

The 2017 approved rate for the GBID is $.1081 per $100 dollar of assessed property value. See BL2017-788

A change in the rate of levy of such special assessment may be initiated only by a resolution from the District Management Corporation. Upon receipt of this resolution from the District Management Corporation, the Metropolitan Council must hold a public hearing on whether there should be a change in the rate of levy for the special assessment, and no such change shall become effective unless and until it is approved by an ordinance enacted by the Metropolitan Council.

When Sales Tax Is Exempt In Tennessee

Tennessee does offer quite a few exemptions when it comes to sales tax on cars, including the following:

- Sales to members of the armed forces

- Sales or transfers between spouses or siblings, parents, grandparents, children, and grandchildren

- Sales to nonresidents of Tennessee who plan to leave the state with the vehicle within three days of buying it

- Sales to nonprofit organizations or government entities only for organizational or governmental use

- Any vehicles given as gifts

- Vehicles transferred personally from a sole proprietor’s business to the sole proprietor

- Vehicles converted by an individual for use at their sole proprietor business

- Vehicles owned by two individuals who get the vehicle’s title issued in only one of their names

- Vehicles given as a gift in which the giver receives no benefit

- Vehicles given to a Tennessee qualified nonprofit

- Vehicles given to the federal government, the state of Tennessee, a Tennessee county or municipality, or an agency of these governments

Recommended Reading: How To Pay My Tax Online

Tennessee Sales Tax And Other Fees

In most cases, the total cost for titling and registering your vehicle in Knox County is $77.00. See below for an itemization of this charge. $77 is the fee for a standard plate. Fees vary and are more expensive for specialty and commercial tags. Specialty plates for some organizations require proof of membership. Standard fees and sales tax rates are listed below. Call 215-2385 with further questions

Sales Tax

- State Sales Tax is 7% of purchase price less total value of trade in.

- Local Sales Tax is 2.25% of the first $1,600. This amount is never to exceed $36.00. For purchases in excess of $1,600, an additional state tax of 2.75% is added up to a maximum of $44.

- Local collection fee is $1

Fees

- Title Fee $14.00 + Licenses plate fee $29 = $79.00 Knox County Wheel Tax is $36.00 and may apply when purchasing a new plate.

- Title and transfer of existing plate $14.50.

- The mailing fee is $2.00 if we are just mailing out a registration and $3.00 if we are mailing out a plate and registration. Make check payable to: Knox County Clerk, PO Box 1566, Knoxville, TN 37901 Optional $1.00 donation to Donate Life, the Tennessee County Clerk Organ Donor Awareness Foundation

Disclaimer: The sales tax calculator is for informational purposes only, please see your motor vehicle clerk to confirm exact sales tax amount.

How To Calculate Sales Tax In Tennessee

Businesses and Sellers involved in the sale taxable tangible personal property and some services, and have Nexus in Tennessee are required to register for Sales tax.

They must collect, manage, and remit it to the Tennessee Department of Revenue while staying in compliance with state laws and avoid penalties and interest.

The sales tax determined on four factors:

To calculate Sales Tax in Tennessee, follow the steps below:

You May Like: Corporate Tax Rate In India

How To Calculate Tennessee Sales Tax On A Car

You can calculate the sales tax in Tennessee by multiplying the final purchase price by .07%.

For example, lets say that you want to purchase a new car for $60,000, you would use the following formula to calculate the sales tax:

$60,000 x.07 = $4,200.

This means that your sales tax is $4,200 on a $60,000 purchase price.

Sales Tax Calculation Formulas

- Sales tax rate = sales tax percent / 100

- Sales tax = list price * sales tax rate

- Total price including tax = list price + sales tax, or

- Total price including tax = list price + , or

- Total price including tax = list price *

If you need to calculate state sales tax, use tax and local sales tax see theState and Local Sales Tax Calculator.

Read Also: Amend My 2020 Tax Return

How Do I Register For A Tennessee Resale Certificate

Registration for in-state tax filing is done through the departments Tennessee Taxpayer Access Point . The website uses a wizard-based questionnaire to guide you through the process of registering. For out-of-state retailers who meet the requirements, you must also register to collect and remit Tennessee sales tax. This is also done through TNTAP.

Visit the Department of Revenue for:

Payees may only file and pay online. Payments may be done via:

- ACH payments, either via taxpayer bank account or their 3rd party vendor, Global Payment Systems.

Note that taxpayers with a block or restriction on their account who use ACH must provide the information as required by the state.

Local Sales Tax And Single Article

Local Tax

Any county or incorporated city, by resolution or ordinance, may levy the local sales and use tax on the same privileges that are subject to the states sales or use tax. The local tax rate may not be higher than 2.75% and must be a multiple of .25. All local jurisdictions in Tennessee have a local sales and use tax rate. The local sales tax rate and use tax rate are the same rate. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes.

Local Tax Rate Look Up

The local sales tax rate map is a complete and up-to-date list of the tax rate for each jurisdiction.

You can download sales tax rate tables and the boundary database, however, you should consider reading the Streamlined Sales Tax Technology Guide to help you understand what these files include and how to use the files to determine the correct tax rate. These files are created for use in tax calculation applications to determine the tax rate. It is difficult to determine a rate by simply looking at the files.

Single Article Local Tax Base Limitation

The local tax is applied only to the first $1600 of the sales price of any single article of tangible personal property in most local jurisdictions.

Also Check: File State And Federal Taxes For Free

Does Tennessee Have A Sales Tax Holiday

Like certain other states, Tennessee also has a sales tax holiday that exempts the tax for clothing and school supplies that cost $100 or less and for computers and tablets that cost $1500 or less. The tax holiday fell on the last weekend of July 2021 . Additional sales tax holidays were implemented in 2021 for food and ingredients and gun safety equipment. Neither has been renewed yet for 2022.

Are There Penalties And Interest If I File Late Or Fail To File

If you do not make your sales tax payment on time, it is considered delinquent. If you make a smaller payment than the amount due, then it is called deficient. In both cases, both penalties and interest apply to the unpaid amount. Penalties may also be assessed if you pay by a method other than electronic payment.

The penalty is 5% of the unpaid amount for each month or partial month the tax is unpaid, for a maximum of 25%. Interest is calculated at the current rate, which can be found here. To calculate the interest, use the following formula:

Original liability * Rate * # of days delinquent / 365.25

If you arent comfortable calculating it, the Tennessee Department of Revenue will send you a bill for the correct amount.

Read Also: Pay My Car Tax Online

Determine The Sales Tax Rate:

Once you have determined that your Nexus is with Tennessee, next is to deduce the Sales Tax rate applicable to your product, for which you can refer to the table below:

| 9.25% |

Note:

- If your single product price is above $1600, then you may be subjected to “Single Article Tax,” where the product will be charged with combined sales tax in a different way. The first $1600 will be charged with a standard combined sales tax rate, while the next $1,600 of the purchase will be taxed at 9.75%. However, any remaining portion from the purchase price exceeding $3,200 will be charged with a lower sales tax rate of 7%.

Tennessee Sales Tax Software

While calculating sales tax in Tennessee is easier than in many destination-based states, retailers may find that sales tax software helps them streamline the process and avoid the kinds of mistakes that lead to audits. Our TaxTools software is the answer. It pinpoints the right sales tax for every US address, and applies the appropriate sales tax to each order placed on your site. Then when youre ready to file your return, our reports make the process simple. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of AccurateTaxs TaxTools software.

You can also use our free sales tax calculator to look up the rate for any Tennessee address.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Recommended Reading: Is Ein And Tax Id The Same

Tennessee Sales Tax Nexus

A sales tax nexus is a legal way of stating that a small business has a significant enough presence within a state that the state can require them to collect and remit sales tax on behalf of their customers. Traditionally this has been only a physical presence, but it now consists of any corporate presence. Within Tennessee, this corporate presence means:

- Having an office, warehouse, or another place of business in Tennessee

- Having an employee, contractor, salesperson, or other solicitors who operate physically within the state

- Furnishing property, or providing services that are subject to sales or use tax while in the state

Tennessee Sales Tax Calculator

You can use our Tennessee Sales Tax Calculator to look up sales tax rates in Tennessee by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Tennessee has a 7% statewide sales tax rate,but also has 307 local tax jurisdictions that collect an average local sales tax of 2.614% on top of the state tax. This means that, depending on your location within Tennessee, the total tax you pay can be significantly higher than the 7% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Tennessee:

You May Like: Property Taxes In Brazoria County

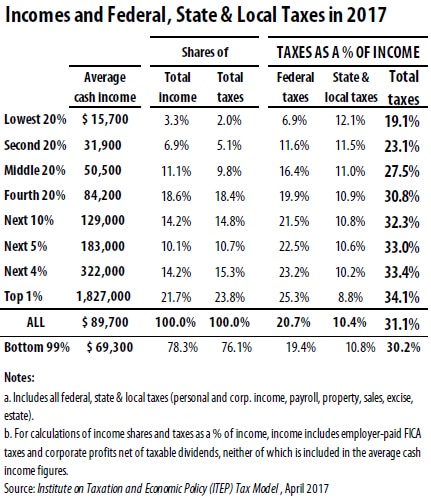

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

Is Tennessee Destination

Tennessee is an origin-based state. This means that the tax rate you use to calculate sales tax on orders is the rate where your business is located. If your local tax rate is 9.25%, then youll charge 9.25% sales tax on all orders shipping to Tennessee addresses, regardless of what the sales tax rate is at the location youre shipping to.

Also Check: Does Texas Have State Income Taxes

Car Sales Tax For Trade

You dont have to pay sales tax on trade-ins. In other words, be sure to subtract the trade-in amount from the car price before calculating sales tax.

As an example, lets say you are purchasing a new SUV for $40,000 and your trade-in is worth $15,000. You will subtract the trade-in value by the purchase price and get $25,000. Therefore, your car sales tax will be based on the $25,000 amount.

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Also Check: What State Has Highest Taxes