Top Aaa Diamond Hotels

AAAs in-person hotel evaluations are unscheduled to ensure the inspector has an experience similar to that of members. To pass inspection, all hotels must meet the same rigorous standards for cleanliness, comfort and hospitality. These hotels receive a AAA Diamond designation that tells members what type of experience to expect.

Sponsored Listing

700 W Convention Way. Anaheim, CA 92802

1601 S Anaheim Blvd. Anaheim, CA 92805

777 W Convention Way. Anaheim, CA 92802

2035 S Harbor Blvd. Anaheim, CA 92802

158 ft.

Sales Tax

State and county sales taxes total 7.75 to 8 percent in Anaheim. A lodging tax, called a transient occupancy tax, of 17 percent also is levied along with an 8 percent rental car tax.

Emergency

765-1900

Hospitals

Anaheim Global Medical Center, 533-6220 Anaheim Regional Medical Center, 774-1450 Kaiser Permanente Orange County – Anaheim Medical Center, 644-2000 St. Joseph Hospital, 633-9111 West Anaheim Medical Center, 827-3000.

Visitor Information

2099 S. State College Blvd. Suite 600 Anaheim, CA 92806. Phone:765-2800

Air Travel

Rental Cars

Most major car rental agencies serve Anaheim. Hertz, 654-3080, provides discounts to AAA members.

Rail Service

Buses

Taxis

The base rate is $3.50 at flag drop and $2.75 per mile. Two large companies are California Yellow Cab, 444-4444 and Yellow Cab Co, 999-9999 OR 649-1222.

Public Transportation

Transportation by bus and commuter rail service is available in Anaheim.

Not a Member?

California Sales Tax Lookup By Zip Code

Look up sales tax rates in California by ZIP code with the tool below.Note that ZIP codes in California may cross multiple local sales tax jurisdictions.

Sales-Taxes.com last updated the California and Buena Park sales tax rate in November 2022 from the California Board of Equalization

Sales-Taxes.com strives to provide accurate and up-to-date sales tax rates, however, our data is provided AS-IS for informational purposes only.

Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions.

© 2022 Sales-Taxes.com. All rights reserved. Usage is subject to our Terms and Privacy Policy.

What Is The Sales Tax In San Mateo County

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. California has a 6% sales tax and San Mateo County collects an additional 0.25%, so the minimum sales tax rate in San Mateo County is 6.25% .

You May Like: Small Business Income Tax Calculator

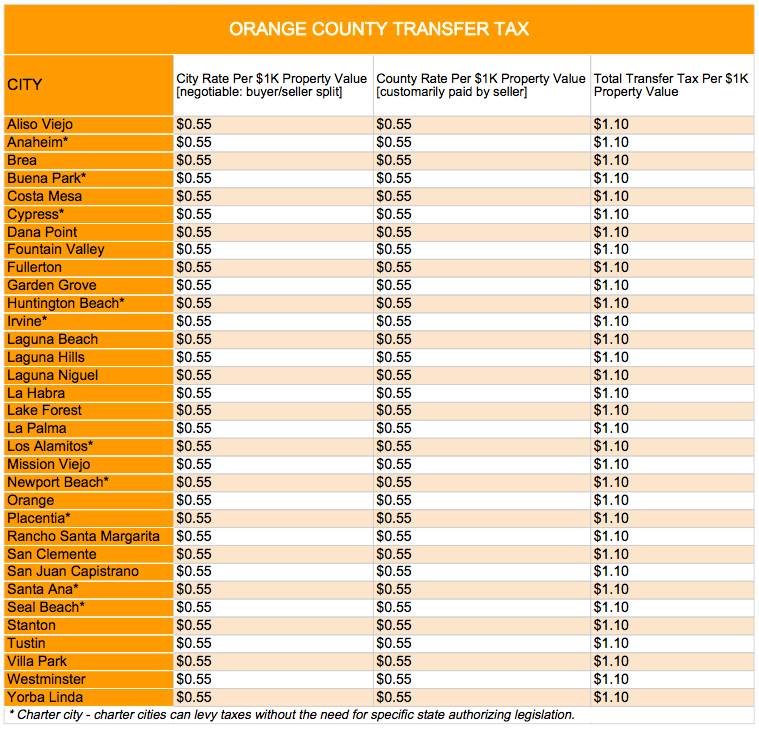

Tax Rates By City In Orange County California

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. California has a 6% sales tax and Orange County collects an additional 0.25%, so the minimum sales tax rate in Orange County is 6.25% . This table shows the total sales tax rates for all cities and towns in Orange County, including all local taxes.

| City |

|---|

What Is The Sales Tax In Arcadia Ca

Arcadia, California Sales Tax Rate 2021 The 10.25% sales tax rate in Arcadia consists of 6% California state sales tax, 0.25% Los Angeles County sales tax, 0.75% Arcadia tax and 3.25% Special tax. You can print a 10.25% sales tax table here. For tax rates in other cities, see California sales taxes by city and county.

Read Also: How Long To Receive Tax Refund 2022

What Is The Sales Tax In San Luis Obispo Ca

The 8.75% sales tax rate in San Luis Obispo consists of 6% California state sales tax, 0.25% San Luis Obispo County sales tax, 1.5% San Luis Obispo tax and 1% Special tax. The sales tax jurisdiction name is San Luis Obispo City Tourism Business Improvement District, which may refer to a local government division.

How To Calculate California Restaurant Tax

Related

California state regulation of businesses of all kinds is notoriously detailed. Tax regulation of restaurants is no exception and includes some provisions that make figuring out how much you owe the state even a little more laborious. Here’s some basic California restaurant-related tax information.

Read Also: Do 16 Year Olds Have To File Taxes

Where The Trouble Begins

The trouble for restaurant owners begins with a relatively uncomplicated-seeming statement in the California tax code: “Sales of food for human consumption are generally exempt from tax unless….”

The trouble begins at the phrase “generally exempt” and continues after “unless” with the provided list of exceptions along with the exceptions to the exceptions.

The exceptions to the exemption from the tax are:

- food sold in a heated condition

- food consumed at or near the seller’s facilities

- soft drinks and alcoholic beverages

- food sold for consumption where there’s an admission charge

This is already mildly confusing but wait, there’s more and it only gets worse.

California Sales Tax Rates By City

The state sales tax rate in California is 7.250%. With local taxes, the total sales tax rate is between 7.250% and 10.750%.

California has recent rate changes .

Select the California city from the list of popular cities below to see its current sales tax rate.

Sales tax data for California was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Don’t Miss: T Mobile Taxes And Fees

Nearby Recently Sold Homes

| 3 Beds | – Baths | 1701 Sq. Ft. | $907,418 |

| 3 Beds | 2.5 Baths | 1701 Sq. Ft. | $850,328 |

| 3 Beds | 2 Baths | 1327 Sq. Ft. | $863,927 |

| 3 Beds | 2.5 Baths | 1692 Sq. Ft. | $790,243 |

| 4 Beds | 2 Baths | 1363 Sq. Ft. | |

| 2 Beds | – Baths | 1176 Sq. Ft. | $748,491 |

| 3 Beds | 2.5 Baths | 1701 Sq. Ft. |

| 3 Beds | 2.5 Baths | 1692 Sq. Ft. | $931,348 |

| 3 Beds | 2 Baths | 1327 Sq. Ft. | |

| 2 Beds | 2 Baths | 1176 Sq. Ft. | $755,328 |

| 3 Beds | 2 Baths | 1327 Sq. Ft. | $753,870 |

| 3 Beds | 2 Baths | 1482 Sq. Ft. | $821,026 |

| 3 Beds | – Baths | 1701 Sq. Ft. | $886,710 |

| 2 Beds | 2 Baths | 1176 Sq. Ft. |

| 3 Beds | – Baths | 1701 Sq. Ft. | $838,915 |

| 3 Beds | 2 Baths | 1328 Sq. Ft. | $839,193 |

| 3 Beds | 2.5 Baths | 1705 Sq. Ft. | $883,569 |

| 3 Beds | 2 Baths | 1224 Sq. Ft. | $749,350 |

| 3 Beds | 2 Baths | 1233 Sq. Ft. | $787,483 |

| 3 Beds | 2.5 Baths | 1701 Sq. Ft. | $888,985 |

| 3 Beds | 2 Baths | 1327 Sq. Ft. | $815,049 |

How Much Tax Will You Have To Pay As A Promoter Sales In Anaheim Ca

For an individual filer in this tax bracket, you would have an estimated average federal tax in 2018 of 22% and an added California state tax of 9.3%. After the combined taxes have been taken out, Promoter Sales could expect to have a take-home pay of $58,902/year, with each paycheck equaling approximately $2,454*.

* assuming bi-monthly pay period. Taxes estimated using tax rates for a single filer using 2018 federal and state tax tables. Metro-specific taxes are not considered in calculations. This data is intended to be an estimate, not prescriptive financial or tax advice.

Don’t Miss: How Much Is Bonus Tax

Sales & Use Tax In California

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those salesspecifically exempted by law. The use tax generally applies to the storage, use, or other consumption in Californiaof goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchasesshipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate,and any district tax rate that may be in effect.

State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific statefund allocations, and to other local jurisdictions.

Anaheim California Sales Tax Rate

anaheim Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Anaheim, California?

The minimum combined 2022 sales tax rate for Anaheim, California is . This is the total of state, county and city sales tax rates. The California sales tax rate is currently %. The County sales tax rate is %. The Anaheim sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect California?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in California, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Anaheim?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Anaheim. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Recommended Reading: What Can I Write Off On My Taxes

To Calculate Anaheim Sales Tax In 2021

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

The California sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. The average sales tax rate in California is 8.551%

The Sales tax rates may differ depending on the type of purchase. Usually it includes rentals, lodging, consumer purchases, sales, etc

For more information, please have a look at Californias Official Site

See Promoter Sales Salaries In Other Areas

You May Like: How Much Is Property Tax In California

Anaheim Hills California Sales Tax Rate

anaheim hills Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Anaheim Hills, California?

The minimum combined 2022 sales tax rate for Anaheim Hills, California is . This is the total of state, county and city sales tax rates. The California sales tax rate is currently %. The County sales tax rate is %. The Anaheim Hills sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect California?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in California, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Anaheim Hills?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Anaheim Hills. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Popular Questions About Sales Tax In Anaheim

What is sales tax rate?

The sales tax varies by state, county, and city. Since each jurisdiction has its own applicable sales tax rate, it is difficult to keep track of the tax amount owed for various jurisdictions. Therefore, we have created a simple tool that makes all the necessary calculations for you. Using our free online Sales Tax Calculator will allow you to automatically figure out the sales tax amount owed. All that you must do is input the total sales amount and the zip code that you are completing the purchase. The site will list the total sales amount and the components of the sales tax. This means it will list the appropriate applicable state, county, local, and city taxes. This service is nice and simple to use.

What state does not charge sales tax?

Sales taxes are regulated by state and federal laws. Since states control the amount of sales tax that they charge locally, some others have decided to omit sales taxes at all to facilitate transactions. There are municipalities, or cities that can impose their taxes. As of right now, there are 5 states in the USA that do not charge a state sales tax. These states are Alaska, Montana, Oregon, Delaware, New Hampshire.

Who pays sales tax when selling a car privately?What is the provincial sales tax?How do i get a sales tax id number?

Read Also: How To File State Taxes

Sales Tax In Orange County

The total Orange County sales tax for most OC cities is 7.75%. However, nine cities in Orange County have a higher sales tax than 7.75% due to additional taxes levied by the respective cities. Santa Ana has the highest tax rate in Orange County at 9.25% with Fountain Valley, Garden Grove, Placentia, Seal Beach, Stanton and Westminster .5% behind at 8.75%. La Habra and La Palma also have higher tax rates at 8.25%.

California Sales & Use Tax Rates

| Rate | ||

|---|---|---|

| Goes to State’s General Fund | Revenue and Taxation Code Sections 6051, 6201 | |

| 0.25% | Goes to State’s General Fund | Revenue and Taxation Code Sections 6051.3, 6201.3 |

| 0.50% | Goes to Local Public Safety Fund to support local criminal justice activities | Section 35, Article XIII, State Constitution |

| 0.50% | Goes to Local Revenue Fund to support local health and social services programs | Revenue and Taxation Code Sections 6051.2, 6201.2 |

| 1.06% | Goes to Local Revenue Fund 2011 | Revenue and Taxation Code Sections 6051.15 and 6201.15 |

| 1.25% | 0.25% Goes to county transportation funds / 1.00% Goes to city or county operations | Revenue and Taxation Code Sections 7202 and 7203 |

| Total: | ||

| Total Statewide Base Sales and Use Tax Rate |

You May Like: What Happens If Your Late Filing Taxes

Quality Of Life For Promoter Sales

With a take-home pay of roughly $4,909/month, and the median 2BR apartment rental price of $1,756/mo** in Anaheim, CA, a Promoter Sales would pay 35.77% of their monthly take-home salary towards rent. The average income spent on cost of living excluding rent within Anaheim per month for an individual is $971, and for a 4-person family $3,566***. This means for an individual, total cost of living is 55.55% of a Promoter Sales in Anaheim’s salary leaving $2,182 as discretionary income whereas for a family of 4, total cost of living is 108.43% of a Promoter Sales in Anaheim’s salary leaving $-414 as discretionary income. When considering cost of living, this places Anaheim, CA as 2nd out of the 3 largest nearby metros in terms of quality of life for Promoter Sales**.

** This rental cost was derived according to an online report at Apartment List*** Average cost of living was acquired from Numbeo’s Cost of Living Index

Orange County California Sales Tax Rate 2022up To 1025%

0.25%

A county-wide sales tax rate of 0.25% is applicable to localities in Orange County, in addition to the 6% California sales tax.

Here’s how Orange County’s maximum sales tax rate of 10.25% compares to other counties around the United States:

- Higher maximum sales tax than95% ofCalifornia counties

- Higher maximum sales tax than94% ofcounties nationwide

Don’t Miss: How Much To Set Aside For Taxes 1099

Where California Sales Tax Money Goes

The state of California keeps 6.00% of the sales tax collected and the additional 1.25% goes to the county and city funds. Orange County collects an additional 0.50% which brings the Orange County sales tax .50% higher than the state minimum sales tax of 7.25%.

Here is the breakdown of the of 7.25% minimum CA sales tax:

The Alternative Tax Calculation

Fortunately, there is a way out of this mess, although you’re probably not going to like it much. California’s “Tax Guide for Restaurant Owners” explains that you don’t have to document these dual sales. Instead, you can just charge the applicable tax on 100 percent of all sales_._ That’s what a lot of food truck and cafe owners do.

References

Don’t Miss: Taxes On Lottery Winnings Calculator