Due Dates For New Yorks Sales Taxes

Businesses can file annually if they collect $3,000 or less in taxes throughout the year. If the taxes you collect are less than $300,000 during a quarter, you can file quarterly. If you collect $300,000 or more during a quarter, you must file monthly.

If you collect over $500,000 during a year, you might have to participate in PrompTax, which means that you pay tax electronically on an accelerated payment schedule and file a quarterly return to reconcile all payments for the previous quarter.

Any businesss filing frequency can change. New Yorks Department of Revenue automatically uploads the correct forms into your account if your filing frequency changes.

A business must submit its return and remit payment within 20 days from the end of the period. However, annual filers have until March 20 of the next year to file.

You Must File Sales Tax Returns

Once you receive your Certificate of Authority, you are considered to be in business for sales tax purposes even if you never make a sale or never open the doors of your establishment. Therefore, it is very important that you file your sales tax returns on time, even if you have no taxable sales. There are penalties for late filing even if you owe no tax. You can file your sales tax returns online using the Tax Departments Online Services, located on our website. To learn more about the filing requirements, see Tax Bulletin Filing Requirements for Sales and Use Tax Returns .

New York City Details

Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Dont Miss: H& r Block Tax Identity Shield

Don’t Miss: How To Find 2020 Tax Return

Nassau County New York Sales Tax Rate

Nassau County Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Nassau County?

The minimum combined 2022 sales tax rate for Nassau County, New York is . This is the total of state and county sales tax rates. The New York state sales tax rate is currently %. The Nassau County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in New York, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in Nassau County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least annually. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Also Check: T Mobile Taxes And Fees

Claiming Tax Exemptions If You Lived In The House At Least 2 Years Of The Last 5 Years Prior To Sale

If the property being sold is the primary residence and the taxpayer lived in the house for 2 out of the 5 years preceding the sale, the taxpayer can avail of a federal tax exemption of $250,000 from capital gains if single and $500,000 for married couples filing jointly. In the Hamptons house case above, if you are a married couple living in the property as your main home, the capital gain will be $800,000 instead of $1,300,000 because of the $500,000 tax exemption on married couples filing jointly on income arising from property lived in as their main home.

Fee On Hotel Occupancy In New York City

In addition to the state and local sales taxes on hotel occupancy, a hotel unit fee in the amount of $1.50 per unit per day applies to hotels located in New York City. These fees are reported on Schedule N, Selected Services in New York City. See TSB-M-05S, Fee on Hotel Occupancy in New York City, for additional information on the hotel unit fee, and for the definition of a unit in a hotel.

You May Like: Is Home Insurance Tax Deductable

Regular Certificate Of Authority

You must apply for a regular Certificate of Authority if you will be making taxable sales from your home, a shop, a store, a cart, a stand, or any other facility from which you regularly conduct your business. It does not matter whether you own or rent the facility.

If you make sales at a show or entertainment event, such as a craft show, antique show, flea market, or sporting event, you must apply for a regular Certificate of Authority, even if your sales are only on an isolated or occasional basis. The department no longer issues the Certificate of Authority for Show and Entertainment Vendors that was previously issued for these vendors. See TSB-M-08S, Changes Regarding the Issuance of Certificates of Authority to Show and Entertainment Vendors.

Temporary Certificate Of Authority

If you expect to make taxable sales in New York State for no more than two consecutive sales tax quarters in any 12-month period, you may apply for a temporary Certificate of Authority. In determining whether you meet this requirement, keep in mind that the sales tax quarters are: March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through February 28 .

Show and entertainment vendors may not apply for a temporary Certificate of Authority they must apply for a regular Certificate of Authority.

To request a temporary Certificate of Authority, you must indicate when you expect your business operation to begin and end. The temporary certificate will only authorize you to collect tax and conduct your business between those dates.

However, even if you are eligible to obtain a temporary Certificate of Authority, it may be to your benefit to apply for a regular Certificate of Authority. A regular certificate provides flexibility to continue your business without reapplying for a Certificate of Authority each time you begin business again. You may not apply for more than one temporary Certificate of Authority for any 12-month period.

For additional information on the types of Certificates of Authority, see Publication 750, A Guide to Sales Tax in New York State.

Recommended Reading: Irs Tax Exempt Organization Search

Is It Holiday Time Yet

Its December 1. We can talk about the holidays. Finally. As if my Instagram feed hasnt been advertising Advent calendars since Halloween. As if my satellite radio didnt start playing holiday music on November 1. As if I didnt shop at a pre-pre-pre-Black Friday sale in September. Im Jewish, so, of course, my favorite holiday is Christmas. I love the lights, the trees, the carols. I wrote a column about my love of carols. Read it on the 27east.com archive. Im sure youre not too busy getting ready for Christmas. Youve got 24 whole days! For me, the best thing …Crime is happening here on the East End, especially crimes involving the theft of luxury …Students Learn About South Fork Bakery Pierson Middle School special education students took a field …

Sales Tax Jurisdiction And Rate Lookup

With certain limitations, sales tax rates can be found on the Tax Department Web site, using the address and ZIP code of your customers, by visiting Find sales tax rates. Be sure to review Limitations on Use located within the lookup for an explanation of the limitations.

Publication 718, New York State Sales and Use Tax Rates by Jurisdiction

Publication 718 lists the combined general tax rates by jurisdiction, and the corresponding reporting codes.

Read Also: Federal Tax Return By Mail

New York Real Property Taxes

In New York, the median property tax rate is $1,720 per $100,000 of assessed home value.

New York Property Tax Breaks for Retirees

New York State law gives local governments and public-school districts the option of granting a reduction on the amount of property taxes paid by qualifying senior citizens by reducing the assessed value of residential property owned by seniors by 50%. To qualify, seniors must be 65 or older and meet certain income limitations and other requirements. For the 50% exemption, the law allows each county, city, town, village or school district to set the maximum income limit between $3,000 and $50,000. Under the so-called sliding-scale option, localities may also grant an exemption of less than 50% to senior citizens with yearly incomes over $50,000 but less than $58,400.

There is also an Enhanced STAR program for seniors. The Enhanced STAR exemption is available for the primary residences of senior citizens with annual household incomes not exceeding the statewide standard. Combined income must be $92,000 or less for 2022 benefits . For qualifying senior citizens, the Enhanced STAR program exempts part of the value of their home from school property taxes.

Sales Tax New York Registration

A New York sales tax permit is called a Certificate of Authority and is issued by the New York State License Center free of charge. You can register for New York sales tax online or by visiting one of the organizations field offices. For the registration, you will have to submit your personal and business details.

Don’t Miss: Is Gross Before Taxes Or After

Guide To New York Sales Tax

Nov 30, 2022 | Knowledge Hub,

4.875%

What are the taxable goods and services?

The first step in sales tax compliance is determining if the items or services your firm offers are taxable in New York.

Traditional Products and Services

Physical property, such as furniture, household appliances, and motor vehicles, is subject to sales tax in New York.

Medicine, both prescription and non-prescription, food, fuel, and apparel are all tax-free.

In New York, several services are subject to sales tax. View this PDF from the New York Department of Revenue and Finance website for a complete list of taxable services.

Digital Products and Services

A digital item or service is anything that is supplied electronically, such as a music downloaded from iTunes or a movie bought from Amazon.

Businesses in New York State are not required to collect sales tax on the sale of digital products or services.

However, there is one exception to this regulation in New York. Businesses are required to collect sales tax on pre-written computer software offered online.

How to Register for Sales Tax in New York

If you have concluded that you must charge sales tax on part or all of the products and services that your company offers, the next step is to apply for a Certificate of Authority.

This enables your company to collect sales tax on behalf of the municipal and state governments.

You will need the following information to register:

A Resale Certificate might help you save money.

Retail Sales

New York County New York Sales Tax Rate

New York County Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in New York County?

The minimum combined 2022 sales tax rate for New York County, New York is . This is the total of state and county sales tax rates. The New York state sales tax rate is currently %. The New York County sales tax rate is %.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in New York, visit our state-by-state guide.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

NOTE: The outbreak of COVID-19 may have impacted sales tax filing due dates in New York County. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Read Also: How Much Do Taxes Take Out Of My Paycheck

Sales Tax Nyc Vs Washington Dc

Dear All,

I am travelling to New York in 2 weeks time, staying in New York for one week and then head to Washington DC for another week. I will spend most time to visit museums, visit popular spots in both cities. But I do want to spend a day or so to do a bit clothes shopping, since I find Jeans and some other clothes are way much cheaper than Australia even with current FX rate.

Just would like to know New York City or Washington DC, which has cheaper tax for clothing? I am not after high end brand, normally goes to Macys etc. And also after a couple skin care products from Neutrogena , and if this brand sold in Chrmist or any Macys in USA?

Thank you.

In NYC any clothing item less than $110 is not subject to sales tax – which otherwise is 8.75%. I have no idea of sales tax in DC but you can google easily enough. Neutrogena brand is basic cosmetics and any large drug store will have a ton of items . Not sure if Macy’s has them.

Also remember NYC has way more and larger stores than DC – so a much greater selection. And Macy’s has a discount card they give to tourists who go to the info booth with a passport for most items .

Just checked and apparently in DC sales tax is 5.75%. But remember if you go to suburban malls in MD or VA the rates are probably different.

I believe DC has lower sales taxes but don’t know if they have similar exceptions for tax free categories of goods.

Neutrogena is sold in many drug and cosmetics stores – depends on the specific item you want.

New York New York Sales Tax Rate

new york Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in New York, New York?

The minimum combined 2022 sales tax rate for New York, New York is . This is the total of state, county and city sales tax rates. The New York sales tax rate is currently %. The County sales tax rate is %. The New York sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect New York?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in New York, visit our state-by-state guide.

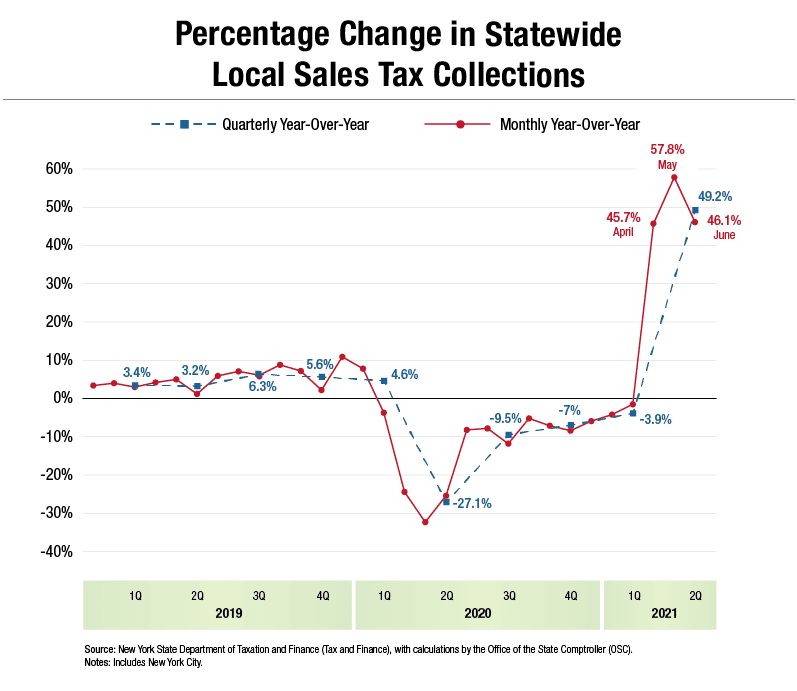

Did COVID-19 impact sales tax filing due dates in New York?

The outbreak of COVID-19 may have impacted sales tax filing due dates in New York. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Also Check: Maryland Sales And Use Tax

Should Your Business Charge Sales Tax On Saas In New York

New York clearly defines prewritten software, no matter if sold in tangible format , transmitted electronically , or accessed online, as taxable.

Further, New York specifies that tax should be charged to the location where the purchaser plans to use or direct the software , and not the location where the software originates . For example, if a user in Buffalo, NY purchases a SaaS product built by a developer in Brooklyn, NY then the tax charged should be the Buffalo sales tax rate.