The Sales Tax Rate For The State Of Illinois Is 625% Why Was I Charged With 1025% Sales Tax Rate

Sales tax in Illinois is determined by the location where the order is processed, not where the buyer is located. All orders are processed from our headquarters in Chicago. The Chicago sales tax rate is 10.25%. This includes State 6.25%, County 1.75%, City 1.25% and Special 1%. Therefore, all Illinois orders are charged Chicagos sales tax rate.

Not a tax-exempt organization but still need help?

If you are you a customer inquiring about an order you placed with one of our partners for software or another type of online service, we have helpful information for you, too. Please visit our Featured Articles section or look up your order using our easy-to-use purchase lookup tool.

Property Taxes & Chicago Schools

One school of thought contends that Chicago property taxes are too high considering students quality of education in public schools.

Although the citys leadership has made vast improvements in education over the past decade, there is still much room for improvement.

In fact, according to a survey conducted by the University of Chicagos Consortium on Chicago School Research, students in public schools are only as likely as students in private schools to successfully apply and be accepted into four-year colleges.

Homeowners who would rather send their children to a private school must pay tuition, averaging $11,000 per year.

How To Calculate Chicago Sales Tax

To calculate the amount of sales tax to charge in Chicago, use this simple formula:

Sales tax = total amount of sale x sales tax rate .

Or to make things even easier, input the Chicago minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

Also Check: What If I Already Paid Taxes On Unemployment

How To Get The Lowest Property Tax Bills

Proper planning can help you save thousands of dollars in property taxes. Here are some tips that are sure to help:

- If you are already a homeowner, review your property tax bill to determine if you can refinance your mortgage and have it taken out of the new monthly payment. Your lender should be able to do this.

- Should you be looking at purchasing a home in Chicago, budget for property taxes before taking out a loan on your new house, which is especially important for first-time homebuyers who do not have the cash to pay their property taxes.

- Record your conversations with your lender or agent, even if things are going well during negotiations, because you never know when they might change their tone about putting property taxes in the monthly loan payment.

- Study up on all the possible exemptions that you may be able to apply for to save money.

Work with a realtor who will be able to show you homes in neighborhoods within your price range, so you wont have to overspend on your primary residence just because your taxes are higher than expected.

Overview Of Illinois Taxes

Illinois has a flat income tax that features a 4.95% rate. This means that no matter how much money you make, you pay that same rate. Sales and property taxes in Illinois are among the highest in the nation.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Recommended Reading: Sales And Use Tax Exemption Certificate

Where Your Property Tax Goes

Property tax money is used to pay for local services and projects and to cover the debt that the city has issued. Some of your property tax dollars go toward federal funding as well, such as Medicare and Social Security.

However, only 13 percent of revenue from property taxes goes to the city, 15 percent goes to schools, and 20 percent to the county. The remainder is used for other local programs and projects and paying off debt.

Cook County And Chicago Sales Tax

In addition to generating property tax revenue, both the city and county continue to raise the local sales tax on its residents, tourists, and visitors. Based on the consumer price index, Chicago increased its city sales tax by 0.75 percentage points.

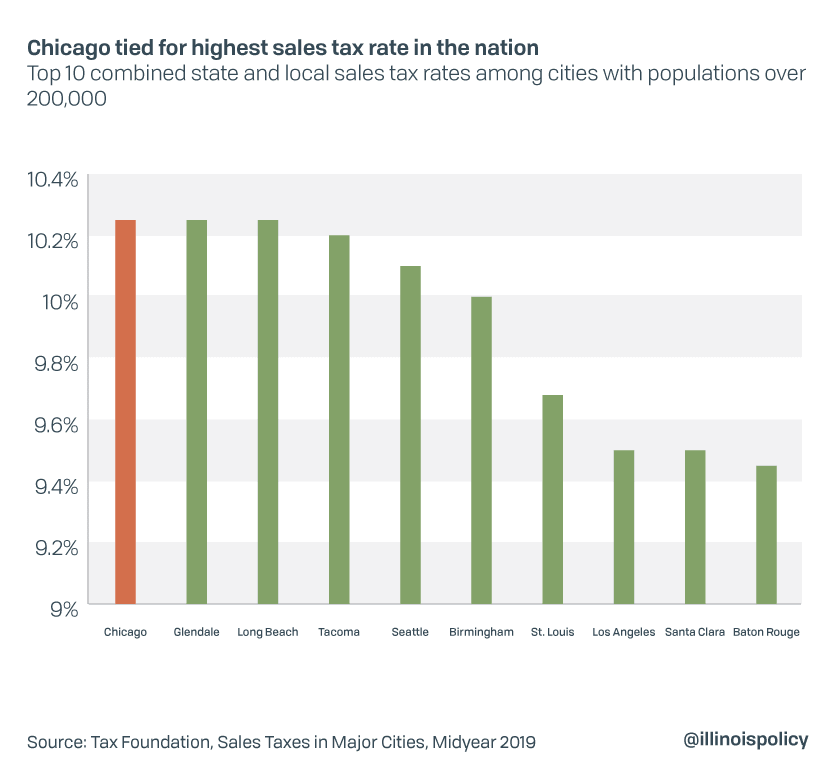

This change raised the citys overall sales tax rate to 10.25 percentthe highest in the country for a major city .

Residents living outside of Cook County purchase products and services, such as a wedding reception in a banquet hall in the county and are required to pay the increased sales tax.

Chicago raised its overall sales tax from 9 percent to nearly 10 percent, higher than most other major cities when it increased its sales taxes. For example:

- Houstons sales tax is currently 8.25 percent

- Philadelphias sales tax is currently 8 percent

- Phoenixs sales tax is 9.6 percent

- San Antonios sales tax is currently 8.25 percent

- Dallas sales tax is 8.25 percent

Los Angeles sales tax rate is 10.25 percent, making it the highest property tax rate in the country for a major city, beating out Chicago by 0.25 points. Philadelphia, Houston, San Antonio, Dallas, Phoenix, and LA have sales tax rates under Chicagos current 10.25 percent rate.

The city of Chicago also raised its amusement tax from 1 percent to 6 percent, hoping that it will generate another $12 million in revenue per year to make up for the citys $33 million budget deficit.

Recommended Reading: Highest Sales Tax By State

West Chicago Sales Tax Calculator

All merchants operating in West Chicago must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax. If you purchase goods online or through the mail and do not pay any sales tax, you are expected to pay use tax to the Illinois Department of Revenue . For more details, see the Illinois sales tax.

Illinois Sales Tax Registration

To collect sales tax in the State of Illinois, a business must first register for a sales tax permit, required before you make any purchases or sales and before you hire your first employee. To do so, you can use the MyTaxIllinois website or you can complete the paper form, REG-1 to obtain your sales tax permit.

To complete your sales tax permit application, you will need all of your businesss identifying information, a detailed breakdown of your business structure, owners, and officers, and a list of what you will be collecting sales tax on. The process is free and takes about 2 days online, or 6-8 weeks if you mail the paper form to process, so its recommended you file this as early as possible so you have a permit in hand before you start operating in Illinois.

Once you receive your permit, you are not required to renew it regularly, but it is recommended to keep it up to date with relevant information as your business grows.

You May Like: How Long To Receive Tax Refund 2022

Find Out Why People Are Falling In Love With Living In The City Of Chicago

Chicago offers many amenities that other cities do not. There is shopping, dining, entertainment, and world-renowned museums.

In addition, it offers employment opportunities with its central location to other major cities such as New York, Detroit, and Dallas. So, its no wonder that people are flocking to the Windy City and enjoying their newfound quality of life.

Of course, great opportunities also come with great responsibilities like owning a property in Chicago and paying taxes.

If youre contemplating whether you should purchase property here in this city, you may want to know the average amount of property taxes paid for a home in Chicago. This information will give you a better idea of what to expect when your property taxes are due.

The Internal Revenue Service provides a table and worksheet that enables taxpayers to determine the average amount for property taxes paid for homes within their respective counties or metro areas.

These properties are divided into two categories: single-family homes and condominiums.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Don’t Miss: How To Read Tax Return

What You Need To Know About Illinois State Taxes

The state of Illinois requires you to pay taxes if youâre a resident or nonresident that receives income from an Illinois source. The state income tax rates are 4.95%, and the sales tax rate is 1% for qualifying food drugs and medical appliances and 6.25% on general merchandise.

The tax rates on this page apply to the 2020 tax season as Illinois hasnât yet released its rates for the 2021 tax season. Weâll update this page when they do.

Illinois state offers a personal exemption and tax credits, such as the earned income tax credit, and education expense credit.

Illinois Sales Tax Rates

Illinois has a base state sales tax rate of 6.25% on cumulative gross receipts. In addition to this rate, there are also several location-specific sales taxes. These are administered by both home rule units and non-home rule units.

A home rule unit in Illinois is defined as a county with a chief executive officer or a municipality with a population of at least 25,000. It is possible for smaller municipalities to vote to become home rule units as well. These home rule sales tax rates are defined on The State of Illinoiss Department of Revenue website, and are between 0.25% and 2.50% depending on location. Home rule sales taxes can rise in increments of 0.25% and have no maximum limit.

Additional local sales taxes at the county level include County Public Safety, Public Facilities, and Transportation Sales Taxes. These are charged at the county level and range between 0.25% and 1.25%. An additional 1.00% sales tax is also charged in certain counties with the County School Facility Tax Rate. All of these taxes are rolled together into either State, Local, or County level taxes and all are collected by the State of Illinois, though some local governments may impose taxes beyond these.

The above rates apply to general merchandise, which includes most tangible property, with the exception of qualifying food, drugs, and medical appliances, and any items that require a title or registration.

You May Like: Are Gofundme Donations Tax Deductable

Chicago Sales Tax 1125

For all those who eat out in the city and near OHare – Sales Tax on restaurant food including fast food is between 11.25% to 12% . OUCH!!!

This is due to a recent Cook County sales tax hike by Todd Stoger.

We live in the ‘burbs and we rarely go into the city anymore. The taxes are ridiculous compared to collar counties. Raising Metra fares and parking fees was the nail in the coffin.

And don’t forget those taxes on top of the sales tax. I always hated that my bottle of pop was taxed additionally to the sales tax. Also, there is an additional carry-out tax on top of sales tax for food to-go.

No only is this bad for tourism, I certainly don’t want to work downtown with these outrageous taxes. It is bad enough when I have to frequent business in Cook county with 10% sales tax.

I would encourage anyone visiting Chicago to stay in Lake or Dupage counties. Both are not far from O’hare airport. For instance, Sales tax in Vernon Hills is only 7%. You are automatically saving 3% on your purchases.

I would tell you to rent your rental car in these areas, however supposedly the City has even found a way to get their sales tax from suburban rental car companies.

I tried to eat cheap in the city by stopping into Boston Market on Ashland on the north side and the sales tax was 12% on everything on my order!

WAKE UP GOVERNMENT ! Repeal the outrageous Cook County taxes.

I no longer buy anything in Cook County and won’t park my car in a metered spot anymore.

Illinois Alcohol And Tobacco Tax

Illinois applies per-gallon alcohol excise taxes based on the alcohol content of the beverage being sold. Beer will generally be subject to a rate of 23 cents per gallon while liquor is subject to a rate of $8.55 per gallon. The cigarette excise tax in Illinois is $2.98 per pack of 20.

- Illinois is the home state of former U.S. president, Barack Obama.

- Former U.S. president Abraham Lincoln owned and operated a bar in New Salem, Illinois, before entering politics.

- Illinois is the French adaptation of an Algonquin word that means warriors.

You May Like: Property Taxes In Brazoria County

Property Tax Exemptions For Senior Citizens And Disabled

Senior citizens who are 65 years of age or older and disabled people may qualify for property tax exemptions on their primary residences. This savings is especially beneficial when one of the individuals incomes is social security.

The exemption can be applied to either yearly property tax payments or monthly installments whichever you choose, the senior citizen or disabled resident will not have to pay anything. However, you may still want to check with your local county clerk in case there are other taxes that youll need to pay in addition to the ones that have been suspended.

Chicago Ridge Illinois Sales Tax Rate

chicago ridge Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Chicago Ridge, Illinois?

The minimum combined 2022 sales tax rate for Chicago Ridge, Illinois is . This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently %. The County sales tax rate is %. The Chicago Ridge sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Illinois?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Illinois, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Chicago Ridge?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Chicago Ridge. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Recommended Reading: How To File Unemployment Taxes

Save With Wise When Invoicing Clients Abroad

If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees. Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

Invest In Kids Credit

Contributions to a qualified Scholarship Granting Organization are eligible for a tax credit equal to 75% of their contribution. The total credit claimed per taxpayer canât exceed $1 million per year. You canât claim this credit if you claimed a portion of the contribution on your federal tax return. Any credit amount that exceeds your tax liability can be carried forward for five years.

You May Like: What Is Real Estate Tax

West Chicago Illinois Sales Tax Exemptions

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.Many municipalities exempt or charge special sales tax rates to certain types of transactions. Groceries and prepared food are subject to special sales tax rates under Illinois law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Illinois state excise taxes in addition to the sales tax.

Note that in some areas, items like alcohol and prepared food are charged at a higher sales tax rate than general purchases. Illinois’s sales tax rates for commonly exempted categories are listed below. Some rates might be different in West Chicago.

Groceries:

Which State Has No Sales Tax

Alaska. Known as The Last Frontier, Alaska is the most tax-friendly state in the country. It has no sales tax and no state income tax. Alaska charges a slightly higher than average property tax rate of 1.18%, but the state has several ways to apply for property tax exemptions.

Don’t Miss: Sales Tax In Alameda County

Illinois Combined State And Local Sales Tax Highest Among Neighbors 8th In Country

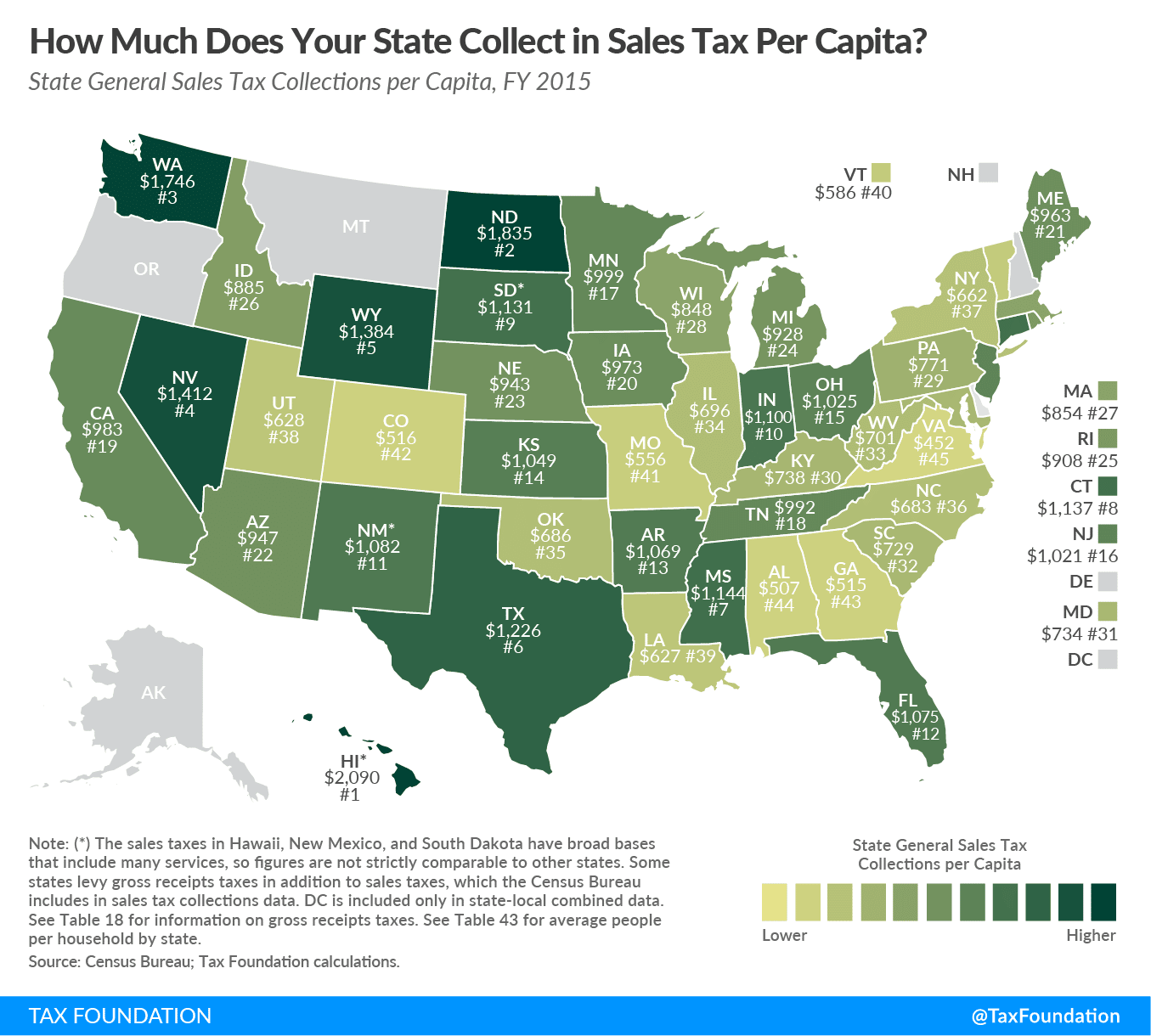

Combined state and local sales taxes in Illinois rank among the highest in the country, according to new research by the Tax Foundation.

The report looked at a population-weighted average of local taxes in addition to the statewide rate of 6.25%. Illinois combined rate of 8.81% ranked 8th in the country.

It’s primarily due to the local rates, said Katherine Loughead, senior policy analyst with the Tax Foundation. If you look at the state rate alone, its still above average, but it’s not quite as high. Illinois state rate of 6.25% is the 13th highest.

No state sales tax rates have changed in the U.S. since Utah increased its rate in 2019. That means most of the movement on the list comes from local municipalities making adjustments.

The really high rate in Chicago of 10.25%, that’s weighted heavily, Loughead said. Some of the less densely-populated areas of the state are the ones that have slightly lower rates across the board.

Illinois combined rate is also higher than all neighboring states, which could lead shoppers to slip across the border for purchases.

Wisconsin has one of the lowest sales tax rates in the country, Loughead said. Indiana, Iowa, Missouri, and Kentucky all have lower combined rates as well. Really anywhere along those borders, there’s a pretty strong incentive to shop across state lines.