Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

What Is Sales Tax

Sales tax is a type of pass-through tax. This means that the tax passes through the business and onto the customer. Forty-five states and Washington D.C. have some form of sales tax . Alaska, Delaware, Montana, New Hampshire, and Oregon do not have any state sales tax laws.

Businesses collect sales tax at the point of sale when a customer is making a purchase. Customers are responsible for paying the sales tax on applicable purchases. However, the business owner is responsible for collecting and remitting the sales tax to the proper agency.

In some cases, customers may be exempt from paying sales tax on certain products . And, some states even have sales tax holidays that exempt certain items, like clothing and shoes, from sales tax for a day , week, or weekend. However, sales tax rules and holidays vary by state and locality.

The amount of sales tax you collect depends on what state, county, or city your business has physical presence in, otherwise known as sales tax nexus. Sales tax nexus determines if your business has enough presence in a location to collect sales tax. For example, states look at factors like office location, employees, and amount of sales to determine if you have nexus.

Businesses located in a state with sales tax and that have sales tax nexus must collect the tax from customers on taxable purchases. Generally, sales tax is a percentage of the customers total bill . Again, the seller is responsible for collecting and remitting the sales tax.

What Is A Taxable Purchase For Use Tax

Usage is the keyword and determining factor for which items are taxed. How you consume, use or store items for your business. Purchases made by phone, web, mail, in person, and internationally are all subject to use tax. Plus the item can be reviewed long after the transaction has taken place.

These are common taxable purchases for businesses:

- Charitable donations

Since each state regulates use tax, they vary on what items are taxable or exempt. If items are intended for resale and you didnt pay sales tax, you must pay use tax. A good rule of thumbif your state doesnt charge sales tax on the item, it is likely you do NOT owe use tax.

For Example: You purchased computer equipment for your SaaS company from Oregon, and you were not charged sales tax. The items are for use in your resident state of Colorado. Since Colorado charges sales tax on computer equipment items, you owe use tax.

Don’t Miss: 1 Year Tax Return Mortgage

What Is The Purpose Of A Use Tax

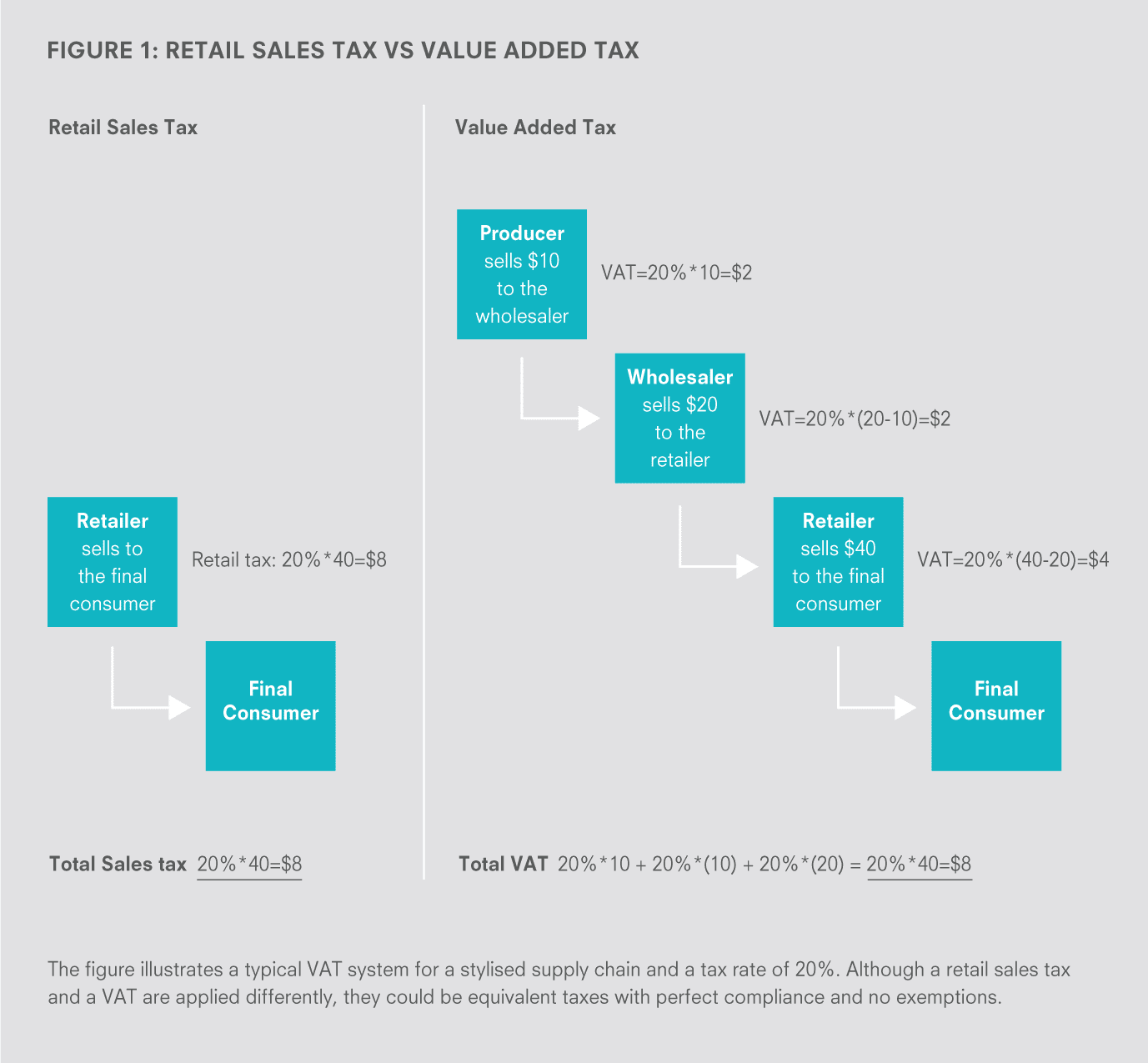

A use tax serves the same purpose as a sales tax or a value added tax . Use taxes fund state and local initiatives that include infrastructure, government administration, lending programs, and elder care. In some jurisdictions, sales and use taxes provide governments with their greatest source of revenue in a calendar year. Yet in states without a sales tax or a use tax, such as Montana and Oregon, government revenue must come from other sources such as property taxes, income taxes, and administrative fees.

What’s The Difference Between The Use Tax And The Sales Tax

A sales and use tax are ultimately the same thing. They are both applied to goods and services. The difference lies in how they’re calculated and who pays them. While a sales tax is applied at the time a purchase is made and is collected and remitted to the government by the seller, a use tax is calculated and paid by the consumer or end user. The rate, however, is generally the same as the local/state sales tax.

Also Check: Are Funeral Expenses Tax Deductable

Narrowing Down The Differences Between Use Tax Versus Sales Tax

Phew, that was a lot of information to soak in. Heres a brief recap on the similarities and differences between sales tax vs. use tax:

Both sales and use tax:

- Are types of sales tax

- Vary based on location

- Follow similar tax rate

- Must be remitted to the proper tax agency by either the buyer or the seller

The following may vary depending on if you deal with use tax or sales tax:

- When the tax is paid

- Who must pay and remit it

Motor Vehicle Sales Rental And Use Tax

Seller-Financed Sales

Comptrollers Decision No. 116,430 The ALJ found that a dealer making seller-financed sales didnt provided sufficient proof that it had applied for title and registration within 60 days of the date of sale. Therefore, the dealer was liable for all unpaid tax on the total consideration received from the sale. The fact that the dealer had repossessed some of these vehicles didnt affect the amount of tax due on the sale of the vehicles.

Recommended Reading: New York State Tax Login

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See .

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

How Do I Calculate What I Owe

Use the sales and use tax rate applicable to the place in California where the item is used, stored, or otherwise consumed and apply it to the total purchase price. For personal purchases, this is usually your home address. Include handling charges.

Example

- Question: I bought a stereo online for $200, including shipping, and had it sent to my home. But, I was not charged tax during the purchase. How much use tax do I owe?

- Answer: Find your local tax rate at the time of the purchase on this webpage. If your local rate is 8.0%, then you would owe $16 in use tax .

Shipping charges are generally not taxable when items are shipped by common carrier or US Mail, the invoice separately states charges for shipping, and the charge is not higher than the actual cost for shipping.

You May Like: How Do The Rich Avoid Taxes

Additional Sales And Use Tax Information

For additional information about the specifics of certain types of sales rates, fees and exemptions, visit the following two sections in the sales and use tax section for businesses:

- 1 cent on each sale where the taxable price is 20 cents.

- 2 cents if the taxable price is at least 21 cents but less than 34 cents.

- 3 cents if the taxable price is at least 34 cents but less than 51 cents.

- 4 cents if the taxable price is at least 51 cents but less that 67 cents.

- 5 cents if the taxable price is at least 67 cents but less than 84 cents.

- 6 cents if the taxable price is at least 84 cents.

- 1 cent if the excess over an exact dollar is at least 1 cent but less than 17 cents.

- 2 cents if the excess over an exact dollar is at least 17 cents but less than 34 cents.

- 3 cents if the excess over an exact dollar is at least 34 cents but less than 51 cents.

- 4 cents if the excess over an exact dollar is at least 51 cents but less than 67 cents.

- 5 cents if the excess over an exact dollar is at least 67 cents but less than 84 cents.

- 6 cents if the excess over an exact dollar is at least 84 cents.

Download our sales and use tax rate chart.

What Is Considered To Be A Taxable Sale

Taxable Sale Definition

The definition of a taxable sale varies by state, but generally includes:

- Transfer of title or possession of taxable tangible personal property for consideration.

- Exchange, barter, lease, or rental of taxable tangible personal property.

- Performance of a taxable enumerated service for consideration.

Don’t Miss: Irs Tax Exempt Organization Search

What Is An Example Of A Use Tax

To visualize how use tax works in the real world, imagine that a company operates in a state that charges a 6% sales tax. An online retailer didnt collect sales tax on the companys business-related purchases. To make up for this, the company must remit use tax directly to the state. The use tax will be 6% of the purchase price. However, if the online retailer added shipping charges, those are not subject to sales or use tax.

Local Retail Sales Tax

Businesses collect both the state and local sales tax. Local taxes are used by cities and counties to fund services such as police and fire protection, water/garbage/sewer service, and mass transit. For local tax rates and codes, refer to the List of Local Sales Tax Rates or the Department’s Tax Rate Lookup Tool. WAC 458-20-145

Recommended Reading: Sales Tax Rate For Chicago Il

Direct And Predominant Use

Tangible personal property is considered to be used “directly” when the use of the property is integral and essential to the production activity the use occurs where the production activity is carried on and occurs during the production activity. The property is considered to be used “predominantly” when the property is used directly in production activities more than 50 percent of the time.

Use Tax Vs Sales Tax: Whats The Difference

Sales tax compliance comes in many forms, and use tax is one of them. You may see the term sales and use tax when applying for a sales tax permit in a state, filing a sales tax return in a state, or checking your economic nexus thresholds within a state.

Whats the definition of sales tax? Whats the definition of use tax? Whats the difference between use tax vs. sales tax? What states enforce use tax on the seller or the buyer?

Sales and use tax generally refer to the same thing: A percentage tax on the price of a sale that is collected by a merchant or consumer and remitted to the government. However, there are subtle differences in how these taxes are collected and remitted.

Free Download: Navigating Sales Tax Compliance in 2020

Recommended Reading: North Carolina Capital Gains Tax

The Difference Between Sales Tax And Use Tax

Theres more to sales tax compliance than sales tax. At one time or another, most businesses also deal with use tax, which comes in two types: consumer use tax and seller use tax. Though all three are often lumped together as sales and use tax, there are important distinctions between them.

To properly register a business with a state and correctly file and pay sales or use tax , you need to understand what each tax is, which situations call for each type of tax, and if/when youre responsible for remitting sales tax, consumer use tax, and/or seller use tax. Read on to deepen your understanding of all three.

What is sales tax nexus?

Before diving into sales tax, consumer use tax, and seller use tax, we need to define the concept of nexus. Whether sales or use tax applies to a transaction depends primarily on sales tax nexus, the connection between a seller and a state that permits the state to impose a tax collection obligation on the seller.

When a business has sales tax nexus in a state, its required to collect and remit sales tax in that state. In certain situations, it may also have to remit consumer use tax.

When a business doesnt have sales tax nexus in a state, it generally cant be required to collect sales tax or pay consumer use tax. However, it may be required to collect seller use tax. More on that below.

How and when sales tax matters

Understanding consumer use tax

Nexus is a key element in consumer use tax, too.

Understanding seller use tax

What Is Sellers Use Tax

Sellers use tax is the same as sales tax. It is also known as retailers use tax or vendors use tax, and applies to remote sellers with economic nexus in a certain state. Tax is collected and remitted by the out-of-state seller, just like a sales tax would be. It is called use tax and not sales tax because in some states it is remitted on a use tax return, NOT a sales tax return.

Don’t Miss: Florida Total Sales Tax Rate

How Do I Pay The Tax Due1

Use tax is owed by April 15th the year after you make a purchase for which California tax was not charged. You can either pay once a year when you file your state income taxes, or make payments directly to the CDTFA after each purchase.

Option 1: Pay on Your State Income Tax Forms

On your California state income taxes, using forms 540 or 540 2EZ, simply put in the amount owed on the appropriate line for the entire year1.

You can save all of your receipts and report the exact amount you owe or follow the instructions included with your income tax return to use the Use Tax Lookup Table for nonbusiness items with a purchase price under $1,000.Learn more about the lookup table.

Option 2: Make Payments Directly to the California Department of Tax and Fee Administration

You may pay use tax on a one-time purchase, directly to us. Follow log-in and step-by-step reporting and payment instructions.

If you are late in paying your use tax, you may be eligible to pay a liability from a previous year and avoid late payment penalties under our In-State Voluntary Disclosure Program.

1Purchases of vehicles, vessels, aircraft, and mobile homes, as well as purchases of cigarettes and tobacco products cannot be reported on your California state income tax return. If you hold a California consumer use tax account, you are required to report purchases subject to use tax directly to us and may not report the tax on your income tax return.

Examples Of Purchases Subject To Use Tax

Also Check: T Mobile Taxes And Fees

Transactions Subject To Consumer Use Tax

- Purchases from mail-order companies not required or registered to collect sales tax from the state of delivery.

- Deliveries from out-of-state companies that are not required or registered to collect sales tax from the state of delivery.

- Buyer gives an in-state merchant a blanket resale or exemption certificate and transaction is taxable.

- Purchases from an out-of-state or in-state company that is required to collect sales tax but does not.

- Benefit received from an out-of-state performance of a service.

- Purchases made on the Internet from vendors who are not required to be registered and sales tax is not charged.

Why Is There A Use Tax

The use tax, which was created in July 1935, is a companion to California’s sales tax that is designed to level the playing field between in-state retailers who are required to collect tax, and some out-of-state retailers who are not. Use tax, just like sales tax, goes to fund state and local services throughout California.

Read Also: Tax On Ira Withdrawal After 59 1/2

How Do I Know When To Pay Use Tax

Ask yourself these questions:

Example: if you made an online purchase of an item taxable in Vermont and had it delivered to you in Vermont, then the item is subject to Vermont Sales & Use Tax. On the other hand, if you had the same item sent to your friend in New York, the item is not subject to Vermont Sales & Use Tax .