What Are The Limits On Self

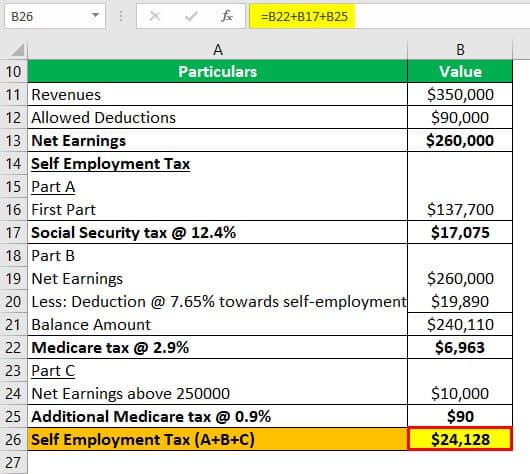

There is currently no maximum limit for the Medicare portion, which totals . The IRS self-employment limits for the Social Security portion for 2020 is $137,700, which is subject to of the self-employment tax. High income individuals may be assessed an additional Medicare tax equal to 0.9% of any income above the threashold amount.

| Filing Status |

|---|

Work Out Your Net Earnings

To calculate your self-employment tax, youll need to know your net earnings from self- employment for the year. Your net earnings are your total income from freelancing, minus anyallowable business expenses. Tax deductible business expenses include items like the cost of goods sold, office expenses, travel expenses, and marketing costs.

Tax deductible simply means that the IRS allows you to subtract these expenses from your total income, in order to arrive at your net earnings. As a freelancer, you should empower yourself with knowledge onwhich business expenses are tax deductible, so that you can keep track of them throughout the year and save money.

Your workings out of your net income might look something like this:

Gross income from freelancing: $30,000

Minus business expenses: -$12,000

Equals net income: $18,000

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Rv Sales Tax By State

What Are Medicare Taxes

Freelancers pay self-employment tax and a portion of it goes to fund the federal governmentâs Medicare program. It is used to provide subsidized health care and programs to retired Americans and to disabled individuals. Money from the Medicare program also subsidizes hospital insurance benefits. So, when you pay your self-employment tax, less than 3% of that money is going to this program.If you are a high earner, an additional Medicare tax of 0.9% may also be tacked on to your tax bill.

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

You May Like: California Used Car Sales Tax

How Might Future Self Employment Tax Limits Change

Risk of a Large Increase in Self-Employment Taxes

President-elect Joe Biden suggested that in addition to increasing marginal tax rates on corporations and high income earners he would remove the cap on FICA taxes for those earning above $400,000 in income. He would treat any income above that level similarly to the first $137,700 and have it fully exposed to FICA taxes. If this policy were enacted it would dramatically increase the income taxes on small business owners who had over a half-million dollars in annual income. It would shift the top marginal rate from the current 37% to 39.7% plus 15.3% FICA taxes for a total marginal Federal income tax rate of 55%. In states like California with relatively high state income taxes the blended marginal rate could hit nearly 70%.

Additional Self Employment Tax Deductions

As a freelancer, youre able to deduct half of your self-employment tax from your income taxes. This is because, as an employer, you would normally be responsible for paying half of the Social Security and Medicare taxes owed by an employee.

Since you are both the employer and the employee when youre self-employed, you can deduct half of the self-employment tax you paid. This deduction is taken as an adjustment to income, which means you can claim it even if you dont itemize deductions on your tax return. The instructions for Schedule SE will tell you how to figure out your deduction for half of your self-employment taxes.

Its important to note that the deduction for half of your self-employment taxes only applies to the Social Security and Medicare taxes owed. It does not apply to any other taxes, like federal income tax or state income tax.

In some cases, you may be eligible for a credit against your self-employment tax. The two most common credits are the earned income credit and the child and dependent care credit. Theearned income credit is a refundable credit for low- and moderate-income taxpayers. To be eligible, you must have earned income under $57,414 and have investment income under $10,000 in the last tax cycle. The child and dependent care credit is a non-refundable credit that can reduce the amount of tax you owe .

To be eligible, you must have paid someone to care for your child or dependent so that you could work or look for work.

Read Also: Percent Of Taxes Taken Out Of Paycheck

Before You Start Calculating Your Self

If youre a freelancer, youll more than likely be receiving self-employment income from a range of clients. This means that youll need to know your total net earnings from self- employment for the year, as this is what youll use to calculate your self-employment tax.

This is where a 1099-MISC form or 1099-K form comes in. For every freelance client youve worked with during the year, you should receive a 1099-MISC form. A 1099-K form is used if you receive income from a marketplace platform or payment processor, and reports the total amount of money youve earned from that source.

The 1099 form will show how much money youve earned from that client during the year, and its this number that youll use to calculate your total net earnings. The 1099 form ensures that you are declaring all of your income and not underpaying your taxes. Youll use this form to work out your gross earnings i.e., the total amount of money youve earned from self-employment during the year, before youve deducted expenses. You can then go on to calculate your self-employment taxes.

How To Report & Pay Self Employment Tax

You need to report your self-employment earnings via IRS Schedule C and also IRS Schedule SE to calculate how much self-employment tax you owe. Then, you may need to examine if you need to pay estimated tax which is to be paid quarterly .I suggest you to read Estimated Tax :Who ,When & How to Pay ?. See this calculator on the estimated tax penalty calculator.

Recommended Reading: Tax Id Numbers For Businesses

More Options For Retirement Saving

Working in your pajamas is still work.

So plan now for full-time relaxation later and start a retirement plan, which is another great tax saver. And once you’re self-employed, your options go far beyond an individual retirement account. Check out an SEP , SIMPLE , and Keogh as well as individual 401 plans. All allow you to sock away money for retirement and take a tax deduction for what you contribute.

With TurboTax Live Full Service Self-Employed, work with a tax expert who understands independent contractors and freelancers. Your tax expert will do your taxes for you and search 500 deductions and credits so you dont miss a thing. Backed by our Full Service Guarantee.You can also file your self-employed taxes on your own with TurboTax Self-Employed. Well find every industry-specific deduction you qualify for and get you every dollar you deserve.

Tax Deductions For Self

You can deduct half of your self-employment tax on your income taxes. So, for example, if your Schedule SE says you owe $2,000 in self-employment tax for the year, you’ll need to pay that money when it’s due during the year, but at tax time $1,000 would be deductible on your 1040.

Self-employment can score you a bunch of sweet tax deductions, too. One is the qualified business income deduction, which lets you take an income tax deduction for as much as 20% of your self-employment net income. Plus, there are other deductions available for your home office, health insurance and more. Heres a primer.

» MORE:Compare online loan options for funding and eventually growing your small business.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

Read Also: Morgan Stanley Tax Documents 2021

How To Pay Self

-

Generally, you use IRS Schedule C to calculate your net earnings from self-employment.

-

You use IRS Schedule SE to calculate how much self-employment tax you owe.

-

Youll need to provide your Social Security number or individual taxpayer identification number when you pay the tax.

-

Taxes are a pay-as-you-go deal in the United States, so waiting until the annual tax-filing deadline to pay your self-employment tax may mean incurring late-payment penalties. Instead, you may need to make quarterly estimated tax payments throughout the year if you expect:

Youll owe at least $1,000 in federal income taxes this year, even after accounting for your withholding and refundable credits , and

Your withholding and refundable credits will cover less than 90% of your tax liability for this year or 100% of your liability last year, whichever is smaller.

How Was This Result Calculated

Lets start with some quick definitions:

-

Business Net Income , basically your revenues minus normal business expenses. This is the basis for many other calculations made.

-

Above the line deductions – IRS approved items that can be subtracted from net income. The calculator took one of these for you known as the self employment deduction.

-

Adjusted Gross Income is your net income minus above the line deductions.

Because your Social Security and Medicare tax bill is based on your Adjusted Gross Income, you want to take as many deductions as you can to reduce it.

While weve only taken the self employment deduction into account, there are a few others for small business owners to take advantage of.

Wheres my QBI Deduction?

A popular deduction in recent years is the qualified business income or QBI, which can reduce business owners taxable income up to 20%. Its not included above because its considered a below the line deduction having no impact on self employment taxes.

Once youve applied all above the line deductions to your net income and have found your AGI, next you need to calculate your Social Security and Medicare tax bills. Unfortunately calculating Social Security and Medicare can be tricky because of caps and added taxes.

Read Also: Where S My Tax Refund

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Recommended Reading: New York State Tax Login

Paying Taxes On Top Of Your Self

As long as your earnings is more than $400 in a given tax year, you’ll always owe self-employment tax, consists of Social Security and Medicare, on your earnings. You may also pay income taxes, which are figured out differently for different earning brackets. Since you will pay both income and self-employment taxes on profit made from your independent contractor business, it is beneficial to try to claim every legitimate business-related expense you can.One other important rule of thumb is this: While those working for an employer can avoid even filing taxes if they make below the filing threshold, this is because they have money withheld from their paycheck to cover the Social Security and Medicare taxes Since freelancers really have no easy way to withhold these taxes, they must pay them at the end of the year on a tax return, even if they made very little.

How Much Is The Self

For the 2021 tax year, you’ll pay 15.3% of your net freelance income in self-employment taxes. That comes out to 12.4% for Social Security taxes and 2.9% on Medicare taxes.

The good news? Depending on how much you earned, not all of your self-employment income is hit by all of the self-employment tax. For the 2021 tax year, only the first $142,800 of your self-employment earnings are subject to the Social Security portion of the self-employment tax. That will rise to $147,000 in the 2022 tax year.

You might, though, have to pay more in Medicare tax if you earned a high amount of self-employment income. For the 2021 tax year, you’ll have to pay an additional Medicare tax of 0.9% if your net earnings from self-employment are higher than $200,000 if you are a single filer or $250,000 if you are married and filing jointly.

Read Also: Will Property Taxes Go Up In 2022

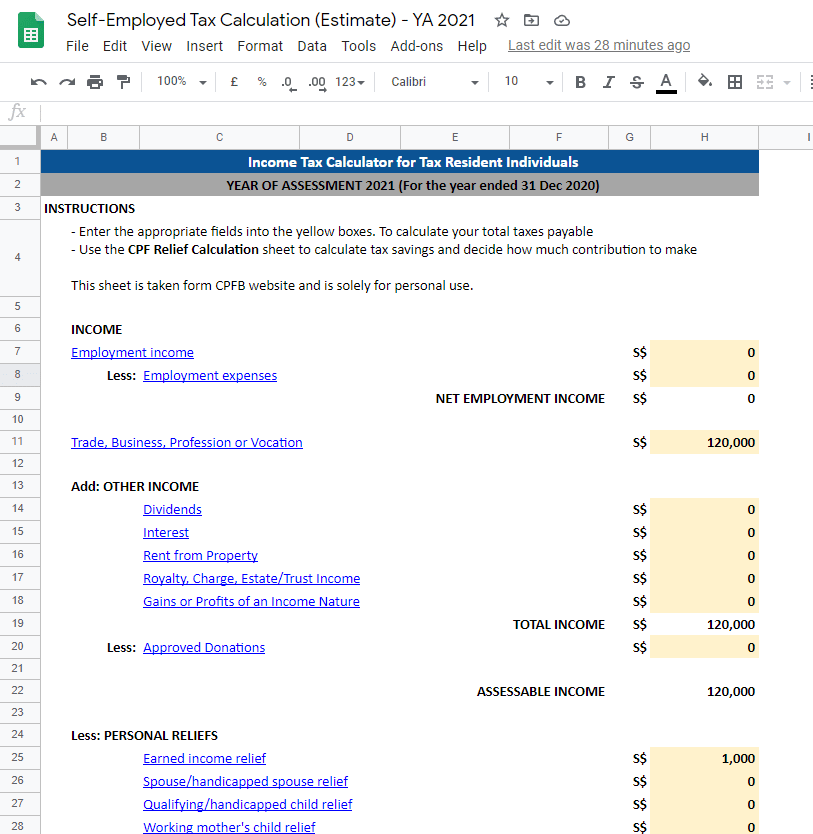

Estimate Your Income Tax For The Current Year

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year .

This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans.

If youre self-employed, the self-employed ready reckoner tool can help you budget for your tax bill.

You may be able to claim a refund if youve paid too much tax.

How To Calculate Your Self

Even if youre using a self-employed tax calculator or an accountant to work out your self- employment tax for the year, its important to know how to calculate it yourself. Part of being a successful freelancer is knowing the ins and outs of your taxes, so that you can be confident that everything is being done correctly.

Read Also: How To Apply For An Extension On Taxes

Freelancers Others With Side Jobs In The Gig Economy May Benefit From New Online Tool

IR-2019-149, September 4, 2019

WASHINGTON The Internal Revenue Service said today that the new Tax Withholding Estimator tool includes a feature designed to make it easier for employees who also receive self-employment income to accurately estimate the right amount of tax to have taken out of their pay.

The Tax Withholding Estimator is an expanded, mobile-friendly online tool that replaced the Withholding Calculator, which since 2001 had offered workers an online method for checking their withholding. The old calculator lacked features geared to self-employed individuals the new Tax Withholding Estimator made changes to address this important group.

The new tool offers self-employed individuals, workers, retirees and other taxpayers a more dynamic and user-friendly way to calculate the amount of income tax they want to have withheld from either wages or pension payments. With only a third of the year remaining, the IRS encourages these taxpayers and others to use the tool to take a Paycheck Checkup as soon as possible to make sure they are having the right amount of tax withheld and avoid a surprise when they file next year.

The enhancement for self-employed people is just one of many new features offered by the Tax Withholding Estimator. Others include:

The IRS sponsors a free two-hour webinar on the Tax Withholding Estimator. The webinar will take place on Thursday, September 19 at 2 p.m. Eastern time. To sign up, visit the webinars page on IRS.gov.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

You May Like: How Much Tax On Rental Income