Simple Tax Return Vs Complex Tax Return

A simple tax return is the most basic type of tax return you can file, and many tax software programs let you file this return for free. A simple return generally includes W-2 income, limited interest and dividend income, standard deductions and unemployment income.

Some free plans also include the earned income tax credit , child tax credits and student loan/education deductions .

If your finances are more complicated and you don’t qualify for a simple tax return, you’ll need to file a complex tax return, and most tax software programs will charge you fees to file. Complex tax situations typically include anyone with freelance income , small business owners and landlords, as well as anyone with earnings from investments and stock sales.

The tax program you use will notify you if you can’t file a free simple tax return and instead need to upgrade and pay to file a more complex return. And even if you can file a simple tax return, you may want to pay for the next-tier plan to benefit from more deductions.

Determine If Youre Required To File

For taxpayers who only have W-2 income, if their earnings for the year were less than the standard deduction , they donât have to file a tax return at all. Self-employed individuals, on the other hand, get the short end of the stick. If you have net earnings of $400 or more, youâre required to file a tax return. The IRS does this in order to collect your self-employment tax. You wonât owe income tax if your earnings are that low, but you might still owe self-employment tax.

How Much Does It Cost To File Taxes

Many tax software programs have a free version, but you’ll be charged a fee if you upgrade to a paid plan. The tax programs we reviewed either have no cost for the free plans, or charge as low as $11.05 for federal filing plus $4.95 per state. However, the costs can add up fast with the more complex deluxe, premium and self-employed plans the most expensive is $170 for federal, plus $50 per state. If you want to add live tax support, the surcharge can be $35 to $100, plus state fees.

Don’t miss: Free vs. paid tax services: When to plan on paying for an upgrade

You May Like: Avoid Capital Gains Tax On Stocks

Choose The Filing Option That Works Best For You:

|

IRS-certified volunteers work one-on-one with you to prepare and e-file your federal and state tax returns, all in the same day. Print or download our tax packet HERE and then schedule your appointment! Schedule by Phone: |

Quick & Easy Drop-OffDrop off your tax documents with IRS-certified volunteers at a tax prep location, then pick up your completed return in 10-14 days. Print or download our tax packet HERE and then drop off your tax documents, along with photocopy of picture ID and social security cards, at any of the below locations! Learn More About Drop Off: |

File VirtuallySend in a digital copy of your tax documents to one of our IRS-certified volunteers using any device with a network connection. getyourrefund.org/nmcaa |

DIY – Do It YourselfDo it yourself ! Prepare and file your own return with help from an IRS-certified volunteer using free and secure software or low-fee filing for self employed or higher income filers. |

Is It Worth Going To A Tax Preparer

Tax season can be quite a headache, and many people wonder if its worth going to a tax preparer for help. The answer is yes! It may cost more money to hire someone for professional tax assistance, but the time and effort saved in the long run can be well worth it.

A tax preparer typically has extensive knowledge of the tax code and tax deductions such as self-employed taxes, which they can use to maximize your return or minimize what you owe if you are facing an audit. Tax preparers also have access to the latest software updates that make tax filing quicker and easier, meaning less stress for you during this busy time.

So if youre feeling overwhelmed with managing your finances during tax season, a professional tax preparer could be just the thing to help make things simpler.

Read Also: Short Term Capital Gains Tax Rate

Connect With Military Tax Consultants

If you have questions, enlist free one-on-one help from MilTax experts: tax pros with special training in military-specific tax situations. Call or chat anytime 24/7 to schedule a consultation, or get in person support at a Volunteer Income Tax Support Assistance office location.

VITA support may also be available elsewhere in your state but is not available in every state or location.

Talk to a Tax Pro

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule CPDF to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C InstructionsPDF may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions for Schedule SEPDF may be helpful in filing out the form.

Recommended Reading: Irs Extension To File Taxes

When Are Taxes Due

While taxes are traditionally due on April 15, because of a holiday in Washington, D.C. you have until April 18, 2022 to file your taxes. Taxpayers in Maine and Massachusetts have until April 19, 2022 to file their taxes due to the Patriots’ Day holiday in those states.

The IRS has not announced an automatic extension for 2022 as it did in 2020 and 2021. If you’re requesting an extension you have until Monday, Oct. 17, 2022, to file.

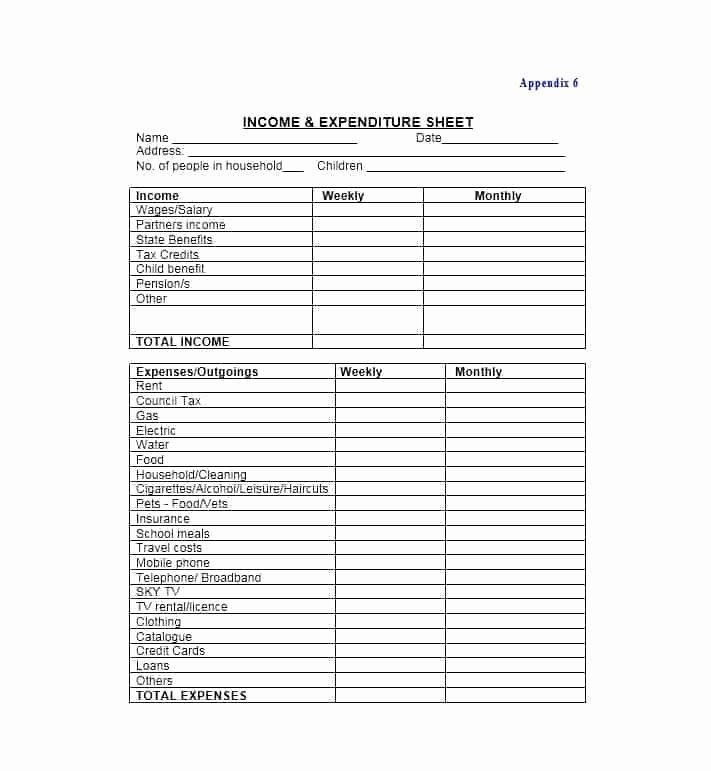

Figure Out How Much You Earned

This is the starting point for all taxes: you need to know how much you received in income before anything else can be relevant. If you donât have a good set of records to rely on, the year-end tax forms you receive will be key.

If you earned more than $600 from a single client or work platform they will likely send you a 1099-NEC by January 31st. You might also receive a 1099-K, reflecting payments you received through a third-party payment processor like PayPal or Stripe. You can use these statements to recreate your income for the year. I also highly recommend sifting through your bank statements for any income that might have been missed, or that falls under the $600 reporting threshold.

Recommended Reading: Self Employed Tax Write Offs

How Long Does It Take For A Tax Preparer To Do Your Taxes

The time it takes for a tax preparer to complete your taxes will depend on a number of factors, including the complexity of your return and the efficiency of the tax preparation service. A professional tax preparer may be able to complete and file your taxes in as little as a few hours, or it may take several days or weeks depending on your needs and situation.

Truly, the best way to find out how long it will take for a tax preparer to do your taxes is to consult with a tax professional directly.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

You May Like: Self Employed Estimated Tax Calculator

Make Sure You Actually Have To Pay

Not everyone is subject to self-employment tax, but youâll likely have to pay it if you are:

- A sole proprietor

- A side hustler â even if youâre receiving W-2 income as well

Hereâs the bottom line: self-employment taxes apply to all âearned income,â which is money received in exchange for a product or service. Thatâs true whether or not itâs your main source of income.

For instance, letâs say you work a standard 9-to-5 job, but sell your handmade jewelry on Etsy for a bit of extra cash. Your sales are subject to self-employment tax!

What Is My Tax Id Number For My Business

Your personal tax ID number is your Social Security number . Your business should have a unique employer identification number as well, and you must apply for the number. If you dont have any employees and your state doesnt require a separate number, you can use your SSN for your self-employment income. If you have employees or are otherwise required to, you must complete an online Form SS-4 with the IRS to get an EIN.

You May Like: Montgomery County Texas Property Tax

H& r Block Best Overall

Heading our list for best overall tax service is H& R Block. H& R Block was started in 1955 by two brothers and has grown to over 12,000 locations worldwide. It has multiple services to choose from, the best tax software, and competitive prices that will take care of all your individual or business income tax preparation needs.

Turbo Tax Live Pricing

Turbo Tax Live offers various tiers with clear pricing for filers. The Basic package is free for state and federal tax filing. Next is the Deluxe which includes an $89 filing fee in addition to $49 to file state taxes. Another choice is the Premier and it will cost you $139 plus $49 to file your state taxes. The last and most expensive tier is the Self-Employed costing $169 and $49 to file state taxes.

Also Check: Iowa State Tax Refund Status

What Should You Look For In A Tax Software Program

“Freelancer” is synonymous with “self-employed business owner” in the eyes of the IRS “), so you’ll be reporting your business income and expenses on a Schedule C and your self-employment tax on a Schedule SE include both with your Form 1040, the standard individual tax filing form. The tax software you use will definitely need to support that paperwork along with Form 1099-NEC, the non-employee income document you get from your clients instead of a W-2. You may also receive a Form 1099-K from a third-party payment network like Venmo or PayPal if your client paid you at least $600 that way.

Other good-to-have features include:

-

An intuitive e-filing process with straightforward questions and prompts

-

Some sort of accuracy and maximum refund guarantees

-

Solid customer support, with optional access to a real live tax expert in case of emergency

Dont forget that youll also need to file your state taxes in addition to your federal taxes see Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming). Some tax software providers will include one state for free, but most will charge you per state where you need to file.

Other Free File Options

The IRS has a helpful lookup tool for Free File so you can identify the best provider for you: Free File Online Lookup Tool

At this time online products are only available in English. If someone in your household can help you translate from English, you can use either software. If you need to prepare your taxes in Spanish, we recommend you use ezTaxReturn.com.

Por el momento, TurboTax y H& R Block solo están disponibles en inglés. Si alguien en su hogar puede ayudarle a traducir el inglés, puede usar cualquier programa. Si necesita preparar sus impuestos en español, le recomendamos que use ezTaxReturn.com.

If you have a complicated family situation, are self-employed, are unsure of what a particular tax form is, or have unusual tax situations such as sale of stock or cancellation of non-business credit card debt, please call our hotline at 312-409-1555 or e-mail . Please exercise patience, as we are experiencing higher-than-usual call volume.

Don’t Miss: Where.is.my Tax Refund

Irs Free File Is Now Closed

Check back January 2023 to prepare and file your federal taxes for free.

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

What Expenses Can I Deduct As A Self

It depends on the field youre working in. But the most commonly overlooked deductions are: business use of your home , business meals, car expenses, education expenses, and business startup costs. We know it can be quite overwhelming to make sure you didnt miss anything. Just link your bank or credit card to Freely and well scan your past purchases to automatically find the tax write-offs you may have missed!

Read Also: How Much Taxes Deducted From Paycheck Tn

Why Do Freelancers Need To Use Tax Software

Instead of receiving regular payments with taxes withheld like salaried employees of a company, freelancers are paid by anyone who hires them, and taxes are not automatically withheld. That means freelancers will receive different tax forms for their income and also need to save money throughout the year to pay taxes. In fact, most freelancers are expected to pay their estimated taxes quarterly.

All freelancers are considered small business owners by the IRS, meaning they are required to pay the federal self-employment tax — 15.3% for 2021 — in addition to regular taxes on income. They are also eligible for a host of self-employed tax deductions, such as for office supplies, vehicles, Internet and travel.

In short, working as a freelancer generally makes filing your tax return more complicated. Quality tax software can explain what freelancers should do with all of their forms and guide them through the specific tax issues that arise when filing their tax returns.

Common Business Expenses For Self

If youâre not sure whether something counts as a write-off, check Keeperâs free resources page! Or to make things even easier, download the app and connect your accounts so that we can do the sifting for you. Some common business expenses include:

- ð Auto expenses

- 𪧠Marketing and advertising

Once you have a good idea of your annual business expenses, you can subtract them from your gross income to determine how much youâll actually be taxed on. Doing this at the last minute? Donât feel too bad: itâs not uncommon for freelancers to put off thinking about recordkeeping and taxes until the end of the year, so youâre in good company.

That being said, be better. Use Keeper.

Recommended Reading: United Way Free Tax Preparation

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

What Can Freelancers Write Off On Their Taxes

Speaking of deductions: The one big thing freelancers have going for them during tax season is the fact that they can write off way more work-related expenses than the average employee that includes office supplies, internet bills, meals, education, mileage, health insurance premiums, and the portion of your rent that covers your home office. Don’t get too brazen, though: These expenses must be “both ordinary and necessary” to your business, per the IRS.

Also Check: Sales Tax Rate In Chicago Il

Add Up Your Business Expenses

Ideally, youâve been using the Keeper app to track your business expenses throughout the year. If not, shame on you. Kidding! We donât judge around here . Since you already have your bank statements open, go ahead and scan for business-related expenses while youâre at it. And donât forget to check your credit card purchases as well!