How Do Individuals Pay Self

The IRS provides tools for you to use to file and pay self-employment taxes. You use the IRS Schedule C to calculate net earnings, and then IRS Schedule SE to calculate how much self-employment tax you owe.

The IRS also requires you to make quarterly estimated tax payments throughout the year if you expect you will owe at least $1000 in federal income taxes. If you donât make the estimated payments, you could be subject to a penalty. Youâll use IRS Form 1040-ES to make these payments.

Either way, itâs a good idea to set aside some of your earnings throughout the year, so that you have money available when you do pay taxes.

How Often Should You Calculate And Re

If youâve just started your business, you will need to estimate your net earnings in order to determine the self-employment tax and to make quarterly payments. If youâve been in business, you will have a good sense of annual income to determine the quarterly payments.

However, itâs important to keep meticulous records of your expenses all through the year. You donât want to wait until tax season and then scramble to find expense records. After all, deducting legitimate expenses from your gross earnings will lower your net earnings and ensure your tax bill is lower.

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Nonresident aliens use Form 1040-ES to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Don’t Miss: Filing For An Extension On Taxes 2022

Additional Self Employment Tax Deductions

As a freelancer, youre able to deduct half of your self-employment tax from your income taxes. This is because, as an employer, you would normally be responsible for paying half of the Social Security and Medicare taxes owed by an employee.

Since you are both the employer and the employee when youre self-employed, you can deduct half of the self-employment tax you paid. This deduction is taken as an adjustment to income, which means you can claim it even if you dont itemize deductions on your tax return. The instructions for Schedule SE will tell you how to figure out your deduction for half of your self-employment taxes.

Its important to note that the deduction for half of your self-employment taxes only applies to the Social Security and Medicare taxes owed. It does not apply to any other taxes, like federal income tax or state income tax.

In some cases, you may be eligible for a credit against your self-employment tax. The two most common credits are the earned income credit and the child and dependent care credit. Theearned income credit is a refundable credit for low- and moderate-income taxpayers. To be eligible, you must have earned income under $57,414 and have investment income under $10,000 in the last tax cycle. The child and dependent care credit is a non-refundable credit that can reduce the amount of tax you owe .

To be eligible, you must have paid someone to care for your child or dependent so that you could work or look for work.

How Do You Calculate Annual Income

To calculate your annual salary, multiply the gross pay before taxes by the number of pay periods in the year.

For example, if you earn $2,000/week, your annual income is calculated by taking $2,000 x 52 weeks for a total salary of $104,000.

Note: your pay frequency may differ, such as if youre paid bi-weekly, semi-monthly, or monthly.

Experiment with the paycheck calculator above to answer these questions among others while also pinpointing any changes you can make to boost your take-home pay and improve your personal finances.

SurePayroll, Inc. and its subsidiaries assume no liability and make no warranties on or for the information contained on these state payroll pages. The information presented is intended for reference only and is neither tax nor legal advice. Consult a professional tax, legal or other advisor to verify this information and determine if and/or how it may apply to your particular situation.

Recommended Reading: Penalty For Missing Tax Deadline

Work Out Your Net Earnings

To calculate your self-employment tax, youll need to know your net earnings from self- employment for the year. Your net earnings are your total income from freelancing, minus anyallowable business expenses. Tax deductible business expenses include items like the cost of goods sold, office expenses, travel expenses, and marketing costs.

Tax deductible simply means that the IRS allows you to subtract these expenses from your total income, in order to arrive at your net earnings. As a freelancer, you should empower yourself with knowledge onwhich business expenses are tax deductible, so that you can keep track of them throughout the year and save money.

Your workings out of your net income might look something like this:

Gross income from freelancing: $30,000

Minus business expenses: -$12,000

Equals net income: $18,000

Whats The Social Security Tax

Similar to the Medicare Tax, this is a portion of your self-employed tax that supports another government program â specifically, the Social Security program. Social Security is known for the cash benefits it provides to seniors, but it also plays a role in supporting the disabled and surviving spouses and children. One important thing to note is that Social Security Retirement Benefits are based on your highest 35 years of earnings in a lifetime. Your freelance income is counted into this formula the more you make and report as a self-employed freelancer, the closer youâll be to max out Social Security retirement benefits later in life!

Also Check: Corporate Tax Rate In India

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. Each period has a specific payment due date. If you dont pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.

If a payment is mailed, the date of the U.S. postmark is the date of payment. If the due date for an estimated tax payment falls on a Saturday, Sunday, or legal holiday, the payment will be on time if you make it on the next day that isnt a Saturday, Sunday or holiday.

How Does This Calculator Work

Calculate your take-home income, National Insurance Contributions , and income tax using Experlu’s self-employment Income Tax calculator.

- Enter your annual sales

- Enter your allowable annual business expenses

- The Self-employed income calculator will then calculate your annual profit before taxes, the amount of income tax and class 2 & 4 NIC, all while considering the standard tax free allowance levels.

- You can use the estimated numbers of you are preparing a budget, cash flow forecast.

Don’t Miss: How Much Is The Tax In Texas

Benefits Of Using A Payroll Calculator

There are many benefits of using a payroll calculator, including the ability to estimate your paycheck in advance. You can also use the same tool to calculate hypothetical changes, such as withholding more money from each paycheck or increasing your retirement contributions.

Another benefit of a salary paycheck calculator is its ability to answer questions regarding your finances accurately. Examples include:

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

You May Like: How Property Taxes Are Calculated

How Might Future Self Employment Tax Limits Change

Risk of a Large Increase in Self-Employment Taxes

President-elect Joe Biden suggested that in addition to increasing marginal tax rates on corporations and high income earners he would remove the cap on FICA taxes for those earning above $400,000 in income. He would treat any income above that level similarly to the first $137,700 and have it fully exposed to FICA taxes. If this policy were enacted it would dramatically increase the income taxes on small business owners who had over a half-million dollars in annual income. It would shift the top marginal rate from the current 37% to 39.7% plus 15.3% FICA taxes for a total marginal Federal income tax rate of 55%. In states like California with relatively high state income taxes the blended marginal rate could hit nearly 70%.

What If I Make A Mistake On My Tax Return

Once you submit your tax return and know that an entry is inaccurate, you can amend that return. To make the changes, you have up to 12 months starting on 31 January after the end of the tax year to which the tax return relates .

As a result, you usually have until 31 January 2023 to make any changes to your 2020/21 tax return. This is applicable whether you manually filed a paper copy of the return or electronically filed the tax.

If you need to modify your tax return beyond these time limits, then you need to inform HMRC so that your tax position can be corrected. If additional tax is due, HMRC will issue an amended calculation once the errors are rectified, and there may be penalties.

Don’t Miss: California Employer Payroll Tax Account Number

How Much Is The Self

For the 2021 tax year, you’ll pay 15.3% of your net freelance income in self-employment taxes. That comes out to 12.4% for Social Security taxes and 2.9% on Medicare taxes.

The good news? Depending on how much you earned, not all of your self-employment income is hit by all of the self-employment tax. For the 2021 tax year, only the first $142,800 of your self-employment earnings are subject to the Social Security portion of the self-employment tax. That will rise to $147,000 in the 2022 tax year.

You might, though, have to pay more in Medicare tax if you earned a high amount of self-employment income. For the 2021 tax year, you’ll have to pay an additional Medicare tax of 0.9% if your net earnings from self-employment are higher than $200,000 if you are a single filer or $250,000 if you are married and filing jointly.

What Are Medicare Taxes

Freelancers pay self-employment tax and a portion of it goes to fund the federal governmentâs Medicare program. It is used to provide subsidized health care and programs to retired Americans and to disabled individuals. Money from the Medicare program also subsidizes hospital insurance benefits. So, when you pay your self-employment tax, less than 3% of that money is going to this program.If you are a high earner, an additional Medicare tax of 0.9% may also be tacked on to your tax bill.

You May Like: Capital Gains Tax On Primary Residence

Deducting Retirement Plan Contributions

Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan.

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. This limit is $330,000 in 2023, $305,000 in 2022, $290,000 in 2021, $285,000 in 2020 and $280,000 in 2019 and is adjusted annually.

Plan contributions for a self-employed individual are deducted on Form 1040, Schedule 1 and not on the Schedule C. If you made the deduction on Schedule C, or made and deducted more than your allowed plan contribution for yourself, you must amend your Form 1040 tax return and Schedule C.

You should amend your Form 1040 tax return and Schedule C if you:

- deducted your own plan contribution on Schedule C instead of on Form 1040, Schedule 1, or

- made and deducted more than the allowable plan contribution for yourself.

If you contributed more for yourself than your plan terms allowed, you should also correct this plan qualification failure by using the IRS correction programs.

How To Report & Pay Self Employment Tax

You need to report your self-employment earnings via IRS Schedule C and also IRS Schedule SE to calculate how much self-employment tax you owe. Then, you may need to examine if you need to pay estimated tax which is to be paid quarterly .I suggest you to read Estimated Tax :Who ,When & How to Pay ?. See this calculator on the estimated tax penalty calculator.

You May Like: New York State Income Tax Rates

What If Someone Is Already Charged Fica Tax

Section 1401 of IRC provides that additional medicare tax amount shall be reduced by the amount of wages taken into account in determining the tax imposed under section 3121 with respect to the taxpayer. Thus , it is clear same amount will not suffer both additional medicare tax and FICA tax at the same time.

How To Decrease Income Tax If You’re Self

You don’t pay income tax on total income. Instead, you can subtract various allowable expenses from your total trading profits. To pay the correct tax amount, it’s crucial to keep track of and deduct all of your allowable expenses.

Usually, you can claim expenses that are entirely and exclusively for business purposes such as business purchases, marketing, advertising, salaries, accounting, business insurance, a business phone, etc.

There’s also plenty of HMRC guidance about business expenses, and you should check whether there is any data from trade bodies particular to your industry.

Also Check: How Does Income Tax Work

Who Must Pay Self

You must pay self-employment tax and file Schedule SE if either of the following applies.

- Your net earnings from self-employment were $400 or more.

- You had church employee income of $108.28 or more.

Generally, your net earnings from self-employment are subject to self-employment tax. If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-employment.

If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax.

Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

How Is The Self

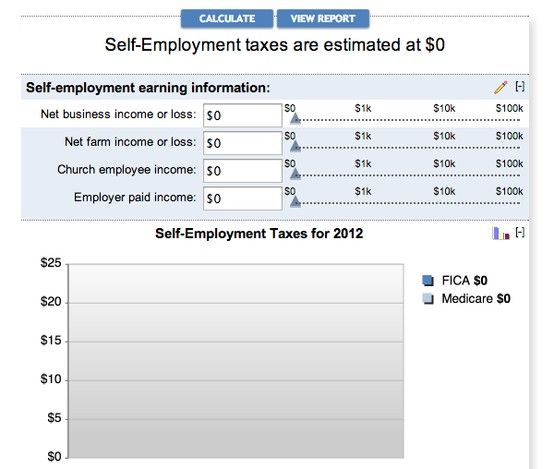

Self-employment income is the total income subject to self-employment taxes. This is calculated by taking your total ‘net farm income or loss’ and ‘net business income or loss’. The tax rate is calculated on 92.35% of your total self-employment income. This rate is derived from the fact that self-employed taxpayers can deduct the employer’s portion of the tax, which is 7.65%. This is done to adjust your net income downward by the total employment tax that would have been employer paid income, had you not been self-employed. If the result is less than $400.00, you do not owe any self-employment tax on this income.

If your net church employee income or total church income subject to self-employed tax is under $100, you will not owe any self-employment taxes.

The self-employment tax rate is currently 15.3% of your income. Self-employment tax consists of 12.4% going to Social Security and 2.9% going to Medicare.

The Social Security portion has a limit on how much of your income is taxed , whereas the Medicare portion does not. So, if your total employment wages exceed $142,800, you will not owe any additional FICA taxes. You must pay this tax if youâve made money from your freelance business of $400 or more.

You will probably not receive a tax refund.

Read Also: H& r Block Tax Refund Calculator

What Should You Do If Your Self

The first thing you should know is that no matter if you are able to pay your taxes you should always, still file on time. Anytime you are unable to pay your taxes or even unable to pay in full, The Internal Revenue Service does have several avenues which are helpful to the taxpayer. You can do a few things:

- Request an extension of up to days to pay in full by applying with the online payment agreement or by calling 800-829-1040

- If you just simply need more time to pay you can request an installment agreement.

- Lastly, you may also qualify for an offer in compromise, which means the IRS may settle for a lesser amount than what you actually owe.

Now, for those of you who just wanted to know how to calculate your estimated self-employment tax, you can certainly do so by following the guidelines and instructions on the Long Schedule SE form or you can follow the steps below:

To summarize in short: