Home Offices And Depreciation: A Tax Drawback

The capital gains tax exclusion does not apply to depreciation allowable on residences after May 6, 1997. If you are in a high tax bracket and plan to live in your home for a long time, taking depreciation deductions for a home office is quite valuable right now. But if not, you might want to reconsider using a portion of your home as an office, because all depreciation deductions you take will be taxed at 25% when you sell the house.

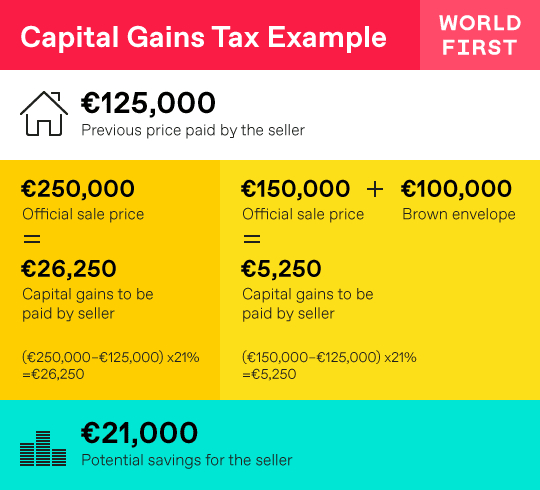

Example: A married couple sells a home with an adjusted basis of $100,000 for $600,000. Over the years, they had taken $50,000 in depreciation deductions for a home office.

Sales Price: $600,000Adjusted Basis – $100,000Taxable gain = $500,000

Of that gain, $450,000 is tax-free the $50,000 taken as depreciation deductions is subject to 25% capital gains tax.

Always Seek Guidance From A Professional Real Estate Agent

One way to avoid as much tax as possible is by hiring an expert local real estate agent. These agents usually have hundreds of deals under their belts and know exactly what taxes apply in your particular situation and how you can avoid them.

One way to hire great real estate agents is to get in touch with a Clever Partner Agent. Given that Clever only partners with the very best agents in your area, you can rest assured that they know all about taxes and how you can avoid them.

Clever partner agents charge a simple flat fee of $3000 or 1% if your home sells for more than $350,000.

Calculate Your Cost Basis

To determine capital gains on the sale of your home, you simply subtract your cost basis from the selling price. But what exactly is your cost basis? It’s not just the purchase price. It also includes certain settlement fees, closing costs and commissions associated with both the purchase and the sale . Add to this the cost of significant capital improvements you made over time for renovations, additions, roofing, landscaping, and other upgrades. All of these improvements will increase your cost basis, and therefore lower your potential tax liability. Hopefully, youve kept good records because this can add up!

On the other side of the equation, there are a few things that can reduce your cost basis. A lower basis will increase your profit, and potentially your tax. For example, if you have a home office and have claimed depreciation over time, you now have to subtract those deductions from your cost basis. Or if you received tax credits for energy-related improvements, you have to subtract that amount as well.

Read Also: Where’s My Tax Credit

How To Avoid Capital Gains Tax On A Home Sale

Capital gains taxes can greatly affect your bottom line. Fortunately, there are ways to reduce the tax bill, or avoid capital gains taxes on a home sale altogether. It depends on the property type and your filing status. The IRS offers a few scenarios to avoid capital gains taxes when selling your house.

Do Home Improvements Reduce Tax On Capital Gains

You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements youve made. You can add the amount of money you spent on any home improvementssuch as replacing the roof, building a deck, replacing the flooring, or finishing a basementto the initial price of your home to give you the adjusted cost basis. The higher your adjusted cost basis, the lower your capital gain when you sell the home.

For example: if you purchased your home for $200,000 in 1990 and sold it for $550,000, but over the past three decades have spent $100,000 on home improvements. That $100,000 would be subtracted from the sales price of your home this year. Instead of owing capital gains taxes on the $350,000 profit from the sale, you would owe taxes on $250,000. In that case, youd meet the requirements for a capital gains tax exclusion and owe nothing.

Take-home lesson: Make sure to save receipts of any renovations, since they can help reduce your taxable income when you sell your home. However, keep in mind that these must be home improvements. You cant take a deduction from income for ordinary repairs and maintenance on your house.

Read Also: How To Find 2020 Tax Return

Leverage The Irs Primary Residence Exclusion

You can be exempt from paying CGT when you sell a primary residence that meets certain criteria. Individuals can exclude up to $250,000 of capital gains while a married couple can exclude up to $500,000.

Under the Section 121 exclusion, youll have to own and use the property as your primary residence for two out of the five years immediately preceding the date of the sale. In addition, youre only eligible if you havent taken a capital gains exclusion for any other property sold at least two years before this current sale.

Since this strategy can only apply to one property being used as a primary residence, it wont benefit investors who have multiple investment properties. Moreover, youll need to hold onto a property for five years before you can take advantage of this exclusion.

How Real Estate Taxes Work

Taxes for most purchases are assessed on the price of the item being bought. The same is true for real estate. State and local governments levy real estate or property taxes on real properties these collected taxes help pay for public services, projects, schools, and more.

Real estate taxes are ad valorem taxes, which are taxes assessed against the value of the home and the land it sits on. It is not assessed on the cost basiswhat was paid for it. The real estate tax is calculated by multiplying the tax rate by the assessed value of the property. Tax rates vary across jurisdictions and can change, as can the assessed value of the property. However, some exemptions and deductions are available for certain situations.

Read Also: How Long Does Your Tax Return Take

How The Tax On Capital Gains Works For Inherited Homes

What if youre selling a home youve inherited from family members whove died? The IRS also gives a free step-up in basis when you inherit a family house. But what does that mean?

Lets say Mom and Dad bought the family home years ago for $100,000, and its worth $1 million when its left to you. When you sell, your purchase price is not the $100,000 your folks paid, but instead the $1 million its worth on the last parents date of death.

You pay capital gains tax only on the difference between what you sell the house for, and the amount it was worth when your last parent died.

Basis When You Inherit A Home

If you inherited your home from your spouse in any year except 2010 and you lived in a community property stateArizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsinyour basis will generally be the fair market value of the home at the time of your spouse’s death.

If you lived somewhere other than a community property state, your basis for the inherited portion of the home in any year except 2010 will be the fair market value at your spouse’s death multiplied by the percentage of the home your spouse owned.

- If your spouse solely owned the home, for example, the entire basis would be “stepped up” to date-of-death value.

- If you and your spouse jointly owned the home, then half of the basis would rise to date-of-death value.

If you inherited your home from someone other than your spouse in any year except 2010, your basis will generally be the fair market value of the home at the time the previous owner died.

- If the person you inherited the home from died in 2010, special rules apply.

- Your basis generally is the same as the person you inherited the property from.

- The executor has the option to increase the basis of property passing to a non-spouse by $1.3 million and property passing to a spouse by $3 million.

- To find out the exact basis of any property you inherit, check with the estates executor.

Read Also: Are Funeral Expenses Tax Deductable

How Capital Gains Tax Works

Once you sell any property, say your home, you will automatically initiate the capital gains tax. The tax doesnât apply to assets that have not been sold. The assets that the Internal Revenue Service taxes commonly include stocks, bonds, and tangible property such as homes and cars.

The government will only tax you if you have a positive capital gain.

So, whatâs a positive capital gain?

If the selling price is greater than the buying price, the net gain is positive.

But if the value of the home depreciates at the time of sale, you will not pay the tax. That is because the selling price would be lower than the original cost.

Estimate Sale Price And Capital Gains

Now estimate your sale price and subtract your cost basis. Let’s say you bought your house for $350,000, put in $50,000 in improvements and had related fees and costs of another $15,000, giving you a cost basis of $415,000. Now let’s say you expect to sell the house for $850,000. Your potential capital gain would be $435,000.

Don’t Miss: Penalty For Filing Taxes Late If I Owe Nothing

What Are Capital Gains Taxes On Real Estate

A capital gains tax is a tax on the gains you realized from the sale of an asset. The net profit on a home sale is considered a capital gain and can be taxed.

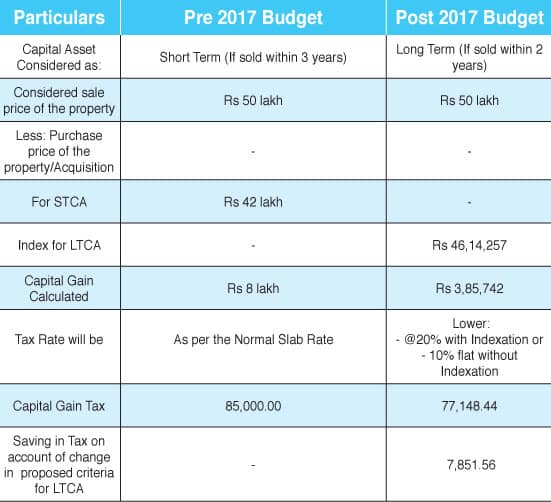

You are taxed on any profit if you sell your home within two years of buying it. If you hold the property for one year or less , youre liable for short-term capital gains, which are taxed as ordinary income. Youll pay the same federal rate on these gains as on wages and other earnings ranging from 1037%, depending on your household income.

If you sell after more than one year of ownership, your profits will be taxed as long-term capital gains, which have lower tax rates ranging from 020%.

But heres the good news. If you have owned and used your home for at least two years, you only pay those taxes on any profit over a certain amount the $250,000 or $500,000 thresholds for individuals or married joint owners respectively, as mentioned above.

What Is The Penalty For Selling A House Less Than 2 Years After Purchase

You probably cannot qualify for the $250,000/$500,000 exemption from gains on selling your primary residence. Thats because to qualify for that exemption, you must have used the home in question as your primary residence for at least two of the previous five years, and you generally cant use the exemption twice within two years.

However, there are exceptions for certain circumstances: Military service, death of a spouse, and job relocation are the most common reasons that might allow you to take at least a partial exemption. The IRS has a worksheet for determining an exclusion limit see Topic 701.

Also Check: File Income Tax Return India

Section 121 Doesnt Apply To Me What Now

Even if you dont meet the requirements for Section 121 exclusion, there are other ways to trim your capital gains tax burden or avoid it entirely. But these strategies involve the sale of an investment or rental property, rather than a primary residence.

The most common ways to reduce capital gains tax exposure include 1031 exchanges, converting a rental property to a primary residence, tax-loss harvesting, and monetized asset sales.

If you cant use any of these methods to avoid a hefty tax hit, selling with a low commission realtor could help you offset your costs.

Are There Specific Exemptions For Investment Property

Yes. Investors can look to Tax Code Section 1031 to profit on business or investment properties without paying capital gains tax.

Section 1031 allows you to trade like-kind properties to avoid paying taxes on the initial profit. These like-kind properties must be similar: You can trade a retail space for another retail space, but you cant trade a retail space for a rental property.

If the value of one property is greater than the other, you can add cash to the deal. The person who owns the property of lesser value can pay any difference at the time of sale.

Can I avoid the tax by moving into my investment property?

Yes. If you live in your property for at least two years, it changes the nature of your property from an investment property back to your primary residence. Youre then eligible for the capital gains tax exemption of up to $250,000 .

Say you live in New York City with your spouse. You decide to sell your place in the city, where youve lived for the past two years, and move into your vacation home upstate. Since your city apartment was your primary residence, you take your $500,000 profit tax-free.

Your move upstate doesnt have to be permanent. If you want to ultimately move back to the city, stay in your vacation home at least two years. After two years, that property becomes your primary residence, and you can sell it and pocket another tax-free profit of up $500,000.

Recommended Reading: Personal Tax Return Due Date 2022

What Is Capital Gains Tax

The definition is pretty simple: Its the difference between what you paid for a capital asset and what you sold it for. If you sell your asset for more than you bought it, youll have a capital gain If the opposite is true and you sell the asset for less than you bought it, youll have a capital loss.

Capital gains tax is the taxation of capital assets. The taxation is classified by the length in which you own the asset, which well describe in detail below!

Capital Gains On Sale Of Second Home

If you own multiple homes, it may not be as easy to shelter sale profits as it was in the past.

The Housing Assistance Act of 2008 was designed to provide relief for homeowners on the edge of foreclosure, yet it could cost the owners when they decide to sell.

You used to be able to move into the second property, make it your primary residence, live there for two years, and profit from the gains.

Even when your second piece of real estate is converted into your primary home, you will be taxed on part of the gains based on how long the home was used as a second home and not the primary residence.

Also Check: How To File An Extension Taxes

How Do I Qualify For Section 121 Exclusion

First and most importantly, hold the property for at least two years! Section 121 exclusion only kicks in after two years of ownership.

Next, check whether your home sale qualifies for this exclusion. Again, Section 121 exclusion applies to the sale of your main home only.

Also note that Section 121 applies to many types of housing, including:

- Single-family home

The IRS offers complete information about these and other eligibility rules in Publication 523.

According to the document, the exclusion does not apply if youre transferring your home to a spouse or ex-spouse, because in that case the IRS considers there to be no capital gain or loss.

You should also know the homes date of sale to qualify for Section 121 exclusion.

Next, you will determine how much of your gain is tax-exempt.

Is There A Way To Avoid Paying Capital Gains Taxes When Selling An Investment Or Vacation Property

The capital gains exclusion only applies if you meet the three criteria mentioned above, which would not apply to an investment or vacation property. Some homeowners who own rental properties or vacation homes do avoid paying capital gains taxes when selling their property by moving into their home permanently for the two years before they sell it and making sure to spread their home sales out by two years. Also, if you are selling an investment or business property and are planning to purchase a similar property, you may qualify to defer the capital gain under what is called a 1031 exchange.

Other than that, you may have to pay a capital gains tax on the sale of a secondary property. Remember, tax fraud is a serious crime so you should never claim that you lived permanently in a home if you didnt.

Also Check: Oklahoma Tag Title And Tax Calculator

Do I Pay Property Tax When I Sell My House

Yes. At closing, youll pay taxes prorated up to the closing date . If your mortgage lender handles your property tax payments for you, you can expect to see the amount as a line item in your payoff settlement statement.

Most property taxes are paid in arrears, which means you pay after the fact for charges that are already accrued. And most property taxes are charged on a twice-yearly basis, so its likely youll have to pay a prorated portion of your six-month tax bill at closing.

Topic No 701 Sale Of Your Home

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse. Publication 523, Selling Your Home provides rules and worksheets. Topic No. 409 covers general capital gain and loss information.

Read Also: Tax Credits For Electric Vehicles

Capital Gains On Selling Your Home

Your home like most assets you own for personal or investment purposes is a capital asset.

Internal Revenue Code Section §1221 defines a capital asset as any property you hold except for eight things:

Anything not included in that list is a capital asset.

So because primary residences are not included in that list, your primary residence the home that you live in is in fact a capital asset, and you will realize capital gains on the sale of your home unless, of course, youre selling it for a loss or it qualifies for an exclusion.

The amount of your capital gain is the difference between your net proceeds and that includes the mortgage payoff, if there is one and your basis in the home.

And basis of your home does include not include the original purchase price but also things like title fees, legal fees to prepare the contract, escrow fees, recording fees in the county office, appraisal costs, and other costs you incurred to purchase the property.