Net Investment Income Tax

Under certain circumstances, the net investment income tax, or NIIT, can affect income you receive from your investments. While it mostly applies to individuals, this tax can also be levied on the income of estates and trusts. The NIIT is levied on the lesser of your net investment income and the amount by which your modified adjusted gross income is higher than the NIIT thresholds set by the IRS. These thresholds are based on your tax filing status, and they go as follows:

- Single: $200,000

- Qualifying widow with dependent child: $250,000

- Head of household: $200,000

The NIIT tax rate is 3.8%. The tax only applies for U.S. citizens and resident aliens, so nonresident aliens are not required to pay it. According to the IRS, net investment income includes interest, dividends, capital gains, rental income, royalty income, non-qualified annuities, income from businesses that are involved in the trading of financial instruments or commodities and income from businesses that are passive to the taxpayer.

Capital Gains Go Overwhelmingly To Wealthy White Households

Capital gains are generated by wealth. Because wealth is highly concentrated, so is capital gains income. About 85 percent of capital gains go to the wealthiest 5 percent of taxpayers 75 percent go to the top 1 percent of taxpayers. Wealthy households are disproportionately white: white families are three times likelier than families of color to be in the top 1 percent.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Penalty For Filing Taxes Late If I Owe Nothing

States Play A Major Role In Capital Gains Taxes

The lion’s share of taxes, including personal income and capital gains taxes, go to the federal government. But each taxpayer’s state also determines how much they owe on their capital gains. It’s important for taxpayers to know the capital gains tax brackets and exclusions in their respective states so they pay the correct amount.

What Is The 2022 Short

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period begins ticking from the day after you acquire the asset, up to and including the day you sell it.

- For 2022, ordinary tax rates range from 10% to 37%, depending on your income and filing status.

Read Also: When Is Tax Free Day

Deduct The Costs Incurred By The Sale

You can also deduct any repairs or renovations you made to an investment property to improve the final selling price of the home. Remember to keep documentation such as bills, deeds of sale, credit card statements and other similar papers to prove how much you spent. These documents will be an asset if youre audited.

Use Tax Advantaged Accounts

These incorporate 401 plans, singular retirement accounts and 529 school bank accounts, in which the ventures develop tax-exempt or charge conceded. That implies that you do not need to cover capital increases charge on the off chance that you sell speculations inside these records. Roth IRAs and 529s specifically have large expense focal points. Qualified conveyances from those are tax-exempt at the end of the day, you do not pay any expenses on venture income. With conventional IRAs and 401s, you will pay charges when you take dispersions from the records in retirement.

Don’t Miss: Payroll Tax Deposit Due Dates 2022

No Matter How You File Block Has Your Back

Do You Pay State Taxes On Capital Gains

In general, youll pay state taxes on your capital gains in addition to federal taxes, though there are some exceptions. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently

Just seven states have no income tax Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Two other states New Hampshire and Tennessee dont tax earned income but do tax investment income, including dividends.

Of states that do levy an income tax, nine of them tax long-term capital gains less than ordinary income. These states include Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont and Wisconsin. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains.

Some other states provide breaks on capital gains taxes only on in-state investments or specific industries.

Recommended Reading: State With No Property Tax

How Much Of Short

The tax-free portion of an asset disposition held for a short period will depend on the taxpayer’s ordinary income tax rate. Investors may be imposed taxes between 10% and 37% depending on their income and tax filing status. Unlike long-term capital gains, no portion of short-term capital gains is tax-free.

What Are The Methods To Minimize Tax On Investment Property Sales

Saving money is the priority of every investor. Nobody desires to pay more taxes than necessary. However, an investor can gain more benefits from capital gains tax in New York if it follows certain tax-saving strategies.

Here are a few tax strategies to lower your real estate capital gains taxes in New York.

Recommended Reading: How Is Property Tax Paid

Capital Gains Tax Brackets For 2022 And 2023

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

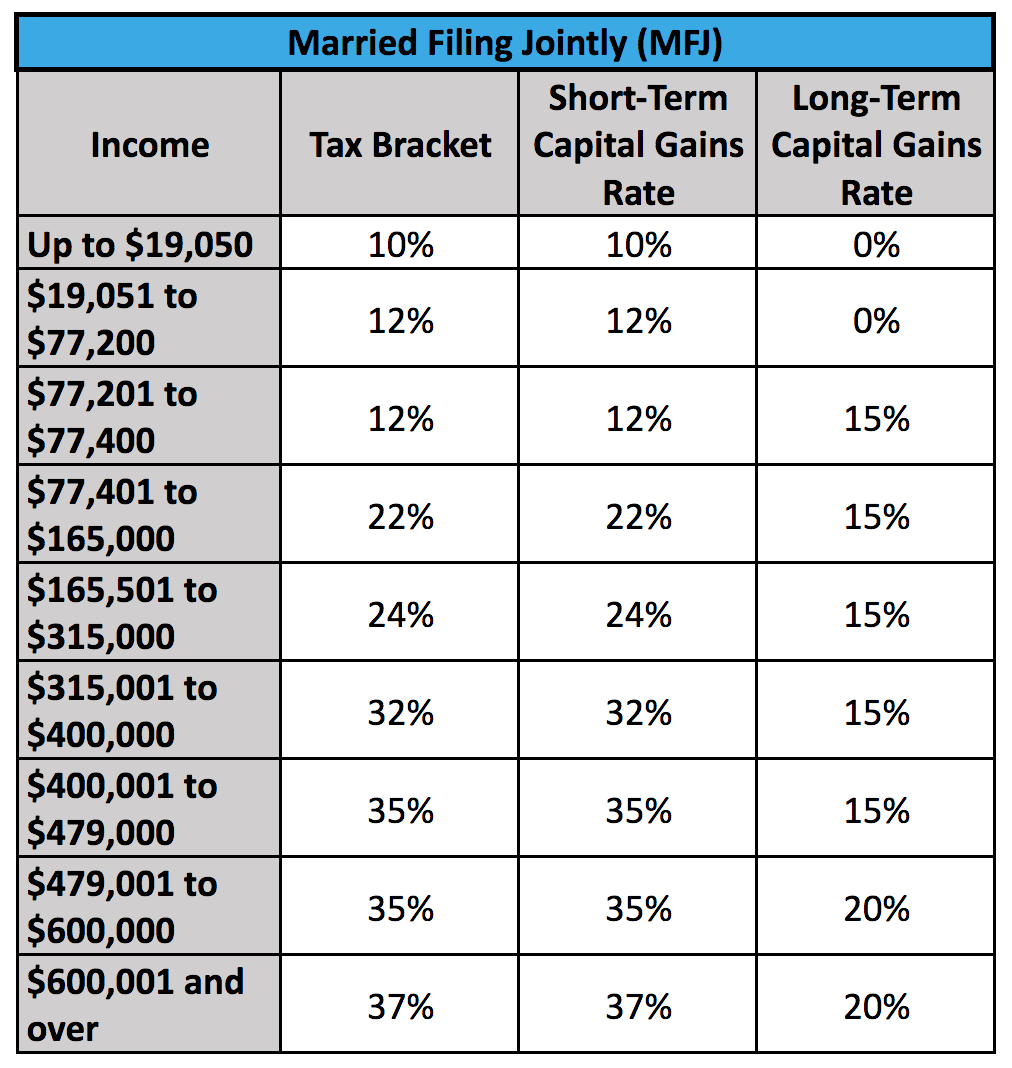

There are two capital gains tax categories with different tax brackets – short term and long term.

Long term investments pay less in taxes – these are investments that you typically hold for longer than one year.

Short term investments are taxed at your regular income rate.

Short Term Vs Long Term

If an investor held an asset for less than a year before selling it, the profits are short term capital gains. If the holding period longer than one year, the profits are long term capital gains. Short and long term gains are taxed at different rates, with short term rates based on the ordinary income tax bracket of the investor. Long term gains are taxed based on income as well, but with generally more favorable rates. All EquityMultiple investments are held for longer than one year, so any profits resulting from them would be considered long term capital gains.

The 2022 short term capital gains federal tax rates are 10%, 12%, 22%, 24%, 32%, 35%, or 37% depending on income and filing status. See the chart below for more information.

The long term capital gains federal tax rates for the 2022 tax year are 0%, 15%, or 20% depending on income and filing status. See the chart below for more information.

Don’t Miss: Where To Mail Tax Returns

What Is The Short

Short-term capital gain rates are the same as ordinary tax rates for 2022. This means the lowest income taxpayers will pay 10% short-term capital gains tax rates, and the highest income taxpayers will pay 37% short-term capital gains tax rates. A full table of rates based on filing status and income is provided above.

Capital Gains Vs Capital Losses

Just as you can profit from the stock market, you can lose, too. Earning capital gains means youve sold your position at a higher rate than when you bought it. Its not the only outcome for your investments, as you likely know.

Capital losses occur when you sell your position at a lower rate than when you bought it, or below your cost basis. Capital losses can score you tax deductions to a certain extent.

Hey, crypto investors:

You can dollar cost average your purchases of crypto on Public.com platform using the Recurring Investing feature.

This lets you automate investing weekly, biweekly, or monthly in your assets. Some investors may use it to help navigate volatile markets, manage risk, and build wealth over time. Keep tabs on the Public apprecurring investing is coming soon for stocks!

Don’t Miss: Exempt From Federal Income Tax

Capital Gains Taxes On Collectibles

If you realize long-term capital gains from the sale of collectibles, such as precious metals, coins or art, they are taxed at a maximum rate of 28%. Remember, short-term capital gains from collectible assets are still taxed as ordinary income. The IRS classifies collectible assets as:

- Works of art, rugs and antiques

- Musical instruments and historical objects

- Stamps and coins

- Alcoholic beverages

- Any metal or gem

The latter point is worth reiterating: The IRS considers precious metals to be collectibles. That means long-term capital gains from the sale of shares in any pass-through investing vehicle that invests in precious metals are generally taxed at the 28% rate.

Capital Gains And State Taxes

Whether you also have to pay capital gains to the state depends on where you live. Some states also tax capital gains, while others have no capital gains taxes or favorable treatment of them. The following states have no income taxes, and therefore no capital gains taxes:

Several states offer either a credit, deduction, or exclusion. For example, Colorado offers an exclusion on real or tangible property, and New Mexico offers a deduction on federally taxable gains. Montana has a credit to offset part of any capital gains tax. Washington state implemented a 7% tax on long-term net capital gains in excess of $250,000 beginning Jan. 1, 2022.

Read Also: How To Get Extension On Taxes 2021

Capital Gains Yield Vs Dividend Yield

The other source of returns on public equities is income earned on the investment, such as the receipt of dividends on common stock.

Since the capital gains yield neglects any income received on an investment aside from share price appreciation, the metric can be used in conjunction with the dividend yield.

The dividend yield is the ratio between the dividend per share and the current price.

Dividend Yield ÷

While certain companies will either not pay any shareholder dividends or opt to repurchase shares, mature companies with limited opportunities for growth frequently have long-term dividend programs to compensate their shareholder base.

Because corporate dividends are rarely cut once implemented, these so-called dividend stocks attract investors that prefer a steady stream of dividends over share price appreciation.

Given the reliance on the dividend payout returns, the share price of the company contributes less to the total return .

Factors That Complicate Measurement

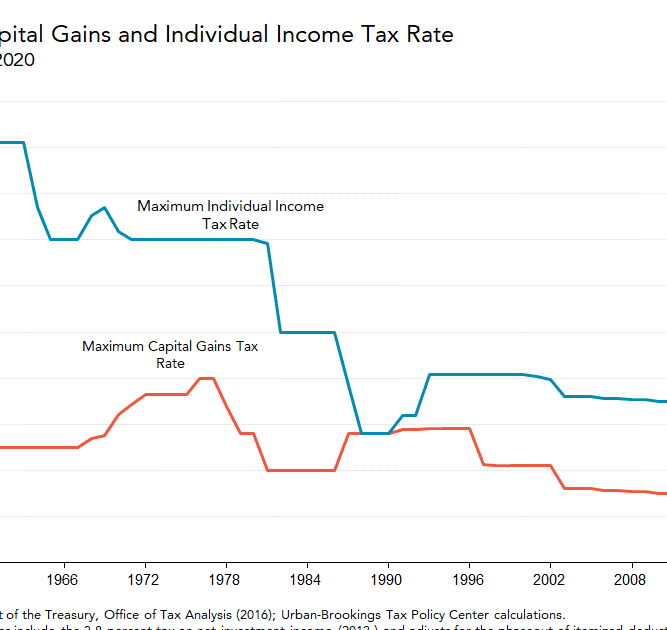

Researchers usually use the top to characterize policy as high-tax or low-tax. This figure measures the disincentive on the largest transactions per additional dollar of taxable income. However, this might not tell the complete story. The table Summary of recent history above shows that, although the marginal rate is higher now than at any time since 1998, there is also a substantial bracket on which the tax rate is 0%.

Another reason it is hard to prove correlation between the top capital gains rate and total economic output is that changes to the capital gains rate do not occur in isolation, but as part of a tax reform package. They may be accompanied by other measures to boost investment, and Congressional consensus to do so may derive from an economic shock, from which the economy may have been recovering independent of tax reform. A reform package may include increases and decreases in tax rates the Tax Reform Act of 1986 increased the top capital gains rate, from 20% to 28%, as a compromise for reducing the top rate on ordinary income from 50% to 28%.

Don’t Miss: Tax Id Numbers For Businesses

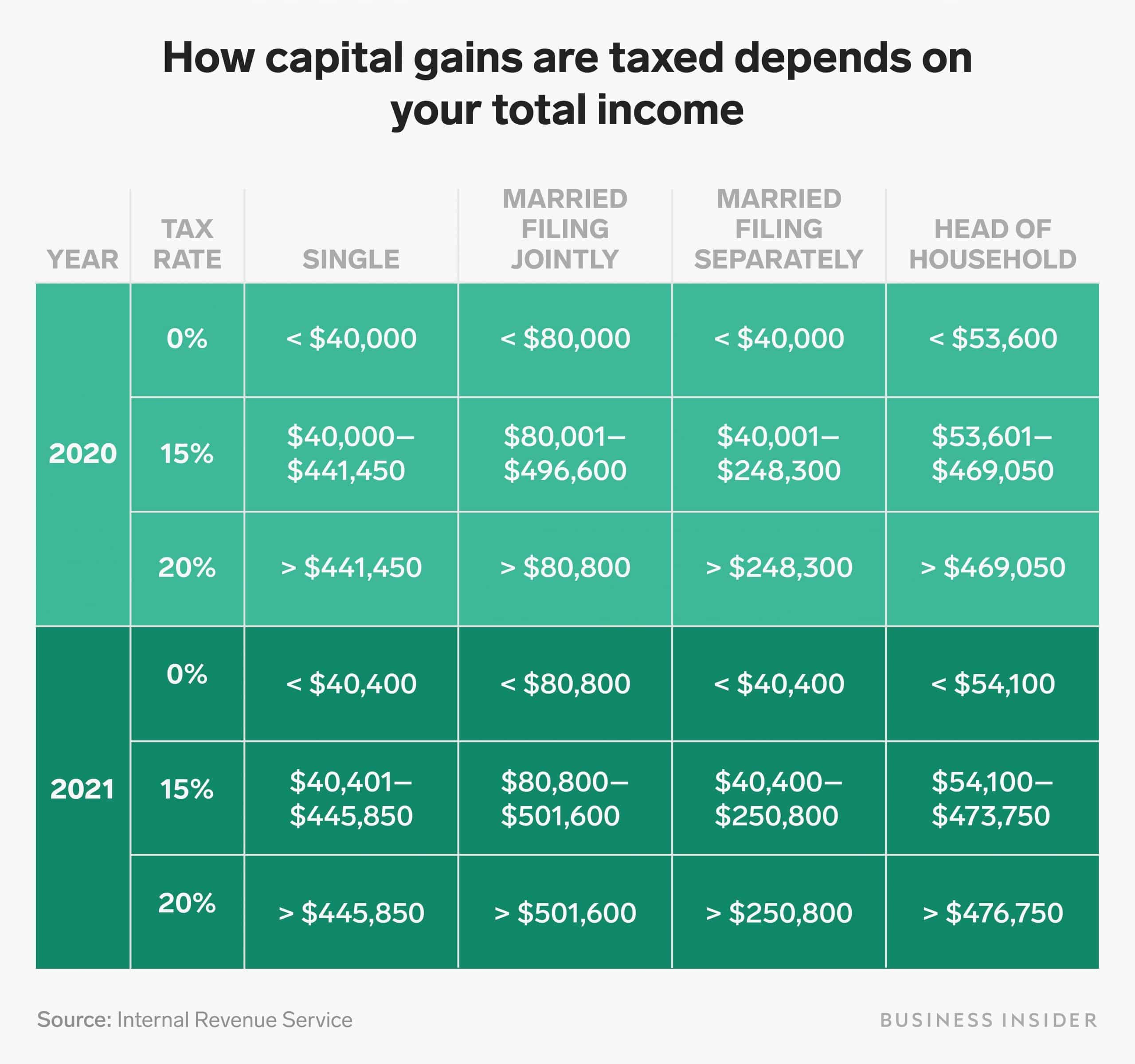

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow.

A capital gain rate of 15% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single more than $80,800 but less than or equal to $501,600 for married filing jointly or qualifying widow more than $54,100 but less than or equal to $473,750 for head of household or more than $40,400 but less than or equal to $250,800 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

Measuring The Effect On The Economy

Supporters of cuts in capital gains tax rates may argue that the current rate is on the falling side of the Laffer curve that it is so high that its disincentive effect is dominant, and thus that a rate cut would “pay for itself.” Opponents of cutting the capital gains tax rate argue the correlation between top tax rate and total economic growth is inconclusive.

Mark LaRochelle wrote on the conservative website Human Events that cutting the capital gains rate increases employment. He presented a U.S. Treasury chart to assert that “in general, capital gains taxes and GDP have an inverse relationship: when the rate goes up, the economy goes down”. He also cited statistical correlation based on tax rate changes during the presidencies of George W. Bush, Bill Clinton, and Ronald Reagan.

However, comparing capital gains tax rates and economic growth in America from 1950 to 2011, Brookings Institution economist Leonard Burman found “no statistically significant correlation between the two”, even after using “lag times of five years.” Burman’s data are shown in the chart at right.

Don’t Miss: Irs Address To Mail Tax Returns