When Do You Pay Capital Gains Tax On A Home

There are certain circumstances where a home sale may be fully taxable. In these cases, capital gains taxes are often unavoidable, though you should always speak with a tax planning advisor to confirm. For example, if you have used the capital gains exclusion on a home sale within the last two years you may not qualify for the exclusion.

Other circumstances include properties that are the sellers primary residence, if the property was recently acquired through a 1031 exchange, or if the seller pays expatriate taxes. Each of these situations may open up complex tax questions, so again be sure to consult with a professional before filing.

Generally, if any of the following conditions are met, you must pay tax on the entire gain from the sale of a home.

-

You didnt live in the house as your primary residence.

-

You owned the property for less than two years out of the five years before selling it.

-

You are subject to expatriate tax.

-

You did not live in the house for at least two years before selling it in the five-year period preceding the sale. Consult IRS Publication 523 if you are disabled, in the military, Foreign Service, or intelligence community for tax breaks.

-

You used the $250,000 or $500,000 exclusion on another property in the two years preceding the sale.

-

You acquired the residence in the last five years through a 1031 or like-kind, exchange where you trade one investment property for another.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

What Is The Capital Gains Tax On Property Sales

Again, if you make a profit on the sale of any asset, its considered a capital gain. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules.

For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly.

If youre just flipping a home for a profit, however, you could be subjected to a steep short-term capital gains tax if you buy and sell a house within a year or less.

Recommended Reading: Haven T Received Tax Return

New York Capital Gain Taxes

The state of New York treats all capital gains as income. That is the capital gain you make on selling your investment will be treated as income and taxed at the same rates. Similar to California, New York makes no distinction between long-term and short-term capital gains. No matter when you choose to sell your investment, your capital gain will be taxed at the following rates by the state government:

New York Capital Gain Tax Rates

| Tax Rate |

|---|

Jeffrey H Kahn Harry M Walborsky Professor & Associate Dean For Business Law Programs Florida State University College Of Law

If Washington puts state capital gains taxes in place, might that pave the way for other states to do the same?

I do not think that the addition of a capital gains tax in the state of Washington would have much of a bearing on whether other states decide to impose one. The other considerations on whether to impose a state-level capital gains tax are likely more important.

For example, a capital gains tax on top of a higher federal tax might lead some to flee the state or at least make it less desirable to move there. We have seen a general trend of people moving from high tax states to low tax states and state governments are certainly aware of this.

I believe the pandemic has sped up the remote worker movement which allows people to be even more mobile and so tax rates may play an even larger role in residency decisions.

If the government expresses interest in raising capital gains taxes, could we see a stock sell-off in response? How might that affect the greater economy?

I believe a sell-off is certainty, especially if the increase is paired with the repeal of section 1014 which provides for a step-up basis at death.

The loss of value in the market will impact pension and retirement funds and make investments less attractive. It is unclear whether an increase will actually raise significantly more revenue so the trade-off does not appear to be worth it.

Recommended Reading: Exempt From Federal Income Tax

State Capital Gains Tax Rates

Each state has its own method of taxing capital gains. Most states tax capital gains as income. In states that do this, the state income tax applies to both long- and short-term capital gains.

Keep in mind that if your state taxes capital gains as income, you’ll add your capital gains to your other ordinary income, which may put you in a higher tax bracket.

There are also plenty of states that handle capital gains differently. Some allow taxpayers to deduct a certain amount of capital gains. Others don’t tax income or capital gains at all.

The sections below cover every state’s tax laws for capital gains. Keep in mind that many states have special rules that apply to the sale of certain assets, such as exclusions for collectibles purchased before a certain year.

Not every rule for every situation is included. Taxpayers should always review the capital gains rules in their state so they know about any relevant exceptions.

Also, it’s important to note that this is the most recent data for each state at the time of this writing — to get exact figures, taxpayers should consult their state’s online documentation. If you have questions about capital gains on your tax return, it’s a good idea to consult that documentation or a tax professional.

How Are Capital Gains Taxes Calculated

You can calculate capital gains taxes using IRS forms. To calculate and report sales that resulted in capital gains or losses, start with IRS Form 8949. Record each sale, and calculate your hold time, basis, and gain or loss. Next, figure your net capital gains using Schedule D of IRS Form 1040. Then copy the results to your tax return on Form 1040 to figure your overall tax rate.

Recommended Reading: Do You Have To Pay Taxes On Inheritance

Avoiding A Capital Gains Tax On Your Primary Residence

You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is single, and up to $500,000 if married filing jointly. The exemption is only available once every two years. But it can in effect render the capital gains tax moot.

Lets say a single filer bought a home for $250,000, lived in it, and sold it for $400,000 three years later. Their profit is $150,000. But thats exempt from any capital gains tax, because its under the $250,000 threshold allowed for gains.

Of course, there are conditions. To qualify the property as your primary residence, the IRS requires that you prove that it was your main home where you lived most of the time. Youll need to show that:

- You owned the home for at least two years.

- You lived in the property as the primary residence for at least two out of the five years immediately preceding the sale.

However, there is wiggle room in how the rules are interpreted. You dont have to show you lived in the home the entire time you owned it or even consecutively for two years. You could, for example, purchase the house, live in it for 12 months, rent it out for a few years and then move in to establish primary residence for another 12 months. As long as you lived in the property as your primary residence for a total of 24 months within the five years before the homes sale, you can qualify for the capital gains tax exemption.

Hold Your Investments Longer

The long-term capital gains tax rate is usually lower than the rate for short-term capital gains. An individual making up to $41,000 in taxable income, or a married couple making up to $83,000, will pay no taxes at all on a long-term capital gain in 2022. These same people would pay up to 12% for a short-term capital gain. And the difference could be 20% for long-term capital gains versus 37% for short-term capital gains earned in tax year 2022 for very high earners.

Read Also: What Is The Sales Tax

Small Business Stock And Collectibles: 28 Percent Capital Gains Rate

Two categories of capital gains are subject to the 28 percent rate: small business stock and collectibles.

If you realized a gain from qualified small business stock that you held for more than five years, you generally can exclude one-half of your gain from income. The remaining gain is taxed at a 28 percent rate. You can get the specifics on gains on qualified small business stock in IRS Publication 550.

If your gains came from collectibles rather than a business sale, youll also pay the 28 percent rate. This includes proceeds from the sale of:

- Wine or brandy collections

Establishing The Rental As Primary Residence

You might find that an investment property you rent and plan to sell has spiked in value. It may be a good idea to move into the rental for at least two years to convert it into a primary residence to avoid capital gains. However, you wont be able to exclude the portion you depreciated while renting the property.

Youll lose primary residency status on your main home, but it can always be gained later by moving back in after the sale of the rental property. As long as you dont plan to sell the main home for at least two years, you can re-establish primary residency and qualify for the capital gains exclusion later.

Read Also: Income Tax By State Ranked

What Is Capital Gains Tax On Real Estate

-

A capital gains tax on real estate is a fee levied on profits made from the sale of a property.

-

Capital gains taxes can be applied to both securities and as well as real estate and other tangible assets.

-

The difference between what you paid for an asset or property and what you sell it for is what the IRS uses to assess capital gains tax.

The name says it all: capital gains tax on real estate simply refers to the tax levied on any gains made from a real estate sale. To clarify, capital gains are only realized when an asset is sold for more than it is purchased. Therefore, you may not be taxed on capital gains if you sell a property for less than you bought it for.

Generally, its rare to sell an asset for more than it was purchased for due to depreciation, but if an individual does sell their asset for more than they acquired it, the asset would then be classified as a capital gain. Capital gain can be applied for more than just real estate gains. It can also apply to a car, boat, or even rare piece of artwork that is sold for more than it was initially purchased.

How To Avoid Capital Gains Tax On A Home Sale

Capital gains taxes can greatly affect your bottom line. Fortunately, there are ways to reduce the tax bill, or avoid capital gains taxes on a home sale altogether. It depends on the property type and your filing status. The IRS offers a few scenarios to avoid capital gains taxes when selling your house.

Also Check: Irs Solar Tax Credit 2021 Form

Capital Gains Tax Brackets

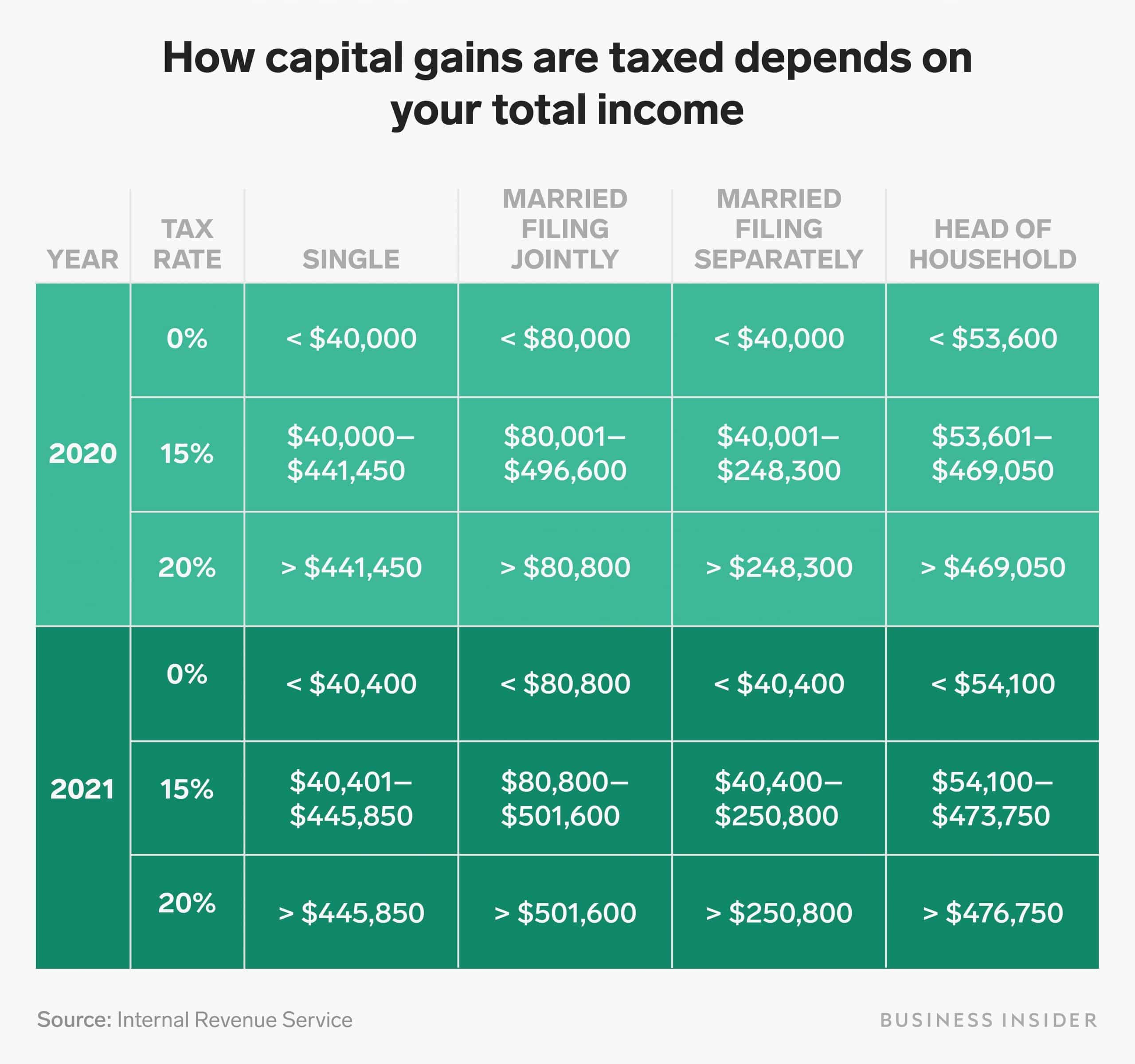

There are two main categories for capital gains: short- and long-term. Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%.

Remember, this isn’t for the tax return you file in 2023, but rather, any gains you incur from January 1, 2023 to December 31, 2023.

The actual rates didn’t change for this year, but the income brackets did adjust significantly due to rising inflation.

Capital Gains Taxes On Collectibles

If you realize long-term capital gains from the sale of collectibles, such as precious metals, coins or art, they are taxed at a maximum rate of 28%. Remember, short-term capital gains from collectible assets are still taxed as ordinary income. The IRS classifies collectible assets as:

- Works of art, rugs and antiques

- Musical instruments and historical objects

- Stamps and coins

- Alcoholic beverages

- Any metal or gem

The latter point is worth reiterating: The IRS considers precious metals to be collectibles. That means long-term capital gains from the sale of shares in any pass-through investing vehicle that invests in precious metals are generally taxed at the 28% rate.

Recommended Reading: Annual Income After Taxes Calculator

How To Avoid Capital Gains Tax

Avoiding or minimizing capital gains tax comes down to being proactive. The easiest way to lock to reduce your tax bill is to hold on to an asset for longer than a year.

You can also reduce or eliminate capital gains tax through tax-loss harvesting, which is the process of selling underperforming investments and using the loss to offset gains. The remaining gain, if any, is the only amount subject to taxation.

You can also avoid capital gains tax by investing in tax-advantaged retirement accounts and donating appreciated assets to charity.

Read More:How to Avoid Capital Gains Tax

Real Property That’s Been Depreciated

Real property that has been depreciated is subject to a special depreciation recapture tax. A 25% tax rate applies to the amount of gain that’s related to depreciation deductions that were claimed or could have been claimed on a property. The remainder of the gain is taxed at ordinary tax rates or at long-term capital gain tax rates, depending on how long the property was held.

Read Also: Tax Deduction For Charitable Donations

Capital Gain Tax Rates

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow.

A capital gain rate of 15% applies if your taxable income is more than $40,400 but less than or equal to $445,850 for single more than $80,800 but less than or equal to $501,600 for married filing jointly or qualifying widow more than $54,100 but less than or equal to $473,750 for head of household or more than $40,400 but less than or equal to $250,800 for married filing separately.

However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

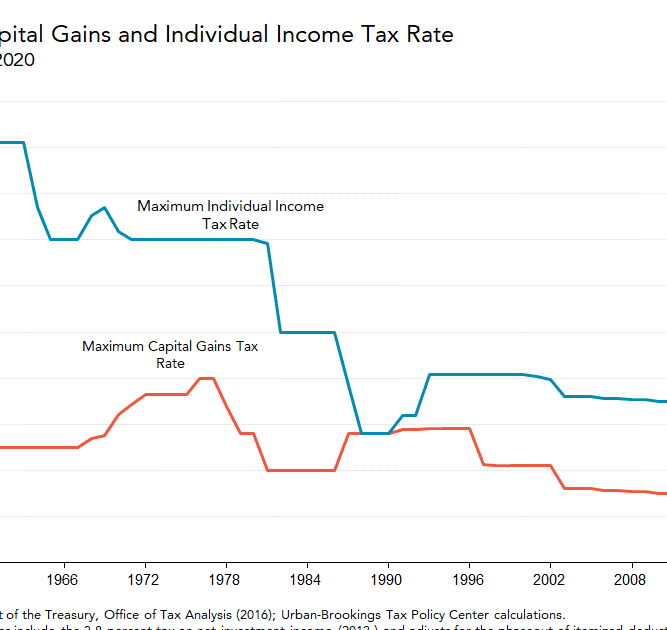

The Impact Of A Capital Gains Tax

Capital gains taxes affect more than just shareholders there are repercussions across the entire economy. When multiple layers of tax apply to the same dollar, reducing the after-tax return to saving, taxpayers are incentivized to consume immediately rather than save. Take the following example from our primer on capital gains taxes:

Suppose a person makes $1,000 and pays individual income taxes on that income. The person now faces a choice: should I save my after-tax money or should I spend it? Spending it today on a good or service would likely result in paying some state or local sales tax. However, saving it would mean paying an additional layer of tax, such as the capital gains tax, plus the sales tax when the money is eventually used to purchase a good or service. This second layer of tax reduces the potential return that a saver can earn on their savings, thus skewing the decision toward immediate consumption rather than saving. By immediately spending the money, the second layer of tax can be avoided.

Recommended Reading: Are Medical Insurance Premiums Tax Deductible