Gifts Of Ecologically Sensitive Land

If you made a gift of ecologically sensitive land to certain qualified donees , the inclusion rate of zero may apply to your capital gain. Use Form T1170, Capital Gains on Gifts of Certain Capital Property, to report the amounts.

Note A gift of ecologically sensitive land cannot be made to a private foundation after March 21, 2017.

To qualify for the capital gains inclusion rate of zero, you must meet certain conditions, and other special rules may apply.

For more information, see Pamphlet P113, Gifts and Income Tax.

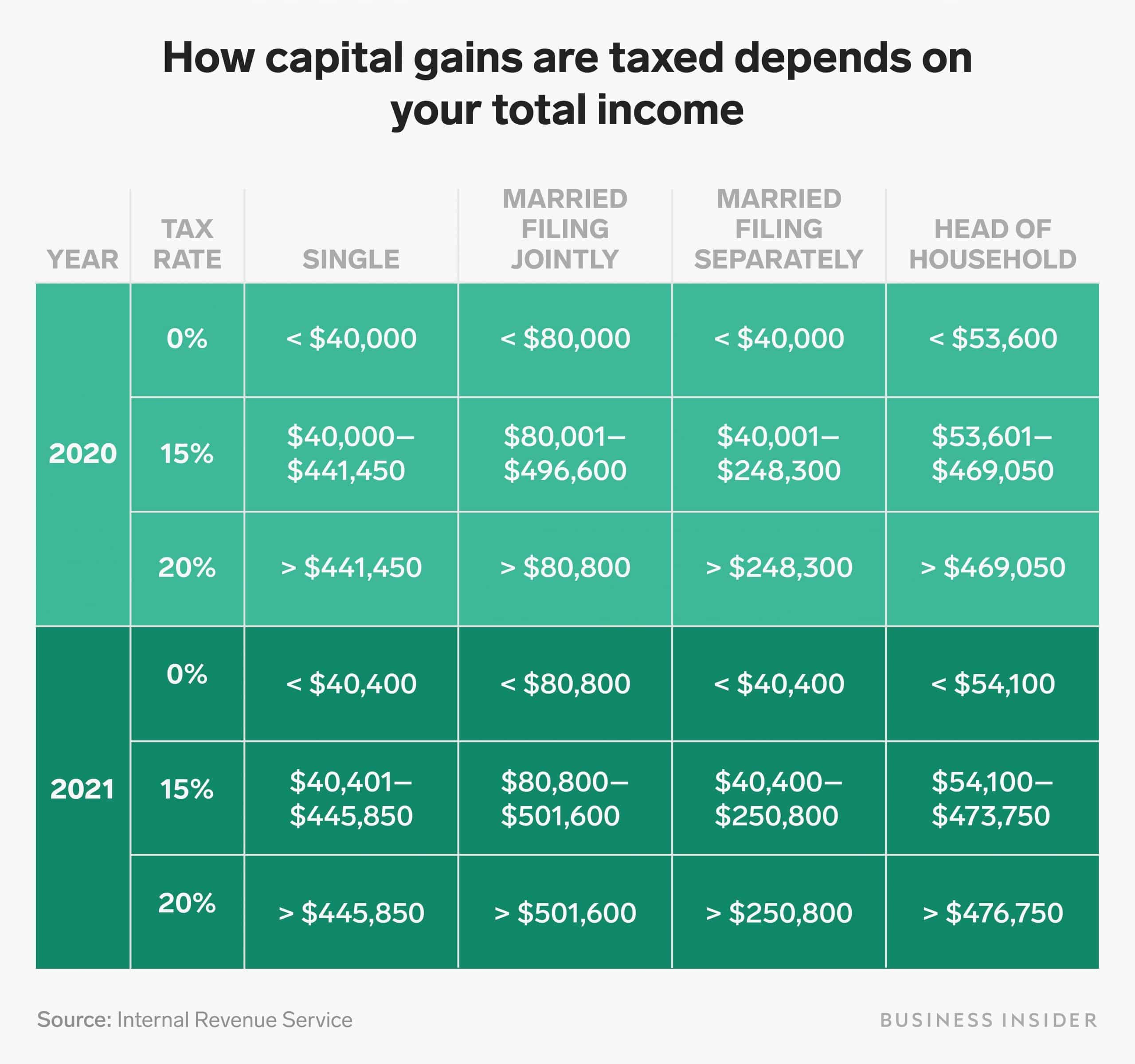

Capital Gains Tax Rate

In Canada, 50% of the value of any capital gains are taxable. Should you sell the investments at a higher price than you paid you’ll need to add 50% of the capital gain to your income. This means the amount of additional tax you actually pay will vary depending on how much you’re making and what other sources of income you have.

What Is The 2021 Short

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period begins ticking from the day after you acquire the asset, up to and including the day you sell it.

- For 2021, ordinary tax rates range from 10% to 37%, depending on your income and filing status.

You May Like: Haven T Received Tax Return

What Is The Capital Gains Tax Rate In Canada

In Canada, its incorrect to assume that capital gains are taxed at a rate of 50% consistently or that they are taxed completely at your marginal tax rate.

Instead, you only owe half of the increased value, or capital gain, on any given sale that is then taxed at the marginal tax rate, both federally and provincially. Both federal and provincial tax brackets are broken down into five tiers according to income, and you are only taxed the minimum tax rate according to how much money you made and what tier that amount falls into.

Below is how the federal tax brackets break down for the 2021 tax year:

If you earned a capital gain of $10,000 on an investment, $5,000 of that is taxable.

Multiply $5,000 by the tax rate listed according to your annual income minus any selling costs. The number remaining is either a capital gain or a capital loss. If its a capital gain, the answer is how much you owe in capital gains tax. The rest of the profit you made on the sale is yours to keep.

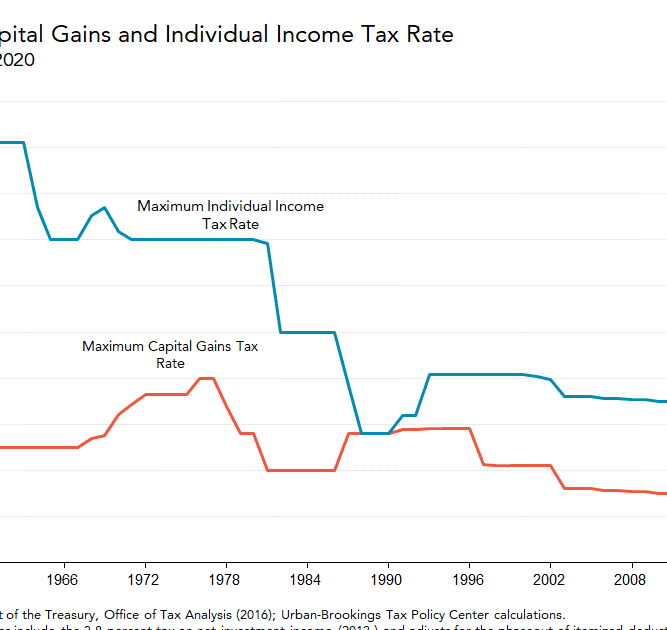

Compared With Historical Capital Gains Tax Rates

Because short-term capital gains tax rates are the same as those for wages and salaries, they adjust when ordinary income tax rates change. For instance, in 2018, tax rates went down because of the Trump Administrations tax cuts. Therefore, so did short-term capital gains rates.

As for long-term capital gains tax, Americans today are paying rates that are relatively low historically. Todays maximum long-term capital gains tax rate of 23.8% started in 2013, when the Obamacare 3.8% tax was added.

For comparison, the high point for long-term capital gains tax was in the 1970s, when the maximum rate was at 35%.

Going back in time, in the 1920s the maximum rate was around 12%. From the early 1940s to the late 1960s, the rate was around 25%. Maximum rates were also pretty high, at around 28%, in the late 1980s and 1990s. Then, between 2004 and 2012, they dropped to 15%.

You May Like: What Is Form 5498 For Taxes

What Is The Difference Between Short

A short-term capital gain is the result of selling a capital asset you held in your possession for one year or less. Long-term capital gains are capital assets held for more than a year. Typically, you pay a higher tax rate on short-term capital holdings versus long-term ones.

Depending on how long you hold your capital asset determines the amount of tax you will pay. Short-term capital assets are taxed at your ordinary income tax rate up to 37% for 2022. Long-term assets are subject to capital gain tax rates, which are lower. For 2022, the top capital gain tax rate is 20%.

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capital expensesindicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

Also Check: Status Of Federal Tax Return

Limit On The Deduction And Carryover Of Losses

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 or your total net loss shown on line 16 of Schedule D . Claim the loss on line 7 of your Form 1040 or Form 1040-SR. If your net capital loss is more than this limit, you can carry the loss forward to later years. You may use the Capital Loss Carryover Worksheet found in Publication 550, Investment Income and Expenses or in the Instructions for Schedule D PDF to figure the amount you can carry forward.

Lifetime Capital Gains Exemption

The lifetime capital gains exemption is also known as the capital gains deduction and is on line 25400 of your tax return. Canadian residents have a cumulative lifetime capital gains exemption when they dispose of eligible properties. The capital properties eligible for the LCGE include qualified small business corporation shares and qualified farm or fishing property . The lifetime limit refers to the total amount of LCGE you can claim throughout your lifetime. Last updated in 2019, the lifetime capital gains exemption for qualified small business corporation shares is $866,912 and the lifetime capital gains exemption for qualified farm or fishing property is $1,000,000. This means that in the years prior to 2019, if you have already claimed $866,912 in lifetime capital gains exemption for QSBCS, you cannot claim any further amounts.

Letâs say you have earned $10,000 in capital gains on a QSBCS in 2019 and you have not reached the lifetime capital gains exemption limit. Upon claiming the LCGE exemption, you will have used up $5,000 of your LCGE for QSBCS as the capital gains inclusion rate is 50%. You will still have $861,912 left in your lifetime capital gains exemption for qualified small business corporations as of 2019 limit amounts.

Also Check: Montgomery County Texas Tax Office

Exempt Capital Gains Balance

When you filed Form T664 for your shares of, or interest in, a flow-through entity, the elected capital gain you reported created an exempt capital gains balance for that entity.

Note

Generally, your ECGB expired after 2004. If you did not use all of your ECGB by the end of 2004, you can add the unused balance to the adjusted cost base of your shares of, or interest in, the flow-through entity.

Example

Andrew filed Form T664 for his 800 units in a mutual fund trust with his 1994 income tax and benefit return. He designated the fair market value of the units at the end of February 22, 1994, as his proceeds of disposition. Andrew claimed capital gains reductions of $500 in 1997 and $600 in 1998. At the end of 2003, his exempt capital gains balance was $2,250. In 2004, he had a $935 capital gain from the sale of 300 units. This left him with an unused balance of $1,315 at the end of 2004. In future years, he can only add the unused ECGB to the cost of any remaining units.

1. ECGB carryforward to 2004

6. Unused ECGB at the end of 2004

6

The unused ECGB expired after 2004 so Andrew can add this amount to the adjusted cost base of his shares of, or interest in, the flow-through entity.

How Are Capital Gains Taxes Calculated

You can calculate capital gains taxes using IRS forms. To calculate and report sales that resulted in capital gains or losses, start with IRS Form 8949. Record each sale, and calculate your hold time, basis, and gain or loss. Next, figure your net capital gains using Schedule D of IRS Form 1040. Then copy the results to your tax return on Form 1040 to figure your overall tax rate.

You May Like: Out Of State Sales Tax

How Do I Calculate Capital Gain On The Sale Of Property

You must first determine your basis in the property. Your basis is your original purchase price plus any fees that you paid minus any depreciation taken. Next, determine your realized amount. Your realized amount is the price that youre selling the property for minus any fees paid by you. Finally, you need to subtract your basis from your realized amount. If the figure is positive, then you will have a capital gain. If the figure is negative, then you will have a capital loss.

Capital Gains Tax Rate For Qualified Small Business Stock

If you sell “qualified small business stock” that you held for at least five years, some or all of your gain may be tax-free. However, for any gain that is not exempt from tax, a maximum capital gains tax rate of 28% applies.

As with the 28% rate for collectibles, if your ordinary tax rate is below 28%, then that rate will apply to taxable QSBS gain. The 28% rate doesn’t apply to short-term capital gains from the sale of QSBS, either.

Recommended Reading: How To Add Sales Tax On Square

How To Calculate A Capital Gain

Before you can calculate your capital gain on an investment, there are some terms you need to be aware of.

- The Proceeds of Disposition What you will receive or have received for the sale.

- The Adjusted Cost Base The cost of the investment plus any expenses paid to acquire it, like commissions and legal fees.

- The Outlays and Expenses These are any costs incurred to sell your investment, such as renovations, maintenance expenses, commissions and finders fees.

The equation to calculate capital gains uses the values above and is laid out as follows:

Proceeds of disposition = capital gain

If the amount is less than the proceeds of disposition, then what you have is a capital loss that can be used to offset other capital gains in the future or up to three years in the past.

Invest For The Long Term

Investing for the long term has many advantages. It can be a far less risky strategy than attempting to capture short-term profits by trading in and out of stocks, and it reduces the need to try to time the market, which can be impossible even for most skilled investors.

But perhaps one of the most important benefits of long-term investing is that you can save substantially on your taxes compared with the IRS bill you’d face if you trade more actively. Remember, if you sell shares before a year of ownership, you’ll be taxed at the short-term capital gains tax rate. This is your ordinary income tax rate, which is usually higher than the long-term capital gains tax rate.

If you can reduce your tax bill and keep more of your investment profit by holding your stocks for the long term, this can substantially increase the effective return on your investment. The tax savings you realize by investing for the long term is one big reason why Warren Buffett, one of the greatest investors of all time, has stressed that his favorite holding period for stocks is “forever.”

Read Also: Travel Trailer Tax Deduction 2021

Do You Pay Capital Gains If You Sell A Stock And Buy Another

Taking sales proceeds and buying new stock typically doesn’t save you from taxes. … With some investments, you can reinvest proceeds to avoid capital gains, but for stock owned in regular taxable accounts, no such provision applies, and you’ll pay capital gains taxes according to how long you held your investment.

Donate Assets To Charity

When you make a donation to a registered charitable institution, you receive a tax receipt which allows you to deduct a portion of your donation from income tax owing. Instead of making a donation in cash, you can transfer ownership of stocks to the registered charity. . It’s a way of rebalancing your portfolio without triggering a capital gain because you are not selling the stock, you are simply transferring ownership. You will receive a tax receipt for the current fair market value . Consult a tax professional before you do this so you follow the correct procedure.

Recommended Reading: Free Tax Filing 2022 For Seniors

How Do You Apply Your 2021 Net Capital Loss To Previous Years

You can carry your 2021 net capital loss back to 2018, 2019, and 2020 and use it to reduce your taxable capital gains in any of these years. When you carry back your net capital loss, you can choose the year to which you apply the loss.

Note

When you apply a net capital loss back to a previous year’s taxable capital gain, it will reduce your taxable income for that previous year. However, your net income, which is used to calculate certain credits and benefits, will not change.

If you carry your 2021 net capital loss back to 2018, 2019, or 2020, you do not have to adjust the amount of the 2021 net capital loss since the inclusion rate is the same for these years.

To apply a 2021 net capital loss to 2018, 2019, or 2020, complete “Section III Net capital loss for carryback” on Form T1A, Request for Loss Carryback. This form will also help you determine the amount you have left to carry forward to future years. Do not file an amended income tax and benefit return for the year to which you want to apply the loss.

Note

If you apply a 2021 net capital loss to a previous year, any capital gains deduction that you claimed in that year, or a following year, may be reduced.

Capital Gains Taxes Are Confusing

Wealthy Americans likely breathed a collective sigh of relief when President Joe Biden revealed his $2 trillion infrastructure plan.

Despite the president’s campaign pledge to raise the capital gains tax rate, the new plan doesn’t include any changes in that regard.

However, when it comes to capital gains tax, it’s not just the federal tax rate that matters. States can also set their own tax rates, and some may have changes on the horizon. In the state of Washington, the governor has proposed a capital gains tax that could raise almost $1 billion if passed.

To provide the most recent info on capital gains taxes, we’ve collected data on long and short-term capital gains tax rates at both the federal and state level.

Don’t Miss: Who Does Taxes For Free

What Is Capital Gains Tax

Capital gains taxes are the taxes you pay on any profits you make from selling investments, like stocks, bonds, properties, cars, or businesses. The tax isnt applied for owning these assets it only hits when you profit from selling them.

Its important for beginner investors to understand that a number of factors can affect their capital gains tax rate: how long they hold onto an investment, which asset theyre selling, the amount of their annual income, as well as their marital status.

Heres a guide on how to calculate stock profits, and below are some basic facts about capital gains taxes.

What Happens If You Have A Capital Gain

If you have a capital gain, you may be able to do one of the following:

- defer part of the capital gain by claiming a reserve

- reduce or offset all or a part of the gain by claiming a capital gains deduction

Claiming a reserve

When you sell a capital property, you usually receive full payment at that time. However, sometimes you receive the amount over a number of years. For example, you sell a capital property for $50,000 and receive $10,000 when you sell it and the remaining $40,000 over the next four years. If this happens, you may be able to claim a reserve. Usually, a reserve allows you to report a portion of the capital gain in the year you receive the proceeds of disposition.

Who can claim a reserve?

Most people can claim a reserve when they dispose of a capital property. Generally, you cannot claim a reserve in a tax year if you were in any of the following situations:

- You were not a resident of Canada at the end of the tax year, or at any time in the following year.

- You were exempt from paying tax at the end of the tax year, or at any time in the following year.

- You sold the capital property to a corporation that you control in any way.

How do you calculate and report a reserve?

Your children include any of the following:

Note

You do not have to claim the maximum reserve in a tax year . However, the amount you claim in a later year cannot be more than the amount you claimed for that property in the previous year .

Reserve for a gift of non-qualifying securities

Note

Also Check: How Are Taxes Calculated On Paycheck