Is There A Way To Find Out If Someone Filed Taxes

Consult With the IRS Contact the IRS at 1-800-829-0433 if you think someone has filed your taxes without your permission. Contacting the IRS and inquiring about the status of your tax return is the best way to determine whether a return has been filed without your consent.

How can you find out if someone has filed a tax refund using your Social Security number?

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus .

What To Do If Someone Else Claim My Son On Thier Incom Tax Without My Permission

If someone else claimed yourchild inappropriately, and if they file first, your return will be rejected ife-filed. You would then need to file a return on paper, claiming thechild as appropriate. The IRS will process your return and send youyour refund, in the normal time. Shortly thereafter, you’ll receive a letter from the IRS, stating that yourchild was claimed on another return. It will tell you that if you made a mistaketo file an amended return and if you didn’t make a mistake to do nothing. Theother party will get the same letter you did. If one of you doesn’t file anamended return, unclaiming the child, the next letter, from the IRS, willrequire you to provide proof. Be sure to reply in a timely manner.

Winner gets the tax benefits loser gets to pay the IRS back with penalties and interest. Thecustodial parent almost always wins. The non-custodial parent can onlyclaim the child as a dependent if the custodial parent gives permission or if it’s spelled out in a pre 2009 divorce decree.

Does Irs Forgive Tax Debt After 10 Years

In general, the Internal Revenue Service has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations. … Therefore, many taxpayers with unpaid tax bills are unaware this statute of limitations exists.

Also Check: New Jersey State Sales Tax

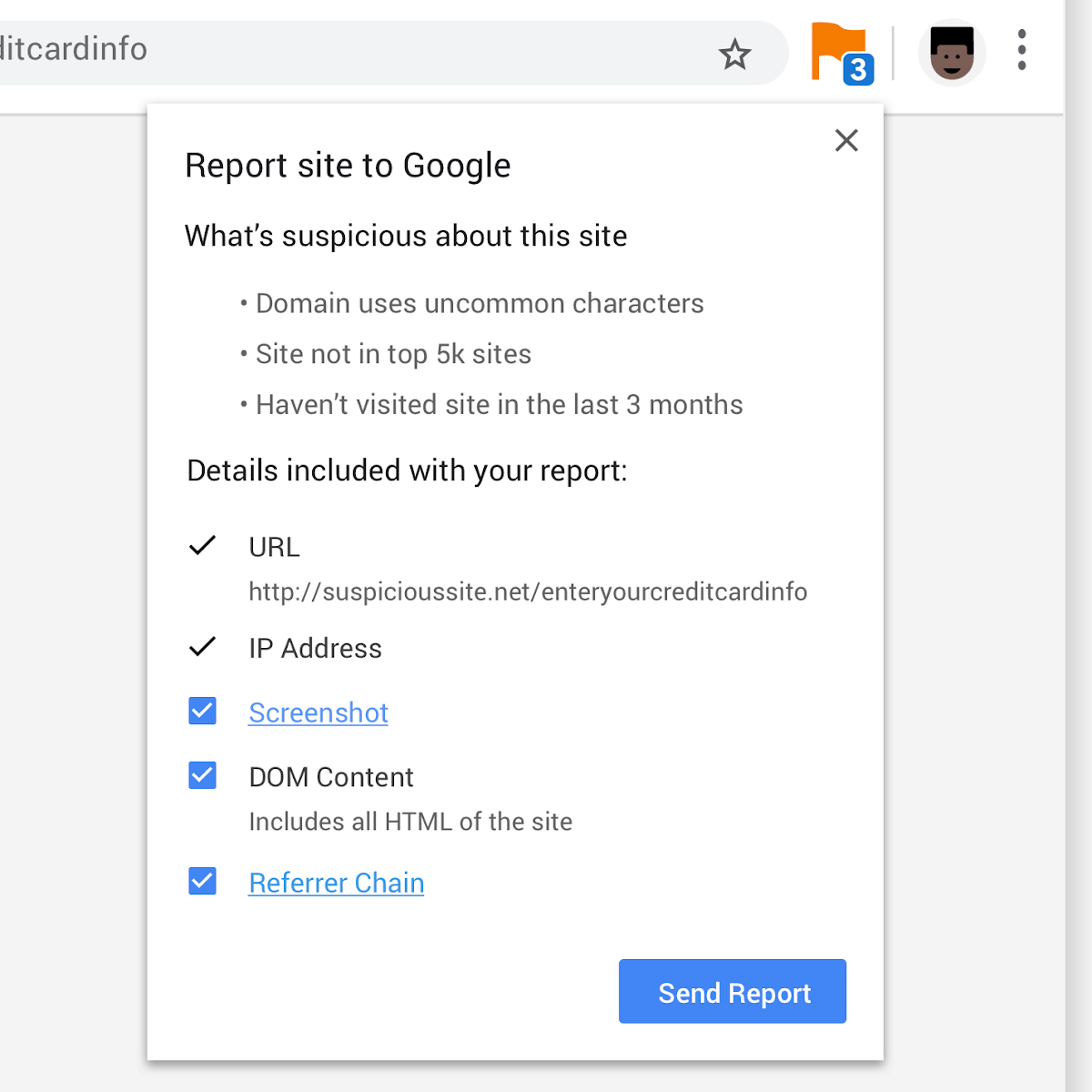

Learn About Tax Id Theft And How To Avoid It

Tax ID theft occurs when someone uses your Social Security number to file taxes and claim a tax refund. You may not know that your tax ID has been stolen until you:

- E-file your tax return and find that another return has already been filed using your Social Security number, or

- The Internal Revenue Service sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred.

Find out what steps you can take after receiving a 5071C letter and how you can avoid or report tax ID scams.

How Can I Speak To Someone From The Irs

How to speak directly to an IRS agent

Read Also: What Day Can You File Taxes 2022

Prevent Tax Id Theft With An Identification Protection Id

Identification Protection PINs are six-digit numbers issued to taxpayers by the IRS to prevent tax ID theft. If youve experienced tax ID theft in the past, the IRS will automatically issue you an IP PIN. You can also voluntarily request one. After the IRS issues your IP PIN, you will use it to file your return. This will help the IRS confirm your identity so no one can file a return using your personal information to fraudulently collect a refund. Learn more about the IP PIN and how you can apply.

Monitor Future Tax Preparation

To ease the burden of tax preparation, you may opt to hire someone else to prepare and file your tax return. Since these people have access to confidential information, do your due diligence to make sure they are qualified for the role. Qualified tax preparers include attorneys, Certified Public Accountants and enrolled agents, retirement plan agents and actuaries.

All should have a Tax Preparation Identification Number and be willing to sign your tax forms. Qualified agents will also use the IRS e-file system and provide you with a final copy of your submitted return.

References

Also Check: Will Property Taxes Go Up In 2022

Did You Enter Your Dependents Information Correctly

If so, you need to know the IRS is prohibited from telling you who claimed your dependent. Due to federal privacy laws, the IRS can only disclose the return information if the victims name and SSN are listed as either the primary or secondary taxpayer on the fraudulent return. For this reason, the IRS cannot disclose return information to any person listed only as a dependent.

If you dont know anyone who could have claimed the dependent, your dependent may be a victim of identity theft. See The Taxpayer’s Guide to Identity Theft for steps you may take if you feel you or your dependents identity has been stolen.

Using the Interactive Tax Assistant on IRS.gov, verify you meet the requirements to claim the dependent. Once you verify another person was not eligible to claim your dependent, youll need to take steps to protect your right to claim the dependent and ensure an accurate filing.

What Can I Do If Someone Without Permission Claimed Me On Their Taxes How Do I Fix That

You will need to prepare your return as if you are not claimed by someone else, but an independent. You will need to print and mail your return into the IRS and your state. The IRS will look at your return and that of the person who claimed you. They will ask you for more information so they can determine who is correct. Once they have made a determination, they will adjust the returns as necessary.

Recommended Reading: When Am I Getting My Tax Return

Prevent This Headache By Taking These Steps

Since dealing with more than one person claiming either you or your dependent is a nightmare, it makes sense to try to avoid this.

First, dont give out your own or your dependents Social Security Numbers if at all possible. Many places may ask for this information on intake forms, such as doctors offices.

The information is rarely necessary but can be useful if a provider needs to send your bill to collections. Refuse to give out the information whenever possible so there is one less way the data can be exposed in a data breach.

If you know youre going to have conflict about claiming yourself or a dependent, look up the rules.

Based on the rules for claiming a dependent, explain your stance to the other person before you both file your tax returns.

Try to sort out who should rightfully claim you or your dependent to avoid a lengthy dispute with the IRS.

In some cases, it may make sense to have an agreement about when each person will claim a dependent.

If youre the person in question, talk with your parents to see what makes the most sense for everyone as long as youre following the IRSs rules.

When parents get divorced, they may alternate which parent gets to claim the dependent each year if they both qualify according to the IRSs rules.

In this case, get the agreement in writing. If the other parent is forgetful, remind them who gets to claim the dependent this year before they file their tax return.

Mixed Earners Unemployment Compensation

What is the Mixed Earners Unemployment Compensation Program?

Mixed Earners Unemployment Compensation is a temporary, federal program created by the Continued Assistance for Unemployed Workers Act of 2020 that provides a $100 per week supplemental benefit amount to certain self-employed individuals who have earned at least $5,000 in net earnings in the most recent taxable year ending prior to the individuals application for regular unemployment compensation benefits.

What is the duration of the MEUC Program?

MEUC is available for the week ending January 2, 2021 through week ending September 4, 2021 .

Who is eligible for MEUC?

MEUC is only payable to certain individuals who:

The application process will not move forward until the supporting documentation is provided. Failure to submit a completed application with the required supporting documentation will result in a denial of MEUC benefits. MEUC is NOT available for weeks claimants received Pandemic Unemployment Assistance .

What underlying unemployment benefits can I receive to be eligible for MEUC?

What is the most recent taxable year ending prior to my application for regular UC?

How do I apply for MEUC?

Note:

Recommended Reading: What States Have No Income Taxes

A Dependent As A Qualifying Child

To be a qualifying child, the person must pass five tests.

First, they must be related to you in one of the following ways. The child must be your:

- A descendant of any of the above

Second, a child must be under age 19 at the end of the year and younger than you. Permanently and totally disabled children can be any age.

Third, the child must have lived with you for more than half of the year, with certain exceptions.

Fourth, the child cannot have provided more than half of their own support during the tax year in question.

Finally, the child must not file a joint return for the year, except in rare circumstances.

Can You Anonymously Report Someone To The Irs

Report Fraud, Waste and Abuse to Treasury Inspector General for Tax Administration , if you want to report, confidentially, misconduct, waste, fraud, or abuse by an IRS employee or a Tax Professional, you can call 1-800-366-4484 . You can remain anonymous.

What to do if someone claimed me on their taxes without my permission?

You should call the IRS at 1-800-829-1040 to report the error and ask them how to proceed. This number is available 24/7 and will help you proceed in handling the error. In addition, you may want to print and mail your return because it generally takes 15 days for the IRS to update their records.

How do I anonymously report someone to the IRS?

How can I find out if my tax return was submitted?

Find out if Your Tax Return Was Submitted You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by: Using the IRS Wheres My Refund tool

Recommended Reading: Last Day To Sell Stock For Tax-loss 2021

Pandemic Emergency Unemployment Compensation

What is Pandemic Emergency Unemployment Compensation ?

PEUC is a federal Continued Assistance Act program that extends benefits to those who have exhausted state unemployment benefits. This benefit ended September 4, 2021.

What does it mean to exhaust state unemployment benefits?

A person exhausts state unemployment benefits when he or she either draws all available benefits that could be paid, or reaches the end of the benefit year and is not monetarily eligible for a new benefit year. Also, the individual cannot be eligible to file a claim in any other state.

How long does PEUC run?

Under the March 2020 CARES Act, the PEUC extension program allowed an additional 13 weeks of benefits and the program expired on December 26, 2020. The Continued Assistance Act extended this program to expire the week ending March 13, 2021. Under the new American Rescue Plan Act of 2021 , the PEUC program expired the week ending September 4, 2021.

How do I apply for PEUC?

Once your state unemployment claim has a zero balance, you can apply for PEUC on our website at www.GetKansasBenefits.gov.

PEUC applications can only be filed online at this time.

Do I have to apply for the extension provided under the new ARP Act?

No. If you were previously filing for PEUC benefits, you do not have to file a new application for the additional weeks. You just need to continue filing weekly claims each week you are unemployed.

How much does PEUC pay each week?

PEUC is available for the following periods:

What Is Identity Theft

Identity theft occurs when someone obtains your personal or financial information and uses it fraudulently without your permission. Identity theft may be:

- tax-related, such as when someone learns your social security number and uses it to file a tax return, or

- nontax-related, such as when you have been identified as a victim in a data breach where your personal information has been compromised.

You May Like: Property Tax Relief For Disabled

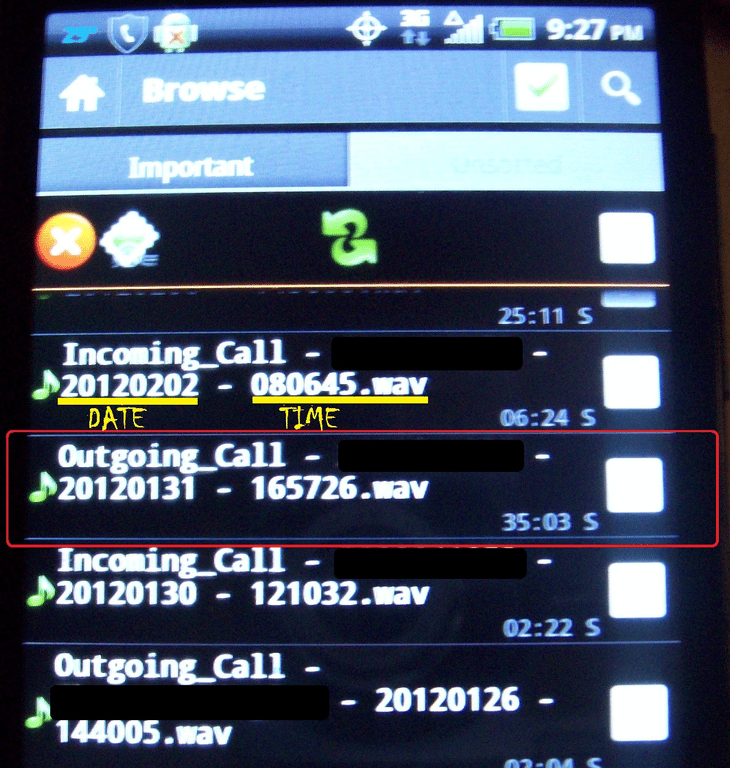

Stolen Identity Refund Fraud

ALERT: The IRS does not send unsolicited email, text messages or use social media to discuss your personal tax issues. If you receive a telephone call from someone claiming to be an IRS employee and demanding money, you should consult the IRS Tax Scams/Consumer Alerts webpage: . If you know you dont owe taxes or have no reason to believe that you do, report the incident to the Treasury Inspector General for Tax Administration at 1.800.366.4484 or at www.tigta.gov.

Stolen Identity Refund Fraud Enforcement

One of the Tax Divisions highest priorities is prosecuting people who use stolen identities to steal money from the United States Treasury by filing fake tax returns that claim tax refunds. Working to stop Stolen Identity Refund Fraud, or SIRF, is vital because these schemes threaten to disrupt the orderly administration of the income tax system for hundreds of thousands of law abiding taxpayers and have cost the United States Treasury billions of dollars.

Typically SIRF perpetrators file the false returns electronically, early in the tax filing season so that the IRS receives the false SIRF return before legitimate taxpayers have time to file their returns. The SIRF perpetrators arrange to have the refunds electronically transferred to debit cards or delivered to addresses where they can steal the refund out of the mail.

Lost Wage Assistance Program

What was the Lost Wages Assistance Program ?

On August 8, 2020, the President issued an executive memorandum authorizing the Federal Emergency Management Agency to expend up to $44 billion from its Disaster Relief Fund to provide supplemental benefits to Americans receiving unemployment benefits, creating the Lost Wages Assistance Program . The program provided eligible claimants with an additional $300 in benefits for each of the qualifying weeks. LWAP was only available for the weeks ending August 1, 2020 through September 5, 2020.

Who was eligible for the additional Lost Wages Assistance ?

The program was limited in scope and, due to federal restrictions, was available only to those persons who provided self-certification that they are unemployed, partially unemployed, or unable or unavailable to work due to disruptions caused by COVID-19 and who received at least $100 from a qualifying underlying unemployment benefit program.

An individual was determined to have received at least $100 per week for purposes of being an eligible claimant if the individuals weekly benefit amount as provided on the monetary determination is at least $100 . In addition, the week in question must have been considered compensable.

When did the additional Lost Wages Assistance start, and how long did it last?

Are the LWA benefits taxable?

Yes. These benefits are subject to state and federal taxes.

Read Also: Iowa State Tax Refund Status

Someone Filed My Taxes Without My Permission

My girlfriiend Filed my tax without my consent. She got my w2 one day right be for I was leaving for work. She was instructing we do them now. With me headed to work I told her to wait tell u got home. She inshered me that it could be put on 2 deffrent card so I left her with that card so half on each one. When I arived that night my card was on the table so, I ask if she had finish the taxes. She said yes an i sent it all to my card. I ask why that was not what I agreed to she promised she was not going to take it we would pay all the loans an bills an then splet whats left an go in on a car together. Well I payed a 1500 dollar loan an shes took off with the rest. Im the one who worked all year not her

Where Can I Get A Copy Of My Tax Return

The IRS can also provide a Tax Return Transcript for many returns free of charge. A transcript provides most of the line entries from the original tax return and may provide income information from Forms W2, 1099, or 1098 if requested.

How to request tax information from the IRS?

If you need to request information from the IRS, we need to know that you are authorized to receive it. To establish that you are properly authorized to receive tax information of a decedent or their estate, submit the following with your information request:

You May Like: States With The Lowest Income Taxes

Examples Of Tax Fraud

Tax fraud occurs when an individual or business entity willfully and intentionally falsifies information on a tax return to limit the amount of tax owed. Tax fraud essentially means cheating on a tax return in an attempt to avoid paying the entire tax obligation. Examples of tax fraud may include, but are not limited to:

What Should I Do If I Think Someone Is Using My Social Security Number

If you think someone is using your Social Security number , there are several actions you can take.

- Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us.

- Contact the Internal Revenue Service at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

- Order free credit reports annually from the three major credit bureaus . Make a single request for all three credit bureau reports at Annual Credit Report Request Form, or by calling 1-877-322-8228.

- File a report with your local police or the police in the community where the identity theft took place.

Recommended Reading: What Percent Of Your Check Goes To Taxes